Content

Many qualified taxpayers overlook the Earned Income Tax Credit , potentially missing out on thousands of dollars at tax time. A dependent is a person who entitles a taxpayer to claim dependent-related tax benefits that reduce the amount of tax the taxpayer owes. This information may be different than what you see when you visit a financial institution, service provider or specific product’s site. All financial products, shopping products and services are presented without warranty. When evaluating offers, please review the financial institution’s Terms and Conditions. If you find discrepancies with your credit score or information from your credit report, please contact TransUnion® directly.

- A couple who is legally married can file MFJ even if they lived apart the entire year and even if they shared no revenues or expenses for the year, as long as both spouses agree.

- A 2013 systematic review of the effect of in-work tax credits on health outcomes in adults conducted through the Cochrane Collaboration found no evidence for an effect of the EITC on health outcomes in adults.

- or an adopted child, including a child in the process of being adopted provided he or she has been lawfully placed.

- You can also visit MyFreeTaxes.com to file your own taxes for free online if you do not have self-employment income.

- A child who supports himself or herself can still qualify as a qualifying child for purposes of the EIC.

- The Internal Revenue Service is providing temporary relief for the Earned Income Tax Credit for tax year 2020.

It was intended to be just a temporary legislative provision, but the credit is still available today. Washington, a state without an individual income tax, has an EITC in its tax code but it has never been implemented or funded. For more information on qualifying for the federal EITC/EIC, go to the IRS website. a—Maryland has temporarily raised the refundable state EITC to 45% for tax year beginning after December 31, 2019 but before January 1, 2023, at which point it shall revert back to 28%. State EITC eligibility requirements often closely match federal requirements. Wisconsin’s creditdoesnotapplytochildlessworkers, and California’s credit focuses on a narrower segment of income levels than the federal credit. Similarly, most states—with notable exceptions includingCalifornia,Indiana,MinnesotaandNewYork(Tax § 606)—calculatetheirEITCsas a simple percentage of the federal credit, ranging from 3% inMontanato 125% inSouthCarolina.

In a tiebreaker between two non-parents, the tiebreak goes to the person with the higher AGI. And in a tiebreaker between a parent and non-parent, the parent wins by definition. These tiebreaker situations only occur if more than one family member actually file tax returns in which they claim the same child. On the other hand, if the family can agree, per the above and following rules, they can engage in a limited amount of tax planning as to which family member claims the child. A person claiming EITC must be older than his or her qualifying child unless the “child” is classified as “permanently and totally disabled” for the tax year . A qualifying “child” who is a full-time student can be up to and including age 23. And a person classified as “permanently and totally disabled” can be any age and count as one’s qualifying “child” provided the other requirements are met.

Tax Software Can Help

A tax refund is a state or federal reimbursement to a taxpayer who overpaid taxes. The EIC is one of the most important tax credits available to individual taxpayers. RALs are short term loans on the security of an expected tax refund, and RACs are temporary accounts specifically to wait to receive tax refunds, which are then paid by a check or debit card from the bank less fees. The combination of Earned Income Credit, RALs, and RACs has created a major market for the storefront tax preparation industry. A 2002 Brookings Institution study of Cleveland taxpayers found that 47 percent of filers claiming EIC purchased RALs, as compared to 10 percent of those not claiming EIC. The tax preparation industry responded that at least one-half of RAL customers included in the IRS data actually received RACs instead. campaign in Minnesota that launched in 2006 to help Minnesotans claim the EITC.

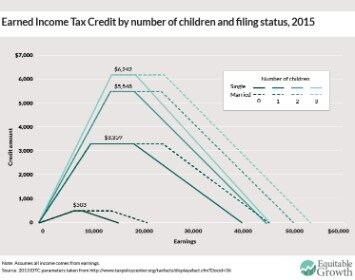

Because the EITC is one of the most lucrative credits available to struggling Americans, filers should consider using a qualified tax software system like TurboTax to maximize the earned income credit. For many Americans, it can be difficult to know which tax credits they qualify for and why. But tax credits are worth having because they provide meaningful savings on a filer’s overall tax contribution and, in some cases, lead to an increased tax refund. IRS Publication 972 provides instructions for parents and guardians of children under age 17 on how to claim the child tax credit. due April 15, 2021), the earned income credit ranges from $538 to $6,660 depending on your filing status and how many children you have. For 2021, the earned income credit ranges from $543 to $6,728 depending on tax-filing status and number of children.

However, a couple can file as Married Filing Jointly even if they lived apart for the entire year if legally married and both agree. A claimant must be either a United States citizen or resident alien. In the case of married filing jointly where one spouse is and one isn’t, the couple can elect to treat the nonresident spouse as resident and have their entire worldwide income subject to U.S. tax, and will then be eligible for EITC. Temporary absences, for either the claimant or the child, due to school, hospital stays, business trips, vacations, shorter periods of military service, or jail or detention, are ignored and instead count as time lived at home. “Temporary” is perhaps unavoidably vague and generally hinges or whether the claimant and/or the child are expected to return, and the IRS does not provide any substantial guidance past this. Both Democrats and Republicans have proposed EITC amendments to provide a substantial credit for childless workers . More recently, several Democratic policy makers have proposed much larger expansions to the credit, while maintaining the credit’s basic structure .

There are many examples of this type of reform proposal, including the President’s Advisory Panel on Federal Tax Reform , the Bipartisan Policy Center , and Maag . Finally, you can’t claim the EITC if your filing status is married filing separately. You can’t claim the foreign earned income exclusion, which relates to wages earned while living abroad. You must have earned income to qualify, but you can’t have too much. Earned income includes all wages you earn from employment, as well as some disability payments.

Your adjusted gross income is your earned income minus certain deductions. for members of the military and the clergy, as well as for people who have disability income or who have children with disabilities. the amount of tax you owe — the EIC could also score you a refund, and in some cases a refund that’s more than what you actually paid in taxes. 501 Exemptions, Standard Deduction, and Filing Information “You are separated under an interlocutory decree of divorce.

A child who supports himself or herself can still qualify as a qualifying child for purposes of the EIC. There is an exception for older married “children.” If an otherwise qualifying child is married, the claimant needs to be able to claim this child as a dependent . The claimant must live with their qualifying child within the fifty states and/or District of Columbia of the United States for more than half the tax year .

Facts About The Earned Income Tax Credit

For purposes of filing a joint return, you are not considered divorced” (part of section “Considered married” on page 5). From 1040 Instructions 2009, “You were legally separated, according to your state law, under a decree of divorce or separate maintenance” . And apparently, the IRS does generally defer to state law and does not provide any more guidance than this.

In this tier, the credit phases in at 45 percent of income , effectively increasing the maximum credit for these families by almost $600. In 1969, Richard Nixon proposed the Family Assistance Plan, which included a guaranteed minimum income in the form of a negative income tax.

The direct cost of the EITC to the U.S. federal government was about $56 billion in 2012. The IRS has estimated that between 21% and 25% of this cost ($11.6 to $13.6 billion) is due to EITC payments that were issued improperly to recipients who did not qualify for the EITC benefit that they received. For the 2013 tax year the IRS paid an estimated $13.6 billion in bogus claims. In total the IRS has overpaid as much as $132.6 billion in EITC over the last ten years. A 2013 systematic review of the effect of in-work tax credits on health outcomes in adults conducted through the Cochrane Collaboration found no evidence for an effect of the EITC on health outcomes in adults. However, the study concluded that further evidence is required to establish the effects of EITC on health outcomes with confidence. All filers and all children being claimed must have a valid social security number.

As the EITC phases in, it is calculated at a set percentage of earnings called the “phase-in rate,” which depends on marital status and number of children. For example, a married couple with two children has an EITC phase-in rate of 40 percent, so for each dollar this family earns up to a certain level, its EITC increases by 40 cents. For households whose income falls between the point where the phase-in ends and a second, higher threshold, the EITC stays constant at the maximum amount. If you qualify for CalEITC and have a child under the age of 6 as of the end of the tax year, you may qualify for up to $1,000 through this credit. Filing your state tax return is required to claim both of these credits.

On the other hand, a taxpayer with two children and filing jointly with her spouse can claim up to a maximum of $5,828 in EIC if the total of the couple’s earned income in 2019 falls below $52,952. A spouse who is filing separately would not qualify for earned income credit. Besides staying below the income thresholds noted above, there are other qualification rules and requirements.

Celebrate it by seeing if you or anyone in your network is eligible for the earned income tax credit. Single, Head of Household, Qualifying Widow, and Married Filing Jointly are all equally valid filing statuses for EITC. A couple who is legally married can file MFJ even if they lived apart the entire year and even if they shared no revenues or expenses for the year, as long as both spouses agree.

Check If You Qualify For Caleitc

This practice occurs when one RAL- or RAC-issuing bank collects for another. That is, such lenders may take all or part of a client’s current year tax refund for purposes of third-party debt collection, and it is unclear how broad are the types of debts for which the banks collect. This contrasts with the more limited types of debt collected for by the IRS. This practice of one bank collecting debt for another may not be adequately disclosed to the tax preparation client; on the other hand, some clients may fail to disclose obligations that result a governmental seizure of their refunds.

For tax year 2020, The CAA allows taxpayers to use their 2019 earned income if it was higher than their 2020 earned income in calculating the Additional Child Tax Credit as well as the Earned Income Tax Credit . Hope Credit, or the Hope Scholarship Tax Credit, is a nonrefundablen higher education tax credit offered to some American taxpayers. When it’s time to pay 2021 taxes, the figures will increase slightly.

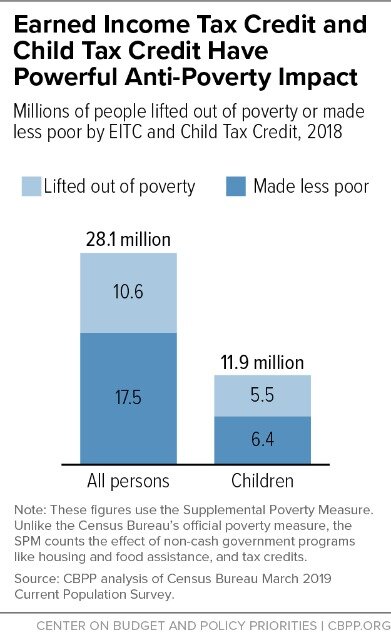

Tax Credit For Case Of One Qualifying Child

The number of poor children would have been more than one-quarter higher without the EITC. The credit reduced the severity of poverty for another 16.5 million people, including 6.1 million children. In combination with the Child Tax Credit, the EITC lifts even more families with children out of poverty. During the 2017 tax year, the average EITC was $3,191 for a family with children (boosting wages by about $266 a month), compared with just $298 for a family without children. Review the chart below to see how much you may get when you file your tax year 2020 return. If you qualify for CalEITC and have a child under the age of 6, you may also qualify for the Young Child Tax Credit. The Consolidated Appropriations Act was signed into law on December 27, 2020 as a stimulus measure to provide relief to those affected by the pandemic.

The amount of credit varies depending on your income and how many dependents you have. The Internal Revenue Service is providing temporary relief for the Earned Income Tax Credit for tax year 2020. If your federal earned income was higher in 2019 than in 2020, you can use the 2019 amount to figure your EITC for 2020. This temporary relief is provided through the Taxpayer Certainty and Disaster Tax Relief Act of 2020. Illinois Earned Income Credit is calculated as 18 percent of your federal EITC.

Iowa andMaineare among states that require beneficiaries of certain assistance programs to be informed of the benefits of EITCs. In addition, several states—includingIowa, Oklahoma, Texas andVirginia—appropriate funds or implement measures to help state and federal EITC-eligible families prepare their tax filings. Earned income tax credits are a common strategy used by governments to bolster the economic security of low-income working families, especially those with children. By reducing personal income tax liability, low-income tax filers retain more of their income. The amount of a tax credit is determined mostly by income level, marital status and number of dependent children. From the table above, a single filer with no dependents earning less than $15,570 is eligible for up to $529 in earned income credit.

The only disqualifying filing status for purposes of the EIC is married filing separately. Filers who are not claiming a qualifying child must be between the ages of 25 and 64 inclusive. For a married couple without a qualifying child, only one spouse must be within this age range.

Provided the parent has lived with the child for at least six months and one day, the parent can always choose to claim his or her child for purposes of the earned income credit. In a tiebreaker situation between two unmarried parents, the tiebreak goes to the parent who lived with the child for the longest.

Disallowances For Reckless Or Fraudulent Claims

The article further states that, “The NCLC also found that some shady tax preparers are even offering tax refund loans to lure taxpayers into their offices, but have no intention of lending them the money.” Beginning with 2011 tax season, the IRS announced that they would no longer provide preparers and financial institutions with the “debt indicator” that assisted banks in determining whether RAL applications were approved. Beginning with the 2013 tax season, major banks are no longer offering RALs but only RACs.