Content

When it comes to taxes, even a small error can lead to big problems. Learn which details to look out for when preparing your returns. There’s no doubt that taxes can be quite complex, especially with the frequency of recent tax law changes and personal circumstances during these times. Did you move to another state or spend time out of state in a secondary home?

You can choose to hand off your taxes at any time. When it’s time to file your tax returns, be on the lookout for a Form 1099-G, which reports the amount of unemployment benefits you received during the year.

Once the download is complete, go to your Windows Desktop and double-click on the file to begin the installation process. Taxpayers can simply snap a picture of their tax documents, send them to your office and sign their tax return all from their mobile device. We offer Interview Mode for novice tax preparers and Direct Input for more seasoned tax preparers. Tax Refund Bank Products allow the taxpayer to have their tax return prepared with no out-of-pocket expense. J. Keller services, see our Frequently Asked Questions. Turbo, Intuit, QuickBooks, QB, TurboTax, ProConnect, and Mint are registered trademarks of Intuit Inc. Terms and conditions, features, support, pricing, and service options subject to change without notice.

Use Ey Taxchat Today

You can explore them in detail right now, as well as stock up on all your basic payroll supplies like 1098 form packages and MICR toner cartridge products. Our selection of HP MICR toner cartridge supplies is so extensive, we’re supremely confident you can find the size and style you need. Please take a few moments to explore our site now by reading our articles and browsing through the product links on our main page.

You don’t have to make an appointment, mail paper documents or understand complicated tax software. If you need additional time to file your federal and state returns, EY TaxChat™ can prepare and file your extension forms for you. EY tax professionals will prepare and file your individual returns including forms related to investment income, such as federal Schedules B, D and E.

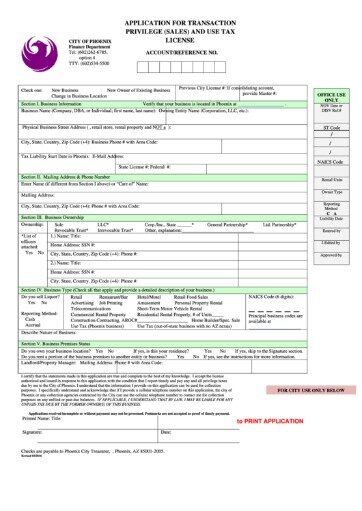

States have varying tax residency rules, which are crucial to understand to avoid unexpected state taxes and filing requirements. For those with investments in real estate, virtual currencies or partnerships, we will calculate income or losses and file the supplemental forms required. Freedom Phoenix 1040 CL gives tax preparers the confidence needed in securing a strong foothold in the industry for years to come. Our software is an exceptionally user-friendly, accurate, and quick income-tax software, specifically intended for tax professionals looking to stay ahead of the industry.

No Bank Application Fee Or Service Bureau Fee

Being self-employed is a major achievement, but it comes with additional responsibilities. If you’re a business owner, partner, contractor or gig worker, you may have to pay self-employment tax.

The insights and quality services we deliver help build trust and confidence in the capital markets and in economies the world over. We develop outstanding leaders who team to deliver on our promises to all of our stakeholders. In so doing, we play a critical role in building a better working world for our people, for our clients and for our communities. The economic impact of the pandemic has been challenging, with millions receiving unemployment. These funds offer a lifeline, but they’re not tax-free income. If paying taxes makes you cringe, tax credits and deductions should make you smile.

Software Manuals

J. Keller helps you increase safety awareness, reduce risk, follow best practices, improve safety training, and stay current with changing regulations. If you’ve filed your IRS Form 2290 by mail in the past, you know it took weeks to receive your stamped Schedule 1. J. Keller® 2290 online service, the filing process can be completed in minutes, and you can have your Schedule 1, with electronic stamp, in as little as 24 hours.

EY TaxChat will be open for enrollment in early January 2021 and available through fall 2021. To get started, create an account either at or by using the mobile app, which is available for download from the Apple App or Google Play stores.

Our business forms offer a complete solution for preparing Federal and State business returns. With EFTPS, you must set up your account with the IRS ahead of time. Your 2290 form must be filed the month after a taxable vehicle is first used on public highways during the current period. The current period begins July 1 and ends June 30 of the following year. Form 2290 must be filed by the last day of the month following the first month of use.

Try An Online Demo Of Phoenix Tax!

Proper reporting is crucial, as certain types of interest, dividends and capital gains may qualify for reduced tax rates. If you’re subject to the net investment income tax, we prepare the Form 8960, and include the tax deductions available to you. We stay current on tax laws to identify the deductions and credits applicable to you.

In most cases, income you earn in another state will be taxed by that state, requiring you to file there, too. The tax rules are vast, and the details are key. EY TaxChat professionals will complete the applicable forms to report your rental activity. For business owners, contractors and gig-workers, the freedom of being your own boss comes with the requirement to pay self-employment tax. Hire EY professionals to file your taxes from the comfort of your home. Get virtual, one-on-one tax guidance and on-demand preparation from a tax professional.

- For business owners, contractors and gig-workers, the freedom of being your own boss comes with the requirement to pay self-employment tax.

- EY tax professionals will prepare and file your individual returns including forms related to investment income, such as federal Schedules B, D and E.

- Please refer to your advisors for specific advice.

- Plus, if you’re interested in tax tips from the pros throughout the year, this section is for you!

- This section is dedicated to keeping you updated.

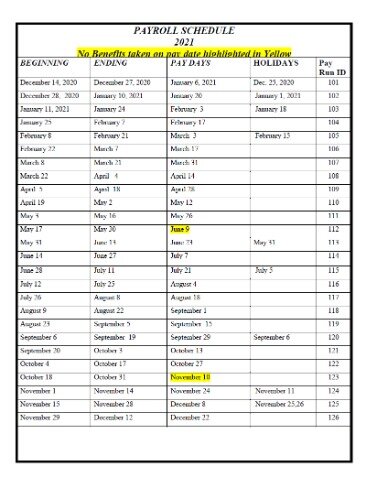

A full-featured live and after-the-fact payroll system for up to 998 companies, each with up to 5000 employees. If you need assistance downloading or installing our software, please call a Customer Service Representative at .

You may use TurboTax Online without charge up to the point you decide to print or electronically file your tax return. Printing or electronically filing your return reflects your satisfaction with TurboTax Online, at which time you will be required to pay or register for the product. Get started with TurboTax Live and connect with tax experts on-demand for help and advice. At any time, you can hand off your taxes to a tax expert or CPA who’ll prepare, sign, and file your return for anadditional fee. Have a dedicated expert do your taxes for you start to finish—They can prepare, sign, and file your return for an additional fee.