Content

See your Cardholder or Account Agreement for details. It does not provide for reimbursement of any taxes, penalties, or interest imposed by taxing authorities and does not include legal representation. Additional terms and restrictions apply; SeeFree In-person Audit Supportfor complete details.

2018 is now the prior year. © 2021 Intuit Inc.

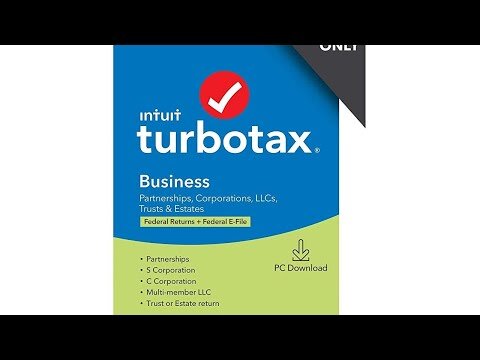

You may use TurboTax Online without charge up to the point you decide to print or electronically file your tax return. Printing or electronically filing your return reflects your satisfaction with TurboTax Online, at which time you will be required to pay or register for the product. You can file prior years returns. You’ll need to purchase and download theTurboTax software for PC or Macas TurboTax Online and the mobile app are only available for the current tax year. Prior years returns can’t be e-file, you will need to print the returns and file them by mail. Terms and conditions, features, support, pricing, and service options subject to change without notice.

Deluxe Online

Conditions apply. See Peace of Mind® Terms for details. State e-file available for $19.95. State e-file available within the program. An additional fee applies for online. Additional state programs are extra. Most state programs are available in January.

Release dates vary by state. Online AL, DC and TN do not support nonresident forms for state e-file. Software DE, HI, LA, ND and VT do not support part-year or nonresident forms.

Ingo Money reserves the right to recover losses resulting from illegal or fraudulent use of the Ingo Money Service. Your wireless carrier may charge a fee for data usage. Additional transaction fees, costs, terms and conditions may be associated with the funding and use of your card or account.

Visit hrblock.com/halfoff to find the nearest participating office or to make an appointment. OBTP# B13696 ©2018 HRB Tax Group, Inc. © Intuit, Inc. All rights reserved. Turbo, Intuit, QuickBooks, QB, TurboTax, ProConnect, and Mint are registered trademarks of Intuit Inc. To file tax returns for past years, you cannot use TurboTax Online which is dedicated to the current year .

©2015 InComm. All Rights Reserved.

Emerald Cash Rewards™ are credited on a monthly basis. Rewards are in the form of a cash credit loaded onto the card and are subject to applicable withdrawal/cash back limits.

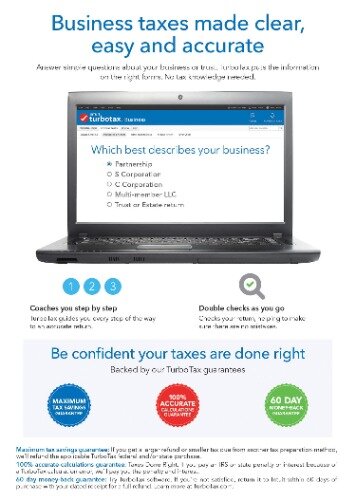

Merchants/Offers vary. Try TurboTax software. If you’re not satisfied, return it within 60 days of shipment with your dated receipt for a full refund (excluding shipping & handling). If you’re not satisfied, return it to Intuit within 60 days of purchase with your dated receipt for a full refund. Try TurboTax Live. We’ll find every tax deduction and credit you qualify for to get you the biggest tax refund, guaranteed. Western Governors University is a registered trademark in the United States and/or other countries.

Learn More About The Turbotax Desktop Premier + States 2020

Box 2890, Sacramento, CA ; or at When you use an ATM, we charge a $3 withdrawal fee. You may be charged an additional fee by the ATM operator . See your Cardholder Agreement for details on all ATM fees.

- Original supporting documentation for dependents must be included in the application.

- CAA service not available at all locations.

- See your Cardholder Agreement for details on all ATM fees.

- Results vary.

- The IRS allows taxpayers to amend returns from the previous three tax years to claim additional refunds to which they are entitled.

Offered at participating locations. Promotional period 11/9/2020 – 1/9/2021. OBTP# B13696 ©2020 HRB Tax Group, Inc.

MetaBank® does not charge a fee for this service; please see your bank for details on its fees. By authorizing H&R Block to e-file your tax return, or by taking the completed return to file, you are accepting the return and are obligated to pay all fees when due. Offer valid for tax preparation fees for new clients only. A new client is an individual who did not use H&R Block office services to prepare his or her 2016 tax return. Valid receipt for 2016 tax preparation fees from a tax preparer other than H&R Block must be presented prior to completion of initial tax office interview. May not be combined with other offers.

Compare Turbotax Desktop Products

Minimum monthly payments apply. Line balance must be paid down to zero by February 15 each year. Year-round access may require an Emerald Savings® account. The Rapid Reload logo is a trademark owned by Wal-Mart Stores. Rapid Reload not available in VT and WY.

Our 60,000 tax pros have an average of 10 years’ experience. We’re here for you when you need us. Not sure where to start? We’ll find the tax prep option for you. Store all of your tax info and docs for up to six years.

Availability of Refund Transfer funds varies by state. Funds will be applied to your selected method of disbursement once they are received from the state taxing authority. Payroll, unemployment, government benefits and other direct deposit funds are available on effective date of settlement with provider.

H&R Block employees, including Tax Professionals, are excluded from participating. Available only at participating H&R Block offices. CAA service not available at all locations.

HRB Maine License No. FRA2.

You have to print and mail prior year returns. When you mail a tax return, you need to attach any documents showing tax withheld, such as your W-2’s or any 1099’s. Use a mailing service that will track it, such as UPS or certified mail so you will know the IRS received the return. Don’t forget state. File taxes electronically (e-file) and receive email confirmation from the IRS once your online tax return has been accepted.

Results may vary. Only available for returns not prepared by H&R Block. All tax situations are different and not everyone gets a refund. Fees apply if you have us file an amended return. The IRS allows taxpayers to amend returns from the previous three tax years to claim additional refunds to which they are entitled. Applies to individual tax returns only. Results vary.

Once activated, you can view your card balance on the login screen with a tap of your finger. You should enable the security features on your mobile device, because anyone who has access to it will be able to view your account balance. You will still be required to login to further manage your account. These provisions limiting your liability do not apply to debit transactions not processed by MasterCard or to unregistered cards.

OBTP#B13696. ©2020 HRB Tax Group, Inc. At participating offices.

Visithrblock.com/ezto find the nearest participating office or to make an appointment. OBTP#B13696 ©2017 HRB Tax Group, Inc. Type of federal return filed is based on taxpayer’s personal situation and IRS rules/regulations. Form 1040EZ is generally used by single/married taxpayers with taxable income under $100,000, no dependents, no itemized deductions, and certain types of income . Available at participating U.S. locations. H&R Block tax software and online prices are ultimately determined at the time of print or e-file. All prices are subject to change without notice.