Content

Your employer is required to withhold payroll taxes on the compensation element, but occasionally that doesn’t happen correctly. By doing so, you can not only avoid the risks associated with investing directly in a startup but possibly improve your taxes as well.

Furthermore, the employee could lose the options if they left the company before the stock options are vested. There might also be clawback provisions that allow the company to reclaim NSOs for a variety of reasons. A non-qualified stock option is a type of employee stock option wherein you pay ordinary income tax on the difference between the grant price and the price at which you exercise the option. If you have non-qualified stock options, be sure to understand their basic features such as exercise price, vesting schedule, early exercise availability, grace period on termination, and end date.

We will describe and illustrate two of those choices – cash and “cashless exercise”. At times for CPAs, it is easy to focus narrowly on obtaining the best tax result possible. It is important to take a step back and remember that the most favorable tax result is not always the best overall financial result for the client.

You give your employer the cash required to purchase the options . The decision of when to exercise your employee stock options can be challenging. There are important factors you should consider in order to make a wise decision. This earned income is also subject to payroll taxes, which include Social Security and Medicare.

You also control how well you plan for that taxable event when you create it by exercising. The terms of the options may require employees to wait a period of time for the options to vest.

This website uses cookies to improve your experience while you navigate through the website. Out of these cookies, the cookies that are categorized as necessary are stored on your browser as they are essential for the working of basic functionalities of the website. We also use third-party cookies that help us analyze and understand how you use this website. These cookies will be stored in your browser only with your consent.

NSOs have different tax treatments depending on whether they have a “readily ascertainable market value” at the time the NSO is granted. If the NSO does have a readily ascertainable market value, then the NSO is taxed when granted. Otherwise, the NSO is taxed when the worker exercises the NSO. Spread or Bargain Element – The fair market value of the stock minus the strike price of the stock option. By exercising your options over time, you won’t see any immediate or significant gains, but you can reduce a lot of the upfront costs and spread out the tax liability.

Does Amt Affect Isos Or Nsos?

Like the strategy discussed in the NQSO planning section, this can be used to improve cash flow during the exercise event. The immediate sale of the shares to cover the AMT is a disqualifying disposition.

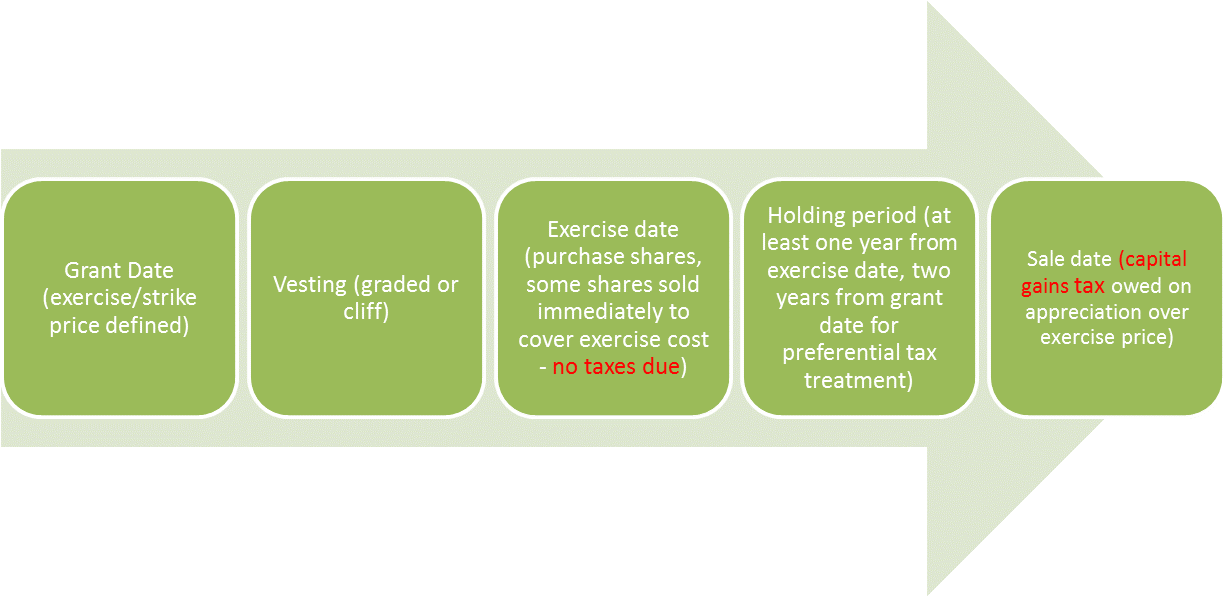

Additionally, the options may not be exercisable after the expiration of 10 years from the date of grant. deferral of income tax consequences will not be an available choice. Readily Determined Fair Market Value – If an option is actively traded on an established market, you can readily determine the fair market value of the option. Incentive Stock Option – After exercising an ISO, you should receive from your employer a Form 3921, Exercise of an Incentive Stock Option Under Section 422.

Small Business Exemption Regs Provide Surprises For Large Taxpayers

The remaining shares received can be held for future appreciation and, if the holding period requirements are met, favorable qualifying disposition treatment. 1) Will the tax liability upon exercise of non qualified ESOs ever be deferred pursuant to IRC 83 c-3. Qualifying disposition refers to a sale, transfer, or exchange of stock that qualifies for favorable tax treatment. For smaller and younger businesses with limited resources, such options that can be offered in lieu of salary increases. They can also be used as a recruiting tool to make up for shortcomings in the salaries offered when hiring talent. As a result, it is typical for NSOs to be subject to tax when exercised. The market value of the option can be readily determined using rules set forth in the regulations.

- There might also be clawback provisions that allow the company to reclaim NSOs for a variety of reasons.

- You exercise your option to purchase the shares, and then you sell the shares the same day.

- This is the best way to see an immediate return on your investment.

- When you exercise your options, the spread between the grant price and the exercise price is taxed the same as compensation income subject to Medicare and Social Security tax.

- The period for which you retain ownership, and the value of the shares dictate how they will be taxed.

Unlike non-qualified stock options, gain on incentive stock options is not subject to payroll taxes. However it is, of course, subject to tax, and it is a preference item for the AMT calculation. When you exercise your options, the spread between the grant price and the exercise price is taxed the same as compensation income subject to Medicare and Social Security tax.

As opposed to ISOs, NSO holders will pay taxes which are withheld when exercised. NSOs do have the possibility of anIRS Section 83 electionwhere you can defer taxes for 5 years. A NSO is a type of employee stock option that gives an employee the right to purchase company stock at a certain price called the exercise or strike price. NSOs do not require employment and the expiration date can be extended well over 90 days, although they do not come with the same favorable tax benefits as ISOs.

Tax Treatment Of Non

Do you want to integrate executive compensation into your broader financial plan? Individuals with high ordinary income, such as wages, could be even further immunized from the AMT regime. The options must be granted pursuant to a shareholder-approved plan. The grants must occur within 10 years of the date on which the plan was adopted or approved by shareholders, whichever is earlier.

With an 83 election, you have your option taxed at early exercise before the company price appreciates and before the option vests. Gain from non-qualified stock options is considered ordinary income and therefore taxed at a higher rate. NQSOs may have higher taxes but they also afford a lot more flexibility in terms of whom they can be granted to and how they may be exercised. Companies typically prefer to grant non-qualified stock options because they can deduct the cost incurred for NQSOs as an operating expense sooner.

Regardless of whether the company withholds taxes or you make estimated payments, you will true it up to the required amount when you actually file taxes. That could result in a refund or additional taxes, such as when lottery winners are surprised that they often owe more taxes despite the mandatory withholding at the beginning. If you sell NSO shares you are also responsible for paying quarterly estimated taxes which you calculate yourself. If you don’t pay enough, there are interest penalties when you file next April. Additionally, Medicare, Social Security taxes, and Federal Unemployment Tax are charged on NSO exercises. NSOs are subject to ordinary income taxes based on the spread between the current FMV and the strike price of the option.

Sale or disposition – when the worker sells or otherwise disposes of the stock. Once your option period ends, typically after 10 years or when you leave the company, your option loses its value and is worth nothing. Your option may have a short grace period after you terminate employment during which you can exercise your option. You may use TurboTax Online without charge up to the point you decide to print or electronically file your tax return.

What Are The Tax Implications Of Isos And Nsos?

Non-qualified stock options may go to employees, company partners, vendors, or others that aren’t on the company payroll. These stocks function much like ISOs, except you pay taxes on the spread between the grant price and exercise price at your standard income tax rate. As with ISOs, employees must wait until shares vest before they can exercise their options. There is an expectation that the company’s share price will increase over time.

To make the most of your employee stock options, it’s best to consult with a certified financial planner who can help you navigate the complexities of stocks and tax laws to maximize your returns and minimize your costs. Employee stock options are increasingly popular, especially among startups that want to attract top talent.

Your stock option gives you the right but not the obligation to buy shares of the company stock. It’s up to you to decide whether and when to exercise your option. Your compensation element is the difference between the exercise price ($25) and the market price ($45) on the day you exercised the option and purchased the stock, times the number of shares you purchased.