Content

Finally, if you absolutely do not want to spend any money to file your tax return—regardless of how badly the software might make you want to rip your hair out—MyFreeTaxes is completely free and has no income or age limitations. It isn’t the most user-friendly software, so we recommend it only if you’re comfortable researching tax information yourself rather than getting assistance from the software. You can learn more about that option in our Notable competition section. If you have student loan debt or college tuition payments, an otherwise simple return (say, just a W-2 and an interest statement from the bank), and you don’t qualify for the IRS Free File version of TurboTax, file with H&R Block Free Online. The IRS has a rather complicated set of instructions on how to report the income or loss from a Form K-1. It depends on whether the business had a gain or loss, and whether or not the earnings were derived from passive investment or active participation in the company. In most cases, ordinary pass-through income from a partnership, LLC or S corporation goes on Schedule E, Line 28.

- Prospective unitholders should consult their tax or financial advisors to determine the federal, state and local tax consequences of ownership of our limited partnership units.

- Keep in mind, the standard deduction for 2020 was $12,400 so it’s possible you’ve itemized deductions in the past but won’t this year.

- This is a service provided by the charitable organization United Way to anyone and everyone.

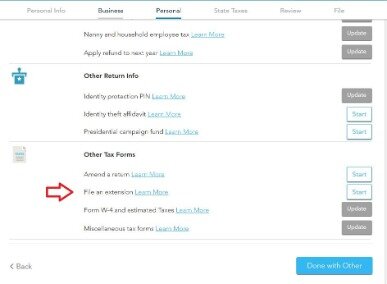

- For knowledgeable tax preparers and DIYers, it also offers the option to select specific forms to work on rather than going through the guided wizards.

- The software points out when some selections are uncommon to help you avoid checking the wrong boxes; for example, when we entered a dependent, H&R Block told us it’s uncommon to report that the child has an individual taxpayer identification number.

The filing process with TurboTax also includes encouraging phrases throughout. This isn’t a necessary feature, but taxes are stressful for many people. Seeing, “You can do this,” throughout the process may help to reduce some anxiety. The net loss of an MLP is considered a “passive loss” and cannot currently be deducted from your other taxable income. However, you can carry the loss forward into future tax years and use it to reduce future taxable income from the same partnership.

Turbo Tax Instructions

You must furnish a copy of each K-1 to the appropriate beneficiary, and attach all copies to Form 1041 when you file the return with the Internal Revenue Service. You may use TurboTax Online without charge up to the point you decide to print or electronically file your tax return. Printing or electronically filing your return reflects your satisfaction with TurboTax Online, at which time you will be required to pay or register for the product. Whenever a beneficiary receives a distribution of income, the trust or estate reports a deduction for the same amount on its 1041.

The profits of a partnership are distributed according to the partnership agreement created by each of the partners. In other words, each partnership decides for itself how it will distribute earnings. You’ve signed a partnership agreement and registered the partnership with the state. Intuit, QuickBooks, QB, TurboTax, ProConnect, and Mint are registered trademarks of Intuit Inc. Terms and conditions, features, support, pricing, and service options subject to change without notice. You would only report unrelated Business Taxable Income from your IRA greater than $1,000, which would be in Section 20 of the K-1 if you had any.

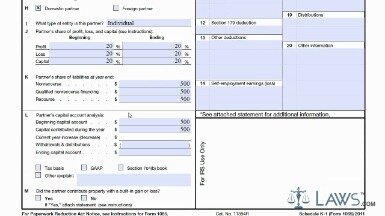

Each person should consult his or her own attorney, business advisor, or tax advisor with respect to matters referenced in this post. Bench assumes no liability for actions taken in reliance upon the information contained herein. If you’re claiming the Section 179 deduction, report your share of that deduction here. If you have any other losses or income to report that doesn’t fall in the interest, ordinary dividends, royalties or capital gains category, report them here and attach a statement explaining what kind of income you’re reporting. The instructions to Schedule K-1 offer a detailed breakdown of what you could report here. Here you’ll report any royalties you received during your dealings with the partnership.

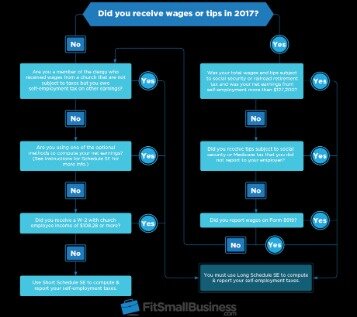

If you are a general or limited partner of a partnership, a shareholder in an S-Corp, or the beneficiary of an estate or trust, you’re likely to receive a K-1. For example, suppose you’re a trustee, and the terms of the trust require all dividend income from a stock portfolio must be distributed equally among the beneficiaries. You must report all dividend income on the 1041, and you report the share of dividend income for each beneficiary on Schedule K-1s.

If any of the loss is left over when you sell your units, you can deduct it from your other income that year. Besides having an outdated interface, FileYourTaxes.com charges $45 to file a federal return, even if you have a simple return.

Looking For More Information?

Form 6478 can be accessed from the Main Menu of the tax program by selecting, Credits, General Business Credit , Current Year Business Credits, Form 6478, then Credit from Pass-Through Entities. Line 13 A – Credit for Estimated Taxes -The beneficiary treats this amount as a payment of estimated tax. Form 1041-T must be timely filed by the fiduciary of the estate or trust for the beneficiary to get credit for these tax payments. Amounts reported in Box 13, with a code of “A” will automatically flow to Form 1040, Line 65 as Estimated Tax Payments. There are a couple of big differences between the options in the forms that they support. TurboTax’s Deluxe option supports Schedule SE, which allows you to fileself-employment taxes. It also allows you to file Schedule C and Schedule C-EZ if you have business income to report but do not have any expenses to report.

The Partnership is, however, subject to a tax on its gross income to retain the PTP status. Both TurboTax and H&R Block offer a service where you can start your return online and then have a tax pro review your information and file for you. These services cost about $100 in addition to the regular software fee plus $40 to $50 per state—pushing them closer to the cost of using your own tax preparer. TurboTax also does a great job of keeping you engaged in the process and preventing you from mindlessly clicking past important details. Its entry forms switch between boxes that look like nicer IRS forms, nested lists of categories you can explore, animated loading screens, and yes-or-no or multiple-choice questions. The large buttons and fonts are also more accessible to tax filers than in competing software; we found that the not-so-user-friendly design of other apps made an already painful task more painful.

should provide the beneficiary a statement with the information needed to determine any credit recapture. Because this item is entered on Schedule A Line 28 as a Miscellaneous Deduction, it is not subject to the limitation that the expense must exceed 2% of the amount on Form 1040, line 38 . K-1 Input – Select ‘New’anddouble-clickon Form 1041 K-1 Estate/Trust which will take you to the K-1 Heading Information Entry menu. At the bottom of this screen, the user must select if the K-1 is from an Estate or a Trust. Jennifer Mansfield, CPA, JD/LLM-Tax, is a Certified Public Accountant with more than 30 years of experience providing tax advice. Both of these services are known for their ease of use but TurboTax is generally the more user-friendly of the two – whether you’re talking about mobile or desktop.

Accordingly, an investor’s basis in a partnership will increase or decrease from year to year. The ending capital account balance that appears on each annual Form K-1 may be a reasonable approximation of a partner’s basis at year-end. Federal tax law requires that a Schedule K-1 be sent to every unitholder.

Both services allow you to import your previous returns no matter which tax service you used . They also make it easy to fill out your state return after going through your federal return. Your information quickly transfers so you don’t waste time retyping everything. H&R Block and TurboTax both offer a free option for filers with simple returns.

These are payments that the partnership made to you without regard to the partnership’s income, usually in exchange for services or for the use of capital. Here you’ll report your share of the partnership’s profits, loss, and capital. Generally speaking, these amounts are based on the business’ partnership agreement.

Before taking any action, you should always seek the assistance of a professional who knows your particular situation for advice on taxes, your investments, the law, or any other business and professional matters that affect you and/or your business. For example, if a business earns $100,000 of taxable income and has four equal partners, each partner should receive a K-1 with $25,000 of income on it. Intuit IMPLIES lots of things to get you to spend more, like “Deduction Maximizer” which is not the same as being able to do itemized deductions. If you happen to need a form that isn’t covered by Credit Karma Tax, then you won’t be able to file with them. If you’re using the online version, you can only do one return. When you buy TurboTax, you’re allowed to install it on any computer you own.

Tools To Stay On Top Of Your Taxes All Year Long

We dismissed it this year because of several reports of issues with the program. Wirecutter readers and staff, as well as commenters on the Better Business Bureau site, have noted frustrating problems such as missing deductions on state returns or forms that fail with no explanation. Credit Karma also doesn’t support multi-state filing and a few common forms such as for underpayment of estimated tax, and it doesn’t offer live support.

Find out how to use this tax form to accurately report your information on your tax return. Credit Karma Tax offers a free way to file both your federal and state taxes. It includes business income and audit defense which are not features you will see in most free file plans. While there are a few scenarios that allow you to skip filing a return, it’s usually a good idea to file even if you don’t have to. Filing allows you to receive a refund, if you over paid your taxes and makes you eligible for any assistance you may qualify for.

Unlike W-2 and 1099 forms which are usually delivered by February, your K-1 may not arrive until March, April, or even later. This is because the K-1 issuer needs to completetheirtax return before they can send out Schedule K-1.

If you need additional assistance don’t forget we have tax experts available to help you live via phone or chat. I received a K-1 for a Survivor’s Trust for calendar year 2011, and am amending my 2011 return (already submitted & rec’d).

Amounts reported in Box 11, using code D represents the unused NOL carryover amounts for any property which the beneficiary has received, and this amount will automatically flow to Form 1040, Schedule 1, Line 21 with a notation of “NOL” listed. You may be required to report certain items of the Partnership’s income or loss on various state and local tax returns. You should contact your tax advisor to understand these additional filing requirements. Some of its questions gave us pause, requiring information such as our driver’s license number or state ID card, which no other program required. Its help topics often just linked to IRS publications or were filled with tax jargon, and the tedious interface made us somehow miss inputting some key forms, such as for dividend income. On the plus side, TaxSlayer lets you preview your return as a PDF file, and it offers live phone support .

For taxpayers who like a more hands-on approach to filing, it’s nice to take a peek under the hood. Besides letting you file your federal and state taxes for free under any scenario, the IRS-sponsored version of TurboTax doesn’t subject you to upsell prompts for unneeded services like identity-theft protection (which most people shouldn’t pay for anyway). You’ll know, each step of the way, that you won’t have to pay to file your federal or state tax return—unlike in other programs, including the commercial TurboTax Free Edition, where it might be unclear whether you can file for free. For the 2020 filing period, we retested four major online tax apps—H&R Block, TaxAct, TaxSlayer, and TurboTax—and two we hadn’t tested before that are part of the IRS’s Free File Program, FileYourTaxes.com and OLT. You can learn more about the reported issues with Credit Karma Tax in the Competition section. We’d be remiss if we didn’t address the concerns many people have with major tax software companies like TurboTax and H&R Block. Both companies have faced multiple lawsuits and investigations regarding their marketing, lobbying, and other business practices.

And that’s why I use turbotax every year to be able to import all the data. It does contain Schedule C which I have used in the past . I am just wondering if it handles the new QBI calculation correctly, since it’s asking me for manual entries upon federal review. He is also diversifying his investment portfolio by adding a little bit of real estate.