5.1 You can view Intuit’s Privacy Statement provided with the Services at the link set forth above. You agree to the applicable Intuit Privacy Statement and any changes published by Intuit. You agree that Intuit may use and maintain your data according to the Intuit Privacy Statement, as part of the Services. This means that Intuit may use your data to improve the Services or to design promotions and to develop new products or services. Intuit is a global company and may access or store personal information in multiple countries, including countries outside of your own country to the extent permitted by applicable law. 3.3 Mobile access to the Services requires a compatible mobile browser and/or the download and installation of an authorized mobile app and may not be available for all mobile devices or telecommunication providers.

By accessing and using this page you agree to the Terms of Use. All rights reserved, Intuit and turbotaxonline are registered trademarks of Intuit Inc.

The Notice of Claim should include both the mailing address and email address you would like Intuit to use to contact you. If Intuit elects to seek arbitration, it will send, by certified mail, a written Notice of Claim to your address on file. A Notice of Claim, whether sent by you or by Intuit, must describe the nature and basis of the claim or dispute; and set forth the specific amount of damages or other relief sought. 7.4 You will manage your passwords and accept updates. You are responsible for securely managing your password for the Services and to contact Intuit if you become aware of any unauthorized access to your account. The Services may periodically be updated with tools, utilities, improvements, third party applications, or general updates to improve the Services.

Before a court of competent jurisdiction issues any public injunctive relief, it shall review the factual findings of the arbitration award on which any injunction would issue with no deference to the arbitrator. If you elect to seek arbitration, you must first send to Intuit a written Notice of your Claim (“Notice of Claim”). The Notice of Claim to Intuit should be sent in care of our registered agent Corporation Service Company, 251 Little Falls Drive, Wilmington, DE 19808.

After cancellation of service, Assisted Payroll customers will have access to their filed tax forms through the Payroll Tax Center until June 30th of the following calendar year. Use your company EIN and Payroll PIN to access these forms online. If you do not know your EIN or Payroll PIN, click the links below.

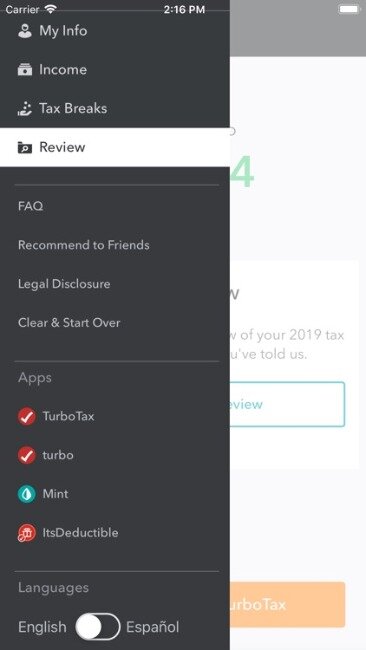

App Privacy

Upon Intuit notice that your use of the Services has been terminated you must immediately stop using the Services and any outstanding payments will become due. Any termination of this Agreement shall not affect Intuit’s rights to any payments due to it. Sections 2.2, 3 through 15 will survive and remain in effect even if the Agreement is terminated. You may be offered other services, products, or promotions by Intuit (“Other Intuit Services”). Additional terms and conditions and fees may apply. With some Other Intuit Services you may upload or enter data from your account such as names, addresses and phone numbers, purchases, etc., to the Internet.

- 7.4 You will manage your passwords and accept updates.

- are a great starting point to see how much you might owe the IRS, and the potential tax refund you might receive.

- The Notice of Claim to Intuit should be sent in care of our registered agent Corporation Service Company, 251 Little Falls Drive, Wilmington, DE 19808.

- If you do not agree to this Agreement, then you may not use the Services.

You agree that Intuit may use your feedback, suggestions, or ideas in any way, including in future modifications of the Services, other products or services, advertising or marketing materials. You grant Intuit a perpetual, worldwide, fully transferable, sublicensable, non-revocable, fully paid-up, royalty free license to use the feedback you provide to Intuit in any way. attempting to probe, scan, penetrate or test the vulnerability of an Intuit system or network or to breach Intuit’s security or authentication measures, whether by passive or intrusive techniques. Intuit reserves the right to not authorize and may terminate your use of the Services based on reasonable suspicion of your activities, business, products or services that are objectionable or promote, support or engage in any of the restricted uses described above.

You agree that you will comply with these laws and regulations and will not export, re-export, import or otherwise make available products and/or technical data in violation of these laws and regulations, directly or indirectly. 4.1 Use of these Services may be available through a compatible mobile device with Internet access and may require software. You agree that you are solely responsible for these requirements, including any applicable changes, updates and fees that may apply as well as the terms of your agreement with your mobile device and telecommunications services provider. Intuit and the Intuit Financial Freedom Foundation are proud to donate tax preparation services to the IRS Free File Program. By using the IRS Free File Program delivered by TurboTax, low to moderate income tax filers have the ability to prepare and electronically file IRS and all state tax returns for free, while claiming all the deductions and credits they deserve.

Either you or Intuit may seek to have a Claim resolved in small claims court in your county of residence or the small claims court in closest proximity to your residence, and you may also bring a claim in small claims court in the Superior Court of California, County of Santa Clara. The Services may include a community forum or other social features to exchange Content and information with other users of the Services and the public. Intuit does not support and is not responsible for the Content in these community forums. Please use respect when you interact with other users.

Other parties’ trademarks or service marks are the property of their respective owners. Frank Ellis is a Traverse City Tax Preparation Planner and published author. He has written tax and finance related articles for twelve years and has published over 1000 articles on leading financial websites. Having children is a rewarding but costly decision. From clothing and food to medical bills and schooling, you need every bit of money you can get to give your child the best, all the time. Either you or Intuit can seek to have a Claim resolved in small claims court if all the requirements of the small claims court are satisfied.

What Are Tax Exemptions?

Terms, conditions, features, support, pricing and service options subject to change without notice. Turbo, Intuit, QuickBooks, QB, TurboTax, ProConnect, and Mint are registered trademarks of Intuit Inc. Is there a taxcaster link for a 2019 tax return estimate, that we file in 2020? File taxes electronically (e-file) and receive email confirmation from the IRS once your online tax return has been accepted. Then, easily track your tax return to see when your refund will hit your bank account. Payment of all filing, administration and arbitrator fees will be governed by the AAA Rules. You are required to pay AAA’s initial filing fee, but Intuit will reimburse you for this filing fee at the conclusion of the arbitration to the extent it exceeds the fee for filing a complaint in a federal or state court in your county of residence or in Santa Clara County, California.

Provide access to or give any part of the Services to any third party. Security Certification of the TurboTax Online application has been performed by C-Level Security.

With Family Sharing set up, up to six family members can use this app. By purchasing this item, you are transacting with Google Payments and agreeing to the Google Payments Terms of Service and Privacy Notice. Intuit, the Intuit logo, checkmark design, TurboTax, EasyStep, QuickBooks, and ItsDeductible among others, are registered trademarks or service marks of Intuit Inc. in the United States and other countries.

@babs1000Activity within an IRA does not affect your taxes. Only distributions from the retirement account will affect your taxable income. Can I receive an e-mail @ to let me know the tax caster for 2019 is available? I need to trade some IRA investments before the end of the year and I need to know how much the extra income and gain will effect my taxes. The definition of the “Services” includes the TaxCaster offering and mobile companion application. Your use of the Services is subject to the General Terms set forth above and the Additional Terms and Conditions below, which govern your use of the Services indicated below. These Additional Terms and Conditions shall prevail over any conflict or inconsistency with the General Terms above.

How Your Taxes Are Calculated

Until termination of this Agreement and as long as you meet any applicable payment obligations and comply with this Agreement, Intuit grants to you a personal, limited, nonexclusive, nontransferable right and license to use the Services in accordance with the terms set forth herein. It is important to have a basic understanding of how you pay your taxes, and with the plethora of tools available, you can quickly familiarize yourself with a basic understanding of how taxes are calculated. As you get into using the tool, the beauty of the TurboTax online tax calculator is that it continues to compile your information in real-time on the screen. After about 5 minutes of quick entry, we gleaned a reasonably accurate picture of what our tax filing situation was going to look like. If you’re not satisfied, return it within 60 days of shipment with your dated receipt for a full refund (excluding shipping & handling).

If you’re not satisfied, return it to Intuit within 60 days of purchase with your dated receipt for a full refund. If you’re not satisfied with your purchase and have not filed or printed your return, return it to Intuit within 60 days of purchase with your dated receipt for a full refund (excluding shipping & handling). , indicated that the app’s privacy practices may include handling of data as described below.

3.1 Intuit reserves the right to suspend, cancel or terminate the Services or your access to the Services at any time without notice, including but not limited to the availability of, any mobile application that provides or facilitates access to the Services. The first step in preparing your federal tax return is determining your filing status. Generally, you will have to select between single, head of household, married filing jointly and separately, or as a qualified widower.

Where Is Taxcaster On Your Website?

Do not reveal information that you do not want to make public. Users may post hypertext links to content of third parties for which Intuit is not responsible.

You will need to check the Services website to ensure your mobile device and telecommunications provider are compatible with TaxCaster. Intuit is not obligated to provide a compatible version of the Services for any or all mobile devices, operating systems or telecommunication providers, all of which Services and/or accessibility are subject to change by Intuit at any time without notice to you. 3.1 Use of these Services may be available through a compatible mobile device, Internet access and may require software.

Thank you for selecting the Services offered by Intuit Consumer Group LLC and/or its subsidiaries and affiliates (referred to as “Intuit”, “we”, “our”, or “us”). Review these Terms of Service (“Agreement”) thoroughly. This Agreement is a legal agreement between you and Intuit. By clicking “I Agree,” indicating acceptance electronically, or installing, accessing or using the Services, you agree to this Agreement.

Intuit reserves the right, in its sole discretion and at its own expense, to assume the exclusive defense and control of any Claims. You agree to reasonably cooperate as requested by Intuit in the defense of any Claims. Intuit may, but has no obligation to, monitor access to or use of the Services or Content or to review or edit any Content for the purpose of operating the Services, to ensure compliance with this Agreement, and to comply with applicable law or other legal requirements. We may disclose any information necessary to satisfy our legal obligations, protect Intuit or its customers, or operate the Services properly.

Just enter some basic info and watch your refund add up. TaxCaster is ready for tax year put on your favorite tax cardigan, sit back, and let the planning begin! We’ve updated the app with all of the latest 2020 tax laws. And now, free data transfer for new TurboTax customers. Send your TaxCaster data over to TurboTax to pre-select questions and start filing.

If Intuit believes that any Claim you have filed in arbitration or in court is inconsistent with the limitations in this Section 14, then you agree that Intuit may seek an order from a court determining whether your Claim is within the scope of the Class Action Waiver. If this Class Action Waiver is found to be unenforceable, then the entirety of this Section 14 shall be null and void. To the extent that you or Intuit prevail on a Claim and seek public injunctive relief , the entitlement to and extent of such relief must be litigated in a civil court of competent jurisdiction and not in arbitration. The parties agree that litigation of any issues of public injunctive relief shall be stayed pending the outcome of the merits of any individual Claims in arbitration.

and credits that you are entitled to for having a child. Their system asks you the right questions to ensure that you receive your largest tax refund estimate possible. is programmed to understand your potential deductions and factors them into your overall tax refund estimate. There are certain payments, transactions, and expenses that will be subtracted from your tax bill.

Intuit, in its sole discretion, may refuse to post, remove, or refuse to remove, or disable any Content, in whole or in part, that is alleged to be, or that we consider to be unacceptable, undesirable, inappropriate, or in violation of this Agreement. However, one of the more difficult aspects to using the calculator is that you need some basic background on your tax situation fairly early in the process. We recommend grabbing a copy of your most recent pay stub and any other tracking documents you have available for the tax calculator, so you will have the information you will need.