Content

Transcripts requested using Form 4506-T may be mailed to any address, including to the attention of the trustee in the debtor’s bankruptcy case. Transcripts are normally mailed within 10 to 15 days of receipt of the request by the IRS. A transcript contains most of the information on the debtor’s filed return, but it isn’t a copy of the return.

You may use TurboTax Online without charge up to the point you decide to print or electronically file your tax return. Printing or electronically filing your return reflects your satisfaction with TurboTax Online, at which time you will be required to pay or register for the product.

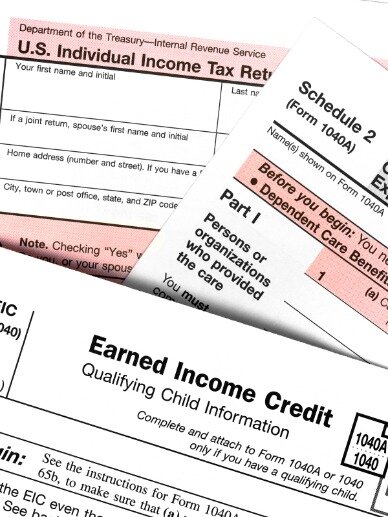

If you can’t use the federal bankruptcy exemptions, most states have a lower value wildcard exemption that offers less protection for your tax refund. On the other hand, certain states do have special exemptions to protect tax refunds attributed to the Earned Income Tax Credit or Child Care Tax Credit. So, you need to carefully check your exemption scheme to know how much of your tax refund you can protect. Dischargeable taxes might be forgiven without any payment at all, depending on the amount of disposable income you have after your reasonable and necessary expenses are deducted from your pay.

incurred during the administration of the case, the trustee may use a properly executed tax return as a claim for refund or credit. Generally, the automatic stay to collect taxes continues until either the bankruptcy court lifts the stay, the bankruptcy case is closed or dismissed, or the debtor receives a discharge.

Get Debt Relief Now

If you plan to file for Chapter 7 in the next year, you can also avoid receiving a refund at all by adjusting your tax withholding so that you only pay the tax you owe. By doing this, you’ll receive more money each month and you can avoid getting a tax refund.

Debtors must usually show undue hardship to discharge their education debt. “Undue hardship” means different things in different parts of the county, because the Supreme Court has not ruled on this issue. So, it should be no surprise that there are specific rules for bankruptcy discharge. It should also be no surprise that the IRS will object to discharge if it has any reason to do so.

You may also be able to access tax law information in your electronic filing software. Tips and links to help you determine if you qualify for tax credits and deductions. The Tax Withholding Estimator (IRS.gov/W4app) makes it easier for everyone to pay the correct amount of tax during the year. The tool is a convenient, online way to check and tailor your withholding. It’s more user-friendly for taxpayers, including retirees and self-employed individuals.

Filing Taxes After Bankruptcy: Is Discharged Debt Income To You?

Cancelling the debt requires the bank to send you the 1099-C regardless of whether you received a discharge in bankruptcy. This means the 1099-C you received was likely generated appropriately, but does not mean that you must take it as actual income on your tax return. You will need to file the appropriate forms with the IRS to exclude the canceled debt as income on your 1040 tax return. Archer said that although the vast majority of Chapter 11 bankruptcies are filed by corporations, not individuals, it is still important for individual debtors to be aware of these two separate filings.

She is known for energetic representation of clients and her command of bankruptcy law. © 2007–2021 Credit Karma, LLC. Credit Karma® is a registered trademark of Credit Karma, LLC. All Rights Reserved. Product name, logo, brands, and other trademarks featured or referred to within Credit Karma are the property of their respective trademark holders. This site may be compensated through third party advertisers. A senior product specialist with Credit Karma Tax®, Janet Murphy is a CPA with more than a decade in the tax industry. She’s worked as a tax analyst, tax product development manager and tax accountant.

- Bankruptcy law determines which of the debtor’s assets become part of a bankruptcy estate.

- In some cases a trustee may indicate that they will check back after your tax return has been filed to to see if you receive a tax refund.

- This is a short overview of a complicated topic, and the rules mentioned here may not apply to every taxpayer or debtor.

- If you owe the IRS a return but don’t file it before your 341 meeting of creditors, things can happen to derail your case.

- You only want to have the necessary taxes withheld from your paycheck, nothing more.

In cases where a trustee isn’t appointed, the debtor-in-possession continues business operations and remains in possession of the business’ property during the bankruptcy proceeding. The debtor-in-possession, rather than the general partner of a partnership or corporate officer of a corporation, assumes the fiduciary responsibility to file the business’ tax returns. Joan enters the total tax, estimated tax payments, and tax due from Form 1040 or 1040-SR on Form 1041. She completes the identification area at the top of Form 1041, then signs and dates the return as the trustee on behalf of the bankruptcy estate. On December 15, 2019, Thomas Smith filed a bankruptcy petition under chapter 7.

What Happens To My Irs Tax Debt If I File Bankruptcy In 2021?

After the conversion, the debtor should notify payors required to report the debtor’s nonemployee compensation that compensation earned after the conversion should be reported using the debtor’s name and TIN, not the estate’s name and EIN. Any income on this property will be taxed to the estate even if the income is realized after the conversion to chapter 7. If a chapter 11 case is dismissed, the debtor is treated as if the bankruptcy case had never been filed and as if no bankruptcy estate had been created. Trustees may require the debtor to submit copies or transcripts of the debtor’s returns as proof of filing. The debtor can request free transcripts of the debtor’s income tax returns by filing Form 4506-T, with the IRS or by placing a request on the IRS’s free Automated Delivery Service , available by calling . If requested through ADS, the transcript will be mailed to the debtor’s most current address according to the IRS’s records.

It could raise a flag if you don’t include the amount on your tax return without any supporting documentation or explanation. A forgiven, canceled, or discharged debt is one that the creditor has agreed to or is prohibited from pursuing payment. You might want to defer more of your salary into an employer IRA or 401k. However, depositing the tax refund into your bank account before making a retirement fund contribution won’t work. Once the return hits your account, it will become an asset. Here are some ways to increase your chances of keeping your tax refund in Chapter 7 bankruptcy. If the IRS has not assessed the debt within the last 240 days, the income tax debt is not dischargeable.

Most Taxes Can’t Be Eliminated In Bankruptcy, But Some Can

Don’t report a discharged debt until you’ve consulted with a tax professional about the exact details of your situation. You want to be very sure that you do, indeed, have to report the income. Likewise, plan on including a debt as income unless and until a tax professional tells you that you don’t have to. The mortgage has to be on your principal residence to qualify. The law allows you to exclude from income up to $1 million in debt, or up to $2 million if you’re married and you file a joint return with your spouse. Be sure to attach the form because the lender is also obligated to submit a copy of it to the IRS.

In reducing NOLs and capital losses, first reduce the loss for the tax year of the debt cancellation, and then any loss carryovers to that year in the order of the tax years from which the carryovers arose, starting with the earliest year. Make the reductions of credit carryovers in the order in which the carryovers are taken into account for the tax year of the debt cancellation. Last, reduce any carryover, to or from the tax year of the debt cancellation, of an amount used to determine the foreign tax credit or the Puerto Rico and possession tax credit. Reduce any passive activity loss or credit carryover from the tax year of the debt cancellation. Reduce any carryovers, to or from the tax year of the debt cancellation, of amounts used to determine the general business credit. Generally, use the amount of canceled debt to reduce the tax attributes in the order listed below.

In chapter 11 cases, post-petition wages earned by a debtor are generally treated as gross income of the estate. However, section 1115 of the Bankruptcy Code does not affect the determination of what are deemed wages for Federal Insurance Contributions Act tax, Federal Unemployment Tax Act tax, or federal income tax withholding purposes. Allocation of income and credits on information returns and required statement for returns for individual chapter 11 cases. A bankruptcy estate deducts expenses incurred in a trade, business, or activity, and uses credits in the same way the debtor would have deducted or credited them had he or she continued operations. The bankruptcy estate generally consists of all of the assets the individual or entity owns on the date the bankruptcy petition was filed. A fundamental goal of the bankruptcy laws enacted by Congress is to give an honest debtor a financial “fresh start”.