Content

Compensation may factor into how and where products appear on our platform . But since we generally make money when you find an offer you like and get, we try to show you offers we think are a good match for you. That’s why we provide features like your Approval Odds and savings estimates.

Some types of taxes cannot be offset by non-refundable taxes and can only be offset by certain refundable taxes. The self-employment tax and tax on premature distributions from retirement accounts are examples of taxes that cannot be offset by all types of credits. For Tax Year 2020, the Saver’s Credit allows taxpayers to reduce their income tax dollar-for-dollar by up to $1,000 ($2,000 for married filing jointly). The exact amount of the credit depends on their income, filing status, and the total amount of their qualified contributions. The Earned Income Tax Credit is a credit for taxpayers who earn low to moderate incomes.

The current credit is income-based, so those making over $200,000 ($400,000 for married couples filing jointly) will see the amount of their credit gradually phased out. If taxpayers’ credit exceeds their taxes owed, they can get up to $1,400 as a refund.

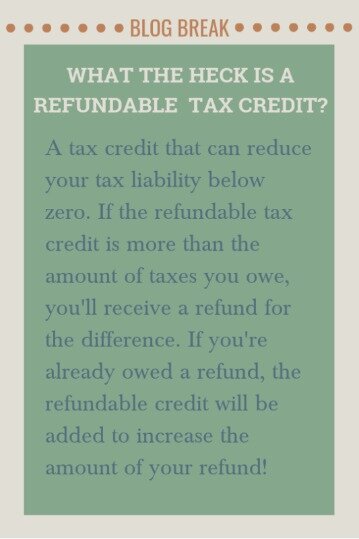

That way all the money that belongs with you stays safe and sound in your pocket. Taxpayers subtract both refundable and nonrefundable credits from the taxes they owe. If a refundable credit exceeds the amount of taxes owed, the difference is paid as a refund. If a nonrefundable credit exceeds the amount of taxes owed, the excess is lost. Here are some tax credits that could help your bottom line on your 2019 tax return. Every credit has certain qualifications you must meet in order to receive it.

A deduction reduces your taxable income — that is, the amount of money subject to income tax. So if you earned $50,000 last year and qualified for $15,000 in deductions, you’d only pay taxes on the remaining $35,000. By contrast, a nonrefundable credit can only reduce your federal income tax liability to zero. Any part of the credit that’s leftover is not refunded back to you. Like payroll withholding, refundable tax credits are regarded as tax payments.

If you have children or other dependents under the age of 17, you likely qualify for the Child Tax Credit. This credit reduces your federal income tax bill by up to $2,000 per child for the 2020 tax year.

For this reason, when doing your taxes, consider calculating any refundable tax credits after figuring in all nonrefundable credits, deductions and tax payments. As a reminder, tax credits directly reduce the amount you owe the IRS. So, if your tax bill is $3,000 but you’re eligible for $1,000 in tax credits, your bill is now $2,000. This differs from a tax deduction, which reduces how much of your income is subject to income tax. A refundable tax credit not only reduces the federal tax you owe but also could result in a refund if it more than you owe.

Eligible filers can claim the CTC on Form 1040, line 12a, or on Form 1040NR, line 49. To help you determine exactly how much of the credit you qualify for, you can use theChild Tax Credit and Credit for Other Dependents Worksheetprovided by the IRS. Another big change was that the new tax plan largely combined the Additional Child Care Tax Credit with the CTC. This is part of the reason the CTC became refundable and its limits increased. The CTC phases out at an income level of $200,000 for single filers and $400,000 for joint filers. In 2017 the phase-out level was $75,000 for single filers and $110,000 for joint filers. The offers for financial products you see on our platform come from companies who pay us.

Use the FREE efile.com “KIDucator” child tax credit tax tool to find whether or not you qualify for the Child Tax Credit. The refundable Recovery Rebate Credit is calculated like the 2020 Economic Impact Payment – EIP – or stimulus payment. However, the credit eligibility and the amount are based on a taxpayer’s 2020 tax information as reported on the 2020 Tax Return.

Employee, Worker Tax Credits

has covered technology and financial services issues for more than 30 years as a writer, editor, publisher, consultant, and analyst for media brands, startups, and established corporations. Jennifer Mansfield, CPA, JD/LLM-Tax, is a Certified Public Accountant with more than 30 years of experience providing tax advice. A financial advisor can help you optimize your tax strategy for your family’s needs.

- If that credit is refundable, it will eliminate the $1,000 you owe the IRS, and the IRS will send you the balance.

- This means that some earners get refunded by the tax system because of their family status, level of income, or some combination of both.

- The Saver’s Credit may allow you to reduce your income tax for making contributions to a retirement plan.

- So a $3,000 credit, for example, could reduce the amount of tax you owe by $3,000.

- One other important point is, at the time when the tax credits are applied, the taxpayer could not show a tax refund in the tax calculation process – a potential tax refund will show later.

This decreases your taxable income and could potentially drop you into a lower tax bracket. Even if your contributions didn’t change your bracket in the past, make sure to check thecurrent tax brackets. They may have changed since you last filed, so contributing slightly more might now help you to really boost your savings. Some states offer a complementary state-level CTC and/or CDCTC that matches part or all of the federal credit. In some states, the credits are refundable and in other states they are not.This state-by-state guide breaks down which states offer their own Earned Income Tax Credit, CTC or CDCTC.

Products & Services

This is a refundable credit, so it can either reduce your liability or be paid out directly to you as a refund. Up to 40% of theAmerican Opportunity Credit, an educational credit for college expenses, is refundable. The Democrats’ legislative proposal, meanwhile, would not eliminate any existing child or family programs, but instead add as much as $120 billion to the federal deficit to cover the cost. “It is an historic proposal in terms of lowering child poverty,” says Chuck Marr, director of federal tax policy at the Center on Budget and Policy Priorities. If it were to become permanent, it would be a “landmark achievement,” he says. When it comes to taxes, all the record keeping and paperwork to keep track of can be exhausting. Tax credits are also a way to provide a tax break for low- and middle-income taxpayers who need it most.

SmartAsset’s free tool connects you with financial advisors in your area in five minutes. If you’re ready to be matched with local advisors, get started now.

Foreign Tax Credit

Some may want to lower the amount of taxes they owe, seek the largest refund possible or avoid paying more in taxes than they are legally required to pay. An individual who qualifies for a refundable tax credit will receive a payment from the government in excess of the taxes they would otherwise owe. If passed, the Treasury Department could issue advance payments of up to half the 2021 child tax credit starting in July based on families’ 2019 or 2020 tax return information. If there is any overpayment of the credit, individuals making less than $40,000 ($60,000 for couples filing jointly) will not need to repay the amount, nor will it be garnished from wages. The Democrats’ new proposal would increase the credit amount by $1,000 ($1,600 for those with children under 6) and allow taxpayers to receive the full amount as a refund. Additionally, the plan would make the credit payable in monthly installments of $250 and $300, respectively, rather than just once a year. The payments would start to phase out for individuals earning more than $75,000 a year or $150,000 for those married filing jointly.

You may use TurboTax Online without charge up to the point you decide to print or electronically file your tax return. Printing or electronically filing your return reflects your satisfaction with TurboTax Online, at which time you will be required to pay or register for the product.

How Much Of The Child Tax Credit Is Refundable?

Take back your hard-earned cash and pay the IRS only what you have to. Use this free quiz to help you decide which tax filing method is right for you. For further help reducing your tax bill, consider working with a financial advisor who specializes in taxes to craft a financial plan. Having a financial plan can be key to ensuring you’re taking everything into account come tax season.

But with a nonrefundable credit, you won’t get a refund—the best you could hope for is to reduce your tax bill to zero. In tax-speak, a refundable tax credit is one that can help you get money from the IRS whether or not you paid any tax in the first place. There are many refundable tax credits, some of which are fully refundable while others are only partially refundable. All of them have specific and sometimes complex qualifying criteria, the most important of which is usually the income level at which the credit begins to phase out. In general, refundable tax credits are meant to help low- and lower-middle income people, so the qualifying income thresholds are correspondingly low.

Questions About Tax Credits Or Deductions?

The money we make helps us give you access to free credit scores and reports and helps us create our other great tools and educational materials. This credit applies to holders of qualified tax credit bonds including new qualified zone academy bonds, clean renewable energy bonds, qualified energy conservation bonds, and qualified school construction bonds. If you are 65 or over as of 2020, you may be entitled to an additional $1,300 in standard deductions. The standard deduction regularly increases to keep up with inflation.