As soon as the customer receives a letter, they should send a copy of it to you, along with a letter of their own explaining the situation. Mary Girsch-Bock is the expert on accounting software and payroll software for The Ascent. Bank policies vary, but an NSF fee can often be waived through an NSF reversal after the fact, especially if it’s the first time that it’s been assessed. Calling the bank’s customer service line and requesting a refund is the best course of action for a consumer.

Sign up for account alerts to notify you whenever your balance is too low. Some banks allow you to link another bank account, like a savings account, to your checking account. If you overdraw on your checking account, the bank moves over funds from the other account to cover any pending transactions.

Switch Banks

When a bank declines a payment due to the customer having inadequate funds in an account, the customer is charged a nonsufficient funds fee, or NSF fee. There can sometimes be criminal or civil consequences for writing bad checks, so customers should try to recover from these fees as quickly as possible. NSF fees and overdraft fees are charged when a customer lacks the funds in their account to cover a check, transaction or payment. Non-sufficient funds and overdrafts are two distinct bank transactions.

A bounced check may result in overdraft fees, restrictions on writing additional checks, and negative impacts to your credit score. Writing too many bounced checks may also prevent you from paying merchants by check in the future. Many merchants use a verification system called TeleCheck to help them determine if a customer’s check is good. If this system connects the check you’ve just presented for payment to a history of unpaid checks, the merchant will decline your check and ask you for a different form of payment.

Tips for reducing the risk of accepting NSF checks

Banks aren’t required to notify an account holder when a check they signed bounces due to non-sufficient funds. However, some banks may offer options for customers to enroll in/sign up for in order to be notified of overdrafts. A customer with $100 in a checking account may initiate an automated clearing house (ACH) or electronic check payment for a purchase in the amount of $120. If the bank accepts the check and pays the seller, the checking account balance falls to –$20 and incurs an overdraft (OD) fee.

- The business to which you wrote the bounced check may also levy a charge against you for the lack of payment.

- In other cases, if a check bounces, the payee reports the issue to debit bureaus such as ChexSystems, which collects financial data on savings and checking accounts.

- The civil penalty is less severe and will usually set the total amount the customer has to pay your business for issuing a bad check.

- To avoid bouncing checks, some consumers use overdraft protection or attach a line of credit to their checking accounts.

Bouncing a check can be embarrassing and hurt your reputation with the business or person you attempted to pay, and the financial consequences can be even more painful. But financial institutions must disclose their fees when customers open a new account, thanks to the Truth in Savings Act. The civil penalty is less severe and will usually set the total amount the customer has to pay your business for issuing a bad check. The amount is almost always more than the amount on the check because the customer will be expected to cover any bank and court fees your business had to pay. A customer can also be penalized for any further damages that your business may suffer due to the NSF check. There’s no guarantee that your bank will waive your NSF fee, but you can contact your bank’s customer service department and ask if they’d be willing to reverse it.

Are NSF Fees Legal?

Having a cushion in your account can help defend you against NSF fees. One of the best ways to avoid NSF fees is to stay on top of your expenses. You can track expenses using a monthly budgeting spreadsheet or a budgeting app that tracks the expenses of linked accounts. Below are some examples of when a bank or credit union may charge you an NSF fee. Get up and running with free payroll setup, and enjoy free expert support.

What to do as an NSF check holder

By taking initiative, you can demonstrate you’re a responsible customer and ask about ways to provide payment for the amount of the check and any returned check fees the merchant might charge. Staying on top of your finances is difficult enough without the added cost of bank fees. When your bank account balance isn’t high enough to cover a pending transaction, your bank may charge a fee for having non-sufficient funds in the account.

The formal letter may include the check information, why it was returned, and a request for remittance of the check amount and bank fees charged to you. Let them know that if you have not received payment by the due date, you will file a small claims court claim against them. The entity attempting to cash an NSF check may be charged a processing fee by its bank. The entity issuing an NSF check will certainly be charged a fee by its bank. An alternative situation is that the bank of the entity issuing the check will honor the check, and then charge an overdraft fee to the check issuer.

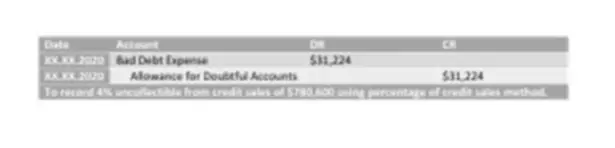

The NSF can be for insufficient funds, but it can also be a bank error, with your customer as upset as you are. But whatever the reason, the fact is that their NSF check is costing you both payment on the item purchased as well as an extra fee from the bank. NSF checks directly impact your accounts receivable balance as well as your cash balance, so you’ll need to be sure that you record both the NSF check and the check fee properly. This is an easy process if you’re using accounting software but will require multiple entries if you’re recording accounting transactions manually. Sending a demand letter by certified mail can encourage a customer to pay you before more serious, and expensive, actions are necessary.

What’s the difference between NSF fees and overdraft fees?

Look at which transactions have cleared and which ones are still unaccounted for. Don’t forget about pending expenses like automatic payments you’ve set up or checks you’ve written. Just because you paid someone by check doesn’t mean they will deposit it immediately, which could leave you with a lingering transaction. Many banks charge the same or similar amounts for NSF and overdrafts. NSF fees can range from $10 to $35 or more, depending on the bank or credit union. According to Forbes Advisor’s annual checking account fee survey, the average overdraft fee was $24.38 in 2020.