Content

See IRS taxable income thresholdsfor previous tax brackets for back taxes or future, 2021 brackets. Use the tool above to see a unique breakdown of your income tax. When you prepare your 2020 Tax Return with eFile.com, our tax app will report your income within the respective tax brackets so you don’t have to worry about which thresholds you fall into.

High-income earners, whether individuals or corporations, tend to use more detailed tax rate schedules in conjunction with itemized deductions. You will then scroll down through the columns for taxable income. Then scroll to the row to the right of your taxable income. Your federal income tax will be shown by filing status. Use the tax figure that corresponds to your filing status in that row.

- The rates apply to taxable income—adjusted gross income minus either the standard deduction or allowable itemized deductions.

- Investors should always be sure that they are using the correct tax tables based on their income sources and area of residence.

- Many people can calculate their taxes using the tax tables provided by the IRS in the instructions to the 1040EZ, 1040A, or 1040.

- The progressive tax system ensures that all taxpayers pay the same rates on the same levels of taxable income.

- Understanding how to use the tables will make it easier for you to calculate the tax you owe or can provide you with an estimate of your future tax bills in case you need to budget for it.

- Guidance issued prior to February 9, 2021, that is contrary to the information in this document is superseded by this document, pursuant to sec. 73.16, Wis.

There are many possible adjustments you may qualify for. Examples include certain business expenses, contributions to health savings accounts, IRA contributions and student loan interest. And the new shorter Form 1040 does manage to reduce the essential tax return to a single, double-sided page.

Generally, deductions lower your taxable income by the percentage of your highest federal income tax bracket. So if you fall into the 22% tax bracket, a $1,000 deduction could save you $220. Your bracket shows you the tax rate that you will pay for each portion of your income. For example, if you are a single person, the lowest possible tax rate of 10 percent is applied to the first $9,525 of your income in 2020. The next portion of your income is taxed at the next tax bracket of 12 percent. That continues for each tax bracket up to the top of your taxable income. Use the new RATEucator below to get your personal tax bracket results for Tax Years 2020 and 2021.

See Which Tax Credits You Qualify For

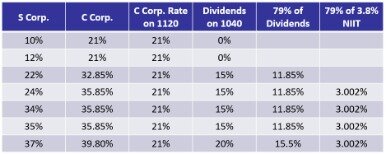

Find the income bracket that contains your taxable income in the left hand column of the table. For example, if you have $33,460, you would use the income bracket ranging from $33,450 to $33,500. For presentation in this table, no distinction is made between MAGI and taxable income. However, since MAGI is generally higher than taxable income, the 3.8% tax may be applicable even if your taxable income is below the applicable threshold. The deduction is available to taxpayers that itemize deductions, not those who take the standard deduction. The deduction is based on adjusted gross income and number of exemptions claimed. Taxpayers who keep all their receipts can deduct actual sales tax and use tax paid.

The Taxpayer will need to enter in the tax year, your income range, the number of exemptions being claimed on your return, the tax on any qualifying large purchases and the zip code for your resident address. A home or a substantial addition to or major renovation of a home up to the amount of the general sales tax rate. To determine the appropriate Wisconsin state and/or county sales and use tax rate that applies to a transaction, see the Sales Tax Rate Lookup. Two common ways of reducing your tax bill are credits and deductions. If you’ll be facing a tax bill, plan ahead for how to cover your underpayment when taxes are due . If you expect a refund, consider how to use the money to achieve your overall financial goals, whether that means increasing your emergency fund, saving for a house or paying off student loan debt. Where your income row and filing status meet, that’s your tax for 2018.

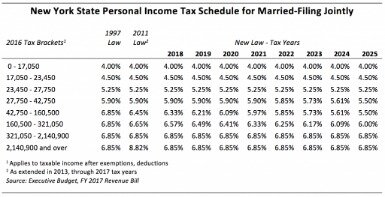

Tennessee and New Hampshire only assess a tax on dividend and interest income. Tax tables will change from year to year, and will vary from state to state. Individuals and companies should always be sure that they are using the correct tax tables based on year, their income and sources and area of residence. Exceptions to the county tax treatment and special situations are explained in Part 18.D. through in Publication 201, Wisconsin Sales and Use Tax Information. Your state might have different brackets, a flat income tax or no income tax at all.

What Is A Tax Table?

However, the income used in tax tables is taxable income, not the gross income. Taxable income refers to gross income minus deductions.

Thus, only the dollar amount that is left after factoring in deductions is subject to income tax. For example, the standard deduction for 2020 is $12,400 for single taxpayers. Each tax rate applies only to income in a specific tax bracket. Thus, if a taxpayer earns enough to reach a new bracket with a higher tax rate, his or her total income is not taxed at that rate, just the income in that bracket. Even a taxpayer in the top bracket has some portion of income taxed at the lower rates in the tax schedule.

Based on the tax brackets, you always have more money after taxes when you earn more. But, of course, rates are not the only factor in your final tax bill. You can lose tax benefits that phase out at higher income levels, such as education for higher education.

Taxpayer Case Study For Tax Rate And Bracket Calculation

William Perez is a tax expert with 20 years of experience who has written hundreds of articles covering topics including filing taxes, solving tax issues, tax credits and deductions, tax planning, and taxable income. He previously worked for the IRS and holds an enrolled agent certification. The federal individual income tax has seven tax rates that rise with income. If you had $41,000 of taxable income, however, much of it would still fall within the 12% bracket, but the last few hundred dollars would land in the 22% tax bracket. For example, if you’re in the 22 percent tax bracket, every $100 you contribute to charity saves you $22 in federal income taxes.

But it does so by moving a lot of essential information off the original form and onto six new schedules that you may need to file along with the 1040. The standard deduction is a portion of income that is not subject to tax and can be used to reduce a tax bill in lieu of itemizing deductions.

In 2020 for example, single filers can claim a standard deduction of $12,400; however, if you also qualify to file as head of household, your deduction increases to $18,650. Understanding how to use the federal tax tables will make it easier for you to calculate the tax you owe. The other option is to use the IRS Sales Tax Calculator.

With a few pieces of information, including your filing status and taxable income, you may be able to use the 2018 income tax table to be better prepared financially come Tax Day. To use a tax table to determine your federal income tax, first you need to know your filing status and taxable income. The federal income tax table allows you to calculate how much tax you owe by using information about your filing status and taxable income . Take a look at this case study as it demonstrates how IRS taxes are calculated by income tax bracket. For more state related tax rate information, select your state. Your income is taxed at a fixed rate for all income within certain brackets. As your income exceeds a bracket, the next portion of income is taxed at the next bracket, and so on.

Some people think if they earn more money, they are in a higher tax bracket. They believe they pay more taxes and may actually have less money left over than they would if they had earned less. There are thousands of forms and publications related to federal income taxes.

All tax brackets for married taxpayers are twice the size of those for singles, except for the penultimate bracket. This can cause a “marriage penalty” for some taxpayers in the highest tax bracket, as some couples pay more tax filing a joint return than they would if each spouse could file as a single person.

If your taxable income was $100,000 or more, you can check out the IRS tax computation worksheet. The federal income tax began with seven brackets but that number exploded to more than 50 by 1920 . From then until the late 1970s, there were never fewer than 20 brackets. The last major federal tax reform, the Tax Reform Act of 1986, reduced the number of brackets from 16 to two, but that number has crept up to the current seven over the last three decades.

Except for the lowest bracket, filers pay a flat tax as well as a levy based on the rate. What’s more, tax calculations can seem downright arcane. They depend on far more than just knowing your tax bracket and rate.

Each filing status has a different column so be sure you use the one for your filing status or you will get the wrong amount of taxes due. Online calculators like our own TaxCaster calculator can help with this. Also, when you use TurboTax to prepare your taxes, we’ll calculate your taxable income for you. The IRS allows you to choose any filing status that you are eligible for. This is important since the amount of your standard deduction will vary depending on which filing status you choose.

So the IRS makes it easier to understand the amount of tax you’re expected to pay by providing federal income tax tables. Many people can calculate their taxes using the tax tables provided by the IRS in the instructions to the 1040EZ, 1040A, or 1040. The amount shown at the intersection between the income line and the filing status column will be your tax.

The federal individual income tax has seven tax rates ranging from 10 percent to 37 percent . The rates apply to taxable income—adjusted gross income minus either the standard deduction or allowable itemized deductions. Income up to the standard deduction is thus taxed at a zero rate. Also known as tax brackets, tax tables change every year.

Then, find your filing status in the top row of the tax table. To determine your taxable income, you’ll need to know your adjusted gross income , which is your gross income minus adjustments.

Tax Brackets

Laws enacted and in effect after February 9, 2021, new administrative rules, and court decisions may change the interpretations in this document. Guidance issued prior to February 9, 2021, that is contrary to the information in this document is superseded by this document, pursuant to sec. 73.16, Wis.

If you’re wondering how much you’ll save after the tax reform bill, check out our Tax Cut & Jobs Act calculator. As a Single filer, you’re now in the 12 percent tax bracket. That doesn’t mean you pay 12 percent on all your income, however. They’re for single filers, married filing jointly, married filing separately and head of household. For qualifying widows or widowers, they can use the married filing jointly category.

Keep in mind, you might be able to reduce your taxable income and/or increase your nontaxable income and, as a result, fall into lower a tax bracket. This is done by factoring in tax deductions, tax credits or other tax savings. We suggest you not only look at the many tax calculator tools here, but also calculate and estimate your 2020 Tax Return and potential tax refund now. In addition, make sure you adjust your W-4 or tax withholding throughout any given tax year; use the W-4 Tax Withholding Tax Calculator for that.