Content

If an individual, bank or other entity pays you at least $10 of interest during a calendar year, that entity is required to issue a 1099-INT to you. It also has to give you a 1099-INT regardless of the amount of interest payment if it withheld from you — and didn’t refund to you — federal income tax under backup withholding rules. It also has to give you one if it withheld and paid any foreign taxes for you. Use Form W-2 for all payments to employees, including business travel allowances and expense reimbursements.

This may influence which products we review and write about , but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services. We believe everyone should be able to make financial decisions with confidence. Auto, homeowners, and renters insurance services offered through Credit Karma Insurance Services, LLC (dba Karma Insurance Services, LLC; CA resident license # ). Janet Berry-Johnson is a freelance writer with a background in accounting and insurance.

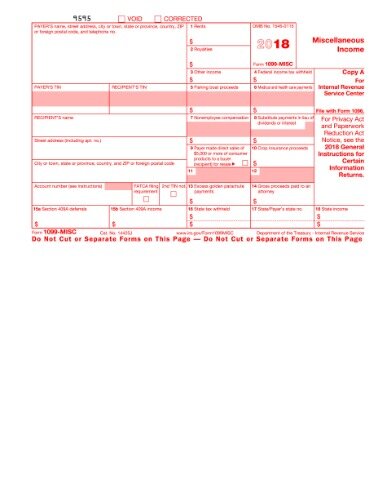

Don’t use Form 1099-MiSC to report payments to non-employees, including independent contractors. For 2020 reporting, you must report payments to non-employees on Form 1099-NEC (non-employee compensation). If you are expecting a 1099 and you do not receive it by January 31, the IRS recommends contacting them at .

What If You Dont Receive A 1099 From Paypal Or Anyone Else?

Generally, the 1099-DIV form is used to report stock or mutual fund dividends and other distributions of $10 or more. The requirements for who has to issue a 1099-DIV and under what circumstances are the same as those for a 1099-INT. So if you get a 1099 form, what do you need to do with it? Although a missing 1099 C will still be a problem in 2018, it’s important to pay attention to some changes that will affect you as a contractor if you’re a six-figure earner. Although you’ll still pay 15.3 percent on your income, the wage base limit has increased to $128,400. A company must issue you a Form 1099-MISC to document the expenditure. If they fail to give you a 1099-MISC by the IRS deadline, which is usually in mid to late February, the company may face a $50 or higher IRS penalty.

Self-employment income you receive through contract payments needs to be claimed on your individual income tax return. In many instances – for example, a small business serving myriad customers, like a bakery or small store – you report the income to the IRS. Form 1099 is a type of information return; you will get a 1099 form in the mail if you received certain types of income or payments during the year.

Suppose you get a 1099-MISC on Jan. 31 reporting $8,000 of pay, when you know you received only $800 from the company that issued the form? There may be time for the payer to correct it before sending it to the IRS. Taxpayers don’t include 1099s with their tax returns when they submit them to the IRS, but it’s a good idea to keep the forms with other tax records in case of an audit. Again, you will report all freelancing income on Schedule C of your personal tax return. Keeper Tax can help you with this using our tax filing software. Third party merchants and payment card processors issue Form 1099-K instead of Form 1099-MISC to report your income.

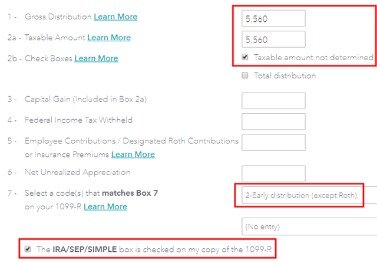

You might not have to report interest earned if you don’t have enough income required to file a tax return. Usually, if you have not made the minimum income for the year, you don’t have to file taxes. There are a few exceptions like if you owe an early withdrawal penalty for an IRA or any other special taxes or if you earned more than $400 in self-employment income. However, even if it’s a hobby, you’ll need to report any income received from PayPal on your tax return. However, if whatever funds you have received represent income, you’ll be required to report that information on your income tax return. Taxpayers generally don’t have to file their 1099s with the IRS because the IRS already has the form, but they do have to report the income on their tax returns. Independent contractors, freelancers, and sole proprietors should receive their 1099-NEC forms from their payers by Feb. 1 of the year following the tax year.

- While our articles may include or feature select companies, vendors, and products, our approach to compiling such is equitable and unbiased.

- Below that threshold you do not need to report the payment.

- The easiest way to calculate your total income is to login to the driving platform and view all of your transactions from the tax year.

- You may also have interest, dividends, capital gains, retirement plan distributions and other income that you’ll need to pay tax on.

Written receipts from the merchants or service providers will be needed to document the business nature of expenses claimed. But you can also deduct any other expenses related to the production of that income.

Kristin is an advocate and affiliate partner for Keeper Tax. Lyft and Uber are only required to send 1099s to those drivers who have reached $20,000 in driving sales or more than $600 from driver referrals or other payments. Form W-9 is simple to fill out and is purely for informational purposes only, so there is no requirement to also send this form to the IRS. The main purpose of this form is to instruct your clients as to how to fill out your 1099, including which address and tax ID to utilize. One simple proactive measure you can take is by filling out form W-9 on behalf of yourself or your freelancing business. Then, you can send this form to all of your clients or employers.

But job wages are far from the only source of income you might have to report on your federal income tax return. You may also have interest, dividends, capital gains, retirement plan distributions and other income that you’ll need to pay tax on. Remember, you as the receiver payee do not send the 1099 to the IRS.

Enter the result appearing on Schedule 1, and ultimately on your Form 1040. Schedule 1 reports “Additional Income and Adjustments to Income” and it’s the catchall form for many 1099 forms. You’ll typically receive a 1099-INT from your bank or credit union if you hold accounts that produced interest income of $10 or more. You’ll also receive one if any foreign taxes were withheld and paid for from your interest income, or if your earned interest was subject to backup withholding. Individual taxpayers do not have to issue and submit 1099-MISC forms when they make any of these types of payments, such as if they pay an attorney. The requirement is only for businesses and self-employed individuals. If you know you should receive a 1099 but it doesn’t appear, don’t panic.

What Is The Foreign Tax Credit And Can I ..

If the amount of money a company claims it paid you doesn’t match your own records, you’ll need to discuss it with them and straighten it out. If you’re wondering how to get a 1099 you never received, the answer is to reach out to the would-be issuer and request one.

A taxpayer, recipient, or payee will receive a paper or electrotonic 1099 form from an issuer or payer by January 31 of the following year of the tax year in which the income occurred. Even without the form, report the income you received with your other gross receipts on Schedule C or Schedule C-EZ of Form 1040. You must report all gross receipts, including income under $600. Include a note with your return, giving details about the income for which you need but lack a 1099-MISC. Explain why you don’t have it, and describe the source of the income.

Not All Paypal Funds Come From Income

These are considered like bank fees, and are part of the process and expense of collecting income from clients and other sources. You can do this regardless of the amount of income earned, or the expenses claimed. You may not even receive one from other parties, like clients. The duplication may be easy to prove if client 1099s match the PayPal 1099-K exactly. But if there is any difference in the two amounts, it could cause the IRS to conclude you’ve under-reported your income. It’s very possible that not all of the funds collected in your PayPal account represent income. If you’re using PayPal to collect income from retail customers, the situation is pretty straightforward.

MyBankTracker and CardRatings may receive a commission from card issuers. Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed or approved by any of these entities. We believe by providing tools and education we can help people optimize their finances to regain control of their future. While our articles may include or feature select companies, vendors, and products, our approach to compiling such is equitable and unbiased.

Can I File A Tax Return Using Bank Statements?

Use form 1099-NEC to report payments to independent contractors. Backup withholding orders are orders you receive from a court requiring your company to withhold income taxes from payments you make to a payee. You must report ALL backup withholding amounts for anyone for whom you have withheld income taxes under a backup withholding order, even if the total is $600 or less. If the backup withholding is for a non-employee, use Form 1099-NEC to report these payments.

Payment for personal physical injuries is excludable from income, and it shouldn’t normally be the subject of a Form 1099. The time delay means you may have a chance to correct obvious errors—so don’t just put arriving 1099s in a pile—open them immediately.

So again, for many people a 1099-SA is simply proof that the money left the account and went to you. Anybody responsible for closing a sale or exchange of real estate furnishes this statement to you, reporting the proceeds. Again, the proceeds from the sale of your house or other real estate aren’t necessarily taxable, so do your homework. If you belong to a co-op and received at least $10 in patronage dividends, expect to see Form 1099-PATR in your mailbox. settle your debt for less than you owe, you’re not entirely off the hook. The amount the lender forgives is likely taxable income, and the 1099-C tells all.

Form 1099-B covers income from the sale of several types of securities, as well as some types of bartering that take place via bartering exchanges, typically websites. In that case, the exchange might “1099 you” for the income you received.

Form 1099-MISC is a general-purpose IRS form for reporting payments to others during the year, not including payments to employees. This form has been redesigned for 2020 to remove the reporting of non-employee income . While a W-2 reports wages, salaries, and tips, a 1099 reports other kinds of income. There are many varieties of 1099 forms and each one is used to report different, specific types of income. You can file taxes on your self-employment income even if you don’t receive a 1099. Good recordkeeping is an essential aspect of self-employment.

From costs of goods sold to car expenses and marketing costs, many expenses will reduce your taxable income. When you don’t file your taxes and the IRS estimates a tax bill, your deductions are not included and penalties and interest are added. Penalties include amounts for failure to file and failure to pay. Failure to file fees max out at $205 after 60 days, while a maximum failure to pay penalty is 25 percent of the total you owe. Self-employment taxes due are included in your final tax bill and will be subject to the same penalties and interest. Even if you don’t receive a 1099, or if the income you earn from a client is less than $600, you’re still required to report the income on your tax return.

You don’t have to file a 1099 with your income tax return, so if you don’t have the form, that’s not really a problem as long as you report the income and pay the proper amount of tax. Form 1099 is used to report certain types of non-employment income to the IRS—such as dividends from a stock or pay you received working as an independent contractor. Generally, businesses must issue the forms to anypayee who receives at least $600 during the year. That’s why you probably get a 1099 form for every bank account you have, even if you earned only $10 of interest income. When you simply forgot to file a 1099 form while completing your income taxes, you can file an amended tax return with the IRS to correct the error.