Content

The name used on a tax return must match the name on file with the Social Security Administration for the Social Security number associated with that name. If one or both of the newlyweds changed their name on the marriage certificate, it is essential to notify the Social Security Administration by filing Form SS-5. The form can be obtained online, but the completed form and documents showing the new name must be submitted by mail or in person at a Social Security office. One of the most surprising things that couples learn when filing taxes is that whether you got hitched on January 1 or December 31, the IRS counts you as “married” for that entire calendar year. If your state has a state income tax, you have to choose between using the deduction for your state tax paid OR the sales tax deduction, whichever is higher. The TT process will suggest one or the other as you prepare your return. Married couples also get more bang for their buck when it comes to the gift tax exclusion.

While the marriage penalty is indeed real, there’s one final point to keep in mind. It’s only a marriage “penalty” if both spouses work, own rental property, have capital losses, and so on. If a couple gets married and only one spouse works, the “married filing jointly” tax brackets will actually save the couple money. Since its creation in the 1960s, the Alternative Minimum Tax has not been adjusted for inflation. Thus, Congress was forced to “patch” the AMT by raising the exemption amount to prevent middle class taxpayers from being hit by the tax as a result of inflation. If one spouse is self-employed and the other doesn’t want to be connected to the business, filing separately may be an option.

Married couples can file federal taxes in only one of two ways—married filing jointly or married filing separately. A marriage bonus is when a household’s overall tax bill decreases due to a couple marrying and filing taxes jointly. Marriage bonuses typically occur when two individuals with disparate incomes marry. One unintended feature of the United States’ income tax system is that the combined tax liability of a married couple may be higher or lower than their combined tax burden if they had remained single. This is called the marriage penalty or marriage bonus.

The money we make helps us give you access to free credit scores and reports and helps us create our other great tools and educational materials. ▪ If a home or homes is owned prior to marriage, decide on a sale or sales and the impact of the home sale exclusion. ▪ If spouses cannot afford to maximize contributions for each 401, decide how much to contribute and to which plan. ▪ Decide which health plan to use if employers of both spouses offer coverage.

Tax Services

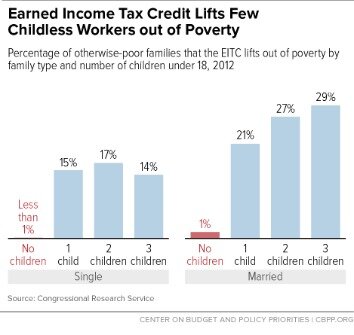

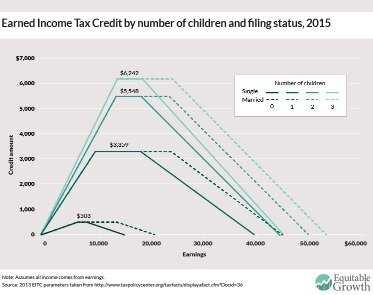

Marriage bonuses also become more pronounced for low-income couples with one child. Both the CTC and the EITC have steep phase-in benefits with one child. This means a low-income, unmarried couple could decrease their total tax bill through marriage, which would add their incomes together and increase the size of their EITC and CTC.

Not only that, but the higher your joint income, the more likely you’ll be phased out of qualifying for various deductions or credits. If you both earn similar incomes, and particularly if you’re high earners, you’re more likely to experience the “marriage penalty”—having a higher tax burden than you would have had if you were filing as single. “Adding two high, equal incomes together could easily push a married couple’s income into a higher tax bracket, which results in a ‘penalty,’ ” Poulos says. Another consequence to consider is that if you are married and filing separately – and one spouse itemizes their deductions – the other spouse gets a standard deduction of $0. This essentially forces the other spouse to itemize to avoid losing tax deductions altogether. Once you get married, your combined incomes may allow you to purchase your first home or you may choose to sell individual homes owned before the marriage. When you own a home, interest you pay on your mortgage is deductible on your tax return as an itemized deduction.

If they had a dependent, one partner could qualify for head of household status. But in 2013, the IRS ruled same-sex couples could submit a federal joint tax return instead.

A change in a couple’s total tax bill through marriage could conceivably alter that couple’s decision to get married. For example, a couple that is facing a $5,000 tax increase for simply getting married may second-guess their commitment.

When Else Can A Penalty Occur?

If one of you has defaulted on loan payments and you fear the government will collect from your tax refund, you should file separately. Filing for the first time after getting married married can be tricky – you need to make sure you make the right decisions so that you pay the lowest amount of taxes. Here are some things to think about before you file as a married couple. “Typically, there is little advantage to filing separately,” says Adam T. Cary, a CPA in Peoria, Arizona. “However, if one of the spouses has an income low enough, it may make sense to file separately to have a lower monthly payment on their student loans” on an income-driven repayment plan. In fact, in most American marriages, both partners are employed, according to the Bureau of Labor Statistics.

The agreement cannot be used, however, to waive spousal rights in qualified retirement plans. This must be done after the marriage, but the agreement can require such a waiver to be made at that time. Newlyweds should review their employee benefit options to choose the best benefits for the couple.

Earned Income And Earned Income Tax Credit (eitc) Tables

Marriage penalties and bonuses in the income tax code violate neutrality. An unmarried couple and a married couple with identical combined incomes may be treated differently. In addition, the penalties and bonuses could impact people’s behaviors in two ways.

The standard deduction reduces a taxpayer’s taxable income by a set amount determined by the government. It was nearly doubled for all classes of filers by the 2017 Tax Cuts and Jobs Act as an incentive for taxpayers not to itemize deductions when filing their federal income taxes.

He started at Tax Foundation as a Taxes and Growth Fellow in the summer of 2016. After previously working at various software companies, Amir uses his passion for technology and statistics to support the role of evidence-based policy in tax reform.

If each spouse’s employer offers a 401 or similar plan and the couple has limited funds for contributions, determine where to put the funds. For example, if one employer matches contributions while the other does not, opting to make the matched contributions will likely generate greater retirement savings overall.

Newly Weds? Heres What To Know About Filing As A Married Couple

As a result, people who might have itemized in previous tax years might be better off taking the standard deduction. For couples filing separately, that’s not always an option. If you’re married and filing separately, you have a standard deduction of $12,000 for 2018, the same as single taxpayers. Here, giving up the responsibility for the accuracy of your spouse’s return trumps any tax savings you’d otherwise get from filing jointly, he said.

Similarly, two single people can each earn up to $61,000, or $122,000 total, and still get a full traditional IRA deduction if you are covered by a retirement plan at work. Of course, most of us aren’t going to plan a momentous, presumably once-in-a-lifetime event around our taxes. Still, it’s good to know how your wedding date will affect your finances beyond the money you spend on the event itself. Especially if you’re getting a penalty, it helps to be prepared for all the changes. The more allowances you claim, the less tax you’ll have withheld. If you’re getting a penalty, you’ll want to remove certain allowances.

May not be combined with any other promotion including Free 1040EZ. Void if sold, purchased or transferred, and where prohibited. Must be a resident of the U.S., in a participating U.S. office.

- For example, if the United States created a perfectly flat individual income tax with no provisions such as the Child Tax Credit or Earned Income Tax Credit, marriage penalties and bonuses would be eliminated.

- We are continually improving the user experience for everyone, and applying the relevant accessibility guidelines.

- This is called the marriage penalty or marriage bonus.

- Most couples get a bonus, which means they pay less in taxes by combining their incomes.

- For example, individually, Jill has an adjusted gross income of $100,000, while Jack’s is $75,000.

- Most personal state programs available in January; release dates vary by state.

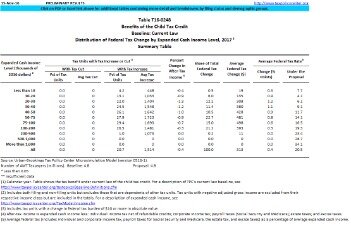

Areas in the figure shaded blue represent marriage bonuses and areas shaded red represent marriage penalties. The depth of the color represents the size of the marriage penalty or bonus as a percent of a couple’s total income.

Support Sound Tax Policy

There are ways to eliminate the marriage penalty and bonus, but it would require large changes to the US tax code. The US tax code is designed to be progressive in nature, but to also be equal in treatment among married and unmarried couples. If the United States adopted a flat tax and removed all provisions, then the marriage penalties and bonuses could be elmiminated.