Content

Conditions and exceptions apply – see your Cardholder Agreement for details about reporting lost or stolen cards and liability for unauthorized transactions. Payroll, unemployment, government benefits and other direct deposit funds are available on effective date of settlement with provider.

Valid for 2017 personal income tax return only. Return must be filed January 5 – February 28, 2018 at participating offices to qualify.

For 1040EZ tax filers, your tax exemption figure is merged with the standard deduction, and should be included on line five of your tax form. In general, tax exemptions offer wide flexibility to multiple shareholders, including individuals, investors, religious groups, and non-profit organizations. For example, the earned income tax credit rolled out in 1975, to help lower-income earners have more money for staples like groceries and gasoline amidst a period when inflation was rising fast. Or, theChild Tax Credit came out of the Taxpayer Relief Act of 1997 as a $400-per-child tax credit, again to help lower- and middle-income Americans keep more of their hard-earned money. Tax exemptions reach back to the Civil War era, when the U.S. government established a standard $600 personal tax exemption at the height of the war. Because the personal exemption was eliminated starting in tax year 2018, subsequent versions of Form 1040 do not include a line to enter a personal exemption. Darla’s two personal exemptions totaled $8,100 before the reduction.

This post was originally posted as part of a series on Tax Basics for AOL’s WalletPop. You can read more from WalletPop’s tax expert, Kelly Phillips Erb, here. You must have provided more than half of your relative’s total support during the year. The relative must not have gross income for the year of $3,650 or more. Your child must be under age 19 at the end of the year and younger than you or a full-time student under age 24 at the end of the year and younger than you. Your permanently and totally disabled child always qualifies, regardless of age.

H&R Block Audit Representation constitutes tax advice only. Consult your attorney for legal advice. Does not provide for reimbursement of any taxes, penalties or interest imposed by taxing authorities. How long do you keep my filed tax information on file? If you’ve already e-filed or mailed your return to the IRS or state taxing authority, you’ll need to complete an amended return.

Get The Latest Stimulus News And Tax Filing Updates

This course is not open to any persons who are currently employed by or seeking employment with any professional tax preparation company or organization other than H&R Block. The student will be required to return all course materials, which may be non-refundable. Discount is off course materials in states where applicable. Discount must be used on initial purchase only. Not valid on subsequent payments.

You can file Form 1040X through the H&R Block online and software tax preparation products or by going to your local H&R Block office. How do I update or delete my online account? What if I receive another tax form after I’ve filed my return? To give you a simple example, let’s say you were a single filer with two children, both of whom you were claiming as dependents. You would be able to claim a personal exemption of $12,150 ($4,050 x 3). You also might not have been able to claim the entire personal exemption depending on your adjusted gross income .

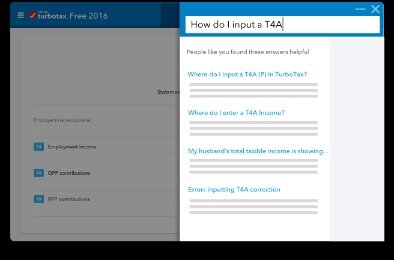

Here are some of the key changes to be aware of and understand. As a family, you may have access to more tax deductions and credits than taxpayers without children. If you’re not aware of these deductions and credits, you may be missing out on some tax savings. For simple tax returns only, file fed and state taxes free, plus get a free expert review with TurboTax Live Basic. If both parents claim the child, but file separately, the IRS looks to see which parent lived with the child the longest during the tax year. If the child lived with each parent for the same amount of time, the IRS will treat the child as the qualifying child of the parent who had the higher AGI for the year.

For example, if you’re paying off your student loans, you may qualify for the student loan interest deduction. Don’t let your taxes add to your stress level. The personal exemption is an automatic deduction provided for by the IRS. Exemptions reduce your taxable income.

Child Tax Credit And Credit For Other Dependents

For 2015, the personal exemption amount is $4,000. Personal exemptions are claimed on Form 1040 lines 6a, 6b, and line 42. Note that if you have any dependents, you can generally claim a dependent exemption for them if they meet the qualifying child or qualifying relative test. As a first time filer, there may be many unfamiliar tax terms when filing your return. We’re here to help with the basics. Rebecca LakeRebecca Lake is a retirement, investing and estate planning expert who has been writing about personal finance for a decade.

You will not be able to claim Head of Household, as that filing status is for unmarried taxpayers only. You can file jointly with your husband, or file separate returns. The basic personal amount is a non-refundable tax credit that can be claimed by all individuals. The purpose of the BPA is to provide a full reduction from federal income tax to all individuals with taxable income below the BPA. It also provides a partial reduction to taxpayers with taxable income above the BPA. The 2021 California standard deductions, personal exemptions, and dependent deduction amounts are sourced from the California . You can only claim a tax exemption for yourself if you’re not claimed as a dependent by another taxpayer.

Lea D. Uradu, JD is an American Entrepreneur and Tax Law Professional. Professionally, Lea has occupied both the tax law analyst and tax law adviser role. Lea has years of experience helping clients navigate the tax world.

In 2020 you can deduct up to $300 per tax return of qualified cash contributions if you take the standard deduction. For 2021, this amount is up to $600 per tax return for those filing married filing jointly and $300 for other filing statuses.

However, these older children and other qualifying dependents may be eligible for a new tax credit of up to $500 called the credit for other dependents. Dependents must be a U.S. citizen, U.S. national or U.S. resident alien. They must also be a qualifying child or qualifying relative. The Tax Cuts and Jobs Act increased the child tax credit from the old $1,000 limit. The new child tax credit results in up to a $2,000 credit per qualifying child age 16 or younger. If you owe no tax, up to $1,400 of the new child tax credit may be refundable using the Additional Child Tax Credit.

However, if you both are nonresident aliens , you may only claim one personal exemption on the tax return. These restrictions don’t apply if you are a nonresident alien married to a U.S. citizen or if you are a resident alien who has chosen to be treated as a resident of the United States. However, the personal exemption was eliminated for the the 2018 tax year because of the tax plan passed in 2017.

Exemptions Vs Deductions

If H&R Block makes an error on your return, we’ll pay resulting penalties and interest. Enrolled Agents do not provide legal representation; signed Power of Attorney required. Audit services constitute tax advice only. Consult an attorney for legal advice.

Year-round access may require an Emerald Savings®account. he Rapid Reload logo is a trademark owned by Wal-Mart Stores. Rapid Reload not available in VT and WY. Check cashing fees may also apply. Check cashing not available in NJ, NY, RI, VT and WY. When you use an ATM, we charge a $3 withdrawal fee. You may be charged an additional fee by the ATM operator .

When you list your medical expenses, you must be able to account for each cost with documentation. “You must keep your receipts,”Larson pointed out. Property Tax Deduction – Many states allow you to deduct any property tax paid to a county or municipality from your gross income. IRA Contribution Deduction – You can deduct a limited contribution to your qualifying Individual Retirement Account every year. The deduction limits for 2012 are $5,000 per year for individuals under 50, and $6,000 per year for individuals 50 or over.

Other Ideas To Save On Your Taxes

Darla’s adjusted gross income of $300,000 exceeded this threshold by $12,500. It might not feel like it at tax time, but the Internal Revenue Service doesn’t actually tax you on every single dollar you earn.

News and World Report, CreditCards.com and Investopedia. Rebecca is a graduate of the University of South Carolina and she also attended Charleston Southern University as a graduate student. Originally from central Virginia, she now lives on the North Carolina coast along with her two children. Suppose your family had high medical and dental expenses due to you, your spouse or a qualifying dependent’s accidental injury or medical treatment. In that case, this could help you claim extra deductions if you already itemize deductions. Unfortunately, if you don’t have enough itemized deductions to exceed the standard deduction, you won’t benefit from the medical and dental expenses deduction.

When our present-day system of taxation was enacted in 1913, the personal exemption for a married person was set at $4,000. And when you file your 2015 tax return, guess how much you can claim as an exemption – $4,000! Fortunately, these days the personal exemption increases each year for inflation, so at least the disparity won’t get any worse. The personal exemption you can claim in 2016 is $4,050. Yes, you would be able to claim him as a dependent on your 2011 tax return. You do not need to make a certain amount to claim him. Just remember you must have a valid social security number for him.

It can provide what most taxpayers want most – to keep more of their income in their pockets and less of it in Uncle Sam’s. Tax exemptions are Uncle Sam’s gift to taxpayers – especially if you qualify for more than one of them.

- You also get a 25% tax credit for the next $2,000 of eligible expenses.

- Up to a $4,000 deduction is available if your modified adjusted gross income is up to $65,000 for single filers or up to $130,000 for married filing jointly filers.

- But as people get older, the need for medical care increases and that portion you pay adds up for medical costs.

- For tax years prior to 2018, if you are not claimed as a dependent on another taxpayer’s return, then you can claim one personal tax exemption.

Be sure you understand the rules for claiming personal exemptions and don’t pay more in taxes than you have to. Additionally, in order to claim a personal exemption, you will have to file a tax return.

Offer valid for tax preparation fees for new clients only. A new client is an individual who did not use H&R Block office services to prepare his or her 2016 tax return. Valid receipt for 2016 tax preparation fees from a tax preparer other than H&R Block must be presented prior to completion of initial tax office interview. May not be combined with other offers. Offer period March 1 – 25, 2018 at participating offices only.

To qualify, tax return must be paid for and filed during this period. Visit hrblock.com/halfoff to find the nearest participating office or to make an appointment. OBTP# B13696 ©2018 HRB Tax Group, Inc.