Content

As long as the foreign government employee is working in an official capacity on official business related to his employment, he does not have to pay Social Security on his pay. The Social Security exemption does not apply to servants of employees of a foreign government or the official’s children or spouse unless they are also employed by the foreign government. Just like the income tax, most people can’t avoid paying Social Security taxes on their employment and self-employment income. There are, however, exemptions available to specific groups of taxpayers. If you fall under one of these categories, you can potentially save a significant amount of money. However, if you do take advantage of the exemption, you will be ineligible to receive any of the benefits offered by Social Security. Once you have a number you are in the Social Security system.

These differences include the housing allowance, self-employed treatment for W-2 wage earners and the big one…the ability to opt out of Social Security. Really you probably have to be born Amish so that you have never been eligible to receive SS benefits.

You must be working in an official capacity and be working on official business related to your employment to avoid paying these taxes. If you’re an employee of a foreign government you generally don’t have to pay Social Security taxes on income related to your official responsibilities. Certain nonresident aliens may be able to avoid paying these taxes, though. If you’re self-employed, you’re responsible for paying both the employee and employer part of Social Security taxes. What you might not know is that you are not the only one paying Social Security taxes.

The exemption is unavailable if you’ve ever been eligible to receive benefits under the Social Security program regardless of whether you actually received the benefit or not. Something comes up that keeps you from investing every penny that you would have paid in taxes.

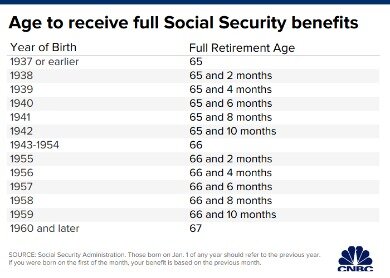

These other benefits usually kick in before you would reach the traditional retirement age if you qualify. If you’re self-employed, Social Security and Medicare taxes are combined in the self-employment taxes you pay.

Social Security is an important source of income for many retirees. Among elderly beneficiaries, 50% of married couples and 70% of unmarried recipients receive 50% or more of their retirement income from Social Security. Social Security is a safety net, but a somewhat frayed one. Know that your taxes aren’t held in a special account for you. Your FICA taxes are used to pay the benefits of people receiving benefits now. Workers paying into the system will provide the funds you get.

Remember what God says next time you feel tempted to handle money like everyone else. Ramsey Solutions has been committed to helping people regain control of their money, build wealth, grow their leadership skills, and enhance their lives through personal development since 1992. Millions of people have used our financial advice through 22 books published by Ramsey Press, as well as two syndicated radio shows and 10 podcasts, which have over 17 million weekly listeners. But keep in mind that if you’re bi-vocational, you’ll still have to pay into Social Security on your secular income. Social Security was never designed to be a complete retirement plan.

The Social Security Administration is notorious for rejecting initial applications for status changes seemingly with out looking at them. I have never heard of anyone under the age of 64 having their initial application accepted.

How To Make Quiet Time With God A Routine

Nonresidents working in the U.S. for a foreign government are exempt from paying Social Security taxes on their salaries. Their families and domestic workers can also qualify for the exemption. Many other categories of nonresidents are eligible for the exemption, but, in all cases, the determining factor is the type of visa the nonresident possesses.

When filing Form 4361, a minister makes some representations under penalty of perjury. A minister must certify opposition on the basis of religious principles to acceptance of public insurance.

Those include nonresident aliens in some cases and some income from jobs paid to students. The exemption only applies to the school job, if a student holds multiple jobs. And the school job must require enrollment in the same school for the income to be exempt. The IRS has clarified the student-employee exemption, making it fairly limited in scope. Students working for the same school they’re enrolled at may be temporarily exempt from paying Social Security taxes. However, only students who obtain employment because of their enrollment qualify. In other words, if you work full-time in the registrar’s office of a university, and take advantage of the tuition-free enrollment the university offers its employees, you don’t qualify.

If your group meets these requirements and opposes accepting Social Security benefits, you can apply for an exemption. In order for this exemption to work, your religious group must have been in existence at the end of the year in 1950.

Who Pays Social Security Taxes?

If you’re not satisfied, return it within 60 days of shipment with your dated receipt for a full refund (excluding shipping & handling). If you’re not satisfied, return it to Intuit within 60 days of purchase with your dated receipt for a full refund. If you’re not satisfied with your purchase and have not filed or printed your return, return it to Intuit within 60 days of purchase with your dated receipt for a full refund (excluding shipping & handling).

Of course, Social Security is social insurance rather than a personal retirement account, and so it uses a formula to cross-subsidize certain beneficiaries. That same male in a one-earner family would contribute the same but could expect $447,000 in lifetime benefits because of the non-working spouse. A worker who had invested his payroll taxes in a broad-based mutual fund could expect to have significantly more money at retirement than he paid in. Social Security has a special provision for certain ministers, members of religious orders , and Christian Science practitioners that was created by Congress to honor sincerely held religious objections to social insurance. There may be some other rare, applicable exemptions, including for children of family businesses. Some participants in state or local retirement plans may also be exempt from paying Social Security tax.

If you opt out, you may need to purchase a costly disability income insurance policy for comparable benefits. But, as we explained in “Is Social Security Safe,” benefits will still be paid even if the trust runs out of money. The average Social Security benefit is $15,228 annually. You would need to save more than $300,000 to provide this same benefit over 20 years. If you live longer, you would need significantly more.Survivor life insurance benefits CPP provides a death benefit to your spouse and dependents, but it doesn’t replace Social Security survivor benefits.

Use The Message Center To Opt Out Of Mailed Notices Available

Foreign citizens working in the U.S. for a foreign government , also do not need to pay. Most foreign students, scholars, teachers, and researchers are exempt if they are non-immigrant and non-resident aliens. Get Started Learn how you can make more money with IBD’s investing tools, top-performing stock lists, and educational content. Unless there’s reform to the program, it will become insolvent by 2034, according to a 2018 report by the Board of Trustees.

These programs include direct cash benefits, payments to surviving family members in the event of the enrollee’s death, and assistance for people with documented disabilities who are unable to continue working. Most people receiving Social Security are retirees who paid taxes that supported these programs during their careers and now receive a monthly check themselves. This is your chance to contribute to an individual retirement account and Roth IRA, too. If you’re new on a job, a Roth IRA can pay off tax-wise, Reichenstein says. Since your annual income may be the lowest of your life, your tax rate may be low, too. By funding your Roth, you’ll pay taxes now and can withdraw later without paying your likely higher tax rate in the future, Reichenstein says. There are other, even less likely ways out of paying FICA, TurboTax says.

Some of these workers are not part of the Social Security system, so they don’t pay FICA taxes, says William Reichenstein, head of research at Solution Security Solutions. Teachers and firefighters in some locales, such as in Texas, aren’t part of Social Security, he says. If you’re in these rare situations, consult with a tax professional. Perhaps the most mainstream way to get out of paying FICA tax is a religious clause. Members of recognized religious organizations opposed to the collection of Social Security benefits can opt out.

In order to qualify for this exemption, which is only on wages earned from this job, you have to be able to obtain employment only because of your enrollment at the school. They’re usually very specific and based on your circumstances, though. This tax is considered a payroll tax because it comes out of your paychecks if you’re an employee. But first, it helps to understand the basics of Social Security taxes.

That’s only fair since Social Security would also cover you on those items. Let’s consider the example of “John.” He’s 25 years old and married. He’s recently graduated Seminary and began his first ministry position which has a starting salary of $30,000. Not including his deductions, we know that in year one John will owe $4,590 in self employment tax; unless he decides to opt out of Social Security ($30,000 salary x 15.3% self employment tax). If you are a minister, you have several key tax issues that makes you uniquely different from other taxpayers.

Types Of Americans Who Won’t Get Social Security

Washington Post reporter Lori Montgomery—one of Washington’s best—recently published an excellent exposé in the Post on Social Security’s financial struggles, and they are legion. account takes less than 10 minutes and you get access to many other online services. You have opted out of mailed notices for those available online.

- MyBankTracker generates revenue through our relationships with our partners and affiliates.

- This means that after he paid for his disability policy and life insurance policy, he would need to invest his tax savings and earn an average of 5.25%.

- In total, on day 1 of retirement, John would need $725,000 to replace what Social Security would pay.

- The contents of this website do not constitute legal, investment, or tax advice.

- I meet with pastors all the time, and they often ask me questions about their financial options as professional ministers.

- Individuals who don’t possess United States citizenship, or aren’t legal residents are classified as nonresident aliens.

The contents of this website do not constitute legal, investment, or tax advice. You should work with a professional to see how the content applies to your own specific situation.

That means that if you’re paying Social Security today, it’s not sitting in a savings account waiting for you to collect it when you retire. It’s paying benefits for retirees, surviving spouses, and surviving dependents right now.

Should Ministers Opt Out Of Social Security?

Plus, it gives you the freedom to make your own biblically informed decision about how to manage that portion of your income, rather than leaving it to Uncle Sam to decide for you. Social Security is an automatic deduction taken from your paycheck if you live in the United States. The amount deducted is based on your income, and there is a tax cap for high-income earners. Considering the consequences, it’s generally not a good idea to opt out of Social Security. Wespath recently presented a webinar to address questions about Social Security benefits. It can be inconvenient to pay 6.2% of the majority of your earnings to this tax every year.