Content

Everlance is the #1 rated mileage and expense tracking solution. Download our award winning app on the Appstore & Google Playstore or try our mileage and expense solution for your company. The automatic expense tracking feature is amazing and quite literally saves businesses over 100 hours vs. manually entering data at the end of the month, or end of the year. Also, learn how the 2019 Reimbursement Rate changes can affect your business. These types of professionals are in their car every day, sometimes all day. For them, keeping every single paper receipt on file and writing down mileage in a paper mileage log is an absolute chore.

Before I knew it, in addition to my JD, I earned an LL.M Taxation. While at law school, I interned at the estates attorney division of the IRS. At IRS, I participated in the review and audit of federal estate tax returns. At one such audit, opposing counsel read my report, looked at his file and said, “Gentlemen, she’s exactly right.” I nearly fainted. It was a short jump from there to practicing, teaching, writing and breathing tax.

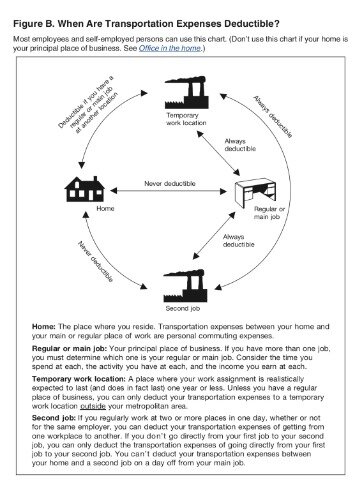

If you’re curious to know which of your medical expenses—mileage related or otherwise—are deductible, this IRS survey should help you find the answer. Now that we’ve covered who can apply for mileage reimbursement on their taxes, let’s cover the specific rates that apply for each of these above categories. Throughout the year, you’ll find it easiest to track all of your business-related expenses using an automated expense management software. In addition to being easier than manually writing everything down, it also helps ensure that you track every single eligible expense and that nothing falls through the cracks. Specific IRS mileage guidelines dictate whether or not you qualify for a vehicle-related tax deduction and, if so, how to calculate it. Normal commuting from your home to your regular workplace and back is not deductible. You may deduct business mileage only if you are traveling to and from a temporary work location, from one work location to another, to meet with a client, to a conference, etc.

You can write off miles between different clients but not to the first and from the last client. However, the 2017 Tax Cuts and Jobs Act eliminated the deduction for everyone but active-duty military members following relocation orders. A qualifying 250-mile business trip is worth $145 under the mileage deduction.

If the TCJA is not renewed in 2026, these deductions may return. Getting to work can be expensive for those who live a considerable distance from their places of employment.

What Miles Count For The Mileage Tax Deduction?

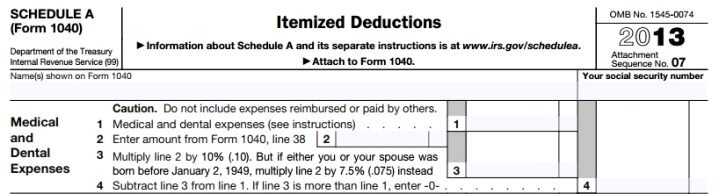

To qualify for this deduction, your total medical or dental expenses must equal 7.5% or more of your adjusted gross income. The IRS has now released the optional standard mileage rates for 2019, rates that most may use to compute deductible costs of operating vehicles. Even so, not all workers are enjoying the same car-related deductions, said Lisa Greene-Lewis, a tax expert and Certified Public Accountant for Intuit’s TurboTax, a tax preparation software program. The Tax Cuts and Jobs Act eliminated a miscellaneous itemized deduction for unreimbursed employee travel expenses. Before 2018, the miles driven from your workplace to another work-related location and back to your place of work were deductible. In addition, the business standard mileage rate cannot be used for more than four vehicles used simultaneously. However, an exception to that disallowance applies to members of a reserve component of the U.S. armed forces, state or local government officials paid on a fee basis, and certain performing artists.

Many of the items listed on the chart apply both to your business and to your personal use. For example, you might use the same phone and wireless plan for both your business and your personal life. Below you’ll find an easy-to-follow road map to choosing the best method for you, this year.

Years ago, I found myself sitting in law school in Moot Court wearing an oversized itchy blue suit. In a desperate attempt to avoid anything like that in the future, I enrolled in a tax course.

The FAVR amounts were recalculated last year after the TCJA retroactively amended the bonus depreciation rules. Under a FAVR plan, a standard amount is deemed substantiated for an employer’s reimbursement to employees for expenses they incur in driving their vehicle in performing services as an employee for the employer. The amount-per-mile fluctuates on a yearly basis by a penny or two, up or down. Keeping your mileage organized and IRS compliant is easy with Everlance. Track all your miles automatically and we will automatically apply the new 2019 standard mileage rate to next years mileage. If you are taking the IRS standard mileage deduction, you will need to provide a listing of all business trips, reason, dates, and mileage.

The IRS allows for each mile driven by the taxpayer for business, charitable, medical or moving purposes to be added as a tax deduction known as the standard mileage rate. The standard mileage rate can be taken in lieu of actual costs incurred when calculating deductible automobile-related business expenses. Standard mileage rates are used to calculate the amount of a deductible business, moving, medical or charitable expense . To use the rates, simply multiply the standard mileage rates by the number of miles traveled. In this case, you can claim a standard mileage rate of 57.5 cents per mile for tax year 2020.

How To Complete Your Schedule C Tax Form

Should it expire, miscellaneous itemized deductions might return to the tax code in 2026, but you’re more or less out of luck until that time if you must travel for work purposes and you’re not self-employed. You must itemize rather than take the standard deduction to claim this expense, and your total employee business expenses must exceed 2% of your adjusted gross income. You can claim a deduction for the balance over this amount.

These mileage rates are optional and you can use the actual vehicle expenses instead of the standard mileage rate as your deduction if you kept detailed records . The IRS has now released the optional standard mileage rates for 2019, rates that most may use to compute deductible costs of operating vehicles for business use, medical use and for use in charitable purposes. These rates are also applicable to some members of the military, who may use them to compute their moving expense deductions.

The same form also applies if you’re itemizing any volunteer work you’ve performed for a charitable organisation. However, you’ll use Schedule C to report any business-related expenses if you’re self-employed. It’s easy to become confused when dealing with multiple kinds of forms to report different expenses.

Standard Mileage Rates 2020, 2021

The IRS has announced the 2019 optional standard mileage rates used to calculate the deductible costs of operating an automobile for business, charitable, medical or moving purposes. WASHINGTON — The Internal Revenue Service today issued the 2019 optional standard mileage rates used to calculate the deductible costs of operating an automobile for business, charitable, medical or moving purposes. If you want to use the standard mileage rate method, you must do so in the first year you use your car for business. In later years you can choose to switch back and forth between the methods from year to year without penalty. Each year, you’ll want to calculate your expenses both ways and then choose the method that yields the larger deduction and greater tax benefit to you.

- The standard mileage rate can be taken in lieu of actual costs incurred when calculating deductible automobile-related business expenses.

- Throughout the year, you’ll find it easiest to track all of your business-related expenses using an automated expense management software.

- They are permitted to deduct mileage expenses on line 24 of Form 1040, U.S.

- The FAVR amounts were recalculated last year after the TCJA retroactively amended the bonus depreciation rules.

- If you use a car part of the time for personal use, you must separate out this use and deduct only the cost of business use for the car.

- Your selected PDF file will load into the DocuClix PDF-Editor.

Your medical mileage likely doesn’t add up to that AGI percentage. If you’re not satisfied, return it within 60 days of shipment with your dated receipt for a full refund (excluding shipping & handling). If you’re not satisfied, return it to Intuit within 60 days of purchase with your dated receipt for a full refund. If you’re not satisfied with your purchase and have not filed or printed your return, return it to Intuit within 60 days of purchase with your dated receipt for a full refund (excluding shipping & handling).

Your Comprehensive Guide To 2019 Irs Mileage Reimbursement

Keep in mind that you can only deduct unreimbursed, out-of-pocket expenses that you incur while using your car for work. In addition, the work must be for an organisation that the IRS recognises as charitable. The IRS does a great job of explaining the process of deducting all kinds of business expenses. The rate for service to a charitable organization is unchanged, set by statute at 14 cents per mile (Sec. 170). Of course, what good is all of this great data if you can’t do anything with it? Whenever you’re ready to do your taxes you can simply export the data into a file and upload it to your favorite tax software or give it to your accountant. In addition to business mileage, there is also an exemption formovingandcharity.

William Perez is a tax expert with 20 years of experience who has written hundreds of articles covering topics including filing taxes, solving tax issues, tax credits and deductions, tax planning, and taxable income. He previously worked for the IRS and holds an enrolled agent certification. Employers and employees alike familiarize themselves with these new rates as 2019 begins, along with members of the armed services, reserves and other select groups.

Your employer can’t reimburse you for the mileage, however, and you can’t deduct expenses associated with traveling from your own home to your tax home. In previous tax years, self-employed people, most businesses, and even many individual taxpayers were able to deduct mileage for business purposes. Unfortunately, from 2018 to 2025, many of these deductions for individuals have been eliminated. Keep in mind that this only applies to self-employed people. Ideally, if you are employed and you use a car almost exclusively for business, then you either drive a company car or get reimbursed by your employer. Unfortunately, the deduction doesn’t apply to your income taxes anymore.

For a vehicle you own or lease, you can deduct either the actual expenses or the standard rate per mile driven. If the car is leased and you use the standard mileage rates, you must use the standard rates for the entire life of the lease. If you itemize the deductions, you can deduct these amounts from your taxable income. Find out what business miles you can deductfrom your income.

The maximum allowance for 2021 a fixed and variable rate plan is $51,100 for automobiles, trucks, and vans. A flat amount to cover fixed costs, including depreciation, lease payments, and insurance. The maximum allowance for 2020 a fixed and variable rate plan is $50,400 for automobiles, trucks, and vans. Moving under a military order and incidental to a permanent change of station. You can’t fill these details at the end of the year – or even monthly.

There are apps for that, which can often transfer the information directly onto your tax return, she added. As with other tax deductions, you must determine the percentage of your mileage that applies to your business. For tax purposes, you need to calculate the percentage of each expense that applies to your business and deduct only that portion from your business income. Earned time, saved costs, improved productivity, happy employees – achieve it all with a single software. Keep records of your deductible mileage each month with a simple journal or mileage log.

It’s important to track your mileage, as well as all vehicle-related costs associated with those visits. There are also tax regulations around donating a vehicle, so be sure to search for the sections that apply to you. If you volunteer with the same organization on a regular basis, they can add you to their non-profit expense management system to make it easier for you to track and report your activities.

You can add to this figure the business miles you drove without passengers, picking them up or to a central location after dropping them off. Arif Khan Arif is known to have traveled far and wide, just using his super intricate mind. He breathes and sleeps the doom of manual expense reporting. To learn more about depreciation, click here to view a list of tax forms and find Form 4562. This form is used to file for Depreciation and Amortization and contains useful information about when, how, and why to file.

Both taxes are based on the net profit of your business, which can be reduced by taking a deduction for the use of your car for your business. If you’re an individual filer, you’ll use Form 1040 to complete your federal income taxes.