Interest is usually incurred whenever a company finances its assets through debt, because it’s the cost of borrowing money. If your business leases assets from another company, this might also generate an interest expense. If any of this financing involves borrowing money, you’ll need to make interest payments as you repay the balance. How is this interest dealt with in business accounting, and what is an interest expense on the income statement?

To calculate it, you need to consider the interest rate and the outstanding debt. This section breaks down the essential steps, ensuring clarity even for those new to financial concepts. The formula for calculating the annual interest expense in a financial model is as follows. You can deduct investment interest expense against any investment income — but only if you itemize your tax deductions.

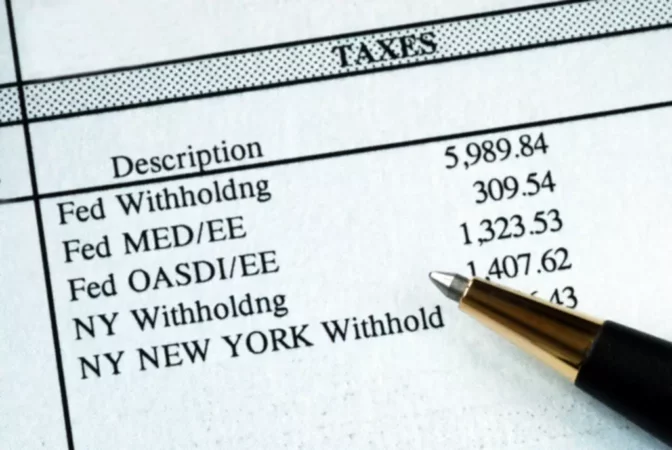

The “I” in EBIT

For double-entry bookkeeping, it would also be listed as a credit to accrued liabilities, a liability account. When an invoice is received from the creditor for this expense, the expense is credited to the accounts payable account. After you’ve paid your interest, debit the accounts payable account accordingly and credit the cash account. For example, if a company has a total of $100 million in debt at a fixed interest rate of 8%, the annual interest expense is calculated by multiplying the average debt principal by the interest rate. Interest expense usually appears below the EBIT (Earnings Before Interest and Taxes) as a separate line on the income statement.

Capital leases are the exception because you’re leasing an asset rather than borrowing money. Once calculated, interest expense is usually recorded by the borrower as an accrued liability. The entry is a debit to interest expense (expense account) and a credit to accrued liabilities (liability account). When the lender eventually sends an invoice for the expense, the credit is shifted to the accounts payable account, which is another liability account. When the interest is paid, the accounts payable account is debited to flush out the amount, and the cash account is credited to show that funds were expended. For the journal entry, you would list it as a debit to the expense account under “interest expense”.

Interest expense in accounting

While interest expense is tax-deductible for companies, in an individual’s case, it depends on their jurisdiction and also on the loan’s purpose. Interest expense refers to the cost of borrowing money and includes a company’s interest payments on any bonds, loans, convertible debt, and lines of credit. Interest expense also includes margin interest, which is charged in taxable brokerage accounts when borrowed funds are used to purchase investments. The income statement shows a full list of all core expenses, one of which is the interest expense.

Interest Expense represents the periodic costs incurred by a borrower as part of a debt financing arrangement. Conceptually, interest expense is the cost of raising capital in the form of debt. Explore its connection and learn how to factor it into your calculations seamlessly. LSI Keywords such as “loan repayment” and “depreciation” guide you through this intricate terrain.

- LSI Keywords like “financial obligations” and “accounting terms” enhance the depth of your understanding.

- You’ve journeyed through the intricate landscape of interest expense calculation.

- Let’s demystify the process and empower you with the knowledge needed to manage your finances more effectively.

- Julia Kagan is a financial/consumer journalist and former senior editor, personal finance, of Investopedia.

Interest expense is a general term used to describe the cost of borrowing money. It can have slightly different meanings depending on the context, but in corporate finance, interest expense is generally the primary financing expense on a company’s income statement. Like other expenses, you can list interest expense deductions on your tax return. Because interest payments are a reduction to your business’s net income, this makes it tax-deductible. The interest expense deduction is something to keep in mind as a strategic way to reduce your tax burden if you need to finance assets for your business.

Interested in automating the way you get paid? GoCardless can help

Here we look at interest expense in the context of evaluating a company’s profitability, as well as its relevance for your personal finances.

Interest Expense: Accounting Definition

You’ve journeyed through the intricate landscape of interest expense calculation. Armed with practical insights, you’re now better equipped to make informed financial decisions. Remember, mastering the art of interest expense is a valuable skill on your journey to financial success. Explore the nuances of interest expense rates and why a universal rate doesn’t exist. Our interest rate assumption will be set at a fixed 5%, and we’ll create a circularity switch (and name it “Circ”).

If interest has been accrued but has not yet been paid, it would appear in the “current liabilities” section of the balance sheet. Conversely, if interest has been paid in advance, it would appear in the “current assets” section as a prepaid item. Distinguish between interest expense and interest payable, unraveling their distinct roles in financial statements. LSI Keywords like “financial obligations” and “accounting terms” enhance the depth of your understanding.

Interest expense for personal finance

The easiest way to avoid paying interest expense is to avoid buying stocks on margin. The simplest way to calculate interest expense is to multiply a company’s total debt by the average interest rate on its debts. Interest expense does not include other fixed payment obligations of a company such as paying dividends on preferred stock.