Content

Conditions and exceptions apply – see your Cardholder Agreement for details about reporting lost or stolen cards and liability for unauthorized transactions. The tax identity theft risk assessment will be provided in January 2019. The tax identity theft risk assessment is based on various data sources and actual risk may vary beyond factors included in analysis. One state program can be downloaded at no additional cost from within the program. H&R Block online tax preparation and Tax Pro Review prices are ultimately determined at the time of print or e-file. All prices are subject to change without notice.

- Our experts have been helping you master your money for over four decades.

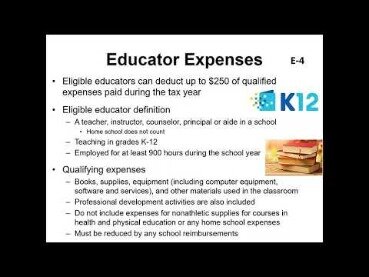

- The American Opportunity Tax Credit is a credit that is specifically for education expenses during the first four years of a student’s higher education.

- This allocation creates a $1,900 tax benefit when compared with the original return (see the table “Student in Undergraduate and Graduate School in the Same Year”).

- TheAmerican Opportunity tax creditis restricted to the first four years of undergraduate classes.

- AOTC requires that a student attend at least half-time, and as little as one course is acceptable for the lifetime learning credit.

- At the end of the year, your educational institution should send you a Form 1098-T that reports your eligible costs.

Mastercard is a registered trademark, and the circles design is a trademark of Mastercard International Incorporated. OBTP# B13696 ©2020 HRB Tax Group, Inc.

Dependents Credit & Deduction Finder

Due to federally declared disaster in 2017 and/or 2018, the IRS will allow affected taxpayers an extended filing date to file and pay for their 2017 taxes. Available only at participating H&R Block offices.

This includes undergraduate and graduate school courses, as well as classes you might be taking to improve your job skills; you do not have to be working toward a degree to qualify for the credit. To qualify, you must have enrolled for at least one academic period—such as a semester, trimester, or quarter, depending on how the school works—during the tax year in question. People of all ages can find themselves pursuing additional education.

Taxpayers with MAGI of over $68,000, or $136,000 for joint filers, cannot claim the credit at all. The IRS also publishes an interactive mobile application–Am I Eligible to Claim an Education Credit? – that students can use to find out if they are eligible to claim an education credit. Finally, they must be enrolled at a qualifying institution for at least one academic period that began within the tax year for which they’re claiming the credit.

If you qualify for the Lifetime Learning Credit, you can claim it any number of years . When you prepare your return on eFile.com, we will help you determine which education credit or deduction you qualify for and which one will be the most beneficial to you. We will then generate the correct forms for you in order to claim the education credit or deduction with your return. The lifetime learning credit is one of two primary tax credits to help cover the costs of higher education. The American opportunity tax credit is the other. The big difference between the two is that the AOTC is only for students in the first four years of higher education. You can claim the LLC for an unlimited number of years so long as you qualify for it.

CAA service not available at all locations. H&R Block does not provide immigration services. An ITIN is an identification number issued by the U.S. government for tax reporting only. Having an ITIN does not change your immigration status.

The Lifetime Learning Credit

To be eligible to claim the AOTC or LLC, the law requires a taxpayer to have received Form 1098-T, Tuition StatementPDF, from an eligible educational institution, whether domestic or foreign. Generally, students receive a Form 1098-T, Tuition Statement, from their school by January 31. This statement helps you figure your credit. The form will have an amount in box 1 to show the amounts received during the year.

If you’re facing higher education expenses this year, it pays to see whether you’re eligible for the Lifetime Learning Credit. You have little to lose and up to $2,000 to gain. As a quick refresher, tax credits tend to be more beneficial than deductions because they reduce your tax liability dollar for dollar. Deductions, by contrast, simply reduce the amount of your income that’s subject to taxes. This is an optional tax refund-related loan from MetaBank®, N.A.; it is not your tax refund. Loans are offered in amounts of $250, $500, $750, $1,250 or $3,500. Approval and loan amount based on expected refund amount, eligibility criteria, and underwriting.

Education Credit & Deduction Finder

Fees apply for approved Money in Minutes transactions funded to your card or account. Unapproved checks will not be funded to your card or account. Ingo Money reserves the right to recover losses resulting from illegal or fraudulent use of the Ingo Money Service. Your wireless carrier may charge a fee for data usage. Additional transaction fees, costs, terms and conditions may be associated with the funding and use of your card or account.

Higher education doesn’t come cheap. Thankfully, the IRS offers families a bit of a tax break in the form of the Lifetime Learning Credit. It pays to see whether you’re eligible to claim this credit on your upcoming return, as doing so could put up to $2,000 back in your pocket.

Keeping You Informed And Prepared Amid The Covid

Unlike the tax deduction, Lifetime learning credit is a non-refundable credit which will reduce the amount of income tax to zero but cannot get you refund if there is no tax liability. You can’t claim both credits for the same student, so you’ll need to decide which credit is best for your situation. was not presented to the student and how the education credits were calculated. This increase in income can also affect an individual’s state income tax.

Select to receive all alerts or just ones for the topic that interest you most. The latest articles and tips to help parents stay on track with saving and paying for college, delivered to your inbox every week. A dependent is a person who entitles a taxpayer to claim dependent-related tax benefits that reduce the amount of tax the taxpayer owes. To claim the LLC, you must complete theForm 8863. Attach the completed form to your Form 1040 or Form 1040-SR. This credit can help pay for undergraduate, graduate and professional degree courses, including courses to acquire or improve job skills.

There, you can add Text and/or Sign the PDF. If MAGI is above $66,000 with single filing status and MAGI is above $132,000 with married filing jointly filing status. Credit Karma is committed to ensuring digital accessibility for people with disabilities. We are continually improving the user experience for everyone, and applying the relevant accessibility guidelines. iPhone is a trademark of Apple Inc., registered in the U.S. and other countries.

Unlike the AOTC, a student does not have to be pursuing a degree or certificate program in order for postsecondary education expenses to qualify for the LLTC. Hope Credit, or the Hope Scholarship Tax Credit, is a nonrefundablen higher education tax credit offered to some American taxpayers. For most students who are in one of their first four years of post-secondary education, the American Opportunity credit can provide greater tax savings. You can include the cost of tuition, fees and any books or supplies you are required to purchase directly from the school, so long as it’s a condition of enrollment.