Content

The taxpayer joins a health club with membership fees of $400 per year. The taxpayer can make an arrangement to give the health club a $5,000 deposit on which it can earn 8% interest which would be equal to the $400 membership fee. This arrangement allows a taxpayer to earn the benefit of the interest without paying any taxes on it. A blended annual rate, published by the IRS each July, may be used for a demand loan with an unvarying principal that was outstanding for the entire calendar year. If the loan balance varied or it was not outstanding for the whole calendar year, then the regular imputed interest rules apply. ] to any qualified continuing care facility pursuant to a continuing care contract.

- DisclaimerAll content on this website, including dictionary, thesaurus, literature, geography, and other reference data is for informational purposes only.

- any interest payable on the loan properly allocable to such period.

- ] to any qualified continuing care facility pursuant to a continuing care contract.

- gift loans of $10,000 or less , unless it is used to purchase income producing property, in which case, the following $100,000 rule applies.

- Any subsequent changes in the market interest rate shall be ignored for the purposes of this transaction.

The IRS uses imputed interest to collect tax revenues on loans or securities that pay little or no interest. Imputed interest is important for discount bonds, such as zero-coupon bonds and other securities sold below face value and mature at par.

Imputed interest may apply to loans among family and friends. For example, a mother loans her son $50,000 with no interest charges.

Related Terms

Any difference between the present value of the note and the fair value of the goods or services shall then be accounted for as a change in interest expense (i.e., as a note discount or premium) over the life of the note. This threshold is referred to as an annual exclusion from the gift tax. You can give your brother $10,000 tax-free because it’s under the exclusion, as long as you don’t want the money back. This isn’t a particularly crippling tax law for small loans, and there are at least a few ways you can spare yourself the headache. Going back to the earlier example, give your brother $9,999 rather than $10,000. Imputed interest applies not only when no interest is charged, but when a minuscule rate is applied as well—less than that required by the AFR. The same imputed interest rule applies if you don’t actually give cash but rather assign your right to receive income to someone else.

Zero-coupon bonds, for example, are sold at a discount to face value and don’t pay interest to the holder. The IRS still requires bondholders to report an imputed annual interest. Imputed interest often becomes an issue when loans are made among family and/or friends. This is the number of times that interest accrues and is recomputed on the note balance. Most commonly, notes compound interest annually, but the IRS publishes rates for semi-annual, quarterly, and monthly compounding. In the case of certain long-term sales of property, the IRS has the authority to convert some of the gain from the sale into interest income if the contract does not provide for a minimum rate of interest to be paid by the purchaser.

You lend $10,000 to your brother, who lost his job and has a family to support. You expect him to repay you over a three-year period once he gains employment, but since he’s family, you don’t charge him interest. A war bond is is a form of government debt that seeks to raise capital to fund war efforts from the public.

Basic Things To Know About Bonds

For purposes of this paragraph, the terms ‘qualified continuing care facility’ and ‘continuing care contract’ have the meanings given such terms by section 7872 of such Code . The term “gift loan” means any below-market loan where the forgoing of interest is in the nature of a gift. In the case of any term loan, the applicable Federal rate shall be the applicable Federal rate in effect under section 1274 , compounded semiannually. This paragraph shall not apply to any loan made by a lender to a borrower for any day on which the aggregate outstanding amount of loans between the borrower and lender exceeds $100,000. Subparagraph shall not apply to any loan the interest arrangements of which have as 1 of their principal purposes the avoidance of any Federal tax. In the case of any loan described in subparagraph or of paragraph , this section shall not apply to any day on which the aggregate outstanding amount of loans between the borrower and lender does not exceed $10,000.

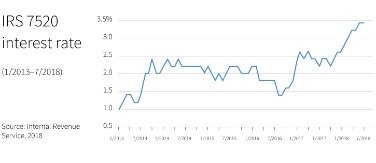

For example, in June 2018, the AFR for loans of less than 3 years was 1.78%. If you loan someone money at no interest, or at 0.25%, or at any rate below 1.78%, you have to deal with imputed interest. The imputed interest rules also do not apply to debt assumed as part of the sale or exchange, or property subject to debt, if the terms of the debt instrument or the nature of the transactions is not changed. As the federal government considers the AFR as the lowest required minimum interest rate, the IRS will impute ruled interest at any rates lower than that. If the sales contract does not stipulate sufficient interest, then imputed interest will require both the buyer and seller to treat part of the contract price as interest.

Imputed interest may apply to a family loan whereas parents may lend their son or daughter $100,000 to buy a house at no interest over 20 years. The IRS wants their share and will force you to charge interest using the Applicable Federal Rates as a minimum. To determine the interest, you would do a Present Value calculation at the AFR. TValue is an excellent program to determine the imputed interest rate, yield, or nominal interest rate by inputting the cash flows and then solving for the rate.

What Kinds Of Loans Have Imputed Interest?

For example, zero-coupon bonds are sold at less than face value and mature at par value. An $800 zero-coupon bond that will pay out $1,000 when it matures in 10 years means recipients will have to pay taxes on the $200 gain. As of September 2020, the short-term federal interest rate hovers around 0.14% annually.

Make gift loans of under $10,000 to avoid being imputed the foregone interest on the loan. The above article is intended to provide generalized financial information designed to educate a broad segment of the public; it does not give personalized tax, investment, legal, or other business and professional advice. Loans provided by a lender to the general public that are consistent with the lender’s normal business practices (such as no-interest financing on an auto loan or a zero-interest period on a credit card). Lend someone money at zero interest, and you don’t make any profit from the deal. Therefore, you might assume that the loan doesn’t have any tax implications for you. The tax code expects you to charge a certain amount of interest for a loan—and even if you don’t, you can be taxed as if you did.

Subparagraph shall not apply to any gift loan directly attributable to the purchase or carrying of income-producing assets. In the case of any gift loan directly between individuals, this section shall not apply to any day on which the aggregate outstanding amount of loans between such individuals does not exceed $10,000. To the extent provided in regulations, any below-market loan which is not described in subparagraph , , , or if the interest arrangements of such loan have a significant effect on any Federal tax liability of the lender or the borrower.

Turbotax Guarantees

Gift loans and nongift demand loans are taxed to the lender on the difference between the applicable AFR and the actual rate charged. Imputed interest rules were designed to prevent high bracket taxpayers from shifting income to lower bracket relatives. Before 1984, income could be shifted between taxpayers with interest-free loans.

They are usually recorded as an asset on the company balance sheet. If the loans are at below-market interest, the IRS might classify them as compensation, equity transactions or dividends. If business loans are more than $10,000 to any shareholder, you’re required to charge what the IRS determines as a fair market rate. If you don’t, the shareholders will be subject to the imputed interest rules. The term “demand loan” means any loan which is payable in full at any time on the demand of the lender.

Let’s look into what is imputed interest, and how it could impact loans you give or receive. Once the correct interest rate has been selected, use it to amortize the difference between the imputed interest rate and the rate on the note over the life of the note, with the difference being charged to the interest expense account. If a family loan is being used to specifically help purchase or refinance a home, the Borrower and Lender should consider the advantages of securing the loan through a properly registered Mortgage, Deed of Trust, or Security Deed. Proper family loan documentation can also help avoid serious legal disputes with other family members or estate and repayment complications following an unexpected divorce or untimely death. All National Family Mortgages require Borrowers to make monthly payments.

There is a specific type of commercial loan that does not fall under the compass of the imputed interest rules — prepayments. If a business receives prepayments that are included in the business’s income under its method of accounting, then the prepayments are not subject to imputed interest rules. In the case of any gift loan which is a term loan, subsection (and not subsection ) shall apply for purposes of chapter 12.

Imputed interest is important for determining pension payouts. For example, when an employee retires from a company where they were a member of a pension plan, the company may offer the retiree a lump sum of the $500,000 set aside for them under the plan, or they may receive $5,000 a year in benefits.

Any increase under the preceding sentence shall be rounded to the nearest multiple of $100 (or, if such increase is a multiple of $50, such increase shall be increased to the nearest multiple of $100). regulations exempting from the application of this section any class of transactions the interest arrangements of which have no significant effect on any Federal tax liability of the lender or the borrower. The Secretary shall issue guidance which limits such term to contracts which provide only facilities, care, and services described in this paragraph. Paragraph shall not apply for any calendar year to which subsection applies. The term “qualified continuing care facility” shall not include any facility which is of a type which is traditionally considered a nursing home.