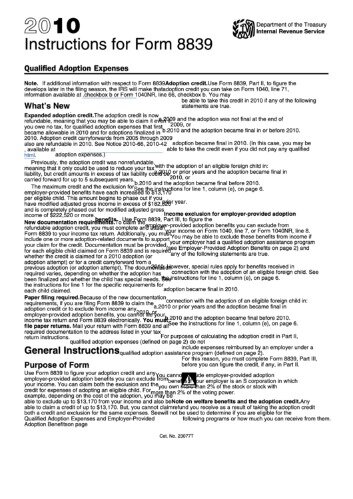

Your employer had a written qualified adoption assistance program as described earlier. A qualified adoption assistance program is a separate written plan set up by an employer to provide adoption assistance to its employees. If you and another person adopted or tried to adopt an eligible U.S. child, see Line 2 , before completing Part II .

- State e-file available for $19.95.

- If your employer has no qualified adoption assistance program, you must enter the smaller of line 19 or line 20.

- Approval and loan amount based on expected refund amount, eligibility criteria, and underwriting.

- The Internal Revenue Service allows you to offset your tax bill with a credit for your qualified adoption expenses, as long as you meet certain eligibility requirements.

- Fees apply to Emerald Card bill pay service.

Valid for 2017 personal income tax return only. Return must be filed January 5 – February 28, 2018 at participating offices to qualify.

Tax Tools & Resources

If the adoption didn’t become final by the end of 2020, you can’t take the adoption credit for that child in 2020. The maximum amount of employer-provided adoption benefits that can be excluded from income is $14,300 per child. If you and another person each received employer-provided adoption benefits to adopt the same child, the $14,300 limit must be divided between the two of you. Enter your share of the $14,300 limit on line 2 of this worksheet. except that both attempts are unsuccessful and no adoption is ever finalized. Enter $18,000 ($10,000 + $8,000) on the “Child 1” line because you made more than one attempt to adopt one eligible child.

Students will need to contact WGU to request matriculation of credit. Additional fees may apply from WGU. Enrollment in, or completion of, the H&R Block Income Tax Course is neither an offer nor a guarantee of employment. Additional qualifications may be required. Enrollment restrictions apply. There is no tuition fee for the H&R Block Income Tax Course; however, you may be required to purchase course materials.

Tax Bracket Calculator

There are several factors that determine if a child has “special needs” and those factors can vary by state. The Contract with America document released during the 1994 election campaign included a proposed Family Reenforcement Act which included language about tax incentives for adoption.

This is a friendly notice to tell you that you are now leaving the H&R Block website and will go to a website that is not controlled by or affiliated with H&R Block. This link is to make the transition more convenient for you. You should know that we do not endorse or guarantee any products or services you may view on other sites. For your protection, take a moment to carefully review their policies and procedures, as they may not be the same as those of H&R Block. Timing is based on an e-filed return with direct deposit to your Card Account. Vanilla Reload is provided by ITC Financial Licenses, Inc. ITC Financial Licenses, Inc. is licensed as a Money Transmitter by the New York State Department of Financial Services.

The credit reverted to nonrefundability in 2012. The tax code provides an adoption credit of up to $14,300 for qualified adoption expenses in 2020. The credit is available for each child adopted, whether via public foster care, domestic private adoption, or international adoption. The total amount of adoption credits for 2018 is estimated to reach approximately $400 million.

Looking For More Information?

If you paid adoption expenses in 2020, you might qualify for a credit of up to $14,300 for each child you adopted. If you’ve adopted a child , you know it can be very expensive.

“If you filed Form 8839 for a prior year for the same child, enter on line 3 the total of the amounts shown on lines 3 and 6 of the last form you filed for the child.” This is an optional tax refund-related loan from MetaBank®, N.A.; it is not your tax refund. Loans are offered in amounts of $250, $500, $750, $1,250 or $3,500.

Qualified adoption expenses are calculated by adding up all the expenses related to the adoption, then subtracting any amounts reimbursed or paid for by your employer, a government agency, or another organization. Expenses for a failed adoption might qualify for the credit if a successful adoption follows it, but the two adoption efforts would be considered as one adoption and subject to the dollar limit per eligible child. Likewise, you would be limited to a credit of $14,440 even if you spent $20,000 on qualified expenses, with one exception. You’re entitled to claim the full amount of the credit if you adopt a special needs child even if your out-of-pocket expenses are less than the tax credit amount. Taxpayers who adopt a child can qualify for the adoption tax credit when they pay out-of-pocket expenses related to the adoption.

If Form 8839, line 15, is smaller than line 14, you may have an unused credit to carry forward to the next 5 years or until used, whichever comes first. Use the Adoption Credit Carryforward Worksheet to figure the amount of your credit carryforward. If you have any unused credit to carry forward to 2021, be sure you keep the worksheet. You will need it to figure your credit for 2021. The state must make a determination that a child has special needs before the child is considered to be a child with special needs. A child having a specific factor or condition isn’t enough to establish that the state has made a determination of special needs. Whether the child has a medical condition or a physical, mental, or emotional handicap.

This is true if the child came to the country for adoption under a Hague Custody Certificate . However, this only applies for the year that a state court enters a final decree of adoption. If the adopted child has special needs, you can claim the full amount of the credit and the exclusion. You can do this regardless of the actual amount of expenses incurred. What if I receive another tax form after I’ve filed my return? If you’ve already e-filed or mailed your return to the IRS or state taxing authority, you’ll need to complete an amended return. You can file Form 1040X through the H&R Block online and software tax preparation products or by going to your local H&R Block office.

H&R Block employees, including Tax Professionals, are excluded from participating. Valid for an original 2019 personal income tax return for our Tax Pro Go service only. Must provide a copy of a current police, firefighter, EMT, or healthcare worker ID to qualify. No cash value and void if transferred or where prohibited. Offer valid for returns filed 5/1/ /31/2020. If the return is not complete by 5/31, a $99 fee for federal and $45 per state return will be applied.

Learn how to use it when filing your tax return. Adjusted gross income equals your gross income minus certain adjustments. The IRS uses the AGI to determine how much income tax you owe. The North American Council on Adoptable Children supports, educates, inspires, and advocates so adoptive families thrive and every child in foster care has a permanent, safe, loving family. This worksheet is found in Publication 972, Child Tax Credit and Credit for Other Dependents, and may determine if the Child Tax Credit will be used before the other credits to reduce tax. The Adoption Credit is a nonrefundable credit, so the amount of the credit is limited to the taxpayer’s tax liability for the year.

If you meet all the requirements, you can rely on the safe harbor when you claim the finality of the adoption. If your employer has no qualified adoption assistance program, you must enter the smaller of line 19 or line 20. Complete the credit limit worksheet to figure the limit of your nonrefundable adoption credit. Enter the child’s SSN if the child has an SSN or you will be able to get an SSN in time to file your tax return. Apply for an SSN using Form SS-5. In a few cases, the sending country may allow the child to come to the United States under a custodial agreement. If so, the child will be adopted later in a state court in the United States.

This provision is designed to encourage parents to adopt children who would otherwise be hard to place, even if most of the adoption expenses are covered by someone else . [$2,500][$2,000][$1,500][$2,500][$10,000][$1,000][$10,000][W. Virginia][$2,000][$1,000][$5,000][N.

you exclude the amount from line 9 of this worksheet. Then, subtract the amount from line 9 of this worksheet from that total. Enter the result on line 1 of Form 1040 or 1040-SR or line 1a of Form 1040-NR. On the dotted line next to the line for wages, enter “PYAB” and the amount from line 9 of this worksheet. A state has determined that the child can’t or shouldn’t be returned to his or her parents’ home. For Part III, fill in lines 17 through 20, 22, 26, and 27 for each child. But fill in lines 21, 23 through 25, 28, and 29 on only one Form 8839.

A citizen’s guide to the fascinating elements of the US tax system. For more information see the ‘Adoption Benefits FAQs’ page available at IRS.gov or the Form 8839 instructions.

When you can take the adoption credit or exclusion depends on whether the eligible child is a citizen or resident of the United States (including U.S. possessions) at the time the adoption effort began . The following examples help illustrate how qualified adoption expenses and employer-provided adoption benefits apply to the maximum adoption credit allowed. The maximum credit and the exclusion for employer-provided benefits are both $14,300 per eligible child in 2020. This amount begins to phase out if you have modified adjusted gross income in excess of $214,520 and is completely phased out for modified adjusted gross income of $254,520 or more. An adoption tax credit is a tax credit offered to adoptive parents to encourage adoption in the United States. Section 36C of the United States Internal Revenue code offers a credit for “qualified adoption expenses” paid or incurred by individual taxpayers. The adoption tax credit is subject to phaseout ranges based on the taxpayer’s modified adjusted gross income .

The remaining $1,400 ($30,000 – $14,300 – $14,300) may never be claimed as a credit or excluded from gross income. Qualified adoption expenses are the necessary costs paid to adopt a child younger than 18 years of age or any disabled person who requires care. These fees can be used to claim an adoption credit or exclusion that reduces the adopting parents’ taxable income. Haylee paid $20,000 in qualified adoption expenses for the adoption of an eligible child, including $8,000 of legal fees. Under a qualified adoption assistance program, Haylee’s employer reimbursed the $8,000 of legal fees.