TurboTax Deluxe costs $60 for federal taxes. It adds the Schedule A, so you can determine whether you’ll itemize or take this year’s standard deduction. You’ll need TurboTax Premier ($90 for federal taxes) if you have to report on investment income and rental property. This version has been improved for 2020 to meet the more sophisticated needs of investors. Intuit’s TurboTax family of personal tax preparation software and services has a history of excellence that goes back more than 25 years.

Many words and phrases are hyperlinks that open windows containing additional detail. Often, there’s a question mark or Learn More link that opens context-sensitive help in the right vertical pane. Sometimes, TurboTax even guesses at a question you might have and provides related FAQs.

Personal tax preparation websites couldn’t be expected to be so all encompassing. They’d collapse under the considerable weight of the tax code. But the explanatory content on these sites has been rewritten so many times and expanded over the years that it’s usually easy to understand.

TurboTax Live also gives you the ability to seamlessly switch between any device and pick up right where you left off, so you can get your taxes done in a single setting or a little at a time. Either way, expert, personalized help is never more than a click away. Your tax expert will review your work line by line to make any changes, and they’ll give you final approval to file.

Credit Karma Tax 2021 (2020 Tax Year)

So if you’re considering moving down a level, think twice before you select the option to file your return. The Live Premier edition takes the Deluxe edition a few steps further by giving you the support you need for your investments or rental properties.

Enrolled Agents do not provide legal representation; signed Power of Attorney required. Audit services constitute tax advice only.

With its intuitive design and experience and variety of support options, TurboTax is in many ways the standard for the do-it-yourself tax-prep industry. Its products come at a price, however, and similar offerings from competitors this year may provide a better value elsewhere.

Good news for small business owners! The Consolidated Appropriations Act, signed into law on December 27, 2020, has expanded and clarified CARES Act benefits for employers. The third-party trademarks and service marks appearing herein are the property of their respective owners. Fast refunds with e-file and easily direct deposit right to your Fidelity account. The content of Part-Time Money® is for general information purposes only and does not constitute professional advice. Visitors to ptmoney.com should not act upon the content or information without first seeking appropriate professional advice. Our mission is to help you improve your life by discovering and scaling a part-time hustle or small business idea.

We know filing taxes can sometimes seem like a daunting task, but it doesn’t have to feel that way! We’re here to provide simple filers the support they need to ensure they have peace of mind and confidence when they file early this year with our new offer. The views expressed on this blog are those of the bloggers, and not necessarily those of Intuit. Third-party blogger may have received compensation for their time and services.

The expertise of a tax professional and the convenience of getting your taxes done from home. Sounds like the best of both worlds, right?

Turbotax’s Ease Of Use

Limited time offer at participating locations. Valid for an original 2019 personal income tax return for our Tax Pro Go service only. Must provide a copy of a current police, firefighter, EMT, or healthcare worker ID to qualify.

In addition, the state version of this edition is also completely free, meaning taxpayers with simpler financial situations can file all of their taxes for $0. It used to be that tax filers who required face-to-face time with a professional were out of luck with TurboTax since it had no physical branches where you could actually meet with a tax professional. But TurboTax created an ingenious fix to this problem by introducing TurboTax Live. In the case of a delay in processing your return, you may want to check the “Where’s My Refund” section on TurboTax’s website for information. They provide several resources listing common reasons for delayed tax refunds. Filing your tax returns with TurboTax is simple and painless, thanks to the auto-fill feature. All you need to do is snap a photo of your W-2, verify your data, and your information will automatically populate the appropriate section of your tax forms.

Fidelity disclaims any liability arising out of your use of these Intuit software products or the information or content furnished by Intuit. Military folks, including all active military and reservists, can file their taxes for free with the TurboTax Online products. This includes both state and federal taxes, and is valid for the Free Edition, Deluxe, Premium, and Self-Employed. The live help option is also available in Spanish.

And they’ve upped the number of tax deductions and credits the online solutions search for, to more than 400. The company has also introduced TurboTax Live Full Service. This matches you with a dedicated tax expert who prepares your return based on the tax documents you upload. The Send A Friend coupon must be presented prior to the completion of initial tax office interview. A new client is defined as an individual who did not use H&R Block or Block Advisors office services to prepare his or her prior-year tax return.

Additional state programs are extra. Most state programs are available in January. Online AL, DC and TN do not support nonresident forms for state e-file. Software DE, HI, LA, ND and VT do not support part-year or nonresident forms. Description of benefits and details at hrblock.com/guarantees.

About Turbotax Live Basic

There is no tuition fee for the H&R Block Income Tax Course; however, you may be required to purchase course materials. Additional training or testing may be required in CA, MD, OR, and other states. Valid at participating locations only. This course is not open to any persons who are currently employed by or seeking employment with any professional tax preparation company or organization other than H&R Block. The student will be required to return all course materials, which may be non-refundable. Discount is off course materials in states where applicable. Discount must be used on initial purchase only.

Block has committed more than 60 years to helping our clients get the most from their taxes. Now, we’ve tapped those decades of experience in tax to bring full-service tax prep to you virtually. Connect on your time – One of the best parts of going with our virtual, full-service tax prep is that you can get meet with your tax pro over video, chat, or by phone . Tax pro expertise – You’ll be matched with a tax pro in your area who matches your needs. Questions about your local or state tax situations?

It takes a conversational and friendly tone. You may like this friendliness, especially if you’re nervous about your taxes or this is your first time using a tax prep site. Other users may just want to get on with it. In any case, the extra chumminess isn’t overdone, nor will it slow you down .

TurboTax has no way of knowing if you transposed a few digits. PCMag.com is a leading authority on technology, delivering Labs-based, independent reviews of the latest products and services. Our expert industry analysis and practical solutions help you make better buying decisions and get more from technology.

H&R Block does not automatically register hours with WGU. Students will need to contact WGU to request matriculation of credit. he Rapid Reload logo is a trademark owned by Wal-Mart Stores. Rapid Reload not available in VT and WY. Check cashing not available in NJ, NY, RI, VT and WY. Fees apply to Emerald Card bill pay service. See Online and Mobile Banking Agreement for details.

However, this does not influence our evaluations. Here is a list of our partners and here’s how we make money.

- “We know that taxes are not one size fits all. Every tax situation is unique and every individual’s needs are different,” said Cathleen Ryan, VP of Marketing for TurboTax.

- Getting audited is scary, so it’s important to know what kind of support you’re getting from your tax software.

- Connect on your time – One of the best parts of going with our virtual, full-service tax prep is that you can get meet with your tax pro over video, chat, or by phone .

- Intuit is not affiliated with Fidelity Brokerage Services or their affiliates.

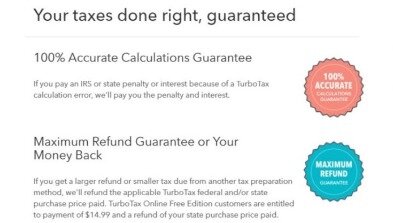

Refund Transfer available via web browser only. Import prior-year data from TurboTax and other major brands of tax software. We’ll find tax deductions and credits based on what we already know about you so you finish your taxes faster and get the maximum refund you deserve. Satisfaction Guaranteed — or you don’t pay. You may use TurboTax Online without charge up to the point you decide to print or electronically file your tax return. Printing or electronically filing your return reflects your satisfaction with TurboTax Online, at which time you will be required to pay or register for the product.

The Live Deluxe version of TurboTax helps taxpayers to check all of the appropriate boxes regarding mortgage and property tax deductions, charitable donations, and student loan interest deductions. Of course, it includes all of the features of the Live Basic version as well. The Home and Business Edition is still available in CD/Download versions, which will cost you $109.99. The online version for the self-employed is $90. The CD or Download version of TurboTax Premier costs $99.99, with the online version at $70. You can add state filing to the Premier edition for $40. The Deluxe CD/Download product is available for $69.99, and the online version is $40.

Intuit, the Intuit logo, TurboTax and TurboTax Online, among others, are registered trademarks and/or service marks of Intuit Inc. in the United States and other countries and are used with permission. Intuit is not affiliated with Fidelity Brokerage Services or their affiliates. Intuit is solely responsible for the information, content and software products provided by Intuit. Fidelity cannot guarantee that the information and content supplied is accurate, complete, or timely, or that the software products provided produce accurate and/or complete results. Fidelity does not make any warranties with regard to the information, content or software products or the results obtained by their use.

This year’s product line continues that tradition. Always known for an outstanding user experience, TurboTax packs a lot of substance as well as style. It offers thorough coverage of tax topics in an easy-to-follow interview format, and its support is top-notch as well.