Content

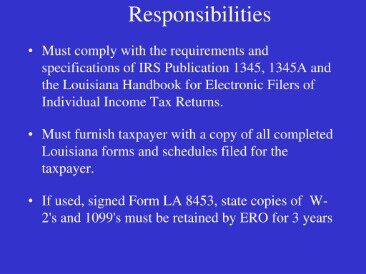

We, eFile.com, are a private company and an IRS-authorized Electronic Return Originator . We have been offering a secure online platform for the preparation and electronic filing of tax returns for over 12 years. We respect your right to privacy and understand when someone uses your email address unexpectedly , your identity may be compromised. Sign into eFile.com and click on ‘My Account’. From there, download your rejected 2020 Tax Return PDF file. Print and sign and include your forms, such as your W-2 or 1099, and mail your return to the IRS.

Or, click the blue Download/Share button to either download or share the PDF via DocuX. Unfortunately, if the person who created the account did not enter the correct contact information , we will not be able to contact the customer. Unfortunately, we have no control over what information is entered to create eFile.com accounts and send automatic notification emails to customers.

The agency will send you a notice saying you had wages that you didn’t report. But the IRS doesn’t know those wages were reported by an employer you don’t know, for work performed by someone else. Continue to pay your taxes and file your tax return, even if you must do so by paper. – Returns Completed in a Prior Year – This reject occurs when the return was completed in a prior year but does was not e-filed until the current year.

If approved, funds will be loaded on a prepaid card and the loan amount will be deducted from your tax refund, reducing the amount paid directly to you. Tax returns may be e-filed without applying for this loan. Fees for other optional products or product features may apply. Limited time offer at participating locations.

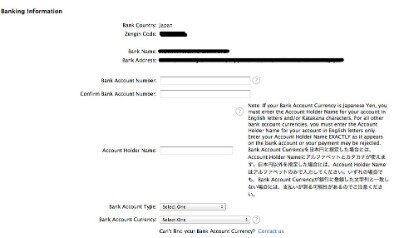

MetaBank® does not charge a fee for this service; please see your bank for details on its fees. The Check-to-Card service is provided by Sunrise Banks, N.A. and Ingo Money, Inc., subject to the Sunrise Banks and Ingo Money ServiceTerms and Conditions, the Ingo MoneyPrivacy Policy, and the Sunrise Banks, N.A.Privacy Policy. Approval review usually takes 3 to 5 minutes but can take up to one hour. All checks are subject to approval for funding in Ingo Money’s sole discretion. Fees apply for approved Money in Minutes transactions funded to your card or account.

TaxSlayer Pro makes tax filing simpler and less stressful for millions of Americans with exceptional, easy-to-use technology. An authorized IRS e-file provider, the company has been building tax software since 1989. With TaxSlayer Pro, customers wait less than 60 seconds for in season support and enjoy the experience of using software built by tax preparers, for tax preparers. To access the installment payment for First Time Homebuyer Credit or Form 5405 from the main menu of the return, select Other Taxes Menu, then First Time Homebuyers Credit Repayment and make the appropriate entries. Form 1040, Line 6c, for each dependent provided, if Line 6c checkbox ‘EligibleForChildTaxCreditInd’ is checked, then that dependent’s age must be under 17. R Each ‘DependentSSN’ and the corresponding ‘DependentNameControlTxt’ that has a value on Line 6c of the return, must match the SSN and Name Control in the e-File database.

What Does It Mean If The Irs Is Correcting My Refund?

Don’t attach any information or documents with your return proving your eligibility to claim a dependent; if needed, the IRS will contact you by mail for any supporting documentation. If you’re not satisfied with your purchase and have not filed or printed your return, return it to Intuit within 60 days of purchase with your dated receipt for a full refund (excluding shipping & handling). This is an optional tax refund-related loan from MetaBank®, N.A.; it is not your tax refund. Loans are offered in amounts of $250, $500, $750, $1,250 or $3,500. Approval and loan amount based on expected refund amount, eligibility criteria, and underwriting.

As the largest tax representation provider in the country, TaxAudit handles more audits than any other firm and also offers Tax Debt Relief Assistance to taxpayers who owe back taxes to the IRS or state government. Our customers receive expert tax representation and relief from the nightmare of facing the IRS alone.

How To Check Your Info When Your Tax Return Is Rejected Due To An Ssn

Since you own the email address in the notification email you received, you can log into the account associated with that address and see if the information in that account matches yours. If you received any of the emails described above, but you did not prepare and file a return on our site, then we take this very seriously. Once your e-filed return is accepted, we recommend you download a copy of your return for your records. We’ll also keep a backup copy in case you need it later.

A taxpayer claims a dependent that is also being claimed on another taxpayers return. This can occur when there is confusion, or a lack of communication by custodial and non-custodial parents or guardians, regarding who claims the dependent. IND Form 8862 must be present in the return. e-File database indicates the taxpayer must file Form 8862 to Claim Earned Income Credit after disallowance. IND Primary taxpayer’s Identity Protection Personal Identification Number must match the e-File database. Please double check your entry and resubmit your return with the correct number. If they are correct, then your return can not be e-Filed.

We think it’s important for you to understand how we make money. The offers for financial products you see on our platform come from companies who pay us. The money we make helps us give you access to free credit scores and reports and helps us create our other great tools and educational materials.

Common Form 1040 E

Since 1986 it has nearly tripled the S&P 500 with an average gain of +26% per year. These returns cover a period from and were examined and attested by Baker Tilly, an independent accounting firm.

- If someone uses your SSN to fraudulently file a tax return and claim a refund, your tax return could get rejected because your SSN was already used to file a return.

- If the EIN issue cannot be corrected, then the return cannot be electronically filed and a paper return must be submitted by mail.

- If the the tax return was accepted by the IRS, please contact the IRS Identity Protection Specialized Unit at as soon as possible to report the fraudulent tax return.

- If you’re not satisfied, return it within 60 days of shipment with your dated receipt for a full refund (excluding shipping & handling).

- Not only will you have to work with the IRS to file your legitimate return, you’ll also have to deal with the fact that someone out there has stolen your identity.

- Complete and print Form and follow the mailing instructions on the form – FileIT.

Or, download, print, sign and mail in your Arizona return. If your mailing in is your only option, lease PRINT your return from My Account, sign them, and MAIL it to the IRS and/or state tax agency as the AGI is not required for verification on paper returns. Attach copies of your W-2, 1099 etc. with you return. Do NOT mail your state return to the IRS but to the respective state agency. If the return was rejected by the IRS, then the IRS will not have the fraudulently e-filed return in their systems. However, if you believe you are the victim of identity theft, you should contact the IRS Identity Protection Specialized Unit phone number above for guidance. When someone creates an account on eFile.com, the user is required to enter some personal information, such as a first and last name and an email address we can use to contact the user.

Please contact the IRS to discuss this issue after you have downloaded, printed and signed your return under your My Account. Then click on the upper left menu My Return. On the page on the right side you will find more detailed instructions on how to to make necessary corrections before you re-efile your return at not additional charges.

Sometimes you can’t e-file a corrected return after an IRS rejection. For example, if your return is rejected because someone else uses your SSN, your spouse’s SSN or your dependent’s SSN without authorization, you may need to print your return and mail it. The IRS will then contact you by mail if it needs additional supporting documents. If you need to e-file an amended return, Credit Karma Tax®can help.

You should enable the security features on your mobile device, because anyone who has access to it will be able to view your account balance. You also accept all risk associated with for Balance, and agree that neither H&R Block, MetaBank® nor any of their respective parents or affiliated companies have any liability associated with its use. You will still be required to login to further manage your account. Applicants must be 18 years of age in the state in which they reside (19 in Nebraska and Alabama, 21 in Puerto Rico.) Identity verification is required. Both cardholders will have equal access to and ownership of all funds added to the card account. Transferring funds from another bank account to your Emerald Card may not be available to all cardholders and other terms and conditions apply. There are limits on the total amount you can transfer and how often you can request transfers.

Once this is done, the user receives three different types of automatic notification emails from us as the user completes a return on eFile.com. These emails are computer-generated using the information the user entered to create the account . If you did not use your credit or debit card to pay for the preparation of a tax return on eFile.com, we take this very seriously.

Forms & Instructions

She had to file a police report and it took a few extra months for her to get her refund. Check out the IRS website for instructions. IND The Spouse did not enter a valid Identity Protection Personal Identification Number . Please visit /getanippin for further information and resubmit your return with the correct number. A sample name mismatch reject for a dependent, which follows,will identify at the end of the reject code description the last four digits of the social security number of the dependent with the name mismatch.

Or, review the Tax Return Status message on the right and follow these instructions. If it’s not clear, try to re-efile at not charge or contact us immediately.