Content

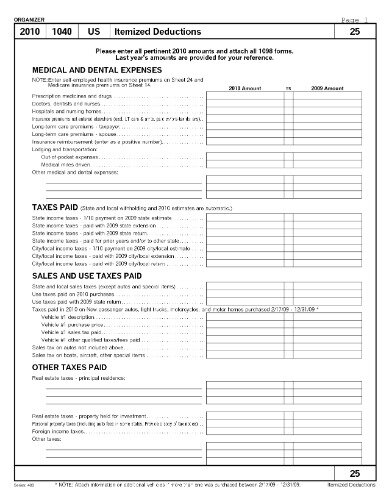

When you itemize deductions, you are listing expenses that will later be subtracted from your adjusted gross income to reduce your taxable income. If your expenses throughout the year were more than the value of the standard deduction, itemizing is a useful strategy to maximize your tax benefits. The mortgage interest deduction is capped at debts of $750,000 and $375,000 for taxpayers who are married and file separate returns. The limitations increase to $1 million and $500,000 if you incurred the debt on which you pay interest before Dec. 16, 2017. Most taxpayers claimed the standard deduction even before the TCJA, and the TCJA also made tweaks to some itemized deductions, capping them at certain amounts where they were unlimited before. Other itemized deductions were eliminated entirely.

Itemized deductions might add up to more than the standard deduction. the multitude of individual tax deductions out there instead of taking the flat-dollar standard deduction. In 2020, due to the coronavirus pandemic and the resulting CARES Act, taxpayers who do not itemize are also allowed up to a $300 deduction for cash charitable contributions made in 2020. The list of expenses that can be itemized is extensive, but there are new limits and exclusions compared to deductions allowed before the Tax Cuts and Jobs Act went into effect. Tax deductions should not be confused with tax credits, which reduce your tax bill directly.

If the standard deduction amount for your filing status is greater than the amount of itemized deductions you’d be able to claim, then you should take the standard deduction. When you use TurboTax to prepare your taxes, we’ll ask simple questions about your tax situation and we’ll recommend whether itemizing or claiming the standard deduction will get you a bigger tax refund .

Consult your attorney for legal advice. Does not provide for reimbursement of any taxes, penalties or interest imposed by taxing authorities. Eliminates the need to itemize deductions, like medical expenses and charitable donations.

Another big consideration is that itemizing will require a bit more work. Itemizing requires you to keep receipts throughout the year. You also need to keep those receipts after you file just in case of an audit. (Don’t forget that the IRS may audit a return from as long as six years ago.) On the other hand, if you take the standard deduction, there is no extra math and you don’t need to keep any receipts. The Trump tax plan overhauled the tax code in December 2017, which lowered individual tax rates, raised standard deductions, and lowered the deduction threshold for medical expenses, among other changes. Itemizing is just what it sounds like—reporting your actual expenses for various types of allowable deductions, then adding them all together and entering that total on your tax return.

Discount valid only for tax prep fees for an original 2017 personal income tax return prepared in a participating office. May not be combined with any other promotion including Free 1040EZ. Void if sold, purchased or transferred, and where prohibited. Must be a resident of the U.S., in a participating U.S. office. Referring client will receive a $20 gift card for each valid new client referred, limit two. Gift card will be mailed approximately two weeks after referred client has had his or her taxes prepared in an H&R Block or Block Advisors office and paid for that tax preparation. Referred client must have taxes prepared by 4/10/2018. H&R Block employees, including Tax Professionals, are excluded from participating.

There, you can add Text and/or Sign the PDF. A citizen’s guide to the fascinating elements of the US tax system. Enter your expenses on the appropriate lines of Schedule A.

Your deduction would be limited to $3,375—the amount that exceeds $4,125 or 7.5% of your AGI—if your AGI is $55,000 and you had $7,500 in qualifying medical expenses. Free ITIN application services available only at participating H&R Block offices, and applies only when completing an original federal tax return . CAA service not available at all locations. The standard deduction is higher for people over 65 or blind, though filing status is still a factor. And if someone can claim you as a dependent, you get a smaller standard deduction.

Key Elements Of The U S. Tax System

You must keep accurate track of what you spend during the year, and you should keep supporting receipts and documentation to show that these expenses are legitimate in case the IRS ever asks for proof. He previously worked for the IRS and holds an enrolled agent certification. The Send A Friend coupon must be presented prior to the completion of initial tax office interview. A new client is defined as an individual who did not use H&R Block or Block Advisors office services to prepare his or her prior-year tax return.

The TCJA limits the casualty and theft loss deduction to losses sustained due to events that occurred in locations that have been declared to be disaster areas by the U.S. president. You can temporarily deduct up to 100% of your AGI beginning in the 2020 tax year.

Taxpayers usually claim the option that lowers their tax bill the most. Sometimes the decision to itemize or to claim the standard deduction can be taken out of your hands. Married couples who file separate tax returns must each use the same method. They must both take the standard deduction or they must both itemize, so you’re stuck with doing so as well if your spouse is determined to itemize. It’s to your advantage to itemize when the total of all your individual deductions exceeds the standard deduction for their filing status. Otherwise, it would make no sense—you’d be paying taxes on more income than you’d have to. Have additional questions about whether to claim itemized deductions or the standard deduction?

How long do you keep my filed tax information on file? How do I update or delete my online account? If your standard deduction is less than your itemized deductions, you probably should itemize and save money. If your standard deduction is more than your itemized deductions, it might be worth it to take the standard and save some time. married but filing separately and your spouse chooses to itemize. You both have to do the same thing — either itemize or take the standard deduction. Itemized deductions are basically expenses allowed by the IRS that can decrease your taxable income.

Terms and conditions apply; seeAccurate Calculations Guaranteefor details. Wondering if your mortgage points are deductible?

Jennifer Mansfield, CPA, JD/LLM-Tax, is a Certified Public Accountant with more than 30 years of experience providing tax advice. Figuring out the best tax strategy for your finances can be complicated, but finding a financial advisor to help you do them doesn’t have to be. SmartAsset’s free toolcan help you find suitable advisors in your area in just five minutes.Get started now.

However, nonresident aliens who are married to a U.S. citizen or resident alien at the end of the year and who choose to be treated as U.S. residents for tax purposes can take the standard deduction. For additional information, refer to Publication 519, U.S. The phase-out of certain itemized deductions is reserved for the highest income earners. The generosity of the IRS does have its limits, though. The tax code applies floors, ceilings and phase-outs for certain itemized deductions. Before you jump into itemizing your deductions, keep in mind it requires careful financial record-keeping and a close reading of the tax rules.

Get Every Deduction You Deserve

If you only claimed $10,000 in deductions, you would still pay less taxes, but you’d still pay the 24% tax rate. Itemized deductions lower your taxable income, which usually means they allow you to pay less taxes. But that depends on your tax bracket. For most people, there is a balance between the work required to itemize and the amount you save by itemizing. For example, let’s say you want to itemize. You add up all your expenses and find that you would save $500 by itemizing. It’s probably worth doing a little extra work to get $500.

For federal purposes, the rules for deducting gambling losses have changed. For New York income tax purposes, gambling loss deductions are limited to the amount of gambling income reported on your return. Other miscellaneous deductions are claimed on Form IT-196, lines 29 through 37. The following sections present 2017 Internal Revenue Service data reporting the percentage of taxpayers who itemized and the type and amount of itemized deductions they claimed. The changes made by the Tax Cuts and Jobs Act will significantly affect comparable estimates for 2018. The amount of itemized deductions was limited and phased out for high income taxpayers for tax years before 2017; however, the Tax Cuts and Jobs Act of 2017 eliminated the phaseout and limitations. At tax time, your tax professional can run the numbers both ways to see which method produces a lower tax bill.

Fees apply if you have us file a corrected or amended return. If you’re using tax software, it’s probably worth the time to answer all the questions about itemized deductions that might apply to you. The software or your advisor can run your return both ways to see which method produces a lower tax bill. Even if you end up taking the standard deduction, at least you’ll know you’re coming out ahead. If you own your home, for example, your itemized deductions for mortgage interest and property taxes may easily exceed the standard deduction, saving you money. The more you can deduct, the less you’ll pay in taxes, which is why some people itemize — the total of their itemized deductions is more than the standard deduction.

Starting price for simple federal return. Price varies based on complexity. Starting price for state returns will vary by state filed and complexity. Available only at participating H&R Block offices. H&R Block does not provide immigration services. An ITIN is an identification number issued by the U.S. government for tax reporting only. Having an ITIN does not change your immigration status.

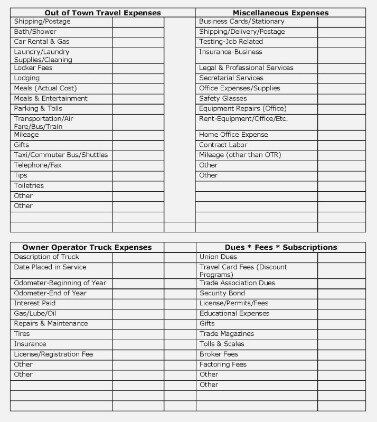

Job Expenses And Certain Miscellaneous Deductions

We briefly describe the difference between federal and New York State itemized deduction rules below. In addition, we provide links to specific current and prior year Internal Revenue Service forms and publications to help you compute your New York itemized deductions. Your standard deduction may be limited if you are claimed as a dependent on someone else’s tax return; for example, if you are claimed as a dependent on your parents’ tax return. Itemized deductions averaged about $28,600 in 2017 for the 47 million tax units claiming them. Miscellaneous itemized deductions are subject to a 2% floor, a.k.a. the “2% Haircut.” A taxpayer can only deduct the amount of miscellaneous itemized deductions that exceed 2% of their adjusted gross income. For example, if a taxpayer has adjusted gross income of $50,000 with $4,000 in miscellaneous itemized deductions, the taxpayer can only deduct $3,000, since the first $1,000 is below the 2% floor. This facilitated amendments to 2011 tax returns to claim a casualty tax deduction.

They pay roughly $5,000 per year in property taxes on their home, and $200 in personal property taxes are paid with their vehicle registrations. Of the total $10,200 they pay in state and local taxes, Mark and Sara can claim $10,000. The additional $200 deduction is lost since the deduction for state and local taxes is capped at $10,000. With the higher standard deductions, taking steps to lower your tax bill might be a little more complicated than it was before. Pre-paying your state and local taxes or making a donation to charity might not be enough to push you over the higher standard deduction hurdle. And if you live in a high-tax state, your combined state income taxes and property taxes may have already reached the $10,000 limit.

Other Miscellaneous Deductions

The standard deduction lowers your income by one fixed amount. On the other hand, itemized deductions are made up of a list of eligible expenses. You can claim whichever lowers your tax bill the most. With tax reform and the increased standard deduction amounts, the standard deduction will be the best choice for a lot of folks. You can see the standard deduction dollar amounts.

- Fees apply if you have us file a corrected or amended return.

- All checks are subject to approval for funding in Ingo Money’s sole discretion.

- Other miscellaneous deductions are claimed on Form IT-196, lines 29 through 37.

- Additionally, you can only deduct 50 percent of the cost of business-related meals and entertainment.

And, gambling losses can’t exceed gambling winnings. Text is available under the Creative Commons Attribution-ShareAlike License; additional terms may apply. By using this site, you agree to the Terms of Use and Privacy Policy. Wikipedia® is a registered trademark of the Wikimedia Foundation, Inc., a non-profit organization. This post is to be used for informational purposes only and does not constitute legal, business, or tax advice. Each person should consult his or her own attorney, business advisor, or tax advisor with respect to matters referenced in this post.

Standard Deduction Additional Amounts

Once you have prepared your return, you can view the results and see which method was chosen for you. If you need to change it for other reasons, it is simple to change it as well. When you prepare and e-File your 2020 Tax Return via eFile.com, you don’t have to worry which deduction method is best for you. Based on the tax information you enter during the tax interview, the eFile Tax App will suggest the best deduction method to you, as we want you to keep more of your hard earned money. Property taxes, including vehicle registration fee, if assessed by reference to the value of the property. This amount is in addition to the previous choice of either income or sales tax. Deductions are reported in the tax year in which the eligible expenses were paid.

Tax returns may be e-filed without applying for this loan. Fees for other optional products or product features may apply. Limited time offer at participating locations. By authorizing H&R Block to e-file your tax return, or by taking the completed return to file, you are accepting the return and are obligated to pay all fees when due. Offer valid for tax preparation fees for new clients only.