Content

Additional feed may apply from SNHU. Timing is based on an e-filed return with direct deposit to your Card Account. Vanilla Reload is provided by ITC Financial Licenses, Inc.

Check cashing fees may also apply. Check cashing not available in NJ, NY, RI, VT and WY. US Mastercard Zero Liability does not apply to commercial accounts . Conditions and exceptions apply – see your Cardholder Agreement for details about reporting lost or stolen cards and liability for unauthorized transactions. When you use an ATM, we charge a $3 withdrawal fee. You may be charged an additional fee by the ATM operator . See your Cardholder Agreement for details on all ATM fees.

The student will be required to return all course materials, which may be non-refundable. Discount is off course materials in states where applicable. Discount must be used on initial purchase only.

• TurboTax coaches you every step of the way and automatically verifies as you go, so you can be confident your taxes are done right. • Get your taxes done right anytime from anywhere. Seamlessly switch between your devices and securely pick up right where you left off when it’s convenient for you. TurboTax Live Basic with Expert Review. estern Governors University is a registered trademark in the United States and/or other countries. H&R Block does not automatically register hours with WGU.

Video: How To Recover Past Tax Returns

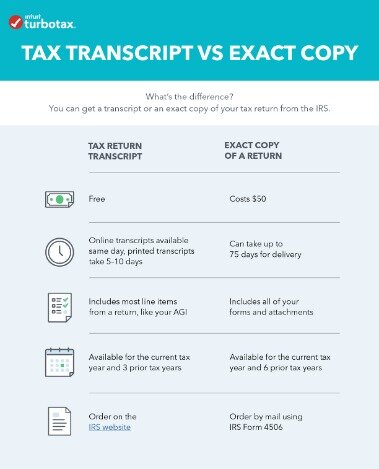

You can view prior-year returns by contacting the IRS for a free transcript or an exact copy. The IRS charges $57 per copy of your tax return at the time of publication. Call to request your transcript, or order one online . For an exact copy of your return, fill out the Request for Copy of Tax Return PDF form . Mail your request to the address indicated on the form. The address differs based on your state.

eFile.com users have access to copies of their tax returns for over 7 Years. Plus, eFile.com will have access to your Adjusted Gross Income. eFile Your 2020 Tax Return by April 15, 2021. The top portion of the form requires you to enter your personal details as it appears on the original tax return you are requesting. At a minimum, the name and Social Security number you provide must match the original return.

- The IRS requires you to file a tax return in each year that your income is greater than your standard deduction if you are not the dependent to another taxpayer.

- H&R Block does not automatically register hours with WGU.

- The IRS charges a fee for each tax year you request a return for.

- Starting price for simple federal return.

- Additional transaction fees, costs, terms and conditions may be associated with the funding and use of your card or account.

Not valid on subsequent payments. CTEC# 1040-QE-2355 ©2020 HRB Tax Group, Inc. Transferring funds from another bank account to your Emerald Card may not be available to all cardholders and other terms and conditions apply. There are limits on the total amount you can transfer and how often you can request transfers. MetaBank® does not charge a fee for this service; please see your bank for details on its fees. Free ITIN application services available only at participating H&R Block offices, and applies only when completing an original federal tax return . CAA service not available at all locations.

How To Get A Copy Of Your Tax Transcript

You’ll need to fill out and mail Form 4506 to the IRS to request a copy of a tax return. We think it’s important for you to understand how we make money. It’s pretty simple, actually. The offers for financial products you see on our platform come from companies who pay us. The money we make helps us give you access to free credit scores and reports and helps us create our other great tools and educational materials.

Type of federal return filed is based on your personal tax situation and IRS rules. Additional fees apply for Earned Income Credit and certain other additional forms, for state and local returns, and if you select other products and services. Visit hrblock.com/ez to find the nearest participating office or to make an appointment.

If you need to view earlier returns, you’ll need to request them from the IRS . Click “Submit” and wait for Tax2PDF to convert the file to a PDF. When the process completes, TurboTax offers you the ConvertedTaxFile.pdf for download. Right-click the file, then click “Open file location” or “Open folder location.” Note the location of your return. Reduce your tax bill with deductions. Just because you are filing your return late doesn’t mean you forfeit the deductions you could have taken.

Importing Txf With Turbotax

Additional transaction fees, costs, terms and conditions may be associated with the funding and use of your card or account. See your Cardholder or Account Agreement for details. Starting price for simple federal return. Price varies based on complexity. Starting price for state returns will vary by state filed and complexity. By authorizing H&R Block to e-file your tax return, or by taking the completed return to file, you are accepting the return and are obligated to pay all fees when due. H&R Block prices are ultimately determined at the time of print or e-file.

H&R Block provides tax advice only through Peace of Mind® Extended Service Plan, Audit Assistance and Audit Representation. Consult your own attorney for legal advice. See Peace of Mind® Terms for details.

After that time, you’ll need to request a copy from the IRS. Select the return you want to view and wait for it to open as a PDF file. Click “View your returns from prior years” on the Welcome Back screen.

You can easily access prior year tax forms on the TurboTax website or by contacting the IRS. Don’t make the mistake of using current year tax forms or you may end up preparing the return again. The IRS requires you to file a tax return in each year that your income is greater than your standard deduction if you are not the dependent to another taxpayer. Many taxpayers fail to file a return even when required to do so.

Additional personal state programs extra. Description of benefits and details at hrblock.com/guarantees. Emerald Cash RewardsTMare credited on a monthly basis. Rewards are in the form of a cash credit loaded onto the card and are subject to applicable withdrawal/cash back limits. If you’re e-filing your taxes, you will be asked for your prior-year AGI. Find out from the experts at H&R Block how to get your AGI from last year. , you can log into your account to see previous returns.

Step 4: Complete Tax Forms

Use the drop-down menu at the top of the screen to choose the tax year you want and then select Download PDF. When you sign in, make sure you’re using the same TurboTax account as in prior years. By accessing and using this page you agree to the Terms of Use. If you are requesting copies of a joint return, it’s not necessary for your spouse to sign Form 4506.

Then you are not signing onto the prior year online account with the same User ID you used to create the account. Many users have multiple User ID’s. I’m unable to do this as well which is complete garbage given the fact that we’ve paid for those returns.

Citizenship and Immigration Services and lending agencies for student loans and mortgages generally accept a tax return transcript as a substitute for a copy of your return. Transcripts requested online can only be mailed to the address used on your last tax return. To file 2019 taxes, please select a TurboTax product. You can file taxes for a different year by selecting the year above. Send in your tax return and all supporting documents to the address listed in the instructions.