Content

Down the left side of the screen, click on State Tax Summary to see the actual tax return that you prepared. Have you ever needed a tax return from a prior year, but either forgot where you put your copy or just didn’t have one to begin with? You can download your tax return using thePrint Centerand choose the option for all worksheets. when I click “download/print return” only my state return downloads without 1040. For all my previous years tax return I am able to download 1040.

- From simple to complex tax situations, we have you covered.

- To help with the estimation, you can start with the previous year’s federal tax return.

- Answer simple questions about your life, and we’ll fill out the right forms for you.

- And maybe even better is the money you can save if you are eligible for free e-filing.

- It’s filled out by your employer to document your earnings for the calendar year.

For calendar year taxpayers , the due dates are April 15, June 15, September 15 of the current year and January 15 of the following year. It’s filled out by your employer to document your earnings for the calendar year.

Of course you can always prepare a 1040EZ form by hand and mail it to the IRS to avoid paying fees, but there are two free e-filing options you may want to consider as well. The IRS Free File Program delivered by TurboTax offers taxpayers who meet certain income requirements the opportunity to prepare and e-file their returns online for free. If you don’t qualify for Free File Program, you can still file a free federal tax return using TurboTax Free Edition for simple tax returns only. The Internal Revenue Service can provide you with copies of your tax returns from the most recent seven tax years. You can request copies by preparing Form 4506 and attaching payment of $50 for each one. Once the IRS receives your request, it can take up to 60 days for the agency to process it. If you filed your taxes with a TurboTax CD/download product, your tax return is stored on your computer, so you can print a copy at any time.

You can also find all federal forms and state tax forms at the links below. IRS Form 1040 acts as one of the official documents that you can use to file your annual federal income tax return. The IRS Form 1040 is one of the official documents that U.S. taxpayers can use to file their annual income tax return.

Answer Simple Questions About Your Life, And Well Fill Out The Right Forms For You

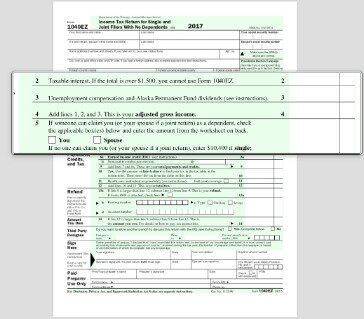

If you had underpaid, then you needed to make a payment for the remaining balance. Forms 1040 and 1040-SR resemble the 1040EZ form, which originally aimed to simplify the tax return preparation process if you faced a straightforward tax situation and met certain conditions. Form 1040EZ is no longer used, but Form 1040 and Form 1040-SR are important for taxpayers to be familiar with.

This form has since been replaced by Form 1040 and Form 1040-SR, depending on your tax situation. Answer simple questions about your life, and we’ll fill out the right forms for you. Also be aware that when using the 1040EZ, you cannot claim dependents, itemize deductions or take any adjustments to income. In addition, there are limitations on the types of tax credits you can take.

What Customers Are Saying About Turbotax Free Edition

For those who are filing prior year returns, you can continue to use form 1040A or EZ for tax years through 2017. Remember, when you file with TurboTax, we’ll ask you simple questions about your life and help you fill out all the right tax forms. From simple to complex tax situations, we have you covered. While it may seem obvious, many taxpayers forget to sign their returns before mailing them to the IRS. For this part, you needed to be sure to sign it in the last section.

Enter the form you used to file your federal income tax return on line 6. If you are requesting a personal income tax return, it’s likely you filed on Form 1040, 1040-SR, 1040A or 1040EZ. You must also enter the tax years you are requesting copies for on line 7. For example, if you are requesting your 2017 tax return, enter “12/31/2018” and not just “2018”. You may use TurboTax Online without charge up to the point you decide to print or electronically file your tax return.

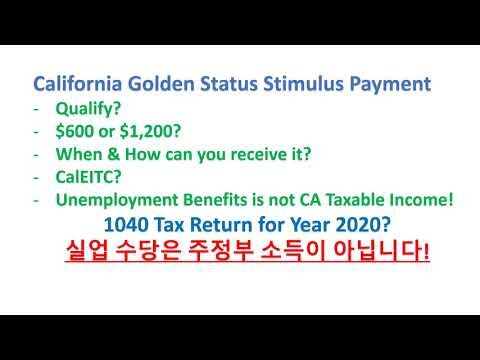

Video: How To Recover Past Tax Returns

Printing or electronically filing your return reflects your satisfaction with TurboTax Online, at which time you will be required to pay or register for the product. The Internal Revenue Service Web site includes all the IRS Forms & Publicationsfor Federal income tax returns. If you used TurboTax to file electronically last year, you’ll receive no tax forms by mail from the IRS. If you filed on paper, you’ll receive a postcard explaining your options for obtaining the forms. While you can pick them up at a post office or print them from , TurboTax will ask simple questions and automatically fill in all of the appropriate tax forms you need to file your tax return. Fortunately, learning just a few key tax forms can give you much of the information you need to understand your tax return. Here’s a primer on some of the documents you’ll want to be familiar with as you use TurboTax to prepare your tax return.

Enter the number of returns you are requesting on line 8b. Multiply the number of returns you are requesting on line 8b by the applicable fee on line 8a and enter the total fee on line 8c. If you filed a joint return for any of the years you are requesting copies, then you must also provide your spouse’s name and Social Security number on line 2. If you answered yes to any of those questions, then you’ll need to file a standard 1040. You may also need to file a 1040 if you claim certain credits or deductions. For example, if you itemize your deductions you’ll need to fill out a 1040, as you can’t attach the Schedule A form needed for itemized deductions to either a 1040EZ or 1040A.

So, if you need a tax return that you filed more than seven years ago, the IRS will try to locate it, but there are no guarantees. In addition, the IRS charges a fee for each tax return you request, and you must enclose payment when mailing the 4506 form. And if you want the returns sent directly to a third party, such as a bank that’s evaluating your application for a mortgage loan, you must provide the bank’s contact information on the form. Luckily, the Internal Revenue Service can provide you with copies of your original tax returns.

Your only adjustments to income are the IRA deduction, the Student Loan Interest deduction, the Educator Expenses deduction, and the Tuition and Fees deduction. The 1040A is only two pages and covers most common income, credits and deductions, but can only be used if the following is true. By accessing and using this page you agree to the Terms of Use. Finally, there is a new credit for sick and family leave for certain self-employed individuals. This credit will be entered on Schedule 3, Line 12b and will be calculated on Form 7202. There is also a new deduction for charitable cash contributions of up to $300. These will be reported on Schedule A, Line 10b for taxpayers taking the standard deduction.

File your taxes for free with TurboTax and get your maximum refund, guaranteed. Prepare your return online and pay only when you’re ready to print or e-file. You can only use the 1040EZ form if you satisfy a number of eligibility requirements. Watch this video for more information on how to file a 1040EZ for free.

This is why the IRS allows some taxpayers to use the 1040EZ form instead of the longer 1040. And maybe even better is the money you can save if you are eligible for free e-filing.

You will then be prompted to register or pay if you haven’t done so to view your full return. To print and view these forms you’ll need Adobe Reader on your computer. You can pay weekly, biweekly or whatever interval suits you, as long as you pay in full the amount due for that period. You can also estimate your tax liability for the whole year and pay the estimated tax in one lump sum by the 15th of April of the current year. If you had no tax liability for the prior year, you were a U.S. citizen or resident for the whole year and your prior tax year covered a 12-month period, then you do not have to file Form 1040-ES.

ExplainWhy™ delivers personalized insights so you can truly understand your taxes. The filing status and exemptions section of Form 1040A is similar to the corresponding section on Form 1040. Due to the limited types of income you can receive and the limited adjustments to income you can make on Form 1040A, the income and adjusted gross income sections of Form 1040A are much shorter. One of the most significant differences between the two forms is that you can itemize deductions on Form 1040 but not on Form 1040A. After reporting your income, the 1040A form allows you to claim certain adjustments to arrive at your adjusted gross income. These include deductions for educator expenses, IRA contributions, student loan interest and tuition payments.

Calculate 90 percent of the tax you estimate you will owe in the current year. This is also where you report income from a seller-financed mortgage.