Content

An ITIN is an identification number issued by the U.S. government for tax reporting only. Having an ITIN does not change your immigration status. You are required to meet government requirements to receive your ITIN. Additional fees and restrictions may apply. You can claim the full $2,500 deduction if your modified AGI is $65,000 or less. At a minimum, the student has to be half-time enrolled.

If you’re a parent making payments on your child’s student loans but the loans are in your child’s name, you don’t qualify for the deduction. You claim this deduction as an adjustment to income, so even if you are taking the standard deductionon your tax return, you can claim the student loan interest deduction. The student loan interest deduction is an “above the line” income adjustment on your tax return.

It has to be used for qualified higher education expenses, such as tuition, fees, textbooks, supplies, and equipment needed for coursework. Room and board, student health fees, insurance, and transportation do not count as qualified educational expenses for a student loan interest deduction.

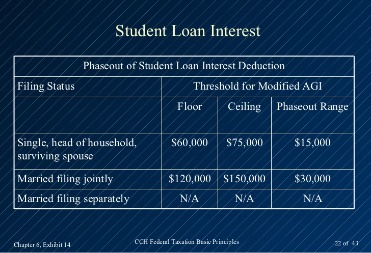

You must also meet the following income requirements to be eligible for this tax break. The deduction will phase out at specific income thresholds and be unavailable at others. The lifetime learning credit can help defray the costs of an undergraduate, graduate or professional degree. It’s worth up to $2,000 per tax year, and there’s no limit on the number of years you can claim it.

A single filer with a MAGI of $85,000 or more can’t claim the deduction. The student loan interest deduction isn’t the only tax break available to students and parents. There are also federal tax credits for higher education.

Do I Owe Taxes On My Scholarship?

These expenses apply specifically to the student loan interest deduction. They aren’t necessarily the same as those that will qualify you for other education tax breaks, such as the American Opportunity tax credit or the Lifetime Learning credit. The IRS provides an interactive tool to help taxpayers determine if they’re eligible for the student loan interest deduction.

H&R Block does not provide audit, attest or public accounting services and therefore is not registered with the board of accountancy of the State in which the tax professional prepares returns. Starting price for simple federal return. Starting price for state returns will vary by state filed and complexity. Personal state programs are $39.95 each (state e-file available for $19.95). Most personal state programs available in January; release dates vary by state. E-file fees do not apply to NY state returns.

Most people earning enough to be in the 24% tax bracket or higher won’t qualify for the student loan interest deduction. If they do qualify, their deduction will be reduced because their income falls within the range where the benefit is phased out. As a result, about nine out of 10 taxpayers are better off taking the standard deduction. The good news is that if you take the standard deduction, you can also claim the tax break on student loan interest payments. No wonder more than 12 million Americans claim nearly $14 billion in deductions each year for student loan interest payments. There are a few conditions to meet, but if you do qualify, it’s easy to take advantage of because you don’t need to itemize your deductions.

However, if you choose to go to an out-of-state college, be prepared to pay thousands more. This is done because the college receives funding from the public via taxes, and if you’re not a resident, you haven’t been paying in. Some college credits don’t transfer when a student decides to switch colleges. This means they have to retake some courses, and this can add an additional two years on. Use our Free Tax Tools to help calculate taxes or determine eligibility for certain credits. Qualified expenses for the Student Loan Interest Deduction are the total costs of attending an eligible educational institution . An eligible educational institution is a school offering higher education beyond high school.

Visit hrblock.com/ez to find the nearest participating office or to make an appointment. OBTP#B13696 ©2017 HRB Tax Group, Inc. But loans provided by your relatives or employers don’t qualify. To claim the student loan deduction, you or your spouse must be legally responsible for paying the loan. If you’re making payments on loans that your children took out in their own name, you cannot claim the student loan interest deduction. Your children cannot claim the deduction either if they are listed as dependents on your tax return.

How Should A Person Deduct Student Loan Interest On Their Taxes? What Form(s) Or Fields Do They Need?

The absolute best value for your max refund. Simply Free For those with a simple tax situation.

You can also choose to combine your loans with your mortgage. By doing this, you would be refinancing your mortgage with a new loan or additional home equity. You would use this money to pay off any student loan debt that you have left. For interest paid to a foreign lender, the deduction is the amount of interest paid for the qualified student loan. IRS Publication 970 provides more guidance on the items related to student loan interest deduction.

and Ingo Money, Inc., subject to the Sunrise Banks and Ingo Money ServiceTerms and Conditions, the Ingo MoneyPrivacy Policy, and the Sunrise Banks, N.A.Privacy Policy. Approval review usually takes 3 to 5 minutes but can take up to one hour. All checks are subject to approval for funding in Ingo Money’s sole discretion. Fees apply for approved Money in Minutes transactions funded to your card or account. Unapproved checks will not be funded to your card or account. Ingo Money reserves the right to recover losses resulting from illegal or fraudulent use of the Ingo Money Service.

Your wireless carrier may charge a fee for data usage. Additional transaction fees, costs, terms and conditions may be associated with the funding and use of your card or account. See your Cardholder or Account Agreement for details. Fees apply to Emerald Card bill pay service. See Online and Mobile Banking Agreement for details.

And you can’t take the deduction for any other type of credit you may have used to pay college costs. A qualified student loan can be used for your own education, your spouse’s or your dependent’s — though there are income and filing status limits on eligibility. This can be simplified to 1,500 x 5,000/15,000, which comes out to a student loan interest tax deduction of $500. Let’s say you do fall into that range. Here’s how you calculate what you can deduct. Say you’re filing as a single individual, you have a MAGI of $75,000 and paid $1,500 in student loan interest.

Financial Services

Let’s take a look at how the student loan interest deduction works, how to qualify for it and how much you could save if you’re eligible to take the deduction. The Send A Friend coupon must be presented prior to the completion of initial tax office interview. A new client is defined as an individual who did not use H&R Block or Block Advisors office services to prepare his or her prior-year tax return. Discount valid only for tax prep fees for an original 2017 personal income tax return prepared in a participating office. May not be combined with any other promotion including Free 1040EZ. Void if sold, purchased or transferred, and where prohibited.

California loans arranged pursuant to Dep’t of Business Oversight Finance Lenders License #60DBO-78868. You may be able to take the deduction if you meet all of these qualifications. Southern New Hampshire University is a registered trademark in the United State and/or other countries. H&R Block does not automatically register hour with SNHU. Students will need to contact SNHU to request matriculation of credit. Additional feed may apply from SNHU.

Education Savings Plans, or 529 Plans, can be used for K-12 student education on your 2020 Return, due April 15, 2021. Prepare and e-File your return or extension through eFile.com to get the most out of your 2020 Refund and let the eFile app do the hard work. Every year, the IRS announces the MAGI limits at which the deduction begins to be reduced and at which it phases out entirely. Here are the limits for the 2020 tax year. Your loan must also meet certain requirements to be eligible for the deduction. Your modified adjusted gross income is low enough.

- For interest paid to a foreign lender, the deduction is the amount of interest paid for the qualified student loan.

- In order to get the deduction, you actually have to pay the interest, not just accrue it.

- Gift card will be mailed approximately two weeks after referred client has had his or her taxes prepared in an H&R Block or Block Advisors office and paid for that tax preparation.

- Available only at participating H&R Block offices.

- See your Cardholder or Account Agreement for details.

Discount must be used on initial purchase only. CTEC# 1040-QE-2355 ©2020 HRB Tax Group, Inc. Due to federally declared disaster in 2017 and/or 2018, the IRS will allow affected taxpayers an extended filing date to file and pay for their 2017 taxes.

For married taxpayers filing jointly, the limits are $140,000 for a full deduction and between $140,000 and $170,000 for a partial one. Couples who report $170,000 or more are ineligible. If you plan to go to a school in your state of residence, you will get a reduced tuition rate.

You must also be legally obligated to repay the loan. You—or your spouse if you file a joint return—must be the signatories on the loan. You can’t claim the deduction if your child takes out the loan in their own name and is the obligor, even if you make the payments for them. Only they can do so—provided, of course, that you’re not claiming them as a dependent. He previously worked for the IRS and holds an enrolled agent certification.

The deduction can decrease your taxable income by thousands, depending on your situation. When you repay student loans, you pay down the original balance and the interest that has accrued on that balance. You can deduct that interest on your taxes, but the entire student loan payment amount is not tax-deductible. If you paid more than $600 in interest in 2020, you will automatically receive form 1098-E — a student loan interest deduction form — in the mail or by email. There is no limit to the number of years you can deduct student loan interest.