Content

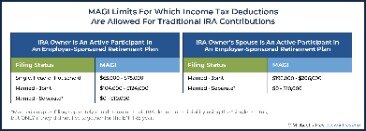

First, maximize your contributions to the retirement plans that your employer offers. Contributions to 401 plans and 403 plans have the same effect on your taxes as a contribution to a traditional IRA. Your ability to deduct contributions doesn’t impact your ability to contribute to a traditional IRA. Even if you can’t deduct anything, you can still contribute up to your annual limit.

You might receive both taxable and nontaxable distributions. If so, use Publication 590-B worksheets to help you figure the taxable portion of your IRA withdrawals. You’ll report the taxable and nontaxable portions of the distributions on Form 8606.

There’s no minimum age to participate in an IRA. If your teen-age child has compensation from a part-time job, your child can contribute to an IRA up to $6,000 . Small Business Small business tax prep File yourself or with a small business certified tax professional. File with a tax Pro At an office, at home, or both, we’ll do the work. Don’t be surprised by an unexpected tax bill on your unemployment benefits. Know where unemployment compensation is taxable and where it isn’t. The answer to this question comes down to whether your stimulus check increases your “provisional income.”

Can I Contribute To An Ira If I Participate In A Retirement Plan At Work?

You will also be obligated to take required minimum distributions after you turn age 70 1/2, so you won’t be able to avoid the IRS forever. The maximum amount you can contribute to a traditional IRA for 2019 is $6,000 if you’re younger than age 50.

- She and her spouse, age 48, reported taxable compensation of $60,000 on their 2020 joint return.

- Lea has years of experience helping clients navigate the tax world.

- This tax information is not intended to be a substitute for specific individualized tax, legal, or investment planning advice.

- Earnings in a Roth account are tax-free rather than tax-deferred.

- H&R Block does not provide immigration services.

As you can see, the backdoor Roth conversion can be as tricky as it is rewarding. It might be a good idea to seek the help of a financial advisor. That way, you can make sure you follow all the rules and avoid pitfalls that may be waiting around the corner.

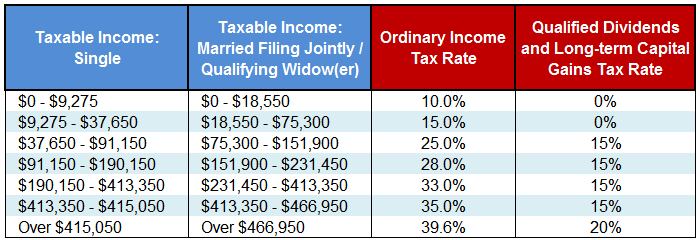

A modified AGI over $208,000 allows for no deduction. Many taxpayers can take a deduction for money they contribute to a traditional IRA each year, but it depends on some rules. You must have earned income to qualify, and certain types of IRAs aren’t eligible. The Internal Revenue Service also sets a cap on the total amount of contributions that can be deducted. If your income is under a certain level or if you don’t have an employer-sponsored retirement plan, your Traditional IRA contribution is fully deductible. If you do have a 401 or pension plan, the tax-deductible portion of your IRA contribution may be limited. Use our IRA contribution limit charts below to see how much you can deduct.

Roth IRA contributions are still a long-term investment in a retirement savings plan. The tax rules differ for contributions to a Roth IRA, which aren’t tax-deductible. Money instead goes into a Roth IRA after taxes have been paid on it, and you can withdraw contributions at any time free of taxes or penalties. The earnings can also be withdrawn tax- and penalty-free once you have owned the Roth for five years and you’re at least age 59 1/2. Also, Roth IRAs don’t have required minimum distributions. The amount that can be contributed to a Roth IRA is subject to income limits. The tax deduction plus the tax-deferred growth that a traditional IRA provides can help build a sizable retirement nest egg.

While a Roth IRA has a strict income limit and those with earnings above it cannot contribute at all, no such rule applies to a traditional IRA. Here’s what you need to know about traditional IRA income limits in 2020 and 2021. If you’re in the income phase-out range, you can deduct a portion of your contributions. To be clear, we’re talking here about contributions to a traditional IRA. Contributions to a Roth IRA are not tax-deductible. Satisfaction Guaranteed — or you don’t pay.

This is a friendly notice to tell you that you are now leaving the H&R Block website and will go to a website that is not controlled by or affiliated with H&R Block. This link is to make the transition more convenient for you. You should know that we do not endorse or guarantee any products or services you may view on other sites. For your protection, take a moment to carefully review their policies and procedures, as they may not be the same as those of H&R Block. Southern New Hampshire University is a registered trademark in the United State and/or other countries. H&R Block does not automatically register hour with SNHU.

Contribution Limits And How Much You Can Deduct

The IRA deduction is phased out if you have between $66,000 and $76,000 in modified adjusted gross income as of 2021 if you’re single or filing as head of household. You’ll be entitled to less of a deduction if you earn $66,000 or more, and you’re not allowed a deduction at all if your MAGI is over $76,000. You’d be entitled to $7,000 in deductible contributions for each of you for a total of $14,000 if you and your unemployed spouse are age 50 and older. You can take an IRA deduction for up to $6,000 in contributions in 2021 if you’re age 49 or under. This increases to $7,000 if you’re age 50 or older. The deadline for making deductible contributions is Tax Day of the year following the tax year in which you’re claiming them. SEP, SIMPLE, and SARSEP IRA plan contributions are deductible, but these can be subject to slightly different rules.

This is an optional tax refund-related loan from MetaBank®, N.A.; it is not your tax refund. Loans are offered in amounts of $250, $500, $750, $1,250 or $3,500. Approval and loan amount based on expected refund amount, eligibility criteria, and underwriting. If approved, funds will be loaded on a prepaid card and the loan amount will be deducted from your tax refund, reducing the amount paid directly to you. Tax returns may be e-filed without applying for this loan.

Who Can Contribute To A Roth Ira?

You can take a partial tax deduction if your combined income is between $196,000 and $206,000. Traditional individual retirement accounts, or IRAs, are tax-deferred, meaning that you don’t have to pay tax on any interest or other gains the account earns until you withdrawal the money.

Say you’re a high-income saver looking to maximize your tax advantages. Contributing to a non-deductible IRA on your way to a backdoor Roth conversion could be a great way to protect some or all of your retirement savings from taxation. But if you’re thinking about parking your money in a non-deductible IRA for the long term, it’s important to weigh the risks. To figure out your tax liability, take your after-tax contributions and divide them by the total value of all your IRAs. Enrollment in, or completion of, the H&R Block Income Tax Course is neither an offer nor a guarantee of employment.

The IRS limits the amount you can deduct each year, and this amount is subject to change each tax year. This maximum tax deduction may also be subject to a reduction when your MAGI is too high. The IRS provides a worksheet with your tax return instructions to help you calculate your deduction. You can make a spousal IRA contribution—a contribution for your non-working spouse—if you have enough earned income to cover the contributions in addition to your own. And yes, you can claim an IRA deduction for doing so.

You might have a traditional IRA with basis from nondeductible contributions or rollovers. If so, you’ll need to calculate the taxable portion of any withdrawals.

See Publication 590-A for certain conditions that may allow you to avoid including withdrawals of excess contributions in your gross income. Excess contributions are taxed at 6% per year for each year the excess amounts remain in the IRA. The tax can’t be more than 6% of the combined value of all your IRAs as of the end of the tax year. The deadline to make a Traditional IRA contribution for the current tax year is typically April 15 of the following tax year. Jim Barnash is a Certified Financial Planner with more than four decades of experience. Jim has run his own advisory firm and taught courses on financial planning at DePaul University and William Rainey Harper Community College. Amelia JosephsonAmelia Josephson is a writer passionate about covering financial literacy topics.

Traditional Ira Deduction Limits

You can mail your IRA contribution, and you’ll meet the deadline if it’s postmarked by the original due date for filing Form 1040. Some IRA accounts have annual fees, while others have no fees. The balance in your account when you die generally goes to your heirs tax-free.

H&R Block does not provide immigration services. An ITIN is an identification number issued by the U.S. government for tax reporting only. Having an ITIN does not change your immigration status.

In some cases, all or a portion of the money you withdraw would be tax-free. That’s because the government can’t tax your retirement savings twice. More on that later, but first, let’s cover the rules to see if you’re eligible to make non-deductible IRA contributions. This will also help you decide if this is a good option for you. Transferring funds from another bank account to your Emerald Card may not be available to all cardholders and other terms and conditions apply.