Content

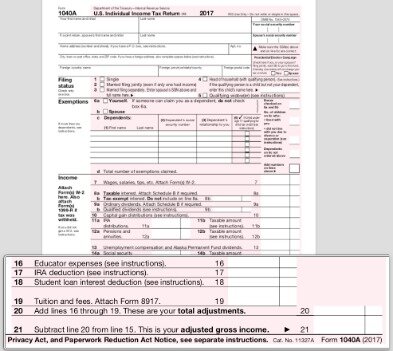

OBTP#B13696 ©2017 HRB Tax Group, Inc. Figuring out your adjusted gross income will happen on the aforementioned Form 1040. The 1040 is the centerpiece of your tax return, providing the IRS with your total income, adjustable gross income, tax deductions, tax credits and if you qualify for one, a tax refund. Your adjusted gross income is equal to your gross income minus any eligible adjustments that you may qualify for. These adjustments to your gross income are specific expenses the IRS allows you to take that reduce your gross income to arrive at your AGI. Now that you know how much you made for the entire year, tally your deductions and expenses.

Well actually, calculating AGI already gets you awfully close to calculating MAGI since you already went from gross income to adjusted gross income. Modified adjusted gross income is adjusted gross income, but with some of those deductions put back into the figure.

Your total deductions will be (300+700+10,000+5,000) $16,000. Now subtract deductions from your annual income (100,000 – 16,000), the value $84,000 will be your adjusted gross income. Do you want to claim your deductions and credits that are available on your tax return?

Gross Income Vs Net Income: Whats The Difference?

Valid for 2017 personal income tax return only. Return must be filed January 5 – February 28, 2018 at participating offices to qualify. Type of federal return filed is based on your personal tax situation and IRS rules. Additional fees apply for Earned Income Credit and certain other additional forms, for state and local returns, and if you select other products and services. Visit hrblock.com/ez to find the nearest participating office or to make an appointment.

Description of benefits and details at hrblock.com/guarantees. Emerald Cash RewardsTMare credited on a monthly basis.

Looking For More Information?

Bonuses, tips, alimony and even gambling winnings are also part of gross income. You generally do not include life insurance payments, child support, loan proceeds, inheritances or gifts in your AGI, though. Once you know your AGI, you can use it to find out if you can take advantage of certain tax credits and deductions to reduce your taxable income.

If you’re filing Form 1040 and itemizing so that you can take certain deductions, you may have to calculate your MAGI. It too can be a baseline for determining the phaseout level of some credits and tax-saving strategies, and sometimes the formula for MAGI can depend on the type of tax benefit it applies to. or your tax preparer will calculate your adjusted gross income as part of the process of preparing your tax return. The greater the value of your deductions, the lower the taxes you will have. So, make sure you write in the correct value of deductions while calculating your adjusted gross income. For tax purposes, your adjusted gross income or AGI is essentially your total or gross income minus eligible deductions.

Additional personal state programs extra. One state program can be downloaded at no additional cost from within the program.

Generally speaking, the lower your AGI, the greater the deductions and credits you’ll be eligible to receive. If you itemize deductions and report medical expenses, for example, you must reduce the total expense by 7.5% of your AGI for 2020.

Deductions For Agi

OBTP# B13696 ©2018 HRB Tax Group, Inc. Prices based on hrblock.com, turbotax.com and intuit.taxaudit.com (as of 11/28/17). TurboTax®offers limited Audit Support services at no additional charge. H&R Block Audit Representation constitutes tax advice only. Consult your attorney for legal advice. Does not provide for reimbursement of any taxes, penalties or interest imposed by taxing authorities. Taxable Income – This is your AGI minus either the standard deduction or total of itemized deductions—whichever is greater and the qualified business income deduction if applicable.

The IRS will generally send your IP PIN to you in a letter. Or you can obtain your IP PIN online via the IRS website. If you contributed to a traditional IRA during the year, you might be able to take an adjustment for some or all of your contributions. The amount you can subtract will depend on your modified adjusted gross income, or MAGI . NerdWallet strives to keep its information accurate and up to date.

- If you have a lower adjusted gross income, you can increase your tax refunds and decrease the amount of tax that you owe.

- Software DE, HI, LA, ND and VT do not support part-year or nonresident forms.

- For this reason, it’s a good idea to get to a better understanding of the difference between your gross income and adjusted gross income and how it impacts your personal financial planning.

- Many states use the AGI from your federal return as the starting point for state income tax calculations.

4) Next is the E-filing Your Return screen. Make sure you select the return you want to eFile and click Continue. Credit Karma is committed to ensuring digital accessibility for people with disabilities. We are continually improving the user experience for everyone, and applying the relevant accessibility guidelines. iPhone is a trademark of Apple Inc., registered in the U.S. and other countries.

Adjusted gross income is also something of a midpoint between your total income and your taxable income. Subtracting certain expenses and deductions from total income gets you your AGI; subtracting further deductions from that will get you to your taxable income.

Promotional period 11/9/2020 – 1/9/2021. Mastercard is a registered trademark, and the circles design is a trademark of Mastercard International Incorporated. OBTP# B13696 ©2020 HRB Tax Group, Inc. Fees apply to Emerald Card bill pay service.

For 2020, this limit is once again 7.5% of your AGI. This means that if your medical and dental expenses don’t exceed 7.5% of your AGI, you likely won’t be able to deduct them at all.

Availability of Refund Transfer funds varies by state. Funds will be applied to your selected method of disbursement once they are received from the state taxing authority. The tax identity theft risk assessment will be provided in January 2019. The tax identity theft risk assessment is based on various data sources and actual risk may vary beyond factors included in analysis.

Tips For Calculating Adjusted Gross Income

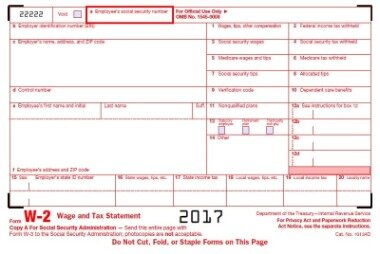

If math wasn’t your best subject, you can also use a helpful online AGI calculator to help you with the calculations. Examine the tax form and make sure you have included all of your income. Once you have accounted for all your wages and income, tally your expenses and adjustments. That said, you can calculate adjusted gross income using a W-2 form if you have the right tax form that lists all possible income and expenses to offset your gross income. Your W-2 form tells you how much you earned from an employer. If you have any other income, that will not be included on a W-2.