Content

If you did not use eFile.com, you can use our online editor to complete the Form 1040-X below, print it and mail it to the IRS. Find out about state tax amendmentsand previous tax year amendments. When you amend your federal tax return, you may need to amend your state income tax return too. Most states calculate taxable income based on information you provide on your federal return. Therefore, changes you make to your federal return are likely to affect your state return.

The TurboTax Audit Support Guarantee also includes the option to connect with an experienced tax professional for free one-on-one audit guidance. Monthly interest will also accrue on the tax you underreported between the original filing date and the date you file the amendment.

Note that the IRS doesn’t accept amended returns electronically. On Thursday, the IRS said it had received almost 93 million tax returns so far this season. If you did not eFile your tax return, you may have made simple math errors or forgotten to attach certain forms . The IRS will generally catch the mathematical mistakes and correct the errors while they process your original return. If the IRS wants additional information from you (i.e. a missing form or clarification on information included in the original return), they will generally send you a request via a letter in the mail. Download the necessary forms for the tax year you are amending. The IRS maintains a database on its website where you can access all tax forms for previous years.

Free Fed & State, Plus Free Expert Review

Select your State click, complete, and follow the instructions for the selected state. If you are amending IRS tax form 1040 or form 1040-NR by filing Form 1040-X in response to a notice you received from the IRS, mail it to the address shown on that notice. Otherwise, mail your 1040-X to the appropriate address listed here. However, you don’t have to amend a return because of math errors you made; the IRS will correct those. You also usually won’t have to file an amended return because you forgot to include forms, such as W-2s or schedules, when you filed — the IRS will normally request those forms from you.

For example, if you file your 2017 tax return on March 15, 2018, then you have until April 15, 2021 to get your amended tax return to the IRS. For a 2019 tax return filed in 2020, the deadline was automatically extended to July 15, 2020 and therefore 2020 amended returns have to be filed prior to July 15, 2023. In order to make changes, corrections, or add information to an income tax return that has been filed and accepted by the IRS or State Tax Agency, you must file a tax amendment to correct your federal or state tax return. If you have prepared and eFiled a 2020 Tax Return via eFile.com, you can prepare your amendment right from your eFile.com account. Click on how to prepare and file a 2020 IRS Tax Amendment on eFile.com.

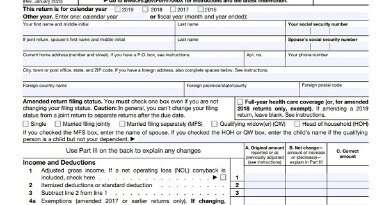

Have you ever discovered a mistake on your tax return or forgot to claim a tax deduction after filing it with the Internal Revenue Service? If so, you may want to consider filing an amended tax return on Form 1040X. However, before you begin preparing an amended tax return, it’s a good idea to make sure you still have time to file it. Common reasons to amend a return are to increase or decrease the income you report, to add or eliminate a deduction and to change your filing status. Column A mirrors the information from your original tax return, column B reports the net change for each line item and column C is the sum of A and B. You may use TurboTax Online without charge up to the point you decide to print or electronically file your tax return. Printing or electronically filing your return reflects your satisfaction with TurboTax Online, at which time you will be required to pay or register for the product.

If you are due a refund from your current year tax return, the IRS states that generally you should wait until you receive your refund before filing your amendment if you are claiming an additional refund. In order to claim a tax refund, a tax amendment has to be filed within 3 years you filed the original tax return , or within 2 years of the date you paid the tax, whichever is later. After 3 years, you can no longer claim a refund, and the money goes to the government.

Interest And Penalties On Tax Amendments

For example, if you originally prepared a Schedule B to report interest income, amending your return to claim a charitable contribution deduction will not affect it. However, it will require you to prepare a new Schedule A to report the charitable contribution with your itemized deductions. Even at this point, the manager of the audit group who receives your return will review it one last time to insure that it’s worthy of an audit. Only when this manager determines your return should be audited, will you be hearing from an IRS representative.

Download a current IRS Form 1040X, Amended U.S. Individual Income Tax Return. The form includes easy-to-follow instructions and only requires you to include new or updated information. It is unnecessary to copy information from your original return. You will also find a space where you can write an explanation as to why you are amending your return.

Generally, you must file an IRS Tax Amendment Form and/or State Amendment if you need to add more information or make corrections to an income tax return you filed or e-filed, and the IRS has accepted this return. If you’ve made an error on a tax return you already filed such as a tax deduction or credit, file an amended tax return to make the correction.

Before you amend your return, here are three things you need to know. If your error means you actually owe more to the IRS, the process can be a little more complicated. Read on for what to do if you have a bigger tax mistake to solve. “There’s no need to panic,” Laurie Kazenoff, a partner and co-chair of the tax department at Moritt Hock & Hamroff, tells CNBC Make It. Or, when done editing or signing, create a free DocuClix account – click the green Sign Up button – and store your PDF files securely. Or, click the blue Download/Share button to either download or share the PDF via DocuX.

Support

Alternatively, you can use TurboTax to file your amendment – we’ll automatically find and fill in the forms you need. You will need to reference your original tax return and any documentation that relates to your amendment such as proof of a new deduction you are claiming or a W-2 you didn’t have when preparing the original return. If you are missing a W-2, you can file a Form 4852 and have the IRS issue a W-2 replacement as long as your employer provided the IRS with this information. Hello, I’m Scott from TurboTax with some information about changing your filing status on an amended return. Are you concerned that if you file an amended return that it will trigger an IRS audit? Watch this video to find out if amending your filing status will trigger an IRS audit. A valid tax return amendment requires you to complete IRS Form 1040X. The two-page form requires you to update the amounts that differ from what you reported on the first tax return.

- Whenever you make changes to a form or schedule that you filed with your original return, you must prepare a new one and attach it to the 1040X.

- After 3 years, you can no longer claim a refund, and the money goes to the government.

- If you owe taxes, you should file an amended return even if 3 years have passed.

- And it’s important that your estimate be as accurate as possible, she adds.

Hello, I’m Jill from TurboTax with some information for taxpayers who need to amend a past tax return. If you’re not satisfied with your purchase and have not filed or printed your return, return it to Intuit within 60 days of purchase with your dated receipt for a full refund (excluding shipping & handling). The above article is intended to provide generalized financial information designed to educate a broad segment of the public; it does not give personalized tax, investment, legal, or other business and professional advice.

The Internal Revenue Code is lengthy and complex, which can sometimes mean that your personal income tax return includes some errors and omissions. The IRS allows you to voluntarily correct the mistakes you later discover by filing an amended tax return. However, you have to adhere to all eligibility criteria before filing the amendment.

You can file an extension, but keep in mind that doesn’t extend the time to pay, Kazenoff says. You’ll need to estimate what you owe and send it into the IRS before your filing deadline. And it’s important that your estimate be as accurate as possible, she adds. This year, the IRS says you need to pay 80 percent of what you owe for the 2018 tax year to avoid a penalty. You should plan to pay the taxes on that unreported income before the April 15 due date. If you don’t, you’re going to owe interest on the outstanding balance. “Taxpayers can’t file amended returns electronically and should mail the Form 1040X to the address listed in the instructions,” Kazenoff says.

It’s free to start, and enjoy $15 off TurboTax Premier when you file. Third, you can amend this year’s return only with this year’s version of TurboTax. If you want to amend your return from a prior year, use that year’s version of TurboTax. Second, print a copy of your original return and have it right by your side when you start to amend in TurboTax.

You can file more than one amendment but if you file two or more amendments at the same time, you should use a different Form 1040-X for each Tax Year. Make sure that you enter the correct Tax Year at the top of each 1040-X form. Sign each amended return and mail each one in a separate envelope to the IRS. If you have more questions about tax amendments, please contact eFile.com. If you owe taxes as a result of your amendment, you should file your amendment and make your tax payment as soon as possibleto avoid further penalties and interest. If you owe taxes, you should file an amended return even if 3 years have passed. Refunds are forfeit after 3 years, but tax debts stay on the IRS books for a minimum of 10 years.

Remember That The Irs Will Catch Many Errors Itself

As of 2021, the deadline for 2017 tax year tax returns that result in an increased tax refund based on a tax amendment will be April 15, 2021. All prior tax years or back taxes can no longer claim tax refunds via a tax amendment. The form also provides you with space to explain your reasons for filing the amendment. You have a limited amount of time to file an amended tax return; otherwise, the IRS will not accept it for a refund of tax.

For example, if you file the amended tax return to increase your refund by adding the charitable contribution deduction you omitted, it may also reduce your state tax if it also allows for charitable deductions. If your original return reports the correct information but includes math errors, there is often no need to file an amendment.

Step 2: Get The Right Forms Together

If the correction results in an increase in the amount of tax you owe, it’s to your advantage to file the amendment to avoid potential interest and penalties on the underpayment. The IRS allows you to correct mistakes on a tax return you’ve already filed by filing an amended tax return. This is because the IRS treats all tax returns you file on or before the deadline as filed on April 15th. However, when you file a tax return after the April deadline, you start counting the three years on the actual filing date.

If you’re missing a document, again, the IRS can handle this and typically alerts you by mail. If it has been over 16 weeks and you still have not received your amended refund check, you can find more information about your refund by calling the IRS amended return hotline at . Tax Amendments for State Tax Returns can be completed from the respective State Page. You should amend your return if you reported certain items incorrectly on the original return, such as filing status, dependents, total income, deductions or credits.