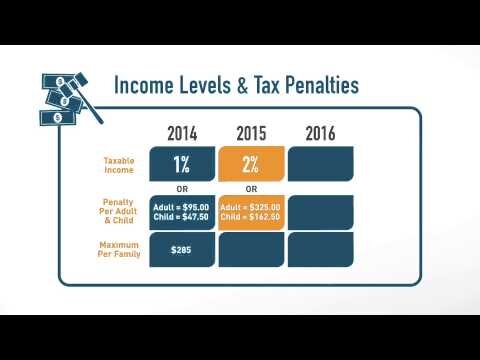

When you file your taxes for 2017, you’ll be assessed a penalty if you didn’t have health insurance for the year. For this tax year, the fee is $695 per adult in your family or 2.5 percent of your household’s taxable income, whichever is greater. The fee increases with inflation each year, so you’ll likely pay more in 2018. Children younger than 18 also get assessed a fee worth half of the adult rate. To avoid this fee, you must prove that you qualify for an exemption as described in the following sections. Your income is substantially low, and you are not required to file a federal tax return.

It is important to note that exemption for members of a health care sharing ministry is determined monthly. You are a member of a federally recognized tribe, or you qualify for health services through an Indian Health Services provider. All federally recognized Native American tribes qualify for an exemption under this regulation. If you are unsure if your tribe is federally recognized, you may visit the National Conference of State Legislatures and search for tribes within your state. It is also important to note that if you decide to pay the fee, you are still without health insurance coverage, and you are solely responsible for any expenses that you may accrue if you become sick or hospitalized. The last of these conditions is particularly vague, but you must submit an explanation to the marketplace in order to receive approval.

A written request can also be made by mailing the document to the marketplace appeals division, a full address for which is available on the marketplace website. You have medical expenses that you have accrued within the last 24 months, and you are unable to pay them. You participate in a recognized religious sect that is against insurance, Medicare and Social Security.

Penalty For Not Having Insurance

“You qualify for the exemption for any month you had any of these statuses for at least 1 day, or for the full year if you had the status all year.” “If you had 2 or more gaps in coverage during the year you can claim this exemption only for the months of your first coverage gap. This is true even if both gaps are less than 3 months.” enrolled in Medicaid coverage provided to a medically needy individual and were without coverage for other months because the spend-down had not been met.”

Catastrophic coverage can be purchased through the marketplace, and premiums for these plans are typically much lower than standard premiums. However, the deductible is usually much higher to compensate, ranging anywhere from $1,000 to $7,000. Plus, you’ll have more out-of-pocket costs if you use a catastrophic plan as regular insurance. The lowest priced health insurance plan offered to you would exceed 8.16 percent of your household income.

Will You Have To Pay Obamacare Taxes This Year?

Under the ACA, lawfully present immigrants can buy health insurance on federal or state marketplaces, but those who aren’t living in the U.S. legally are ineligible for coverage. The “non-citizen” clause relates to U.S. citizens who are still considered legal citizens but who are living in other countries. You can read more about these more complex restrictions on the HealthCare.gov website.

- a combination of qualifying health care coverage and coverage exemptions for every month of 2018.

- The premium from the lowest-priced bronze plan purchased through a health insurance exchange in someone’s home state was more than 8.3% of the purchaser’s household annual income.

- Every employer that has 50 or more full-time employees who are eligible for insurance coverage should provide their employees with Form 1095-C which is a statement of the Employer Provided Health Insurance Offer and Coverage.

- First, you should know that the individual mandate has been set up to make sure that the new health care system works efficiently.

- You will need an Exemption Certificate Number to claim the exemption.

Some taxpayers were also granted a tax exemption for religious beliefs, not being a U.S. citizen, being incarcerated, or belonging to an American Indian tribe. For Tax Preparers includes resources and training for volunteer tax preparers, which are designed to help them with the Affordable Care Act-related components of a tax return. have been serving the greater Evansville area for nearly thirty years. We can help you understand the Affordable Care Act and how it impacts your taxes. If you have questions about which forms you may need to prove your financial situation, click here to download a list.

Exemptions

Some of the most important changes stemming from the Affordable Care Act , also known as Obamacare, center around taxes. To understand how taxes are affected in 2021 by this law, which changed the health care insurance landscape in the United States, it’s important to review the history of taxes under the ACA. “If anyone else on your tax return qualifies, you can claim this exemption for them too when you file your taxes.” A shared policy is not a policy that simply covers more than one individual when all of the people covered on the policy are also on the tax return as a taxpayer, spouse or dependent.

The taxpayer’s health insurance premiums for one or more of those same months are paid by the due date of your return, either through advance credit payments, payment by the taxpayer, or payment by someone else. The taxpayer may owe a Responsibility Payment for any month that the taxpayer, spouse or any dependent on the return does not have coverage or an exemption. The intended purpose of the ACA, , was to expand health care coverage by imposing a mandate on individuals to maintain minimum essential health coverage and create a federal subsidy for the health care premiums for certain individuals that qualify. There may be some exemptions in California, including households with an income level that falls under the threshold for state tax filing. States are likely implementing these penalties to encourage residents to carry health coverage.

Form 1095-C identifies, the employee’s name and the employer; which months during the year the employee was eligible for coverage; and the cost of the least expensive monthly premium the employee could have paid under the plan. This information can be used to verify coverage and when the employee declines to participate in employer provided coverage determine if the unaffordable exemption may be available to the employee/taxpayer. See Form 1095-C – Employer Provided Health Insurance Offer and Coverage. If you are an employee with employer-sponsored health insurance coverage, you will receive a statement from your employer that indicates you were covered for part of the year or for the entire year. If the Marketplace hasn’t processed your exemption application before you file your tax return, complete Part I of Form 8965 and enter “pending” in Column C for each person listed. If you can claim the coverage exemption on your tax return, you do not need to apply for a Marketplace-granted exemption. If your income is 400% or less of the federal poverty level, you may qualify for a tax credit, which varies by state.

The Marketplace determines eligibility for advance credit payments when the taxpayer enrolls or enrolls a family member in Marketplace health insurance. The Marketplace estimates the amount of premium tax credit a taxpayer will qualify for using the taxpayer’s estimated household income and family size. The estimated premium tax credit is the maximum amount of advance credit payments for which the taxpayer is eligible. The taxpayer then chooses to have all, some, or none of the advance credit payments paid to the insurance provider. If an individual doesn’t have qualifying health insurance coverage in 2018, he or she still may not have to pay the Obamacare tax penalty. Many people qualify for an exemption and don’t owe a penalty if their income is below a certain level.

Tax credits or subsidies may be available through health benefit exchanges to lower-income families. As a California resident, you should carry insurance throughout the year with no gaps in coverage of 90 days or more.

The intention behind the tax was to discourage unnecessary or unreasonable use of medical services by individuals with generous health insurance coverage. It was, unsurprisingly, not popular with major employers, patient advocates, labor unions, or health care companies, many of whom banded together to create the Alliance to Fight the 40. Under the Affordable Care Act , most individuals are required to pay a penalty if they do not have health coverage that meets ObamaCare’s guidelines. However, some individuals may qualify for an exemption, whether it is related to income, group coverage, financial hardship, etc. A large difference between the estimated and actual household income can result in a significant repayment of the advance credit payments. There are three basic types of exemptions that an individual can claim to avoid the coverage requirements and the Shared Responsibility Payment. The reason for this is that the Trump administration made it easy for individuals to tick something off in the tax filing process that said they had insurance the previous year.

Though in 2019 the Trump administration rescinded the tax penalty established by the Affordable Care Act, you may still need to pay a tax penalty in 2021 if you live in California and do not have health insurance. If an individual does not have adequate medical insurance for 2018, they can minimize or avoid the penalty by acquiring insurance as soon as possible.

Looking For More Information?

By law, the IRS cannot prosecute you, put a lien on your property or assets, or pursue criminal sanctions against you for failing to pay the individual responsibility tax like it can if you don’t pay your regular taxes. However, the IRS does have the authority to deduct the penalty fee from your refund and levy additional interest for as long as you refuse to pay the fine. In other words, a $695 tax could increase to thousands over the course of several years.

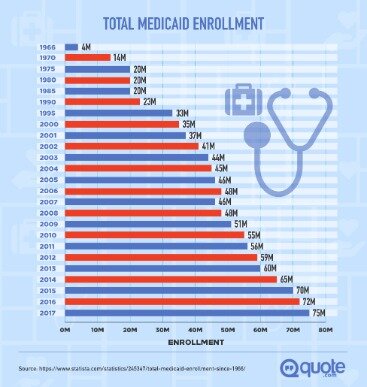

If your income is between 100% and 400% of the federal poverty level, you qualify for premium tax credits that lower your monthly premium for a Marketplace health insurance plan. If your income was 138% or less of the poverty level, you didn’t have to pay the tax, and in most states, you would also be eligible for Medicaid. As part of the Affordable Care Act, which is commonly referred to as Obamacare, an individual mandate went into effect requiring most eligible citizens to obtain a qualifying private insurance policy or pay a fine. The fine is known as the Individual Shared Responsibility Payment or individual mandate.

Get accurate quotes in seconds without having to give your email or phone number. Use online tools to help you quickly find the plan that best suits your needs. And, enroll in minutes on your computer or mobile device using our quick and easy online process. Sign up to get the latest tax tips sent straight to your email for free. The flat rate is $695 per adult, or $347.50 per child under 18, for a maximum of $2,085 per household.

Each January you’ll still get an IRS Form 1095 from your pay center listing the coverage you had during the previous tax year. This process should be repeated for each person on the tax return who is claiming a Coverage Exemption.

It doesn’t matter if you’re low-income, high-income, or if you fall somewhere in between—2017’s Tax Cuts and Jobs Act dealt the penalty known as the “shared responsibility payment” a death blow. Once a decision has been rendered, you’ll be notified by mail of the results. If you are granted an exemption, you’ll be assigned an Exemption Certificate Number , which you will provide to the IRS when completing your annual taxes. Department of Health and Human Services has addressed this situation and has authorized the marketplaces to grant hardship exemptions to custodial parents if a child is not eligible for Medicaid or the Children’s Health Insurance Program . You are a member of a qualifying religious organization with objections to insurance, including Medicare and Social Security.