Content

And for more state tax news, check out all our state tax bloggings. Coronavirus vaccines are rolling out, albeit slowly, and some pandemic precautions are being lifted. That means some restaurants are opening for a limited number of diners.

And knowledge definitely is power, especially when it comes to tax savings. Find this valuable information in the ol’ blog’s special Tax Forms Fiesta! As for servers who are still on the job, remember that your tips are taxable income. If you at least $20 in job-related gratuities in January, you need to account for them today by using Form 4070 to report your tips today to your employer.

- The content on Don’t Mess With Taxes is my personal opinion based on my study and understanding of tax laws, policies and regulations.

- Intuit does not warrant or guarantee the accuracy, reliability, and completeness of the content on this blog.

- Then my book, “The Truth About Paying Fewer Taxes,” is for all y’all.

- You can use one of this year’s nine participating tax software options if your adjusted gross income is $72,000 or less, regardless of filing status.

- Rachel Richards rejoined the League in December 2020 as the Fiscal Policy Director working on state budget and tax policies.

With our Happy Tax guarantee, you’ll enjoy 100% Free Audit Assistance, Built-In Security, Accuracy Guarantee, Year-Round Support, and Free Anytime Tax Return Access. Protesters tell the President, “We care.” Thousands took to the streets in dozens of cities in a “Tax Day March” on Saturday.

Turbotax Editors Picks

Politically costly, yes, in part thanks to the deceptive press coverage, but economically helpful. In 2018, Democrats went to bat for these oppressed wealthy folks with high property taxes and highly leveraged mansions in Bucks County, Pa., and Orange County. Sure enough, Democrats picked up a few dozen seats in high-income, high-home value, high-tax places. No fewer than four out of every five taxpayers saw a reduction thanks to the law. The median cut was more than $1,000, and in many states it was $1,400.

Simon holds a Bachelor of Arts in Public Health Studies and Cognitive Science, as well as a Master of Science in Public Health in Health Policy with a certificate in Community-Based Public Health from Johns Hopkins University. He is actively engaged in Lansing’s progressive political movement. In 2019 he ran for city council to represent his district in the city and has worked on a number of political campaigns in the past.

If April 15 falls on a Friday then Emancipation Day is celebrated on the same day and tax returns are instead due the following Monday, April 18. When April 15 falls on a Saturday or Sunday then Emancipation Day is celebrated on the following Monday and tax returns are instead due on Tuesday. Federal income tax was introduced with the Revenue Act of 1861 to help fund the Civil War, and subsequently repealed, re-adopted, and held unconstitutional.

Latest Tax And Finance News And Tips

Then my book, “The Truth About Paying Fewer Taxes,” is for all y’all. State Tax Departments provides links to your state’s Web page. The companion page, Tax Tidbits, is the compilation of blurbs about each state’s tax laws.

Pat has more than 30 years of experience in monitoring and analyzing state budgets and policies affecting low income families and children, including the founding and management of Michigan’s Children’s Budget Watch project. Pat received her law degree in 1986 from the Thomas M. Cooley Law School and her master’s in social work from the University of Michigan in 1978.

They called on President Trump to make his tax returns public. The President has said he won’t release his 1040s because they are under audit and, besides, taxpayers “don’t care.” The IRS says any taxpayer may share his return even if it is being audited. Yona Isaacs (she/hers) is an Early Childhood Data Analyst for the Kids Count project. This work prompted an interest in exploring social determinants of health and the role of policy in promoting equitable opportunities for all children, families, and communities.

Happy Tax Day Eve!

Julie also has an extensive volunteer history of strategic planning and building community partnerships related to local environmental stewardship efforts. She holds a Bachelor of Arts in social relations from Michigan State University’s James Madison College and a Master of Arts in public policy, also from MSU. Simon Marshall-Shah joined the Michigan League for Public Policy as a State Policy Fellow in August 2019. His work focuses on state policy as it relates to the budget, immigration, health care and other League policy priorities.

e believe that your cost to file your taxes should be transparent from the first step. No more hidden fees, no upsell just a simple flat rate to get you the maximum legal refund and a professionally prepared tax return. Our high performing assembly line model gives you the expert CPA prepared return you deserve, at a fraction of the industry standard cost.

At least two local holidays in the United States sometimes coincide with Tax Day. commemorating the emancipation in April 1862 of African slaves.

Other eateries are continuing with curbside pickup meals and deliveries. Whether you’re able to enjoy table service or still relying on food brought to your house, remember to tip your server or delivery person. Remember that you have to file a 1040 before the IRS will send you your stimulus package rebate. Recognized by Entrepreneur Magazine, Forbes, Accounting Today and other leading publications, Happy Tax is quickly becoming a household name. The Daily Deduction will return to its regular schedule on April 24.

Get Your Maximum Tax Refund With Turbotax Today

Parker James joined the Michigan League for Public Policy in August 2018 as the Kids Count Policy Analyst. He is responsible for the collection and management of data related to the Kids Count project. Renell Weathers, Michigan League for Public Policy Community Engagement Director. As community engagement director, Renell works with organizations throughout the state in connecting the impact of budget and tax policies to their communities. She is motivated by the belief that all children and adults deserve the opportunity to achieve their dreams regardless of race, ethnicity, religion or economic class. released a report that details some of the options we have to overhaul our tax system so that corporations and the wealthy contribute to the state’s coffers. Implementing these laws would ensure that we have enough funding to have a top-notch education system, stable infrastructure and healthy communities.

She is committed to partnering with stakeholders to amplify constituent voices so that all Michiganders have the opportunity to thrive. Brandon is formally trained as a tax economist and has worked in the economics field for over three years. After graduating from Syracuse University, Brandon worked as an economic analyst for the Bureau of Labor Market Information and Strategic Initiatives at the State of Michigan. There, he analyzed and reported state labor market information and interfaced with strategic partners to disseminate economic outlooks and forecasts. He also led a team that conducted a robust program evaluation of Michigan’s workforce training programs. Prior to joining the League, Kelsey managed and delivered direct service programming in the education, health and technology sectors in West Michigan, Washington, D.C. Her diverse experiences inform her systems level thinking and equity lens.

Comments that include profanity or abusive language will not be posted. The views expressed on this blog are those of the bloggers, and not necessarily those of Intuit. Third-party blogger may have received compensation for their time and services. Click here to read full disclosure on third-party bloggers. This blog does not provide legal, financial, accounting or tax advice.

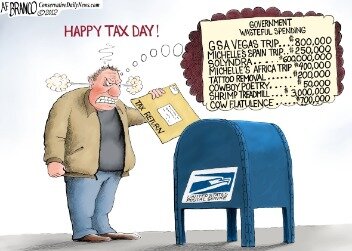

So the tax hike bemoaned by multimillionaire Feinstein would be targeted at five bedrooms or more in the wealthiest enclaves of America. But this Tax Day, we can celebrate the fact that an overwhelming majority of people are being taxed less, thanks to the Tax Cuts and Jobs Act, which Republicans passed in late 2017.