Content

The IRS is unable to change any user’s payment details, including bank account or mailing information. “While the IRS is exploring options to correct their issue, they have stated that this may cause a delay in stimulus payments for some. When you sign-up and connect your bank accounts, it analyzes your spending patterns and then automatically moves small amounts of money (typically $5-$20) into an FDIC-insured savings account.

See if you qualify for a stimulus check and how much you can expect. For the latest on the tax implications of the coronavirus pandemic, check out our COVID Tax Hub. If you have your card, you can use it anywhere Visa debit is accepted in the U.S. You can also withdraw your stimulus money at more than 19,000 fee-free ATMs across all 50 states. information and they are working to send your payment within days.

Turbotax, Irs Services And More: Try These Tax Tools To Ease The Pain Of Filing Taxes

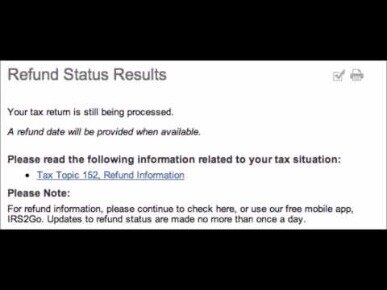

The IRS says that the financial institutions that received the funds will return them to the IRS, and then the IRS will reissue payments to the right accounts. The average tax return for the 2019 tax year was nearly $3,000, according to IRS data. Three out of 4 Americans get a tax refund each year, and it’s the largest single check they receive all year. Only the IRS knows the status of processing your tax return, whether you owe taxes or are due a refund. In prior years, the IRS issued more than 9 out of 10 refunds to taxpayers in less than 21 days last year. Here’s what happens when you press that green button and transmit your tax return.

- All GoBank cardholders are urged to consult their own tax advisors and/or return preparers.

- We are a global financial platform company with products including TurboTax, QuickBooks, Mint and Turbo, designed to empower consumers, self-employed and small businesses to improve their financial lives.

- But many customers told CNBC Make It that they have still not received their payments in the correct account as of Tuesday afternoon.

- tool, both H&R Block and TurboTax customers had their direct deposits sent to temporary pass-through bank accounts, which were mistakenly designated as customers’ primary direct deposit accounts.

- Many are likely to be lower income and among those who could use the stimulus relief the most.

- The views expressed on this blog are those of the bloggers, and not necessarily those of Intuit.

The problem is direct deposited payments bouncing from temporary or alternative bank accounts used to receive the first round of stimulus payments which the companies have now closed. These include Refund Transfer services used with tax prep software and reloadable pre-paid debit cards. Your 2020 stimulus check would automatically have been issued the same way if you received a refund through direct deposit for either your 2018 or 2019 tax returns, assuming you were eligible for the payment.

You may be able to receive the interest free of federal income tax if you pay higher education expenses for yourself, your spouse, or your dependents and satisfy other eligibility requirements. We are a global financial platform company with products including TurboTax, QuickBooks, Mint and Turbo, designed to empower consumers, self-employed and small businesses to improve their financial lives. Our platform and products help customers get more money with the least amount of work, while giving them complete confidence in their actions and decisions. Our innovative ecosystem of financial management solutions serves approximately 50 million customers worldwide.

Your Stimulus Check Might Be Delayed If You Filed Your Taxes With An Online Tax Preparer

There are as many as 10 million Americans who are not required to file a tax return. Because the IRS will use the federal tax return to determine eligibility and send individual stimulus payments, these individuals are at risk of not receiving their stimulus payment. For those tax filers, who have not yet filed a 2019 tax return, TurboTax recommends that they file their 2019 tax return now to get their tax refund and stimulus check quickly. This will ensure that the IRS has the most current tax filing and direct deposit information, which they will use to determine individual stimulus check amounts. The issue can also affect other filers who used alternative temporary bank accounts to receive their first stimulus payments, such as reloadable pre-paid debit cards by Green Dot or RushCard and those accounts are now inactive or closed. A similar issue cropped up with the first round of stimulus payments in April.

tool will not give you a date until your tax return is received, processed, and your tax refund is approved by the IRS. You will need your Social security number or ITIN, your filing status, and your exact refund amount. The IRS began accepting e-filed tax returns on February 12th, 2021. Eligibility for stimulus payments is determined by the IRS based on your adjusted gross income . If you have an adjusted gross income of up to $75,000 ($150,000 married filing jointly), you should be eligible for the full amount of the recovery rebate.

But many customers told CNBC Make It that they have still not received their payments in the correct account as of Tuesday afternoon. “We know how important these funds are for so many Americans and that everyone is anxious to get their money,” Ashley McMahon, a TurboTax spokesperson, tells CNBC Make It. “We are partnering with the IRS to help taxpayers receive their payments as quickly as possible.” tool, both H&R Block and TurboTax customers had their direct deposits sent to temporary pass-through bank accounts, which were mistakenly designated as customers’ primary direct deposit accounts.

Below this line are additional lines that allow you to purchase up to two bonds, which can be in anyone’s name.

If Your Tax Preparer Alters Your Bank Info

Taxpayers in this position might want to consult with an attorney as well to review their options. Contact the bank at which your refund was deposited if the routing number you indicated on your return was incorrect. You can identify the bank by looking up the routing number you inadvertently entered on the IRS website. You can elect direct deposit whether you file electronically or send in a paper return, however. The IRS began sending out a second round of economic impact payments — worth up to $600 for individuals and each of their child dependents — over the past week.

Tax refunds should be directly deposited only into a taxpayer’s bank account. The Treasury Department began processing a second round of emergency payments on Dec. 29 as part of a new congressional COVID-19 aid package. As with the first round distributed in April, millions of payments were to be directly deposited by Jan. 4 in customer accounts the IRS had on file. Some taxpayers might still have to file their 2020 returns to claim their payments, according to the IRS. “IRS tax industry partners are taking steps to redirect stimulus payments to the correct taxpayer account for as many people as possible,” said an IRS statement issued Friday. The maker of TurboTax indicated that the money was being sent to users of its software whose payments were initially misdirected to temporary accounts used by the company.

the IRS cannot issue refunds that include Earned Income Tax Credit and Additional Child Tax Credit before mid-February. The PATH Act, which applies to all tax preparation methods, is intended to help detect and prevent tax fraud.

on Form 1040 or Form 1040-SR of their taxes, which obviously takes much longer to process than a direct deposit. For those receiving their second stimulus payment by mail , “the IRS urges people to carefully watch their mail for either of these during January.” Customers are advised to check the Get My Payment tool on the IRS website to verify where their stimulus check was deposited or mailed. TurboTax’s freecoronavirus tax centercovers frequently asked questions around stimulus checks, unemployment, home offices and more. New this year, tax-prep giant TurboTax is using AI and data science to match people with their own dedicated tax expert based on their unique situation.

Please visit us for the latest news and in-depth information about Intuit and its brands and find us on social. Social Security recipients do not need to take any action to get their stimulus payment, it will be automatically calculated and deposited by the IRS.

Millions were slated to be automatically deposited by Jan. 4, 2021. Several TurboTax users have reported issues with receiving their second stimulus checks, which were recently issued by the Internal Revenue Service amid the ongoing COVID-19 pandemic. Both the IRS and Intuit advise that customers should check the Get My Payment tool on the IRS website to verify where their stimulus check was deposited or mailed. “The IRS reassures taxpayers who do not recognize the bank account number displayed in the Get My Payment tool that deposits were not made to the wrong account; this is not an indicator of fraud. I didn’t realize I was issued a second stimulus check – or that it’s gone missing – until I accidentally stumbled across the IRS Get My Payment page. When you tap that big “Get My Payment” button and fill in a few details, you’ll see the lowdown on when your check will be mailed, if it has been mailed or if you’ll get a direct deposit.

Get Your Maximum Tax Refund With Turbotax Today

Lisa also has been a TurboTax product user for many years and understands how the software program works. In addition to extensive tax experience, Lisa also has a very well-rounded professional background.

Two banking industry sources confirmed the error, which will delay distribution of the badly needed aid. The MasterCard Card is issued by Green Dot Bank pursuant to a license from MasterCard International Incorporated. The Visa Card is issued by Green Dot Bank pursuant to a license from Visa U.S.A Inc. Green Dot Corporation is a member service provider for Green Dot Bank, Member FDIC. MasterCard and the MasterCard Brand Mark are registered trademarks of MasterCard International Incorporated. Visa is a registered trademark of Visa International Service Association. GoBank is a registered trademark of Green Dot Corporation NMLS ID .

Form 8888 should be used for the direct deposit of your refund into two or more accounts, including the purchase of U.S. savings bonds. With the convenience and security of direct deposit available at most financial institutions, more taxpayers are requesting payment of their tax refunds by direct deposit rather than paper checks. Because she paid for her tax prep out of the tax refund, the stimulus payment went to the closed account and has now bounced. “These payments may begin to arrive in some accounts by direct deposit as early as tonight and will continue into next week,” Treasury Secretary Steven Mnuchin tweeted on Dec. 29. The National Taxpayer Advocate has indicated that some less-than-reputable tax preparers have been known to alter direct deposit bank information to divert funds to their own accounts.