Content

The student will be required to return all course materials, which may be non-refundable. Discount is off course materials in states where applicable. Discount must be used on initial purchase only. Not valid on subsequent payments. CTEC# 1040-QE-2355 ©2020 HRB Tax Group, Inc. The Send A Friend coupon must be presented prior to the completion of initial tax office interview.

Mastercard is a registered trademark, and the circles design is a trademark of Mastercard International Incorporated. OBTP# B13696 ©2020 HRB Tax Group, Inc. H&R Block provides tax advice only through Peace of Mind® Extended Service Plan, Audit Assistance and Audit Representation. Consult your own attorney for legal advice.

- If taxes are owed, a delay in filing may result in penalty and interest charges that could increase your tax bill by 25 percent or more.

- Our program will ask you all the relevant questions, so you can file your extension with the IRS.

- Don’t live in the United States?

- Look in the list of forms in the left column, and use the Open Forms button/Search window at the top of that column to find Hawaii Form N-301.

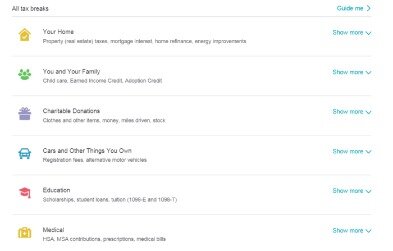

Financial institutions and investment companies typically send 1099s to their customers to report interest, dividends, capital gains and sale proceeds. These returns often need correction, especially if they are based on information from multiple investments. Not only will you extend the filing deadline until October 15, you’ll relieve the stress that often accompanies trying to pull everything together by tax time. More time and less stress means you’ll be able to thoroughly review your return and ensure you’re taking advantage of all the tax benefits available to you. If you request and are granted an extension, you typically have until October 15to file you tax return. If you underestimate the amount of tax you owe, you’ll likely have to pay interest on whatever amount you fail to pay by the filing deadline.

e-Fileor fileIRS Form 4868 by April 15, 2021 for Tax Year 2020 here on eFile.com for free. It is easy to prepare and e-file your Federal Tax Extension on eFile.com since we will generate Form 4868 for you.

To estimate the tax you must pay, you might want to use an estimated tax calculation. This is a friendly notice to tell you that you are now leaving the H&R Block website and will go to a website that is not controlled by or affiliated with H&R Block. This link is to make the transition more convenient for you. You should know that we do not endorse or guarantee any products or services you may view on other sites. For your protection, take a moment to carefully review their policies and procedures, as they may not be the same as those of H&R Block. Timing is based on an e-filed return with direct deposit to your Card Account.

If you do not file or e-File and/or pay your taxes on time, you may be subject to IRS penalties. State guidelines for filing extensions vary. In many cases, unless you owe state taxes, your federal automatic extension can be used to extend your state return as well. Refer to the tax form instructions or tax help for your state before you request a state extension.

Corporation or S corporation owners may work as employees, and this income is taxed on their personal returns. Enrollment in, or completion of, the H&R Block Income Tax Course is neither an offer nor a guarantee of employment. Additional qualifications may be required.

Here Are Your 3 Options For Filing A Tax Extension In 2021

So if you simply forget about the deadline, it’s irrelevant. This extension gives you extra time—until Oct. 15 — to file your federal tax return. If you decide to extend your tax filing to a later date, you’ll need to file the extension no later than April 15, 2021. The process for filing an extension application for business taxes involves filing a simple form online. The form you use depends on your business type.

You can file an extension on your taxes if you don’t think you’ll meet the due date, but there are details to know. Available only at participating H&R Block offices. H&R Block does not provide immigration services. An ITIN is an identification number issued by the U.S. government for tax reporting only.

Business tax on the personal return. Business owners who pay business taxes as part of their personal tax returns are called pass-through businesses. These businesses use Form 4868 to apply for an extension. Only available for returns not prepared by H&R Block. All tax situations are different and not everyone gets a refund. Fees apply if you have us file an amended return.

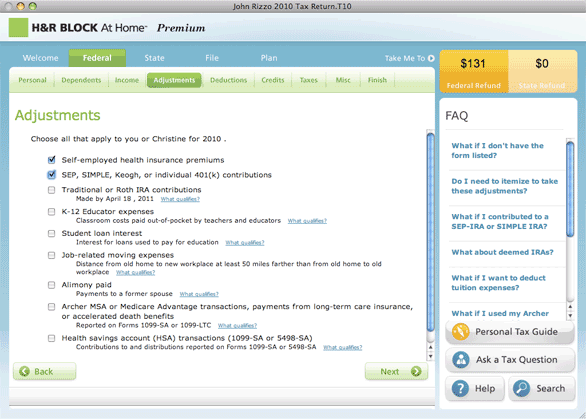

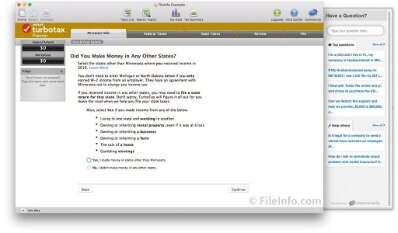

You can file a tax extension online in one of several ways with H&R Block. While you won’t be filling out the paper Form 4868 line-by-line, your tax extension information will be sent online to the IRS.

Students will need to contact SNHU to request matriculation of credit. Additional feed may apply from SNHU. estern Governors University is a registered trademark in the United States and/or other countries. H&R Block does not automatically register hours with WGU. Students will need to contact WGU to request matriculation of credit. Additional fees may apply from WGU. Vanilla Reload is provided by ITC Financial Licenses, Inc.

No Matter How You File, Block Has Your Back

Box 4 asks you to estimate how much you think you’ll owe the IRS when you complete your tax return. Box 5 cites how much you’ve paid so far.

“Our practice had a lot of ‘snowbird’ retired clients who traveled to the southern states for six months of the year,” says Cole. Since the clients were expecting refunds, they would file an extension and complete their tax returns when they headed back up north in the spring. You can’t file an accurate return if you don’t have all the information you need, or if what you have is incorrect. It’s not unusual for some information returns, such as a Schedule K-1 or Form 1099, to arrive too late to allow you to complete your tax return by the filing deadline. The IRS does impose deadlines for filing information returns, but extensions are frequently granted. These extensions can usually be for 30 days or six months, depending on the return. The Internal Revenue Service allows taxpayers to file for an extension if they need more time to prepare their tax return.

More Tax Extensions Articles

Valid for 2017 personal income tax return only. Return must be filed January 5 – February 28, 2018 at participating offices to qualify. Type of federal return filed is based on your personal tax situation and IRS rules.

Fees apply to Emerald Card bill pay service. See Online and Mobile Banking Agreement for details. The tax identity theft risk assessment will be provided in January 2019. The tax identity theft risk assessment is based on various data sources and actual risk may vary beyond factors included in analysis. One personal state program and unlimited business state program downloads are included with the purchase of this software. Additional personal state programs extra.

The automatic deadline to file 2020 Tax Returns is June 15 and you do not have to file any forms in advance to get this 2-month extension. However, you will need to file your return on paper and attach a statement explaining why you qualify for the extension. The standard tax extension allows you to file your tax return after the usual deadline. However, it doesn’t buy you more time to pay any taxes you may owe. That means that if you don’t pay your tax balance by the filing deadline , you’ll get hit with penalty and interest. Even if you apply for an extension for filing your business income tax forms, you can’t extend the payment deadline.

The IRS allows taxpayers to amend returns from the previous three tax years to claim additional refunds to which they are entitled. Applies to individual tax returns only. All tax situations are different. Fees apply if you have us file a corrected or amended return. H&R Block tax software and online prices are ultimately determined at the time of print or e-file. All prices are subject to change without notice.

The First Two Things To Know About Filing For A Tax Extension

ITC Financial Licenses, Inc. is licensed as a Money Transmitter by the New York State Department of Financial Services. These provisions limiting your liability do not apply to debit transactions not processed by MasterCard or to unregistered cards. he Rapid Reload logo is a trademark owned by Wal-Mart Stores. Rapid Reload not available in VT and WY. Check cashing fees may also apply. Check cashing not available in NJ, NY, RI, VT and WY. Availability of Refund Transfer funds varies by state.

Learn more about form CP523, why you received it, and how to handle an IRS CP523 notice with help from the tax experts at H&R Block. Have a local tax pro file your extension – Work with your current tax pro to file your extension virtually.

Despite the fact that taxes are essentially due on the same day every year, many people still find themselves scrambling on the day before to get their records together. Interest on unpaid tax compounds daily from the original due date of the return until the date you pay in full.

Is A Tax Extension Right For You?

The earlier you file your return, the earlier you’ll receive your refund. How long do you keep my filed tax information on file? How do I update or delete my online account? You can get an extension even without filing this form if you pay at least some of what you expect to owe. The requirements for filing a State Tax Extension vary from state to state. They mostly relate to Tax Extension filing deadlines, tax payment rules, or certain Tax Extension forms to fill out (or not, in some states’ cases). However, in general, most states follow the deadline to file a Federal Tax Return Extension.

If you’re unable to complete your federal tax return by the deadline, find out how to get an IRS extension on your taxes and extend your tax filing deadline until October. Satisfaction Guaranteed — or you don’t pay. You may use TurboTax Online without charge up to the point you decide to print or electronically file your tax return. Printing or electronically filing your return reflects your satisfaction with TurboTax Online, at which time you will be required to pay or register for the product. Filing for a tax extension could have an impact on your third stimulus check — and on any money you’re still owed from the first two payments.