Content

Sign up to get the latest tax tips sent straight to your email for free. Verification of Non-filing Letter. If you need proof that the IRS has no record of you filing for a given year , you can get this transcript.

I also do taxes for my family members and friends. I have tried out several online software programs for taxes but TaxAct is by far the best. Its very easy to use and thorough. We’ll find every tax deduction and credit you qualify for to get you the biggest tax refund, guaranteed. A returning TaxACT customer can sign into his account by going to the sign-in page from the company’s website and entering his User ID and password. If he forgets his User ID or password, he can click on the Forgot User ID or Password link for further help.

Conditions and exceptions apply – see your Cardholder Agreement for details about reporting lost or stolen cards and liability for unauthorized transactions. When you use an ATM, we charge a $3 withdrawal fee.

Fees apply for approved Money in Minutes transactions funded to your card or account. Unapproved checks will not be funded to your card or account.

If you’re not satisfied with your purchase and have not filed or printed your return, return it to Intuit within 60 days of purchase with your dated receipt for a full refund (excluding shipping & handling). Amazon.com is not a sponsor of this promotion. Except as required by law, Amazon.com Gift Cards (“GCs”) cannot be transferred for value or redeemed for cash.

You only need your Social Security number or Individual Tax Identification Number, date of birth, and the mailing address from your latest tax return. The IRS online account tool is generally available Monday 6 a.m. According to the IRS, iOS 11, macOS 10.12, and macOS 10.13 VoiceOver users may have issues accessing the site due to technical restrictions. Applies to online products only, download products are not available for Mac OS. Microsoft no longer provide security updates or support for PCs running Windows 7. For the best experience and security of your data, you will need to update your system to Windows 8.1 or 10.

Must be a resident of the U.S., in a participating U.S. office. Referring client will receive a $20 gift card for each valid new client referred, limit two. Gift card will be mailed approximately two weeks after referred client has had his or her taxes prepared in an H&R Block or Block Advisors office and paid for that tax preparation. Referred client must have taxes prepared by 4/10/2018. H&R Block employees, including Tax Professionals, are excluded from participating.

File On Your Own

Original supporting documentation for dependents must be included in the application. For tax years beginning after 2017, applicants claimed as dependents must also prove U.S. residency unless the applicant is a dependent of U.S. military personnel stationed overseas. A passport that doesn’t have a date of entry won’t be accepted as a stand-alone identification document for dependents. One state program can be downloaded at no additional cost from within the program. Additional state programs extra. Emerald Cash Rewards™ are credited on a monthly basis.

Any use of our Services or Content other than as specifically authorized herein, without our prior written permission, is strictly prohibited and will terminate the permissions granted in this Agreement. Cookies are small data files stored on your hard drive or in device memory that help us improve our Services and your experience, enhance security, see which areas and features of our Services are popular and count visits.

Extended Access To Your Return

Consult your attorney for legal advice. Power of Attorney required. Does not provide for reimbursement of any taxes, penalties or interest imposed by taxing authorities. Terms and conditions apply.

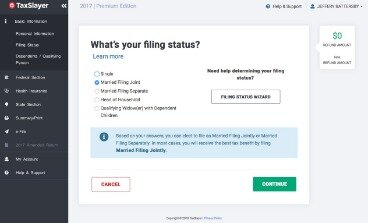

By creating a TaxAct account, you consent to receive electronic communications from TaxAct (e.g., via email or by posting notices on our Services). These communications may include notices about your account (e.g., payment authorizations, password changes and other transactional information) or legal notices and are part of your relationship with us. You agree that any notices, agreements, disclosures or other communications that we send to you electronically will satisfy any legal communication requirements, including, but not limited to, that such communications be in writing. TaxAct may offer you the ability to use certain informative tools, including, without limitation, for example, a tax estimator/calculator, interview questions related to life events, or a deduction maximizer.

We do not direct or oversee the policies, procedures, or other practices for companies other than TaxAct. We do not endorse the products and services that are offered by third party companies. Some of these third-party sites may collect information about you or request sensitive, personal information from you. If accessing a third party site via a link you will be subject to the policies and procedures that have been established by the third party. We encourage you to review their privacy policies to learn more about what information is collected, how it is used, and how it is stored. We use mobile analytics software to allow us to better understand the functionality of our mobile software on your phone. This software may record information such as how often you use the application, the events that occur within the application, aggregated usage, performance data, and where the application was downloaded from.

The IRS has all of the information they need, and you do not need to do anything extra. To see your transcript online, you need to register and provide the same information as you would to see your tax account online. Because the Internal Revenue Service doesn’t automatically send out periodic account statements, it’s easy to wonder about the status of your account. True, you’ll get letters from the IRS if you have overdue amounts from a past year, or if the IRS believes you have made a mistake on your return.

We cannot guarantee how long it will take to complete and file your return, so you are responsible for preparing your return early enough to ensure it can be filed before any applicable deadlines. Subject to your continued compliance with this Agreement, including payment of any applicable fees, you are hereby granted a limited, nonexclusive, nontransferable, non-sublicensable, revocable license to access and use the Services for your personal purposes. You may only use the TaxAct tax preparation software to prepare one valid and complete tax return per applicable service fee paid and, after proper registration and any applicable payment, to file electronically and/or print such tax return. Type of federal return filed is based on taxpayer’s personal situation and IRS rules/regulations.

If you don’t hear from the IRS about a given year, you probably assume that means all is well. Here’s how to access your account status with the IRS. Steer clear of problems. TaxAct Alerts meticulously inspects your return for any errors, omissions, and valuable tax-saving opportunities you may have missed. With TaxAct Bookmarks, simply mark a spot in your Q&A to quickly return to that question at any time. Get the definitions for nearly 300 tax terms, linked directly from the TaxAct interview process right when you need them. TaxAct inspects your return for errors and omissions that could increase your risk of an audit, and finds valuable tax-saving opportunities you may have missed.

Keyword Research: People Who Searched Taxactonline Login Also Searched

The first option is to create a new return using the TaxACT deluxe or ultimate bundle. Users can click on the link to indicate that they did use Tax ACT last year. From there, users are prompted for their prior year’s user names and passwords, which are reused for the new return. Browse through our most popular tax help topics provided by TaxAct. Our support team is also available to help answer any questions you may have. Are you curious about your account status with the Internal Revenue Service?

Fees apply if you have us file a corrected or amended return. Offer valid for tax preparation fees for new clients only. A new client is an individual who did not use H&R Block office services to prepare his or her 2016 tax return. Valid receipt for 2016 tax preparation fees from a tax preparer other than H&R Block must be presented prior to completion of initial tax office interview.

All prices are subject to change without notice. File taxes electronically (e-file) and receive email confirmation from the IRS once your online tax return has been accepted. Then, easily track your tax return to see when your refund will hit your bank account. Download TaxAct Online Free Edition for Windows to prepare, print, e-file your simple or complex tax returns online. A “registered user” is a user from whom TaxAct has received the information necessary to permit such person to print or electronically file a tax return prepared using the Services and who complies with the terms and conditions of this agreement.

- Our tax pros are here to help you with what you need.

- Share consumer personal information with outside third parties to be used for their marketing purposes.

- You agree that you are responsible for submitting accurate and complete information while preparing your tax return and for reviewing your tax return for indications of obvious errors prior to electronically filing or printing your return.

- This transcript shows most line items on your tax return and generally meets the needs of lending institutions who request your tax information.

- By using the Services to prepare and submit your tax return, you consent to the disclosure to the IRS and any other tax authority, revenue authority, or other governmental authority with jurisdiction of all information pertaining to your use of the Services.

- The Rapid Reload logo is a trademark owned by Wal-Mart Stores.

Ingo Money reserves the right to recover losses resulting from illegal or fraudulent use of the Ingo Money Service. Your wireless carrier may charge a fee for data usage. Additional transaction fees, costs, terms and conditions may be associated with the funding and use of your card or account. See your Cardholder or Account Agreement for details. H&R Block does not provide audit, attest or public accounting services and therefore is not registered with the board of accountancy of the State in which the tax professional prepares returns. Available only at participating H&R Block offices. CAA service not available at all locations.

We log information about your use of the Services, including the type of browser you use, access times, pages viewed, your IP address and the page you visited before navigating to our Services. We also collect information about the computer or mobile device you use to access our Services, including the hardware model, operating system version, and mobile network information.

Satisfaction Guaranteed — or you don’t pay. You may use TurboTax Online without charge up to the point you decide to print or electronically file your tax return. Printing or electronically filing your return reflects your satisfaction with TurboTax Online, at which time you will be required to pay or register for the product. If the user has already created a new return with a different user name and password, he can import the prior year’s data by clicking Basic Information, then click Import. The user is then asked to provide the prior year’s user name and password as well as the Social Security number of the primary taxpayer.

We refer to this information as “Tax Return Information.” We may change this Privacy Policy from time to time.

If the customer no longer has access to the email address associated with his account, he can contact TaxACT customer service with his full name and ZIP code, as well as both the old and new email addresses. In addition, TaxAct reserves the right, at any time, to change the terms of this Agreement. If TaxAct makes changes to this Agreement, TaxAct will provide you with notice of such changes, such as by sending an email, posting a notice on the Services or updating the date at the top of this Agreement. Your continued use of the Services after any such changes will confirm your acceptance of the then-current version of this Agreement.