You must add the Earned Income Credit to your return. The Earned Income Credit is a perfect example. IRS spokesman Raphael Tulino says the EITC increases families’ refunds an average of $2,500. Tax season typically runs from early in the new year to April 15 of the year following the tax year in question.

H&R Block Audit Representation constitutes tax advice only. Consult your attorney for legal advice. Does not provide for reimbursement of any taxes, penalties or interest imposed by taxing authorities. Terms and conditions apply; seeAccurate Calculations Guaranteefor details. State tax rates may be different from federal tax rates, and some states don’t have an income tax at all. The states that don’t collect state income tax include Alaska, Florida, Nevada, New Hampshire, South Dakota, Tennessee, Texas, Washington, and Wyoming. However, New Hampshire and Tennessee do tax some types of dividends and interest income, so individuals in those states may still need to file a state return in those cases.

Tax Pro Or File Your Own?

Most people dread this time of year because of all the filing and paperwork involved with taxes. Thankfully, it doesn’t have to be that way!

Discount is off course materials in states where applicable. Discount must be used on initial purchase only. CTEC# 1040-QE-2355 ©2020 HRB Tax Group, Inc.

Applicants must be 18 years of age in the state in which they reside (19 in Nebraska and Alabama, 21 in Puerto Rico.) Identity verification is required. Both cardholders will have equal access to and ownership of all funds added to the card account. Vanilla Reload is provided by ITC Financial Licenses, Inc. ITC Financial Licenses, Inc. is licensed as a Money Transmitter by the New York State Department of Financial Services.

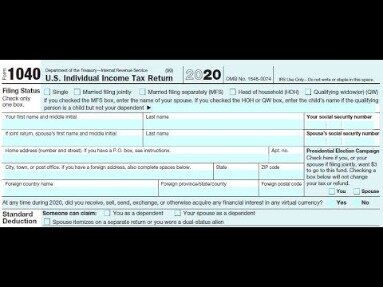

However you choose to prepare your taxes, take time to double check everything. Print the forms out or review the information on screen. Pay special attention to numbers, including income and expenses, as well as Social Security numbers and other ID numbers. Make sure you didn’t reverse numbers with a typo or make another error that could hold up your return. You don’t want to choosesingle as your filing status if you qualify for head of household or widower because you move into a higher tax bracket at a lower income level when you file as single. There are also certain deductions that you can’t claim if you earn too much — and the threshold at which you lose those deductions is lower for the single filing status.

Some free tax filing services let you add a state return too. The IRS will send your refund via mail or you can submit your bank information and request to have your refund distributed using direct deposit. When you submit your tax return, one of the most important steps is choosing the correct filing status. Your filing status determines your tax bracket and can affect the deductions and credits you can claim.

Millions of people have used our financial advice through 22 books published by Ramsey Press, as well as two syndicated radio shows and 10 podcasts, which have over 17 million weekly listeners. If you just take a little time and energy to implement these five steps throughout tax season, you’ll be set. Plus, you’ll eliminate the stress and worry if you’re organized on the front end. But which filing option shouldyouchoose? Let’s take a closer look atonline versus tax profiling options to help you determine which is best for you. There are times when picking your filing status is pretty straightforward—like if you’re single—and other times when you might qualify for more than one filing status and it’s not so clear.

When And How Can You Claim A Tax Refund?

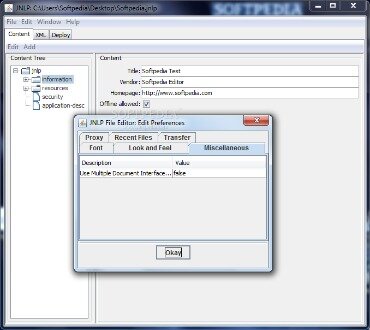

Here’s a video showing how to do that. Adjusted gross income equals your gross income minus certain adjustments. The IRS uses the AGI to determine how much income tax you owe. Form W-9 is an Internal Revenue Service form which is used to confirm a person’s taxpayer identification number . Form 1099-INT, which you would receive from a bank or other financial institution if you earned more than $10 in interest during the tax year. Form 1099-MISC, which you would receive if you earned more than $600 in other income, including rents, prizes, fishing boat proceeds, or crop insurance payments.

The federal tax filing deadline is typically on April 15. If that day falls on a mail holiday, it may be moved to the next business day. Tax returns must be e-filed or mailed by the federal tax deadline to avoid late-filing penalties. As of November 2020, the IRS had received more than 168 million tax returns for the 2019 tax year. More than 72 million—roughly 42%—were self-prepared tax returns.

Signing The Return

H&R Block does not provide audit, attest or public accounting services and therefore is not registered with the board of accountancy of the State in which the tax professional prepares returns. Prices based on hrblock.com, turbotax.com and intuit.taxaudit.com (as of 11/28/17). TurboTax® offers limited Audit Support services at no additional charge.

Charitable deductions.Donating to your alma mater or a favorite charity? Generally, you can deduct those donations if you itemize your taxes.

Referred client must have taxes prepared by 4/10/2018. H&R Block employees, including Tax Professionals, are excluded from participating. Taxes are due April 15, but if you need more time to file your federal taxes, you can apply for an extension. If you file an extension request, the IRS gives you until October 15 of that year to file. That does not change the due date for taxes owed, though. You are still required to estimate the taxes you will owe and pay those by April 15. If you think you will be unable to pay your taxes in full, you can request an installment agreement from the IRS.

If you opt out, though, you may still receive generic advertising. In addition, financial advisors/Client Managers may continue to use information collected online to provide product and service information in accordance with account agreements. Having your tax documents arrive in January or February gives you about two months to prepare your tax return by the usual due date of April 15. Plan the date when you’ll start your return, and make sure it’s early enough that you can plan another session or two in case you need to spend time locating more documents or getting help.

Valid for 2017 personal income tax return only. Return must be filed January 5 – February 28, 2018 at participating offices to qualify.

And once you’re ready to file – electronically or on paper – always remember to sign your return. Living in a community property state and you are married, but filing a separate return. There are, of course, lots of other new tax quirks to be aware of. Your best bet is to either check the IRS Tax Tips page or consult an accountant. Southern New Hampshire University is a registered trademark in the United State and/or other countries.

- Don’t neglect to save a copy of your return for your records—it will come in handy when you’re doing your taxes next year, and it will really come in handy if the IRS has questions or decides to audit you.

- Here’s everything first-time filers need to know, including when to file your tax return and how to track your refund.

- For tax years beginning after 2017, applicants claimed as dependents must also prove U.S. residency unless the applicant is a dependent of U.S. military personnel stationed overseas.

- The website does not include all financial services companies or all of their available product and service offerings.

- Nationwide does not guarantee any products or services offered by Axos Bank.

- When you submit your tax forms, it’s important that you claim all of the deductions and credits you’re entitled to.

The table below shows when you’re required to file for the 2020 tax year . Americans pay taxes throughout the year, with many workers having money directly withheld from their paychecks. The tax-filing process is how the government returns any overpayments made by taxpayers or charges those who didn’t pay enough. The overpayments can be substantial, as the IRS issued more than $452 billion in tax refunds in 2019. Satisfaction Guaranteed — or you don’t pay.

No matter which method of tax filing you choose, you will need to have certain information on hand when you file. Programs are subject to change without notice. Specific costs or fees for a banking product or service received from Axos Bank may apply and will be provided in a separate disclosure to you.

Nationwide’s relationship with Axos Bank gives Nationwide members access to Axos Bank’s banking products and services. Most deductions require receipts and other documentation, so check with your tax advisor to make sure you have the necessary paperwork. You can also use IRS Direct Pay to pull funds from a savings or checking account.

Here’s How To Choose Diy Tax Software According To Tax Expert Kathleen Delaney Thomas

These rates are determined by tax brackets. You can file manually by completing Form 1040 according to instructions provided by the IRS. Mail the form to the IRS, along with any payment you owe.