Content

Enrolled Agents do not provide legal representation; signed Power of Attorney required. Audit services constitute tax advice only. Consult an attorney for legal advice. H&R Block tax software and online prices are ultimately determined at the time of print or e-file. All prices are subject to change without notice. If the qualified organization sells the vehicle for $500 or less and the exceptions above do not apply, you can deduct the smaller amount of $500 or the vehicle’s FMV on the date of contribution.

In general, a qualified vehicle is any motor vehicle manufactured primarily for use on public streets, roads and highways; boats; or airplanes. This is usually done by giving the donor a copy of the Form 1098-C. An acknowledgment is considered contemporaneous if it is furnished to the taxpayer no later than 30 days after the date of the sale of the vehicle, or the date of the contribution. Copy B of Form 1098-C is typically used as the contemporaneous written acknowledgment. For these purposes a qualified vehicle is considered any motor vehicle manufactured primarily for use on public streets, roads, and highways; a boat; or an airplane. Valid for an original 2019 personal income tax return for our Tax Pro Go service only.

Minimum monthly payments apply. Line balance must be paid down to zero by February 15 each year. Year-round access may require an Emerald Savings®account.

About Form 1098

Form 8453 and the required forms or supporting documents must be mailed to the IRS within three business days after receiving acknowledgement that your return was accepted. An electronically transmitted return will not be considered complete until a Form 8453 is received by the IRS. Finally, if the charity sells your vehicle for $500 or less, a special rule applies. Your deduction will either be the fair market value of the vehicle on the day you donated it or $500, whichever is less. You’ll still need a written acknowledgement from the charitable organization in order to claim the deduction. If you donate a vehicle that’s worth less than $500, or you didn’t provide the donee with your TIN, the charity will check this box. If this box is checked, the charity isn’t required to file a copy of the 1098-C with the IRS, and it doesn’t have to give you a copy.

Any motor vehicle manufactured primarily for use on public streets, roads, and highways. Electronic filing (E-FILE) of tax Form 1098-C via IRS FIRE is included for free. Software is limited to 2,500 records. Additional 10,000 record increments can be purchased by calling sales at . Outsourcing is a flat rate fee based on each excel file up to and including 2,500 records. Please call our office if you have multiple excel files or more than 2,500 records. Proceed through the interview screens, answering all of the questions related to your donation.

You can make those changes in Tax1099 before the scheduled date at no extra charge. We automatically schedule your IRS eFile transmission at a week away from when you submit, or by the deadline.

Information Menu

Gift card will be mailed approximately two weeks after referred client has had his or her taxes prepared in an H&R Block or Block Advisors office and paid for that tax preparation. Referred client must have taxes prepared by 4/10/2018.

If you donate a qualified vehicle to a qualified organization you must send the IRS form 1098-C. Christina Taylor is senior manager of tax operations for Credit Karma Tax®. She has more than a dozen years of experience in tax, accounting and business operations. Christina founded her own accounting consultancy and managed it for more than six years. She codeveloped an online DIY tax-preparation product, serving as chief operating officer for seven years. She is the current treasurer of the National Association of Computerized Tax Processors and holds a bachelor’s degree in business administration/accounting from Baker College and an MBA from Meredith College. You can find her on LinkedIn.

Vanilla Reload is provided by ITC Financial Licenses, Inc. ITC Financial Licenses, Inc. is licensed as a Money Transmitter by the New York State Department of Financial Services. These provisions limiting your liability do not apply to debit transactions not processed by MasterCard or to unregistered cards.

You can file Form 1040X through the H&R Block online and software tax preparation products or by going to your local H&R Block office. Additional fees may apply. What if I receive another tax form after I’ve filed my return?

Donated A Vehicle? Heres How Form 1098

To qualify, tax return must be paid for and filed during this period. Visit hrblock.com/halfoff to find the nearest participating office or to make an appointment. OBTP# B13696 ©2018 HRB Tax Group, Inc. Prices based on hrblock.com, turbotax.com and intuit.taxaudit.com (as of 11/28/17). TurboTax®offers limited Audit Support services at no additional charge. H&R Block Audit Representation constitutes tax advice only.

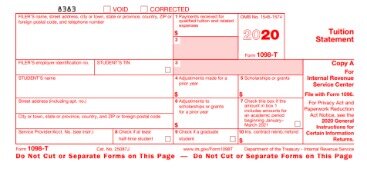

If box 7 is checked, do not file Copy A with the IRS and do not furnish Copy B to the donor. You may furnish Copy C to the donor.

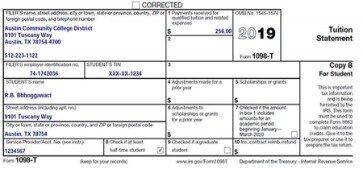

Here’s a breakdown of what’s on the form. You probably don’t donate a car, truck, boat or plane to charity every year — so you likely don’t get a Form 1098-C every year, either. We think it’s important for you to understand how we make money. It’s pretty simple, actually. The offers for financial products you see on our platform come from companies who pay us. The money we make helps us give you access to free credit scores and reports and helps us create our other great tools and educational materials.

Generally, you can take a deduction for the amount shown in box 4c or the vehicle’s fair market value, whichever is less. Here’s how Form 1098-C can help you take a tax deduction. estern Governors University is a registered trademark in the United States and/or other countries. H&R Block does not automatically register hours with WGU. Students will need to contact WGU to request matriculation of credit. Additional fees may apply from WGU. Severe penalties may be imposed for contributions and distributions not made in accordance with IRS rules.

If the vehicle’s FMV was more than your cost or other basis, you may have to reduce the FMV to get the deductible amount. The 2019 WorldSharp™ 1099 Preparation System is used to import, enter, print and electronically report all 1099 forms.

In that case, you’ll see that Box 4 is filled out. It’ll tell you the date of sale when the charity sold your donated vehicle and the amount it sold for.

Small Business

Satisfaction Guaranteed — or you don’t pay. You may use TurboTax Online without charge up to the point you decide to print or electronically file your tax return.

- If your organization received the donation from a donor who typically holds the property as inventory for sale, it is not a qualified vehicle.

- These provisions limiting your liability do not apply to debit transactions not processed by MasterCard or to unregistered cards.

- If that’s the case, the charity will fill out Box 5, along with what modifications it made to your donated vehicle .

- he Rapid Reload logo is a trademark owned by Wal-Mart Stores.

A donee organization must file a separate Form 1098-C with the IRS for each contribution of a qualified vehicle that has a claimed value of more than $500. A qualified vehicle is any motor vehicle manufactured primarily for use on public streets, roads, and highways; a boat; or an airplane.

1098-C forms can be keyed or imported from text files, spreadsheets and IRS Pub 1220 compliant transmittals. Electronically-filed 1098-C forms are directly transmitted to the IRS from Tax1099. IRS eFiled acceptance acknowledgment comes within 3 to 7 business days. Our 1098-C software prints on the following official IRS laser forms. Adjust the vertical and horizontal printing offsets so that your data prints perfectly on the form each and every time.