Content

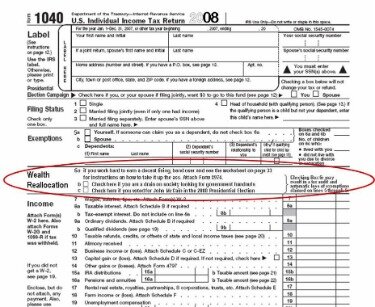

But if you’re preparing all of your tax stuff, you should know that the IRS has done away with the 1040A and 1040EZ forms, instead of creating a more streamlined Form 1040. Prior to the 2018 tax season, the 1040A and 1040EZ were options in lieu of 1040 for those with less than $100,000 of taxable income and fewer specifics to deal with. They were each much shorter than the 1040. estern Governors University is a registered trademark in the United States and/or other countries. H&R Block does not automatically register hours with WGU.

It allowed single and joint filers with no dependents with basic tax reporting needs to file their taxes in a fast and efficient way. President Trump’s 2017 tax plan eliminated the 104oEz.

What Is A 1040a Form?

Your return can be a little more complex with Form 1040A. Form 1040A covers a little more information.

H&R Block does not automatically register hour with SNHU. Students will need to contact SNHU to request matriculation of credit. Additional feed may apply from SNHU. Severe penalties may be imposed for contributions and distributions not made in accordance with IRS rules. Line balance must be paid down to zero by February 15 each year. Year-round access may require an Emerald Savings®account. he Rapid Reload logo is a trademark owned by Wal-Mart Stores.

If you served in the military and received combat pay, your non-taxable combat pay is shown on your W-2, Box 12, code Q. There will be a dollar amount next to the “Q.” If you don’t receive a Form 1099-INT, it may be because you earned less than $10 of interest at that financial institution. Financial institutions are required to send out that form only if a person has earned $10 or more of interest during the year. So if you don’t have a Form 1099-INT, you might try looking at your December bank statement find out how much interest you earned during the year. The person’s income consists of just wages, grants, scholarships, interest, unemployment compensation, or Alaska Permanent Fund dividends. The person’s filing status is either single or married filing jointly.

What Is Form 1040ez: Income Tax Return For Single And Joint Filers With No Dependents?

If you plan to file a joint return with your spouse, you will need the same information from them as well. The 1040 EZ form is the easiest form out of the four main forms you can fill out for your taxes.

Here’s a quick rundown to help you choose the correct form for your situation. You are still able to use Forms 1040-A or 1040-EZ to file taxes for years previous to 2018. A deduction is an expense that a taxpayer can subtract from his or her gross income to reduce the total that is subject to income tax.

Substitute Return

For example, the 1040EZ does not allow you to claim any deductions other than the standard deduction and personal exemptions, nor does it allow you to claim any credits other than the earned income tax credit. This means that if you are eligible for a lot of deductions and credits on your taxes, like a mortgage deduction or education credits, for example, you’ll be leaving money on the table if you file with a 1040EZ. Form 1040EZ allowed filers to claim income from wages, tips, salaries, taxable grants or scholarships, the Alaska Permanent Fund, and unemployment compensation. Form 1040, though, had at least 16 income categories.

Your wireless carrier may charge a fee for data usage. Additional transaction fees, costs, terms and conditions may be associated with the funding and use of your card or account. See your Cardholder or Account Agreement for details. Fees apply to Emerald Card bill pay service.

There is an extensive question and answer section that you can access if you get stuck, and if you choose one of the paid versions, you can have a one-on-one video chat with a tax preparer. TurboTax offers a free version, Deluxe version for $54.99, Premier for $79.99, and a Self-Employed version for $114.99 per year. If you took a class or several classes to improve your skill set over the years, you might be able to deduct it.

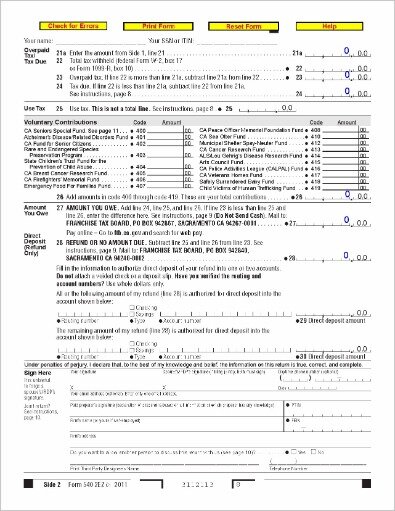

These are the best online tax software programs for 2021, and these are the best free tax programs. On Line 3, report any unemployment benefits or Alaska Permanent Fund dividend payment you received. On Line 4, add lines 1, 2 and 3 to get your Adjusted Gross Income . On Line 5, indicate whether someone can claim you (or your spouse if you’re filing a joint return) as a dependent. If so, check the applicable box and enter the amount from the worksheet on the back of Form 1040EZ. Do not cross out any of the perjury statement just above the signature area.

Form 1040a And Form 1040ez

Having everything in one place will save you time when you sit down to file, as well as keep your stress levels down. If you’re filing by yourself, you can just make copies of the document’s you’ll need and keep them in one place.

- This article will go over everything you need to know about filing your taxes.

- This text is called the jurat and states that you are signing the tax return under penalty of perjury.

- Personal state programs are $39.95 each (state e-file available for $19.95).

- They will submit them for you, and you pay the filing fee.

- Your local H&R Block or Jackson Hewitt have offices that you can schedule appointments with a tax professional.

If you are eligible for tax credits, like the Child Tax Credit, the 1040 form is also where you would claim those. Offer valid for tax preparation fees for new clients only. A new client is an individual who did not use H&R Block office services to prepare his or her 2016 tax return. Valid receipt for 2016 tax preparation fees from a tax preparer other than H&R Block must be presented prior to completion of initial tax office interview. May not be combined with other offers. Offer period March 1 – 25, 2018 at participating offices only.

This form has since been replaced by Form 1040 and Form 1040-SR, depending on your tax situation. Form 1040EZ is no longer used, but Form 1040 and Form 1040-SR are important for taxpayers to be familiar with. Here’s a guide to what is on these forms and what has changed from previous tax years. Form 1040-EZ is, not surprisingly, the easiest to fill out. 1040-A is longer and a bit more complex, and Form 1040 is the most detailed and challenging of the lot. While anyone can file Form 1040, you must meet certain requirements to use the shorter 1040-EZ or 1040-A forms.

How long do you keep my filed tax information on file? If no one can claim you (or your spouse if you’re filing a joint return), enter the dollar amount indicated on the form, which will be different depending on whether you’re filing singly or jointly. On Line 6, subtract Line 5 from Line 4. If line 5 is larger than line 4, enter 0.