Content

Say you inherited a $50,000 IRA when your mother died in 2019, which, because it was included in your mother’s taxable estate, boosted the estate tax bill by $22,500. With TurboTax, we’ll search over 350 tax deductions and credits so you get your maximum refund, guaranteed. It’s free to start, and enjoy $10 off TurboTax Deluxe when you file. Easily access and print copies of your prior returns for seven years after the filing date. Applies to online products only, download products are not available for Mac OS. With 1 year of online return access and 6 years of PDF access, it’s easy to print copies and plan for next year. To file IRS Form 1041, the executor needs to obtain a taxpayer identification number for the estate.

For estate purposes, IRS Form 1041 is used to track the income an estate earns after the estate owner passes away and before any of the beneficiaries receive their designated assets. For example, if you authorize a payment for repairs to real estate in the trust—those costs are deductible on the 1041.

The trust or estate is responsible for paying the income tax on this income, not the beneficiaries. The 1041 reports income retained by the trust or estate, as well as the income distributed to beneficiaries, but income taxes are only paid by the trust or estate if the distributions are required.

That means if a grandparent gives money to three children and nine grandchildren, their estate will need to generate 12 unique Schedule K-1 forms. The beneficiary is expected to pay any relevant taxes on income that is reported on the Schedule K-1. But we do have to make money to pay our team and keep this website running! TheCollegeInvestor.com has an advertising relationship with some or all of the offers included on this page, which may impact how, where, and in what order products and services may appear. The College Investor does not include all companies or offers available in the marketplace. And our partners can never pay us to guarantee favorable reviews . Similar to the concept of gross income on a personal income tax return, calculating estate tax starts with the gross estate.

Trusts

1 TaxSlayer Pro through SurveyMonkey surveyed 757 users of TaxSlayer Pro online tax preparation software 4/1/19 through 4/17/19. 93% of TaxSlayer Pro respondents reported that they continue to use TaxSlayer Pro software after switching. TaxSlayer Pro makes tax filing simpler and less stressful for millions of Americans with exceptional, easy-to-use technology. An authorized IRS e-file provider, the company has been building tax software since 1989. With TaxSlayer Pro, customers wait less than 60 seconds for in season support and enjoy the experience of using software built by tax preparers, for tax preparers.

Once your account is created, you’ll be logged-in to this account. In terms of functionality, TaxAct Online 2019 Estates & Trusts is more focused than TurboTax Business, so it may be easier to use. If you pulled the entire $50,000 out in 2020, you get the full deduction on your 2020 return. If your mother paid tax each year as the interest accrued on the bonds, you only need to report the interest earned after her death.

In this instance, the tax year starts on June 1 and ends on Dec. 31 of that year unless the executor elects a fiscal year. If a fiscal year is chosen, the tax year ends on May 31 of the following year. For example, a trust may own a stock portfolio or rental real estate. And when the stocks pay dividends or tenants pay rent—the income belongs to the trust. But the IRS doesn’t allow a trust or estate to receive the income tax free.

Since the trust and estate must report all income, deductions are available for amounts that must be distributed to beneficiaries. Form 1041 allows for an “income distribution deduction” that includes the total income reported on all beneficiary K-1s. You must prepare a Schedule B attachment for Form 1041 to take the deduction. If you’re not satisfied, return it within 60 days of shipment with your dated receipt for a full refund (excluding shipping & handling). If you’re not satisfied, return it to Intuit within 60 days of purchase with your dated receipt for a full refund. This deduction for federal estate tax on “income in respect of a decedent” is taken on line 16 of Schedule A.

Any taxes due are usually paid out of the trust or estate property. If you need to prepare a federal tax return for an estate or trust using Form 1041, use our TurboTax Business product. You’ll also need to use one of our personal tax products for your individual tax return.

My Father Died In 2019 At Age 68 I Was Named As The Beneficiary Of His Ira. Is This A Tax

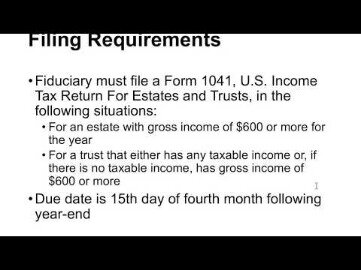

Estates have to file an IRS Form 1041 if they earn more than $600 per year. The estate also has to generate Schedule K-1 forms for any beneficiaries of the estate. Dealing with a deceased person’s estate can be complicated, but tax software can help you stay in compliance with minimal hassle. For more information and a complete list of our advertising partners, please check out our full Advertising Disclosure.

The same concept applies to a decedent’s estate that isn’t immediately distributed to heirs at the time of death. single taxpayers need more than $85,525 of taxable income to be in the 24% bracket for 2020. If you withdrew just $5,000 (one-tenth of the account), you deduct 10% of the estate tax bill attributable to the IRA. If you inherit savings bonds, for example, you’ll owe tax on all interest that accrued during the life of the previous owner. If you inherit an annuity, the same portion of each payment will be taxable or tax-free as was true for the original owner. This same rule applies if you are the beneficiary of a traditional IRA, as discussed later. So you would owe capital gains tax only on the amount of any appreciation after your uncle’s death.

- With TurboTax, we’ll search over 350 tax deductions and credits so you get your maximum refund, guaranteed.

- The College Investor does not include all companies or offers available in the marketplace.

- When you create a trust, it’s likely that you will be transferring personal assets to it such as real estate and investments.

- For example, suppose you’re a trustee, and the terms of the trust require all dividend income from a stock portfolio must be distributed equally among the beneficiaries.

- So you would owe capital gains tax only on the amount of any appreciation after your uncle’s death.

Simple trusts also cannot designate a charity as its beneficiary or distribute its corpus . For ease of use, TurboTax, TaxSlayer, and H&R Block consistently deliver great results. The lowest-cost option that supports Schedule K-1 forms is FreeTaxUSA. If you’re in charge of an estate, you’ll need to generate Form 1041 and Schedule K-1 forms for all beneficiaries.

All interest, dividends, and other income earned by those assets are reported to the Internal Revenue Service on your tax return. All income earned by your revocable living trust is reported on your personal Form 1040, not on a separate revocable trust tax return. She attended Duquesne University School of Law in Pittsburgh and received her J.D. Federal Form U.S. Income Tax Return for Estates and Trusts can be electronically filed starting with tax year 2011. For instructions on electronically filing business returns, click here. It is important to gather all of the financial documents necessary to support the tax deductions you want to claim on 1041 tax form.

This is where the 1041 comes in—you need to report this rental and dividend income on the return. Hello, I’m Tammy from TurboTax with some information about fiduciary income tax returns. Hello, I’m Scott from TurboTax with some important information about fiduciary income tax returns. You may use TurboTax Online without charge up to the point you decide to print or electronically file your tax return.

Best Tax Software For Estates And Trusts

There are thousands of financial products and services out there, and we believe in helping you understand which is best for you, how it works, and will it actually help you achieve your financial goals. We’re proud of our content and guidance, and the information we provide is objective, independent, and free. Only when the tax on the net taxable estate exceeds the decedent’s remaining balance of the unified credit does the estate need to remit a tax payment to the IRS. When someone in your family dies while owning property, the federal government imposes an estate tax on the value of all that property. The law that governs estates is constantly changing may be an inconsistent from one year to the next. The good news is that the estate tax doesn’t affect many American taxpayers who aren’t in the top 2% of the nation’s wealthiest people. If you’re filing a 1041 on behalf of an estate or trust, our TurboTax Business product will walk you through it, step by step.

This person may decide it’s necessary to secure an EIN for your trust so they can best fulfill their fiduciary dutiesor limit liability for paying your income tax bills. If they request an EIN for the trust, they must file a separate income tax return for it using Form 1041.

Say you inherited a $50,000 IRA when your mother died in 2020, which, because it was included in your mother’s taxable estate, boosted the estate tax bill by $22,500. The principal on the bonds is tax-free, but you will owe income tax on some or all of the accrued interest. Cash, stock and real estate are not taxed as income when you inherit them, but you could have taxable gains when you sell the stock or real estate—depending on the circumstances. Some other assets come with a tax string attached—you’re taxed on part or all of the value, just like the original owner would have been if he or she had lived. This rule comes into play for assets that have what’s called “income in respect of a decedent.”

Support

Any income generated by the estate or trust is reported on this form, as well as deductions like attorney fees or charitable contributions. 1041 Schedule K-1 items automatically allocate and update as estate & trust income, deductions and credits change. Once complete, Schedule K-1 data can be imported into TaxAct Plus. TaxAct Estates & Trusts , The fast, easy and affordable way to prepare and e-file your federal Estates & Trusts tax return. IRS Form 1041 is also used to report any income a trust earns over $600. Like the estate, however, Form 1041 must be filed regardless of the amount of income earned if there is a beneficiary that is a nonresident alien. However, if you’re in charge of a relatively small estate, generating your own Form 1041 and Schedule K-1 forms could be worthwhile.

However, it’s a good idea to first confer with an estate planning attorney to ensure that doing so is in your best interests. Otherwise, the time and effort spent might complicate your life at tax time.

Unless the trust document specifies otherwise, capital gains and losses stay with the trust since they are part of the corpus. The trust needs to file a return if it has a gross income of $600 or more during the trust tax year or there is a nonresident alien beneficiary or if there is any taxable income.