Content

An estate or trust may make estimated tax payments by filing Form R-541ES, Fiduciary Income Tax Declaration of Estimated Tax, or through LDR’s online service, Louisiana Taxpayer Access Point . Fiduciary Tax applies to estates and trusts that have $600 or more in annual Minnesota gross income. The personal representative of the estate or the trustee of the trust is responsible to file and pay the fiduciary tax. Determination of taxable income for both trusts and estates is the same as that of an individual with slight differences. The trust gets a deduction for the portion of the estate transferred to heirs and anything remaining becomes taxable income for the trust or estate. The trust or estate pays tax on the taxable income applicable to the estate or trust while the legal heirs pay tax on the assets they receive.

IRS Form 1041 reports only income earned by an estate from the time of the decedent’s death until the estate closes. Income received before the decedent’s date of death is reported on the decedent’s final tax return—a separate document that must also be filed by theestate’s executor.

The Form 510, Pass-through Entity Tax Return, only will allow a refund if there are no nonresident members and the amount on line 13 of the return is zero. Information must be provided to the beneficiaries so that they can file an accurate Maryland return. This includes information on Maryland source income and addition and subtraction modifications.

One interesting feature of the 1041 is that you can deduct some or all of the payments you make to beneficiaries. Suppose the trust document requires that all dividends be paid to beneficiaries or provides you discretionary authority to do so.

How To File:

If you are a tax preparer and filing electronically causes undue hardship, you can request a temporary waiver to file on paper. This waiver will cover the filing of all of your clients’ fiduciary income tax returns. Estates and trusts that follow a calendar year must file their tax returns by mid-April; the specific date in 2012 is April 17. Trusts and estates that follow a fiscal year must file Form 1041 by day 15 of the fourth month following the end of each fiscal year.

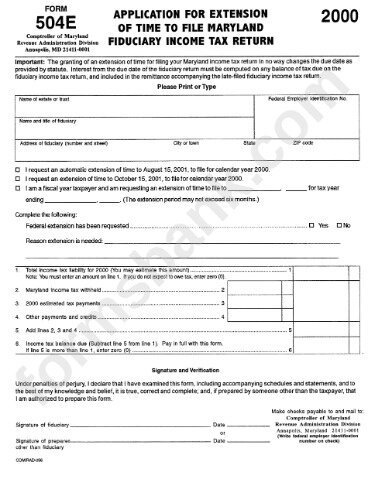

A fiduciary is subject to the local income tax, if the fiduciary is considered a Maryland resident. A fiduciary of an estate is a Maryland resident if the decedent of the estate was domiciled in Maryland on the date of the decedent’s death. The Comptroller’s Office is dedicated to making the process of filing and paying taxes, simple, safe and efficient.

If none of the above is applicable, then the fiduciary is considered a nonresident and is subject to the Maryland special nonresident tax. the trust was created, or consists of property transferred, by the will of the decedent who was domiciled in Maryland on the date of the decedent’s death.

Department Of Taxation And Finance

In all cases, you must submit a certified death certificate, the last will and testament and any applicable trusts. Once you have determined a Maryland estate tax return is required to be filed for the estate, complete the federal estate tax return, IRS Form 706, for the date of the decedent’s death. You will be required to complete the federal return even though you may not be required to file the return with IRS.

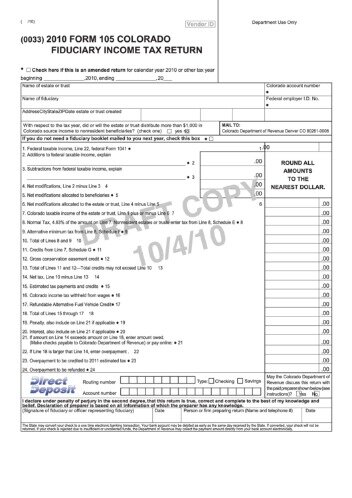

For bankruptcy estates with a Colorado filing requirement, complete the Fiduciary Income Tax Return and provide supporting documentation for the estate only. The above article is intended to provide generalized financial information designed to educate a broad segment of the public; it does not give personalized tax, investment, legal, or other business and professional advice. Please use Internet Explorer to get the best results when downloading a form. Firefox users will need to change their Portable Document Format to allow the use of Adobe Acrobat Reader.

Only income earned from the time of the decedent’s death until bequests are made is reported on Form 1041. Form 1041 is due to the Internal Revenue Service within four months of the close of the tax year in most cases.

- The above article is intended to provide generalized financial information designed to educate a broad segment of the public; it does not give personalized tax, investment, legal, or other business and professional advice.

- A resident trust is a trust or portion of a trust created by last will and testament of a decedent who at his death was domiciled in this state.

- This is because trusts and estates must pay income tax on their income just like you report your own income on a personal tax return each year.

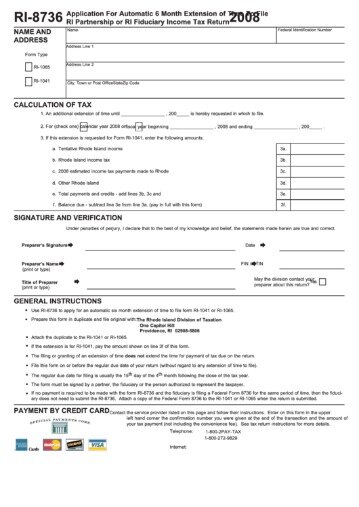

- Fiscal year taxpayers must file the extension request by the 15th day of the fourth month following the close of the taxable year.

- Effective tax year 2011, a pass-through entity may elect to file a composite Maryland income tax return Form 510C on behalf of qualified nonresident individual members.

As compared to an individual taxpayer, trusts and estates receive significantly lower personal exemptions, which are $600 and $300 respectively. Hello, I’m Tammy from TurboTax with some information about fiduciary income tax returns. An estate will begin the tax year on the date of death and may end on December 31 of that year. However, the executor has the option to instead use a fiscal year and have the tax year end on the last day of the month before the month the decedent died. This may afford the executor more time to file if the decedent died close to December 31 since the estate tax return is generally due four months after the close of the tax year. The IRS recently issued Revenue Procedure providing a glimpse at the tax brackets and rates to be used for 2019 tax returns , including the tax rate tables for trusts and estates. Personal representatives and trustees must file Maryland Form 504 to pay the Maryland income tax.

A fiduciary is a person who executes or administers a deceased person’s estate or holds assets in trust. Fiduciaries must settle tax obligations and other liabilities before they can transfer the estate or trust to the legal heirs.

This is because trusts and estates must pay income tax on their income just like you report your own income on a personal tax return each year. South Carolina taxable income of estates and trusts is taxed either to the fiduciary or to the beneficiaries in the same manner as federal Income Tax purposes. Fiduciaries are required to make quarterly payments of Estimated Income Tax in the same manner as for federal Income Tax purposes. A grantor trust is not taxed as a trust; its income or loss is taxable to the grantor.

A fiduciary figures the Maryland income tax in much the same manner as an individual. The executor or personal representative of an estate must file Form 1041 when a domestic estate has gross income during the tax year of $600 or more. A 1041 tax return must also be filed if one or more of the estate’s beneficiaries are nonresident aliens even if it earned less than $600.

Can An Irrevocable Trust Be An S Corporation Shareholder?

A bank or investment account with a payable-on-death designation would go directly to the named beneficiary. The extension provisions do not apply to payment of any tax due with your return. To avoid penalties, you must pay at least 90% of the fiduciary’s final tax liability by the original due date. Interest will apply to any balance that is not paid by the original due date. Fiduciaries of trusts and estates must file their taxes using IRS Form 1041. However, trusts and estates can also take deductions to reduce their taxable income.

This is where the 1041 comes in—you need to report this rental and dividend income on the return. Generally, a claim for a refund must be filed within 3 years from the date the original return was filed or within 2 years from the date the tax was paid, whichever is later. Maryland law imposes mandatory interest and late payment penalty if the tax is not paid when due. Interest is assessed on any portion of the liability that is not satisfied by the statutory due date, notwithstanding the fact that the tax is paid pursuant to an approved alternative payment schedule. A penalty of up to 10% is charged on any Maryland estate tax not paid by the due date. The inheritance tax paid to the Register of Wills is subtracted from the gross Maryland estate tax liability and the difference is the Maryland estate tax due.

The fiduciary of a nonresident estate or trust must file this form if the estate or trust has income from wages or net earnings from self-employment in Yonkers. Before preparing your Colorado Fiduciary Income Tax Return , you must determine your federal income tax by preparing your federal return first. For information on how to file your federal return, including links to services where you can file both federal and state returns free of charge, see theInternal Revenue Service website. The trust or estate must pay quarterly estimated taxes if it is expected to owe more than $1,000 and its withholding and tax credits do not meet the required threshold.

Nonresident fiduciaries must also file Form 504NR which is used to calculate their nonresident tax. If so, you may be interested to hear about the tax returns you are responsible for filing. As a trustee or administrator, you are the fiduciary of the trust or estate. This means that you are the person responsible for overseeing the estate or trust—which includes filing all necessary tax returns. The IRS requires the filing of an income tax return for trusts and estates on Form 1041—formerly known as the fiduciary income tax return.

Due to heavy submissions volume and tax season opening two weeks later than usual, ADOR technical staff are actively working towards accepting and processing individual income tax returns as soon as possible. The payment must be made before the deed or other instrument of transfer is recorded with the court clerk or filed with SDAT. This Act clarifies that the personal representative of an estate may donate a conservation easement on real property if the donation is authorized under the will. A fiduciary, or the trustee of a trust, may donate, or consent to the donation of, a conservation easement on real property if the donation is authorized under the governing instrument. The donation of a conservation easement on real property qualifies as a federal estate tax exclusion. Either tax may be imposed on the Maryland taxable income of a fiduciary of an estate or trust.

How Does The Repurchase Of S Corporation Stock Affect Taxes?

If you need to mail a check or money order, you must use the electronically filed extension payment voucher, Form R-6466V. This voucher can be printed through the Online Payment Voucher application. If you are unable to file your return by the due date and will owe tax, make an extension payment by the due date to avoid penalty and interest. Virginia grants an automatic 6-month filing extension for fiduciary income returns. Prior to that date, all trusts or estates administered or managed in Virginia were considered resident estates or trusts, even if they had no income from Virginia sources. ESBTs are grantor trusts, meaning that the beneficiaries received their interest in the trust through a gift or bequest, which can be transferred during the grantor’s life or at death. ESBT beneficiaries own interest in S Corporations, which are corporations that pass income and losses to shareholders for tax purposes.