Content

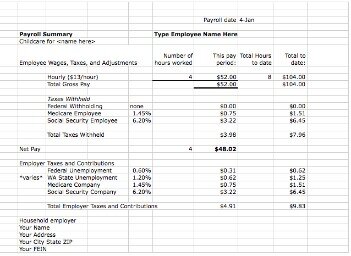

In a number of cases where taxpayers have behaved egregiously, it has also pursued criminal prosecutions that landed offenders in jail. Under Sec. 7202, willful means a voluntary, intentional violation of a known legal duty. The IRS does not have to prove that the person had bad faith or a bad purpose. In addition, the financial circumstances of the person or the company he or she is acting for are not taken into account in determining whether the failure to pay the tax was willful. How the IRS Form W-2 Wage and Tax Statement Works & How to Get One by Tina Orem You need it to do your taxes, and no, you can’t shove it in a drawer and forget about it. download a blank one from the IRS website, fill it out and give it to your human resources or payroll team. FICA tax includes a 6.2% Social Security tax and 1.45% Medicare tax on earnings.

If you’re struggling with tax filing challenges or payroll complexities, contact our team to learn how we can support your business. Federal tax records must be retained for at least four years after the due date of the return or the date the taxes were paid, whichever is later. Similar record-keeping requirements exist in each state, as well. If you are a semi-weekly depositor and your payday falls on Wednesday, Thursday or Friday, you must deposit your taxes by the following Wednesday. If payday falls on Saturday, Sunday, Monday or Tuesday, your taxes are due the following Friday. Federal and State unemployment taxes, which are based on an employee’s taxable wages. Before the beginning of each calendar year, you must determine which of the two deposit schedules you are required to use.

- For a business with numerous employees, unpaid trust fund taxes add up quickly, and the trust fund penalty consequently assessed against a responsible person can be huge.

- Payroll taxes are required to be handled by employers who can be penalized if not done properly.

- You’re not responsible for paying FUTA tax quarterly if your liability for a quarter is $500 or less.

- Below, we walk you step by step through what each process entails, as well as which option might be best for your business.

Individuals enrolled in Medicare pay a monthly income-based fee for basic Medicare coverage and are responsible for a portion of their medical costs. The Supplementary Medical Insurance Trust Fund assists in paying for Medicare Parts B and D and other Medicare program administration costs.

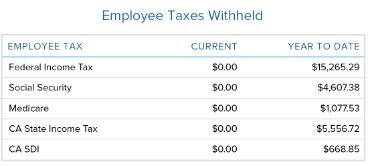

This includes employees’ income taxes as well as Social Security and Medicare taxes. For certain employees, it also includes an additional Medicare tax .

The basic FUTA rate is 6%, but employers can receive a credit for state unemployment tax of up to 5.4%, bringing the net federal rate down to 0.6%, or a maximum FUTA payment of $42 per employee. Income tax withholding from employees’ paychecks is designed to cover what they will owe in federal income tax for the year.

As an employer, you not only have to report the taxable income of your business, but there are a number of other federal taxes you need to pay that relate to your employees. This includes federal income tax withholding, Social Security, Medicare and unemployment taxes. Each type of tax has specific payment deadlines and forms you need to send to the IRS.

Form 941: Employer’s Quarterly Federal Tax Return

Use the same depositing schedule and deposit all the taxes together using electronic funds transfer. Every business will either use a monthly or semiweekly deposit schedule. You do not get to chose your deposit schedule, nor is it based on how often you pay employees. Some employers might have to send money to their state and local governments, too.

Employers have the responsibility to file employment-related tax returns and deposit employment taxes according to set deadlines. If they fail to do so, they may be subject to failure to file and failure to pay penalties.

How To Calculate Employer Payroll Taxes

Michael and Laurie Russell, of Hickman, Neb., were sentenced to prison terms for failing to pay over employment taxes. The Russells were also jointly ordered to pay the IRS $311,486 in restitution. According to court documents, the Russells jointly owned and operated a window installation business, for which they withheld employee income and FICA taxes, but paid none of it to the IRS. The couple lived a comfortable lifestyle and could afford to pay the taxes, but apparently chose not to. Remember, one of the big reasons you file a tax return in April is to calculate the income tax on all of your taxable income for the year and see how much of that tax you’ve already paid via withholding tax.

Federal payroll taxes cover Social Security and Medicare contributions, which constitute the Federal Insurance Contributions Act tax. In the U.S., payroll taxes are used to fund Social Security and Medicare. Most states use tables similar to federal tax tables, and you can get them by going to the tax section of your state’s website or contacting the Small Business Administration. You do not need to withhold state taxes in jurisdictions that do not impose state taxes on income, such as Alaska, Florida, Texas, Wyoming, and Washington. Other exceptions include states whose personal income taxes are a fixed percentage of the federal tax, like Arizona, and where state taxes are a fixed percentage of gross wages, such as Pennsylvania. Taxable wages are compensation for services performed and may include salary, bonuses, or gifts. Some forms of compensation, such as business-expense reimbursements for travel or meals, do not qualify as taxable wages.

This means they must cover both the employer and employee portions of the tax on their own. A payroll tax is a percentage withheld from an employee’s salary and paid to a government to fund public programs. Calculating payroll taxes can be very complicated, and it is important to send out payments on time to avoid penalties and late fees. Federal tax payments may be made either online through the Electronic Federal Tax Payment System , or through banks authorized to accept federal payments.

Tax Bracket Calculator

This article takes you through the process of making these calculations. When you pay employees, you must withhold payroll taxes and other employment taxes from their pay.

Consult your state unemployment tax agency to contact for information and tax forms relating to unemployment taxes. If you close your business or otherwise permanently stop paying wages that subject you to payroll taxes, you can end your obligation to file quarterly returns. You do this by designating the return for the last quarter that you pay taxable wages as a “final” return, by checking a box at the top of the return. The best way to find the amounts for your payroll taxes paid during the lookback period is to look at your 941 Form for each quarter.

It also requires the employer and employee each to pay half of the FICA tax. There really aren’t too many opportunities for reducing your exposure to payroll taxes. The IRS, the Department of Labor and their state counterparts are aggressively targeting employers to uncover misclassification, and the penalties are severe. Some states now require electronic filing for certain returns and payments. Consult your state’s department of revenue for information regarding the required returns and the deadlines for the remittance of withheld income tax.

Why Do I Have To Pay Fica Tax?

If your business is new, you won’t have a lookback period, so you’ll make monthly payroll tax deposits during your first year. Your payment to the IRS is due by the 15th day of the following month.

Learn more about how we are saving small business owners hours of admin every month. President Franklin D. Roosevelt signed the Social Security Act into law on Aug. 14, 1935, to provide a safety net for the disabled and retirees. When the program was conceived, high-wage earners were exempt from paying into the fund and from receiving Social Security benefits. But that exemption was eliminated and replaced with a cap by Congress which has continued to rise roughly at the same rate as wages. This test refers to the way the employer and the worker perceive their relationship. If an employer-worker relationship is expected to last until the end of a specific project or for a specified period of time, then the worker is an independent contractor. On the other hand, if the relationship has no or boundaries, the worker is a taxable employee.

Then such state becomes a “credit reduction state” and the credit reduction means the employer pays more FUTA than usual. If you are a new employer and you did not have employees during the lookback period, you are a monthly depositor. The lookback period to submit employment tax deposits in 2020 would be the 12-month period ending June 30 of 2019. As required by federal and state agencies, you must report the taxes owed. For nearly 30 years, Paycor has maintained a core expertise in payroll, tax filing and compliance. We established our expertise in the Cincinnati tristate area, one of the most complex tax jurisdictions in the country, so we’re able to handle payroll and tax complexities in a way our competitors can’t.

There’s also the Trust Fund Recovery Penalty for failing to pay your payroll taxes when they’re due. This penalty is imposed on the responsible party; that is, if you’re managing payroll in-house, you’ll be fined. If your bookkeeper or CPA is managing payroll, they incur the fine. And, if you outsource your payroll, the payroll provider shoulders the responsibility. In addition to penalties, interest also accrues from the due date. Your deposit schedule is dependent on whether you file Form 941 for reconciling tax payments quarterly or Form 944 for reconciling yearly tax payment.

If you’re not satisfied, return it to Intuit within 60 days of purchase with your dated receipt for a full refund. An HCM platform is the foundation of your business, and choosing the technology is one of the most important decisions you’ll make. Additionally, failure to provide Form W-2 by the end of January could subject you to a $50 fine for each form that wasn’t sent or was improperly prepared.

It is better to ensure your client avoids the trust fund penalty by filing timely payroll tax returns and paying over payroll taxes. If you know any of your clients have failed to pay payroll taxes, advise them to make every effort to pay the taxes. If your clients face financial difficulties, you should advise them to pay the government before paying creditors. Help your client work with the IRS by making sure the client makes prompt payments of current taxes and makes arrangements to pay back taxes. A person who is a responsible person under Sec. 6672 can be criminally liable under Sec. 7202.

Form W-4 asks about your marital status, dependents and other factors to help you calculate how much to withhold. The less you withhold, the less tax comes out of your paycheck. Sometimes referred to as the “hospital insurance tax,” this pays for health insurance for people who are 65 or older, younger people with disabilities and people with certain conditions. Employers typically have to withhold an extra 0.9% on money you earn over $200,000. Here are the taxes coming out of your paycheck — and how you can change them. When it comes time to record payroll costs on your books, Bench can take care of that for you.

You may use TurboTax Online without charge up to the point you decide to print or electronically file your tax return. Printing or electronically filing your return reflects your satisfaction with TurboTax Online, at which time you will be required to pay or register for the product. At the end of the year, the employer must complete Form W-2, Wage and Tax Statement, to report wages, tips and other compensation paid to an employee. File Copy A of all paper and electronic Forms W-2 with Form W-3, Transmittal of Wage and Tax Statements, to the Social Security Administration . You must use electronic funds transfer to make all federal tax deposits.