Content

TurboTax will ask you simple questions and give you the tax deductions and credits you’re eligible for based on your answers. Sometimes a child meets the rules to be a qualifying child of more than one person. Taxpayers can use the worksheet on page 6 of Publication 972, Child Tax CreditPDF, Child Tax Credit, to determine if they can claim this credit.

So, if you’re due to receive a credit of $5,000 but you owe only $2,000 in taxes, you might get a check for $3,000. You have to file a tax return to get this credit, even if you don’t owe tax and are not legally obligated to file a return. Some states also offer their own versions of this credit for child care and dependent care. They are often simply a percentage of the federal credit, but your state could expand eligibility, adjust the income thresholds or provide other incentives.

To qualify, you must meet certain requirements and file a tax return. Even if you do not owe any tax or are not required to file, you still must file a return to be eligible. If EITC reduces your tax to less than zero, you may get a refund. I sent tax return with W7 forms to get dependent benefit. There’s a special tax credit available if your wages or self-employment income are below a certain income level. The amount of credit you receive is based on your income, filing status, and how many qualifying kids you have. This credit is a dollar-for-dollar reduction of your taxes, based on your childcare expenses, up to 35% of $3,000 ($1,050) for one child or $6,000 ($2,100) for two or more children.

Get Your Tax Refund Faster After A Disaster

The potential Child Tax Credit amount will be reduced if your adjusted gross income exceeds $400,000 for people who are married and filing jointly, or $200,000 for all other tax filing statuses. For each $1,000 your adjusted gross income exceeds the limit (rounded up to the nearest $1,000), the total potential Child Tax Credit amount is reduced by $50 until it is completely exhausted. Romney said his plan would lift nearly 3 million children out of poverty, while not adding to the federal deficit.

Any remaining Child Tax Credit amount calculated above will be further reduced if your federal income tax is less than the potential Child Tax Credit amount. If your tax exceeds your potential Child Tax Credit amount, you can claim the full credit.

Have a child who meets all the qualifying rules for you or your spouse if you file a joint return. In order to claim your baby for 2016 she would have to be born by December 31, 2016. Make sure she has a valid social security number so you can claim her and also get the tax deductions and credits you are eligible for. TurboTax will ask you simple questions about you and give you the tax deductions and credits you deserve based on your answers. I live with my boyfriend and we have 1 child together and I have an older child .

Energy-related tax incentives can make home and business energy improvements more affordable. There are credits for buying energy efficient appliances and for making energy-saving improvements. A deduction reduces the amount of your income that is subject to tax. As a result, deductions can lower the amount of tax you have to pay. The American Opportunity Tax Credit helps with expenses during the first four years of higher education.

- Rules and Qualifications for Claiming a Tax Dependent by Tina Orem Tax dependents are either qualifying children or qualifying relatives, and they can score you some big tax breaks.

- qualifying dependent child 16 or younger at the end of the calendar year.

- Get a list of the most recent disasters which may be eligible for tax relief.

- If not, you use the number that results from taking 15% of your earned income above $2,500.

- This story and headline have been updated with additional developments.

You may contribute up to $2,000 per year for each eligible student. When you open the account, the person receiving the benefits must be under 18 or have special needs. Educational tax benefits can help with a variety of expenses, including tuition for college, elementary, and secondary school. Intuit, QuickBooks, QB, TurboTax, ProConnect, and Mint are registered trademarks of Intuit Inc. Terms and conditions, features, support, pricing, and service options subject to change without notice. TurboTax will walk you through determining which income will give you the best tax outcome. if you still have questions, you can connect live via one-way video to a TurboTax Live tax expert with an average of 12 years of experience to get your tax questions answered.

For the last couple of years, he claims our child and I claim my older child. I always thought that that was the best way to get the most credit back. If I claimed both kids this year would this be more beneficial? I would also qualify for medicaid if I claimed both kids.

To qualify, the unrelated person must have lived with the taxpayer for the entire tax year. Remember, with TurboTax, we’ll ask you simple questions about your life and upload your answers into all the right tax forms. The Consolidated Appropriations Act was signed into law on December 27, 2020 as a stimulus measure to provide relief to those affected by the pandemic.

Tax Credits And Deductions

Taxpayers whose dependent does not qualify for this credit might be able to the claim the credit for other dependents. The credit begins to phase out at $200,000 of modified adjusted gross income. This amount is $400,000 for married couples filing jointly. The maximum amount of the credit is $2,000 per qualifying child.

Make sure you have her social security number when you file so you can get the tax deductions and credits for dependents. This is very helpful for those who are incoming dependents to the family and this will reflect to your total savings. Get an arrangement of your tax credits and maximize your fund refund. The refundable tax credit you can receive ranges from a maximum of $6,660 if you have three or more children, to $538 if you have no children for tax year 2020.

An adopted child is a child who is lawfully placed with you for legal adoption. Any age and permanently and totally disabled at any time during the year. For more information, see Disability and Earned Income Tax Credit. The dependent must be a U.S. citizen, a U.S. national, or a U.S. resident alien. Must have lived with you for more than half of the tax year . Not provide more than half of their own financial support during the tax year. This story and headline have been updated with additional developments.

If this number is greater than the standard calculation using the earned income method, you claim the credit using this calculation. If not, you use the number that results from taking 15% of your earned income above $2,500.

Transfer or rollover funds from the 529 plan to an Achieving a Better Life Experience account. These funds can benefit the savings account holder or a family member. Learn how an ABLE account can help a person with a disability pay for education, housing, health, and other qualified expenses. Use the Interactive Tax Assistant to see if you’re eligible for education credits or deductions. This includes the American Opportunity Credit, the Lifetime Learning Credit, and the student loan interest deduction. A .gov website belongs to an official government organization in the United States. Wait 10 working days from the payment date to contact us.

Earned Income Tax Credit

This is a tax credit, which means it reduces your tax bill on a dollar-for-dollar basis. Up to $1,400 of the Child Tax Credit is refundable; that is, it can reduce your tax bill to zero and you might be able to get a refund on anything left over. There is a $500 nonrefundable credit for qualifying dependents other than children. The Child Tax Credit is one of three kid-focused federal tax credits that are among the most effective ways to reduce your tax bill. You may have to pay back some of your Child Benefit in tax if your (or your partner’s) individual income is over £50,000. If you choose not to get Child Benefit payments, you should still fill in and send off the claim form. We’d like to set additional cookies to understand how you use GOV.UK, remember your settings and improve government services.

An adopted child includes a child lawfully placed with them for legal adoption. The child must be younger than 17 on the last day of the tax year, generally Dec 31. Disclaimer – The information on this website is for general information purposes only and nothing on this site should be taken as legal advice for any individual case or situation. It is recommended that consumers seek the advice of a local tax expert to fully understand all options. Upon the request of visitors, a free assessment is provided with no obligation.

These taxpayers must have earned income of at least $2,500 to receive a refund, even if they owe no tax, with the additional child tax credit. If you were eligible to claim the Child Tax Credit on prior year returns but did not do so, you can still claim it in certain cases. You claim this credit on prior year returns by filing an amended tax return. In most cases, you’re allowed to file amended tax returns for three years following the date you filed your original return or two years from the date you paid the tax, whichever is later.

Earned Income Credit (eic)

I can’t afford the “affordable healthcare” because we pay $730 a month for daycare, My boyfriend thinks we would get more back if we claim the kids separately. Childcare is expensive, but Uncle Sam can help you out with the cost.

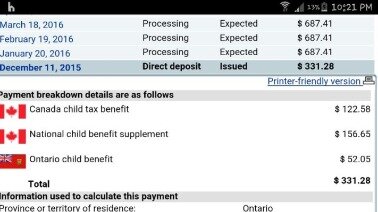

This blog does not provide legal, financial, accounting or tax advice. The content on this blog is “as is” and carries no warranties. Intuit does not warrant or guarantee the accuracy, reliability, and completeness of the content on this blog. Comments that include profanity or abusive language will not be posted. Kids can be overwhelming when they are cooped up in the house during summer or winter break or while taking virtual classes at home, but they are also blessed tax-savers when you file your taxes. The Canada child benefit is administered by the Canada Revenue Agency .

Here is a list of our partners and here’s how we make money. We believe everyone should be able to make financial decisions with confidence. The child must be a U.S. citizen, a U.S. national or a U.S. resident alien.

If Your Circumstances Change

The child must have not provided more than half of their own support for the year. You may choose to resolve on your own, or utilize the expertise of specialists who will negotiate the best possible outcome on your behalf. Based on your unique circumstances, experts evaluate applicable laws and policies to provide your best options to get immediate help and get you the best possible outcome. Specialists take the time to listen and understand your current situation and goals . We’ve served over 2.4 million people in need of taxpayer assistance.

It can be used to lower the amount of taxes you owe and is 24% of your federal credit. You may use TurboTax Online without charge up to the point you decide to print or electronically file your tax return. Printing or electronically filing your return reflects your satisfaction with TurboTax Online, at which time you will be required to pay or register for the product. In a federally-declared disaster area, you can get a faster refund by filing an amended return. You will need to claim the disaster-related losses on your tax return for the previous year. If your dependent child is over 17 or you support a relative, you may still be able to claim the Other Dependent Credit of up to $500 per qualifying person.