Content

Do you have a complaint regarding services being provided to a child by a state agency? Please submit your complaint by phone ( ) or an electronic submission form here with the South Carolina Department of Children’s Advocacy. The difference between your tax liability and your federal withholding is either what you get as a refund or what you owe the federal government when you do your tax return.

Any families who do receive an exception to be gender-specific may also incur an additional fee, which helps cover the additional advertising costs of such a request. Your adoption attorney should apply for an SSN along with the final amended birth certificate after the finalization court hearing. If you do not have these items yet, you or your accountant and/or tax representative can apply for a temporary adoption tax ID number for the baby. Here is a link to Form W-7A for information about obtaining a temporary tax ID number. You can also search the IRS website for Adoption Taxpayer Identification Number information.

The credit is thus of little or no value to low-income families who pay little or no income tax over a period of years. The Patient Protection and Affordable Care Act of 2010 made the adoption tax credit refundable for 2010 and 2011. Concerned about the potential for fraud, the Internal Revenue Service stepped up compliance efforts. The result, according to the National Taxpayer Advocate Service, was substantial delays for taxpayers, with 69 percent of all adoption credit claims filed in 2012 selected for audit. The IRS ultimately disallowed only 1.5 percent of claims, and 20 percent of the savings from the disallowed credits was spent on interest owed to taxpayers with delayed refunds.

With a non-refundable adoption credit you would reduce your tax liability to zero and carry the remaining $2,000 credit forward. IRS Publication 8839 provides a worksheet for calculating the credit carry forward. For adoptions finalized in 2011, the maximum adoption credit is $13,360 and the amount is refundable. Claim your adoption expenses, as well as any adoption-related benefits you received from your employer and can exclude from your income (also up to the $13,460 limit), onForm 8839, Qualified Adoption Expenses. Court costs, adoption charges, attorney fees and travel expenses are some of the items covered by the credit.

- Both a credit and an exclusion may be claimed for the same adoption; however, both cannot be claimed for the same expenses.

- See question 13 at the FAQs for information about documentation.

- Special Needs Tax Credit legislation has been introduced many times in congress to expand special needs adoption tax credit benefits to adults and disabled individuals.

- For 2014 the nonrefundable maximum tax credit per child is $13,190.

- Qualified adoption expenses are reasonable and necessary expenses directly related to the legal adoption of the child who is under 18 years old, or physically or mentally incapable of caring for himself or herself.

In January of 2013, the Federal Adoption Tax Credit was made permanent. It is a means for adoptive families to offset some adoption costs. The tax code provides an adoption credit of up to $14,300 of qualified adoption expenses for each child adopted, whether via public foster care, domestic private adoption, or international adoption. Domestic adoptions expenses are claimed for a tax credit in the tax year following when they are paid.

What Are The Phaseout Amounts For The Adoption Credit?

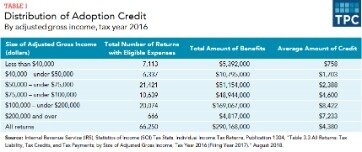

Special Needs Tax Credit legislation has been introduced many times in congress to expand special needs adoption tax credit benefits to adults and disabled individuals. Special needs children are those who receive adoption assistance or adoption subsidy benefits, typically because they’re in foster care. Benefits can include Medicaid or reimbursement of certain expenses, and they’re received because the state believes that the child wouldn’t be adoptable if they weren’t provided. The credit has been repeatedly expanded, from an initial maximum value of $5,000 in 1997 to $14,300 in 2020. In 2016, taxpayers claimed total adoption credit of $290 million . The temporary availability of a refundable credit pushed the cost of the credit up to the dramatically higher figures of $1.2 billion in 2010 and $610 million in 2011 . The IRS is committed to processing adoption credit claims quickly, but must also safeguard against improper claims by ensuring the standards for receiving the credit are met.

In this webinar, The Cradle’s Our Children initiative brings together a panel to share share how listening to the news about racial tension in America today affects them as a parent of a Black child. The child or youth cannot or should not be returned home to his or her parent. Peggy James is a CPA with 8 years of experience in corporate accounting and finance who currently works at a private university, and prior to her accounting career, she spent 18 years in newspaper advertising. A citizen’s guide to the fascinating elements of the US tax system.

Eligible children include those who are age 17 or younger, or a child of any age who is a U.S. citizen or a resident alien and is physically or mentally incapable of caring for themselves. Taxpayers who adopt a child can qualify for the adoption tax credit when they pay out-of-pocket expenses related to the adoption. These expenses include adoption fees, court and attorney fees, and travel expenses. The amount of the tax credit is directly related to how much you spend. The adoption credit is available to most adoptive parents, with some exceptions. The credit is not available to taxpayers whose income exceeds certain thresholds.

Parents who adopt a child with special needs can claim the full credit without documenting expenses. There are several factors that determine if a child has “special needs” and those factors can vary by state. You can’t claim the adoption credit if your MAGI exceeds the top number.

Tax Policy Center Briefing Book

You qualify for the Adoption Tax Credit if you adopted a child (except your spouse’s child) and paid out-of-pocket expenses relating to the adoption. The amount of the tax credit you qualify for is directly related to how much you spent on adoption-related expenses. Income can also be excluded as taxable through an employer-provided adoption benefits program. Both a credit and an exclusion may be claimed for the same adoption; however, both cannot be claimed for the same expenses. It is very important that families understand that the Adoption Tax Credit can be an important part of helping them adopt whether they are adopting through the foster care system, domestically, or internationally. Adoption is rapidly changing — international adoptions have declined and the numbers of children in foster care have increased. But the one thing that has remained constant is the need for families who are adopting or thinking about adopting to understand the financial resources available, especially the federal Adoption Tax Credit.

The ATC helps make adoption possible for families who may otherwise be unable to afford to adopt. The credit offsets qualified adoption expenses, such as court costs, attorney fees, traveling expenses , and other directly related expenses. You can only receive the benefit of the adoption tax credit to the extent that the credit zeroes out your tax liability.

Adoptive parents who work for companies with an adoption assistance program can also receive tax breaks for adoption. Parents can receive up to $14,080 in reimbursement from their employer for adoption expenses without paying taxes on that benefit. However, you cannot double-dip, meaning you cannot take a tax credit for adoption expenses already reimbursed by your company.

And the total is not just for one year’s expenses, but your total for the adoption, which can span years. You can’t claim the credit at all if you make more than $241,920. The same limits apply to either single adoptive parents or the total income of married couples filing jointly. Even if the adoption of a U.S. child is not completed, you still can claim the credit for your expenses in the unsuccessful adoption attempt. Remember, however, if you are adopting a child from another country, the credit is only allowed when the adoption is finalized. You cannot count expenses related to surrogate parents or the adoption of your spouse’s child in figuring your allowable credit.

Speak with a tax professional to make sure this is correctly noted in your W-2 Form and read our guide to employer-provided adoption benefits to learn more about these adoption assistance programs. The adoption tax credit is one way the U.S. government promotes and supports adoption.

Office Of Children And Family Services

You should keep all financial records, legal agreements, and written adoption paperwork, including home study paperwork. Financial records include invoices, bank statements, and copies of written checks. Most audits in adoption tax credit matters are done by correspondence so in the case of an audit, you and your accountant will typically communicate with the Internal Revenue Service IRS by mail and fax. Tax audits can only occur for 3 past tax years so you only need to retain records related to adoption expenses for 4 years. Likewise, you would be limited to a credit of $14,440 even if you spent $20,000 on qualified expenses, with one exception. You’re entitled to claim the full amount of the credit if you adopt a special needs child even if your out-of-pocket expenses are less than the tax credit amount.

Though the adoption tax credit provides a very valuable benefit to adoptive families, it is also among one of the most complicated tax law provisions. In Florida, this applies to adoptions by a member of a child’s extended family as well. The Contract with America document released during the 1994 election campaign included a proposed Family Reenforcement Act which included language about tax incentives for adoption. Democrat President Bill Clinton endorsed the idea of an adoption tax credit in a letter to Speaker of the House Newt Gingrich stating the tax credit would ease the cost of adoption for many families.

Whether the child has a medical condition or a physical, mental, or emotional handicap. Bankrate.com is an independent, advertising-supported publisher and comparison service. We are compensated in exchange for placement of sponsored products and, services, or by you clicking on certain links posted on our site. Therefore, this compensation may impact how, where and in what order products appear within listing categories. Other factors, such as our own proprietary website rules and whether a product is offered in your area or at your self-selected credit score range can also impact how and where products appear on this site.

Any unused amount must be “carried over” to the next tax year to be applied to reduce your tax liability in the next year. So if the adoption of your son or daughter takes four years and costs $17,000, you will be able to claim only $13,460 of your expenses during that whole time. Since there are various types of IR visas, check out Internal Revenue Announcement for details that could affect your particular circumstances. In these cases, any costs you incur cannot be taken until the year the adoption is final. Once your adoption of a foreign-born child is completed, any expenses you pay after that can be claimed the year they are paid.

Although most families will not experience a disruption, those who do are left with a lot of questions. An unsuccessful attempt was made to place the child or youth without adoption assistance, except in cases where such a placement would not have been in the best interests of the child or youth. You must apply for an Adoption Taxpayer Identification Number to begin claiming your adopted child as a dependent if the child doesn’t yet have a Social Security number. The IRS provides comprehensive information about the ATINon its website. Due to the nature of adoption, information on this site can change without notice. All information contained in this site is the sole property of Building Blocks Adoption Service Inc. ,A State of Ohio Adoption Agency, and not to be reprinted or used in any manner without written permission. Building Blocks Adoption Service is licensed by the Ohio Department of Job and Family Services to Accept temporary, permanent, or legal custody of children and to place children from Foster Care or Adoption.

Both domestic and foreign adoption expenses are claimed in the tax year the adoption is final. Domestic adoption expenses are allowed even when the adoption process is abandoned. Adoption expenses per child accumulate so any expenses taken for the credit in a prior year are evaluated in determining whether the maximum tax credit has been obtained. An adoption tax credit is a tax credit offered to adoptive parents to encourage adoption in the United States. Section 36C of the United States Internal Revenue code offers a credit for “qualified adoption expenses” paid or incurred by individual taxpayers. Taxpayers can receive a tax credit for all qualifying adoption expenses up to $14,300 in 2020. Taxpayers may also exclude from income qualified adoption expenses paid or reimbursed by an employer, up to the same limit as the credit.

a child of any age who is a US citizen or resident alien and who is physically or mentally incapable of caring for himself or herself. In the coming years the credit should increase slightly based on cost of living.

Adoption Tax Credit Guide 2020

The Office of the Taxpayer Advocate cites this as a serious problem within the IRS. The average delay for these correspondence audits was 126 days. Over 55% of these correspondence audits were closed with no changes. Qualified adoption expenses are calculated by adding up all the expenses related to the adoption, then subtracting any amounts reimbursed or paid for by your employer, a government agency, or another organization. Expenses for a failed adoption might qualify for the credit if a successful adoption follows it, but the two adoption efforts would be considered as one adoption and subject to the dollar limit per eligible child.

Did you know that American Adoptions offers a free bi-weekly e-newsletter? Sign up today to keep up-to-date on the latest in adoption news and information.

Families who experience a disrupted adoption could also benefit from the adoption tax credit. A family that qualifies for the adoption tax credit may also deduct qualifying adoption expenses from a disrupted adoption. However, families must wait one year before filing for the credit. The maximum credit level also still applies — no matter how many adoptions or disruptions a family experienced during the year.