Some solar roofing tiles and solar roofing shingles serve the function of both traditional roofing and solar electric collectors, and thus serve functions of both solar electric generation and structural support. These solar roofing tiles and solar roofing shingles can qualify for the credit. This is in contrast to structural components such as a roof’s decking or rafters that serve only a roofing or structural function and thus do not qualify for the credit. Qualified solar electric property costs are costs for property that uses solar energy to generate electricity for use in your home located in the United States. Extends the nonbusiness energy property credit to property placed in service after 2017 and before 2021. Satisfaction Guaranteed — or you don’t pay. You may use TurboTax Online without charge up to the point you decide to print or electronically file your tax return.

Most personal state programs available in January; release dates vary by state. E-file fees do not apply to NY state returns. State e-file available for $19.95. H&R Block online tax preparation and Tax Pro Review prices are ultimately determined at the time of print or e-file. All prices are subject to change without notice. Terms and conditions apply; seeAccurate Calculations Guaranteefor details. H&R Block tax software and online prices are ultimately determined at the time of print or e-file.

If you check the “Yes” box, enter the full address of your main home during 2020 on line 7b. You must reduce the basis of your home by the amount of any credit allowed. Form 2555-EZ has been made historical. References to the form have been removed. For the latest information about developments related to Form 5695 and its instructions, such as legislation enacted after they were published, go to IRS.gov/Form5695.

A passport that doesn’t have a date of entry won’t be accepted as a stand-alone identification document for dependents. If H&R Block makes an error on your return, we’ll pay resulting penalties and interest. One state program can be downloaded at no additional cost from within the program. Additional state programs extra. H&R Block prices are ultimately determined at the time of print or e-file.

On the dotted line to the left of line 25, enter “More than one main home.” Then, complete the rest of this form, including line 18. The amount on line 18 can exceed $500.

Join The Millions File Smarter

First we need to know the total amount you paid to install your solar system. This includes the cost of components as well as any associated installation costs. You’ll need four forms to file for the credit, which can be downloaded from the IRS website. Download and complete page 4 of theinstructions for Form 5695to calculate if you have any limits on tax credits you can claim this year. Enter the result on Line 14 of Form 5695. Compare Line 13 and Line 14, and put the smaller of the values on Line 15. Add any additional energy improvement costs, if any, on lines 2 through 4.

Valid at participating locations only. This course is not open to any persons who are currently employed by or seeking employment with any professional tax preparation company or organization other than H&R Block. The student will be required to return all course materials, which may be non-refundable. Discount is off course materials in states where applicable. Discount must be used on initial purchase only.

List the specific amount you spent on different types of qualifying items. Examples include solar electric, solar water heating, small wind energy and geothermal heat pump property costs. Popular improvement, such as insulation, new windows, doors, highlights, and roofs are eligible for this tax credit, but you won’t be able to claim the installation costs. Through December 31st, 2017, these tax credits can be claimed retroactively. There are two primary tax credits you’ll need to look into. Lines 23 to 28 will tell you how to calculate the total value of your tax credit. You should also refer to page six on the IRS worksheet for Form 5695, which can be found on the IRS website.

It’s a good idea to do this first since you will be referencing Line 11 later in this process. The total gross cost of your solar energy system after any cash rebates. A total combined credit limit of $500 for all tax years after 2005.

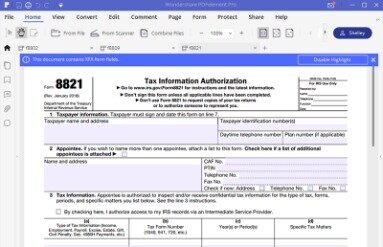

Form i5695 contains instructions on how to fill out Form 5695. We need to complete the worksheet on page 3, then transfer that information over to Form 5695. Due to winter weather conditions & COVID-19, delivery times may be delayed. For people who are retired or on welfare, the Federal ITC won’t be a benefit.

Easily find the app in the Play Market and install it for e-signing your irs form 5695 instructions 2014. Mobile devices like smartphones and tablets are in fact a ready business alternative to desktop and laptop computers. You can take them everywhere and even use them while on the go as long as you have a stable connection to the internet. Therefore, the signNow web application is a must-have for completing and signing irs form 5695 instructions 2014 on the go.

How To Fill Out Form 5695

Valid for 2017 personal income tax return only. Return must be filed January 5 – February 28, 2018 at participating offices to qualify. Type of federal return filed is based on your personal tax situation and IRS rules. Additional fees apply for Earned Income Credit and certain other additional forms, for state and local returns, and if you select other products and services. Visithrblock.com/ezto find the nearest participating office or to make an appointment. OBTP#B13696 ©2017 HRB Tax Group, Inc.

Additional fees and restrictions may apply. State e-file available within the program. An additional fee applies for online. State e-file not available in NH.

Before we start, you’ll need to gather your receipts for any project costs. You can claim the cost of the system as well as any associated installation costs (materials, hired labor, permitting fees, etc.). Forme Solar Solutions is a commercial and residential solar installer and electrical contractor that has served California since 2017. We have installed thousands of panels and have a happy customer near you. Check out what our customers think of us, Forme Solar.

Complete the worksheet below to figure the amount to enter on line 29. $500 multiplied by a fraction. The numerator is the amount on line 24.

Dependents Credit & Deduction Finder

Begin automating your e-signature workflows right now. If you own an iOS device like an iPhone or iPad, easily create electronic signatures for signing a irs form 5695 instructions 2014 in PDF format. signNow has paid close attention to iOS users and developed an application just for them. To find it, go to the AppStore and type signNow in the search field. After that, your irs form 5695 instructions 2014 is ready. All you have to do is download it or send it via email.

Forms & Instructions | Internal Revenue Service May 1, Access printable electronic versions IRS forms, including Form 1040 and Form 941, along with instructions and related publications. Speed up your business’s document workflow by creating the professional online forms and legally-binding electronic signatures. What’s the best way to get users to read a set of instructions for filling out a form? Your question confuses me a bit. What’s missing is “WHY are the instructions displayed?” What makes them so important?

If you are considering solar for your home or need help comparing solar quotes, contact our team. We strive to provide you with the best solar installation service possible, from our high-quality workmanship, along with outstanding customer care. We understand the stress that comes with shopping for solar. Regardless of the size or scope of your solar installation problem, our solar installers have the experience, skills, and the latest equipment to accomplish any solar panel job to your satisfaction.

Lines 19a through 19d and 22a through 22c are dedicated to different types of improvements, to help you calculate how much you spent in total. Line 18 indicates how much you’ve already claimed for the credit in past years. If you have previously claimed $500 or more, you won’t be able to take the credit again for the current year. In the Nonbusiness Energy Property Credit section, you will need to identify the types of any energy-efficient improvements you made to your home and what they cost.

- You must complete IRS Form 5695 if you qualify to claim the non-business energy property credit or the residential energy-efficient property credit.

- Disclaimer – The information on this website is for general information purposes only and nothing on this site should be taken as legal advice for any individual case or situation.

- If you are filing Form 2555, enter the amount, if any, from line 16 of the Child Tax Credit and Credit for Other Dependents Worksheet in Pub.

- Use this step-by-step guide to fill out the Irs form 5695 instructions 2014 quickly and with ideal precision.

- Having an ITIN does not change your immigration status.

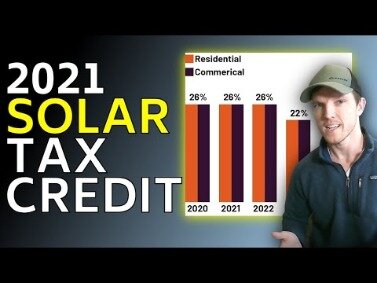

Available at participating U.S. locations. The federal tax credit is a major incentive for going solar. If you build your solar system before Jan. 1, 2020, you’re eligible to claim 30% of your total project costs as a credit toward your federal taxes. The credit offsets any taxes you may owe, and rolls over for up to 5 years if the value of the credit exceeds your tax liability. This article provides quick step-by-step instructions to help you file IRS Form 5695 and claim your renewable energy credits. We’ve provided sample images of the tax forms to help you follow along.

Lines 23 through 28 guide you through determining how much tax credit you can claim. Use the information on page six of the Form 5695 instruction worksheet to calculate your credit limit, then follow the directions on line 30 to transfer your established credit onto Form 1040.

When Dissolving An Llc Do You Need To Fill Out Irs Form 966?

You need to enter the amount you spent on the purchase and installation of any energy-generating upgrades to your property. is extremely vigilant when determining whether to accept an application for a tax credit on Form 5695. Insert the total cost of any additional energy improvements, if any, on lines 2 through 4, and add them up on line 5. Consent is not required as a condition of purchase. Message and data rates may apply. Keep in mind that in order to receive credit via federal tax Form 5695, your new appliances must receive the ENERGY STAR seal of approval.

For purposes of taking the credit, you can rely on a manufacturer’s certification in writing that a product is qualified energy property. Don’t attach the certification to your return. If both you and your spouse owned and lived apart in separate main homes, the limit on the amount of the credit applies to each of you separately. If you are filing separate returns, both of you would complete a separate Form 5695. If you are filing a joint return, figure your nonbusiness energy property credit as follows.

What Is The Earned Income Credit?

Transferring funds from another bank account to your Emerald Card may not be available to all cardholders and other terms and conditions apply. There are limits on the total amount you can transfer and how often you can request transfers. MetaBank® does not charge a fee for this service; please see your bank for details on its fees. The Check-to-Card service is provided by Sunrise Banks, N.A. and Ingo Money, Inc., subject to the Sunrise Banks and Ingo Money Service Terms and Conditions, the Ingo Money Privacy Policy, and the Sunrise Banks, N.A. Privacy Policy. Approval review usually takes 3 to 5 minutes but can take up to one hour.