Content

If a donor gives such an item, it can be in less than good used condition. However, you must have a qualified appraisal of the item’s value and must file IRS Form 8283, Noncash Charitable Contributions with your tax return. Other than cash contributions of up to $300, you can only deduct charitable contributions if you itemize your personal deductions instead of taking the standard deduction. The Tax Cuts and Jobs Act nearly doubled the standard deduction for individual taxpayers. This means there will be far fewer taxpayers who will itemize their deductions—and give to charities.

The more generous you are, the more paperwork you’ll have to fill out. If your gift is worth more than $500, you must fill out and attachIRS Form 8283, Noncash Charitable Contributionsto your tax return. For donations valued at more than $5,000, you must have on hand an appraisal of your gift. At tax time, you may be looking for help deducting your charitable contributions on your tax return in order to lower your taxable income and reduce your tax bill.

The TurboTax community is where you can ask questions and get tips relevant to the software. Answers and tips are provided by other ItsDeductible users and specialists. You can deduct only the amount you paid over the tickets’ face value. If you gave cash, hold on to a bank statement, cancelled check or credit-card receipt showing the amount of the donation. For gifts of cash or property worth more than $250, also keep the written acknowledgement from the charity showing the date and value of the donation. Your donation is not complete until you transfer the car’s title to the charity.

Save tax deduction-related digital images and receipts on a drive and store it with your yearly tax documents along with reports printed from ItsDeductible. He has helped individuals and companies worth tens of millions achieve greater financial success. Fortunately, most charitable organizations provide you with a summary of the tax-deductible amount of your contribution when they send you a letter thanking you for your generosity. A reasonable estimate, usually based on what you could get for your items at a thrift shop, is sufficient. Your account allows you to access your information year-round to add or edit your deductions. Some non-profits aren’t eligible to receive deductible contributions—for example, because they urge people to vote for a particular political candidate. IRS publication 78 lists the charities to which you can make deductible donations.

Congress has clamped down on donations of household goods to make sure folks aren’t inflating the value of their used stuff. For property worth more than $5,000 ($10,000 for stock in closely-held firms), you’ll need to get a formal appraisal. You’ll also have to make sure the appraiser is a member of a recognized professional group or meets minimum education and experience guidelines. Cash may be king, but if you want a really big tax saver, your best bet may be a donation of appreciated property—securities, real estate, art, jewelry or antiques. You can take the deduction for your contribution in the year that you make it.

Most often, these are charitable, religious or educational organizations, though they can also be everything from your local volunteer fire company to a group for the prevention of cruelty to animals. Learn how to get the biggest tax savings when making charitable contributions of cash or checks, household goods, cars or appreciated property. Don’t be surprised by an unexpected tax bill on your unemployment benefits. Know where unemployment compensation is taxable and where it isn’t. The answer to this question comes down to whether your stimulus check increases your “provisional income.” Goodwill will be happy to provide a receipt as substantiation for your contributions in good used condition, only on the date of the donation.

Will Your Stimulus Check Increase Your Tax On Social Security Benefits?

If you want a precise valuation, there are a number of ways that you canestimate the car’s valueand report that on your tax return. • Keep your receipts.The charity may have itemized the donations, or you may have made a list of what you gave. In either case, keep the receipts with your tax records in case you’re audited. The organization you donated to must be an IRS-qualified charitable organization in order for your gift to count toward a tax deduction. If you’re not sure about the charity, look it up using the IRS’s Exempt Organizations Select Check. The new Tax Cuts and Jobs Act, which applies to tax year 2018 and beyond,nearly doubles the standard deduction, which will make itemizing deductions less beneficial for many. Tax-preparation software, including H&R Block’s TaxCut and Intuit’s TurboTax, can provide donors with estimated values for clothing and other household goods based on the condition of each item.

Bankrate.com is an independent, advertising-supported publisher and comparison service. We are compensated in exchange for placement of sponsored products and, services, or by you clicking on certain links posted on our site. Therefore, this compensation may impact how, where and in what order products appear within listing categories. Other factors, such as our own proprietary website rules and whether a product is offered in your area or at your self-selected credit score range can also impact how and where products appear on this site. While we strive to provide a wide range offers, Bankrate does not include information about every financial or credit product or service. TurboTax ItsDeductible is easy to navigate, with intuitive links and drop-down selection lists.

You may use TurboTax Online without charge up to the point you decide to print or electronically file your tax return. Printing or electronically filing your return reflects your satisfaction with TurboTax Online, at which time you will be required to pay or register for the product. The report was particularly critical of donated vehicles, but it also mentioned donations of property, clothing and art. But for your 2017 return, you can still itemize as you’ve done in the past.

Product Reviews

If the value of your donation falls between $250 and $500, the acknowledgment must also say whether you received goods or services in return . For example, if you paid to go to a fundraising dinner, a portion of that might be the value of the dinner. For any property donations worth $5,000 or more, you must obtain a formal appraisal from a qualified appraiser. The only exception is for marketable securities because they have a clear market value. The basic rule is that you may deduct no more than the property’s “fair market value” at the time of the donation. Bankrate is compensated in exchange for featured placement of sponsored products and services, or your clicking on links posted on this website. This compensation may impact how, where and in what order products appear.

When you write a check, charge a donation, or simply provide cash to a charity, the amount of your potential deduction is easy to determine; it’s simply the amount you contributed. Sometimes, however, you might donate household items, such as old clothing or furniture. Instead of being able to deduct what you paid for the items donated, you are limited to the amount they are worth. Beginning in 2020, you can deduct up to $300 of qualified charitable cash contributions as an adjustment to adjusted gross income without itemizing your deductions.

Giving is truly better than receiving, especially when your generosity can provide income tax benefits. If the claimed value of your donated vehicle is more than $500, in most cases your deduction is limited to the amount the car brings when it’s sold at auction.

Again, TurboTax will tell you whether your donation meets this requirement. Get an independent appraisal when giving valuable property. When you claim a donation of furniture, jewelry or other item worth more than $5,000, the IRS wants independent verification of its value.

It’s a good idea for you to photograph any items you donate as additional proof of their condition in case any questions come up later with the IRS. At Bankrate we strive to help you make smarter financial decisions. While we adhere to stricteditorial integrity, this post may contain references to products from our partners.

Irs Rules On Charitable Donations

Congress also gave the IRS broad authority to deny deductions for low-value items such as used socks and underwear. If you’re not sure whether the group you want to help is approved by the IRS to receive tax-deductible donations, check online at IRS Exempt Organizations Select Check. When you donate noncash items to charity, the IRS expects you to use the fair market value in determining the deduction.

TurboTax, a brand of tax preparation software, offers a tool called ItsDeductible that estimates the value of your noncash donations for you. You can use eBay and other resale outlets to estimate the fair market value of your donations.

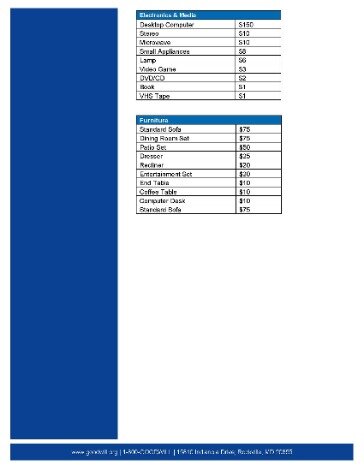

The Salvation Army provides a helpful guide, and tax software such as TurboTax’’s ItsDeductible also offers guidance. Keep in mind that clothes and other household items must be in good condition to be deductible.

It also explains what kind of information you must have to support the charitable contribution deduction you claim on your return. Deanna – You may want to consider making any home improvements before you go out of business to take advantage of some depreciation deductions. Otherwise, there is nothing to do, business wise, before retiring. It would be nice if we could end this discussion of how to value donated items here. Goodwill Industries – Offers a printed form that lists values of 66 items showing one value or a range of values for each item. Salvation Army – Offers a printed form that lists values of 138 items, mostly clothing as either Low or High value. I don’t recommend estimating the value of your donated items based on what they might sell for at a garage sale.

You must attach that form to your tax return or the IRS will disallow the deduction. If you’re waiting for your tax refund, the IRS has an online tool that lets you track the status of your payment. Actually, what I wrote was that if you donated more than $500 you must fill out this form. The form is for items valued at less than $5,000, but my article is correct. The IRS publcation 561 Determining the Value of Donated Property says that you must use a “fair market value” to determine the value of your donation. A fair market value is a price the item would sell for on the open market. The publication is not very helpful in pricing your donated items.

- Your donation is not complete until you transfer the car’s title to the charity.

- With the coronavirus pandemic and the disasters occurring right now, it is the perfect time to show your generosity and give to your favorite charity.

- Our experts have been helping you master your money for over four decades.

- A fair market value is a price the item would sell for on the open market.

- If the total of all your contributed property comes to more than $500, you have to fileIRS Form 8283with your tax return.

ItsDeductible is a built-in feature on TurboTax Deluxe and above. Turbo Tax Itsdeductible – Lists values of thousands of household items, clothing, games, etc. as either Medium or High value. They based their values on survey of thousands of thrift stores across the country. You can use it separately or as part of doing your taxes using Turbo Tax.

ItsDeductible works best for people who prepare their annual income tax return with TurboTax. This is because TurboTax directly imports data from ItsDeductible. If you do not use TurboTax to prepare income taxes, you can use the figures on a printed report from TurboTax ItsDeductible. In order to deduct your charitable donation, you’ll need to itemize your deductions rather than take the standard deduction.

No matter whether you donate cash or goods, be sure to get a receipt. If you donate something worth more than $250, a receipt is required. In short, you must give to a registered non-profit organization which operates as a true charity to take a tax deduction for the donation. In many instances, you’ll get far less by donating your car than by selling or trading it in. The IRS allows you to deduct only the charity’s actual selling price, and requires you to attach a statement of sale to the tax return.

Donations Are Limited

Second-hand clothes and the like must be in at least “good used condition.” You can deduct only the value they would sell for in a thrift shop—not what you paid for them. To help you keep track of this information, TurboTax has a tool called “ItsDeductible” that uses eBay to calculate the IRS-approved value of your donations of things like used clothing, coffee makers, toys or bicycles. The most important step in deducting the value of your car donation is to insure the charity you donate it to is an IRS tax-exempt organization.

This also ensures you won’t be held liable if the car racks up parking tickets. provide information about the value of the item, including your cost or adjusted basis. What if you donated the piece of art to a museum that will display it as part of its collection? If you donate a work of art to the shelter for its fundraising auction, you only get a deduction for the price you paid for the artwork. If you’re donating tangible personal property, what the charity does with the item affects how much you can deduct. If you don’t really want to part with the stock because you think it’s still a good investment, give it away anyway. Then use your $10,000 of cash to buy the shares back in the open market.

And to get the biggest tax savings, make sure you value your charitable donations correctly. The most commonly donated property items are clothing and household items.