Content

For tax year 2020, The CAA allows taxpayers to use their 2019 earned income if it was higher than their 2020 earned income in calculating the Additional Child Tax Credit as well as the Earned Income Tax Credit . If your available Child Tax Credit is greater than your tax liability, the Child Tax Credit can only reduce your tax bill to zero — you don’t get any unused portion of the credit back as a refund. According to a 2015 report by the U.S.

Tax-related identity theft happens when someone steals your personal information to commit tax fraud. Your taxes can be affected if your SSN is used to file a fraudulent return or to claim a refund or credit. IRS Publication 972 provides instructions for parents and guardians of children under age 17 on how to claim the child tax credit. The Child Tax Credit is a $2,000-per-child tax credit given to a taxpaying parent with a dependent child under the age of 17. An individual who owed $800 to the government but claimed $2,000 child tax credit for her two kids will eventually have to pay nothing but the surplus $1,200 would be lost. Refundable tax credits such as the Additional Child Tax Credit are particularly attractive to fraudsters who file doctored tax returns to claim bigger refunds. The Protecting Americans from Tax Hikes Act of 2015 gave the IRS more time to review tax returns and prevent fraudulent returns from being processed.

The impacts on deep poverty would be even larger for Black and Latino children than for non-Hispanic white children. CBO’s latest economic and budget projections show that the unemployment rate will remain above 10 percent through the end of the year and that it won’t return to the levels in CBO’s pre-pandemic economic projections until late in the decade. CBO also projects that real GDP over will be 6.7 percent below CBO’s forecast from January 2020.

Go to IRS.gov/IdentityTheft, the IRS Identity Theft Central webpage, for information on identity theft and data security protection for taxpayers, tax professionals, and businesses. If your SSN has been lost or stolen or you suspect you’re a victim of tax-related identity theft, you can learn what steps you should take. The quickest way to get a copy of your tax transcript is to go to IRS.gov/Transcripts. Click on either “Get Transcript Online” or “Get Transcript by Mail” to order a free copy of your transcript.

Key Elements Of The U S. Tax System

The child did not provide over half of his or her own support for 2020. The child was under age 17 at the end of 2020. The child is your son, daughter, stepchild, eligible foster child, brother, sister, stepbrother, stepsister, half brother, half sister, or a descendant of any of them . A child qualifies you for the CTC if the child meets all of the following conditions. For more information about claiming the CTC, see Claiming the CTC and ODC, later. Go to IRS.gov/OrderForms to order current forms, instructions, and publications; call to order prior-year forms and instructions. Your order should arrive within 10 business days.

You can also download and view popular tax publications and instructions (including the Instructions for Forms 1040 and 1040-SR) on mobile devices as an eBook at IRS.gov/eBooks. Or you can go to IRS.gov/OrderForms to place an order. Go to IRS.gov/SocialMedia to see the various social media tools the IRS uses to share the latest information on tax changes, scam alerts, initiatives, products, and services.

Delayed refund for returns claiming the EIC or ACTC. The IRS cannot issue refunds before mid-February 2021 for returns that properly claim the earned income credit or the ACTC.

Who Qualifies For The Child Tax Credit?

These improvements have substantial merit. Ultimately, policymakers should make the Child Tax Credit fully available on a permanent basis. For now, they should do so for tax year 2020. The Tax Policy Center estimates that 90 percent of families with children will receive an average CTC of $2,380 in 2020 . Families with children in all income groups will benefit from the CTC, but families in the lowest income quintile are least likely to benefit from the credit because more of them will not have sufficient earnings to qualify for the credit. Just under three-quarters of families in the lowest income quintile (the bottom one-fifth of the income distribution, ranked by household income) will be eligible for a CTC, receiving an average benefit of $1,280.

For example, if you qualify to receive $2,000 in Child Tax Credit but your tax liability is only $300, the Child Tax Credit can reduce your $300 tax liability to $0. Of the remaining $1,700, only $1,400 may be refunded to you as an Additional Child Tax Credit. Rules and Qualifications for Claiming a Tax Dependent by Tina Orem Tax dependents are either qualifying children or qualifying relatives, and they can score you some big tax breaks. Some states also offer their own versions of this credit for child care and dependent care. They are often simply a percentage of the federal credit, but your state could expand eligibility, adjust the income thresholds or provide other incentives.

Most state programs are available in January. Online AL, DC and TN do not support nonresident forms for state e-file. Software DE, HI, LA, ND and VT do not support part-year or nonresident forms. Receive 20% off next year’s tax preparation if we fail to provide any of the 4 benefits included in our “No Surprise Guarantee” (Upfront Transparent Pricing, Transparent Process, Free Audit Assistance, and Free Midyear Tax Check-In). Description of benefits and details at hrblock.com/guarantees. Emerald Cash RewardsTMare credited on a monthly basis.

Of course, you must have qualifying kids to be eligible for a child tax credit. But not everyone who has kids will qualify for the child tax credit and additional child tax credit. For 2020, the Child Tax Credit is at least partially refundable if you had a minimum earned income of $2,500. Partially refundable means that some of the credit is nonrefundable while some is refundable and the amounts will be reported in two separate sections of your return. A nonrefundable credit means that the credit cannot be used to increase your tax refund or to create a tax refund when you don’t already have one. Refundable tax credits, on the other hand, are treated as payments of tax you made during the year.

The average credit is the smallest for this group because low-income families are most likely to be limited to the refundable portion of the credit, which is capped at $1,400 rather than the full $2,000 limit for the nonrefundable credit . The additional child tax credit could affect your refund by up to $1,400 per qualifying child. Not filing a joint return for the year. A child may still be a qualifying child if the only reason they file a joint return is to claim a refund of withheld income tax or estimated tax paid. Kids are expensive, and Uncle Sam knows that as well as any parent does.

Furthermore, up to $1,400 is now refundable as an “Additional Child Tax Credit.” Best of all, the phase-out begins at $200,000 for single filers and $400,000 for joint filers—much higher thresholds than before. Notably, the maximum CTC you can claim on your 2020 return is $2,000 for each qualifying child, of which $1,400 is refundable. The Child Tax Credit is a nonrefundable tax credit for each qualifying child you claim on your return, worth up to $1,000 per qualifying child. The credit is limited to the amount of tax on your return. You cannot receive any excess credit as a refund.

iPhone is a trademark of Apple Inc., registered in the U.S. and other countries. App Store is a service mark of Apple Inc. Auto, homeowners, and renters insurance services offered through Credit Karma Insurance Services, LLC (dba Karma Insurance Services, LLC; CA resident license # ).

What Is The Additional Child Tax Credit?

A tax credit is an amount of money that people are permitted to subtract, dollar for dollar, from the income taxes that they owe. A tax refund is a state or federal reimbursement to a taxpayer who overpaid taxes. Taxpayers with income below $3,000 may be eligible if they have at least three qualifying dependents and have paid Social Security Tax in excess of the amount of their earned-income credit for the year. This credit was claimed on Schedule 8812 and was also subject to the same phaseout limitations as the Child Tax Credit.

Like all tax credits, the additional child tax credit works by reducing the amount of tax you owe. The additional child credit is actually part of the child tax credit, which was temporarily increased under the Tax Cuts and Jobs Act of 2017.

Divorced Or Separated: Which Parent Can Claim The Credit?

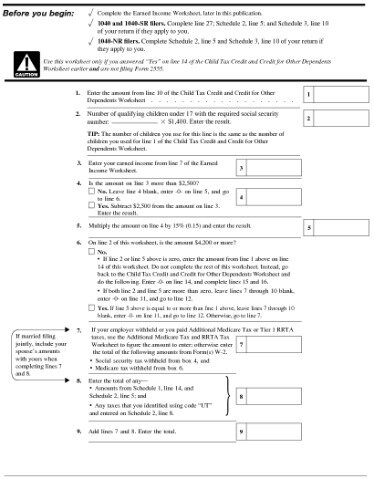

The Tax Counseling for the Elderly program offers free tax help for all taxpayers, particularly those who are 60 years of age and older. TCE volunteers specialize in answering questions about pensions and retirement-related issues unique to seniors. Go to IRS.gov/TCE, download the free IRS2Go app, or call for information on free tax return preparation. If your employer withheld or you paid Additional Medicare Tax or Tier 1 RRTA taxes, use this worksheet to figure the amount to enter on line 7 of the Line 14 Worksheet.Social security tax, Medicare tax, and Additional Medicare Tax on wages. Enter any amount included on Form 1040 or 1040-SR, line 1, that is a Medicaid waiver payment you exclude from income , unless you choose to include this amount in earned income, in which case enter zero4d.

- The Volunteer Income Tax Assistance program offers free tax help to people with low-to-moderate incomes, persons with disabilities, and limited-English-speaking taxpayers who need help preparing their own tax returns.

- TurboTax will ask you simple questions about you and your life and help you fill out the right forms.

- You must have an earned income amount of at least $2,500 in order to receive the Additional Child Tax Credit.

- Emerald Cash RewardsTMare credited on a monthly basis.

- The tax identity theft risk assessment is based on various data sources and actual risk may vary beyond factors included in analysis.

If the return is not complete by 5/31, a $99 fee for federal and $45 per state return will be applied. If you have at least one qualifying child, you can claim a credit of up to 15% of your earned income in excess of the earned income threshold, $2,500. The provision also would expand the age range of childless workers eligible for the credit from to 19-65, making workers aged who aren’t full-time students, as well as workers aged 65, eligible for the first time. The provision would benefit 15.4 million working childless adults across the country, ranging from 31,000 in Wyoming to 1.8 million in California. Moreover, policymakers need to take strong action to prevent the current sharp economic decline from causing poverty to spike dramatically, and one way to help do that would be to stop taxing people into — or deeper into — poverty.

Must have lived with you for more than half of the tax year . Not provide more than half of their own financial support during the tax year. Be under age 17 at the end of the tax year.

Direct deposit also avoids the possibility that your check could be lost, stolen, or returned undeliverable to the IRS. Eight in 10 taxpayers use direct deposit to receive their refunds. The IRS issues more than 90% of refunds in less than 21 days. The Volunteer Income Tax Assistance program offers free tax help to people with low-to-moderate incomes, persons with disabilities, and limited-English-speaking taxpayers who need help preparing their own tax returns. Go to IRS.gov/VITA, download the free IRS2Go app, or call for information on free tax return preparation.

Discount valid only for tax prep fees for an original 2017 personal income tax return prepared in a participating office. May not be combined with any other promotion including Free 1040EZ. Void if sold, purchased or transferred, and where prohibited. Must be a resident of the U.S., in a participating U.S. office. Referring client will receive a $20 gift card for each valid new client referred, limit two.