Content

Now in order to deduct casualty losses on your 2018 return, the affected property must be located in a presidentially declared disaster area. The loss must be due to the events that prompted the area to be designated as a disaster, must still exceed $100 per claim and is still limited by your AGI. See a full list of all the allowed deductions for this section on page A-12 of the instructions to Schedule A. Line 9 lets you deduct any “investment interest,” i.e. any interest you paid on money you borrowed that is allocable to property held for investment.

Make sure not to confuse tax deductions with tax credits. Every dollar of tax credits lowers your tax bill by one dollar—$500 in tax credits lowers your tax bill by $500.

An Overview Of Itemized Deductions

You should keep receipts for at least a few years after you file. It isn’t uncommon for the IRS to also look at returns from three to six years prior to the return they are actually auditing. And depending on which deductions you take, like the home office deduction, your return may be more likely to trigger an audit.

- That means you actually reap more tax benefit by using the standard deduction than you would have by itemizing.

- Hold onto receipts for services and keep a file throughout the year, so you have a record of even the smallest expenses you incur for business, charity, and your health.

- Consult your own attorney for legal advice.

- Must be a resident of the U.S., in a participating U.S. office.

- Before you go to the trouble of filling out that Schedule A form, keep in mind that the standard deductions, which increased significantly in 2018, have all been bumped up a bit more.

- If the value of the donation is over $5,000, you should get the donation formally appraised by an expert.

For items such as electronics, appliances, and furniture, you may need to pay a professional to assess the value of your donation. Please note, if your home loan is over the $750,000 (or $1 million) limit, you can still deduct the mortgage interest related to the portion of your loan up to that amount. Jennifer Mansfield, CPA, JD/LLM-Tax, is a Certified Public Accountant with more than 30 years of experience providing tax advice. Figuring out the best tax strategy for your finances can be complicated, but finding a financial advisor to help you do them doesn’t have to be. SmartAsset’s free toolcan help you find suitable advisors in your area in just five minutes.Get started now.

Job Expenses And Certain Miscellaneous Deductions

For taxpayers in the top 1 percent of the income distribution, the tax saving in 2018 was about one-tenth of the tax saving in 2017. Free ITIN application services available only at participating H&R Block offices, and applies only when completing an original federal tax return .

Additional fees, terms and conditions apply; consult your Cardholder Agreement for details. For tax years beginning after 2017, applicants claimed as dependents must also prove U.S. residency unless the applicant is a dependent of U.S. military personnel stationed overseas. A passport that doesn’t have a date of entry won’t be accepted as a stand-alone identification document for dependents. H&R Block provides tax advice only through Peace of Mind® Extended Service Plan, Audit Assistance and Audit Representation.

Applies to individual tax returns only. Fees apply if you have us file a corrected or amended return. Unfortunately, you cannot deduct the federal taxes you paid. However, you can deduct state taxes as an itemized deduction on Schedule A. If you choose to itemize your deduction to claim state taxes you will not be able to take the standard deduction.

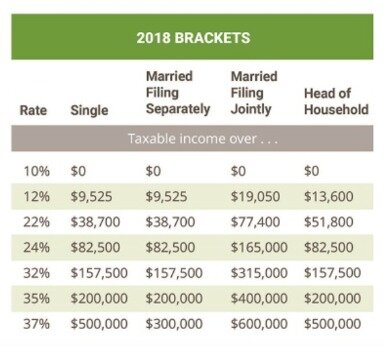

It’s up to $12,200 on single returns for 2019 ($12,400 for 2020). Bulking up the standard deduction has let millions of taxpayers avoid the hassle of itemizing write-offs on their tax return because the bigger standard deduction would exceed their qualifying expenses. In addition, taxpayers are limited to a $10,000 deduction ($5,000 if married filing separately) for state and local taxes , which is a combination of property taxes plus either state and local income taxes or sales taxes. So, as an example, if you’re a single filer with $10,000 worth of deductions, you would have saved almost $4,000 more on your 2017 tax return by itemizing than taking the standard deduction. But itemizing on your 2020 taxes won’t save you anything because the standard deduction is higher. Before the TCJA, taxpayers could deduct certain miscellaneous itemized deductions to the extent that they exceeded 2% of the taxpayer’s adjusted gross income, or AGI. That included items like unreimbursed employee expenses, tax preparation fees, investment expenses, job search expenses, hobby expenses and safe deposit box fees.

One Of The Biggest Changes The 2017 Tax Reform Law Brought Was A Near Doubling Of The Standard Deduction

So if you pay this type of tax, your payments are deductible on Schedule A—n addition to your state income or sales tax deduction. And lastly, your state may charge you a separate tax on the value of your personal property, such as your car. As long as the tax is assessed on at least an annual basis—deduct these payments on your Schedule A, as well. If you’re among the many taxpayers who are concerned that not itemizing tax deductions means you’re at a disadvantage, you can relax. For tax year 2019, the standard deduction amounts increased slightly.

Each person should consult his or her own attorney, business advisor, or tax advisor with respect to matters referenced in this post. Bench assumes no liability for actions taken in reliance upon the information contained herein. Line 13 is where you can report your carryover from the prior year. This would be any charitable contributions you could not deduct in the last 5 years because it exceeded the limit. This section lets you deduct any cash and non-cash donations you made to religious, charitable, educational, scientific, or literary charities. Check out the instructions to Schedule A for a longer discussion about what qualifies as a charitable organization.

Schedule A asks you to list and tally up all your itemized deductions to figure out your Total Itemized Deductions amount , which are then subtracted from your adjusted gross income to determine your total taxable income. I am a using the online-tax software to generate my 1040NR-EZ or 1040NR form, and have paid a state tax in the previous year tax return. For this year’s return, I am unsure whether I should add this amount to “Itemized deductions” / Line 11. The TCJA has had a significant effect on the average tax saving from the SALT deduction. Both the percentage of taxpayers claiming the deduction and the average amount claimed fell dramatically in 2018 because of the changes enacted. Figure 3 compares the tax saving from claiming the deduction in 2017 and 2018, before and after the new tax law. The percentage claiming the deduction ranged from 17 percent in West Virginia to 47 percent in Maryland in 2017.

For example, while travelling for medical care, you can only deduct up to $50 per person per night of lodging. The percentage of the vehicle registration based on the weight of your car is not tax deductible.

It is not uncommon for state wages to be higher than their federal wages. This alone generally should not trigger a return to be rejected for e-filing. Carolyn has been in the tax field since 1984, when she went to work at the IRS as a Revenue Agent. Carolyn taught many classes at the IRS on both tax law changes and new hire training. In 1990, she left the IRS for a position at CCH, where she was a developer on both the service bureau software and on the Prosystevm fx tax preparation software for nearly 17 years. After leaving CCH she worked at several Los Angeles-based CPA firms before starting at TaxAudit as an Audit Representative in 2009. Carolyn became the manager of the Education and Research Department in 2011, developing course materials for the company and overseeing the research requests.

You add up all your expenses and find that you would save $500 by itemizing. It’s probably worth doing a little extra work to get $500. What if you add up your expenses and see that itemizing would only save you $100?

Check out IRS Publication 526 for a full breakdown of what falls under the 60% limit and what does. If the amount of this deduction is more than $500, you must also complete and attach Form 8283. If the value of the donation is small, the IRS will usually let you determine a donation fair market value yourself, usually based on how much comparable goods and services are selling on the market. If the value of the donation is over $5,000, you should get the donation formally appraised by an expert.

Verifying what portion of the amount is actually taxes versus penalties or interest is important to filing a correct return. Keeping all of your tax documents organized will help you ace your tax filing. If you choose to itemize, staying organized includes keeping all your receipts.

Christopher W. Hesse () is a principal in the National Tax Office of CliftonLarsonAllen LLP in Minneapolis. Disclosure is generally made by the taxpayer on either a Form 8275, Disclosure Statement, or Form 8275-R, Regulation Disclosure Statement . Substantial authority has often been described by respected commentators as a 40% to 45% chance of prevailing administratively or judicially on the merits if challenged by the government. Reasonable basis has been similarly described as a 25% chance of prevailing. Both confidence thresholds are based on authorities set forth in Regs.

Sign up to get the latest tax tips sent straight to your email for free. The answer to this question comes down to whether your stimulus check increases your “provisional income.”

If you work for yourself, you have to pay both the employer and the employee share of Social Security and Medicare taxes—a whopping 15.3% of net self-employment income. But at least you get to write off half of what you pay as an adjustment to income. You can also deduct contributions to a self-directed retirement plan such as a SEP or SIMPLE plan . You get an above-the-line deduction for contributions to the HSA, assuming you made them with after-tax money. If you contributed pretax funds through payroll deduction on the job, there’s no double-dipping—so no write off. In either case, you need to file a Form 8889 with your return.

There are limits on the total amount you can transfer and how often you can request transfers. MetaBank® does not charge a fee for this service; please see your bank for details on its fees. H&R Block does not provide audit, attest or public accounting services and therefore is not registered with the board of accountancy of the State in which the tax professional prepares returns.

The portion of the previous year’s state refund that might have been applied toward estimated taxes. If you’re not satisfied with your purchase and have not filed or printed your return, return it to Intuit within 60 days of purchase with your dated receipt for a full refund (excluding shipping & handling). This would be particularly true with regard to attempting to assert analogous treatment of an item if Congress did not intend for the item to be in fact treated in a similar manner. You’re a schoolteacher and you buy supplies for your classroom. The Educator Expense Deduction lets educators write off up to $250 each year of such expenses if they teach kindergarten through 12th grade and put in at least 900 hours a year on the job. You don’t have to be a teacher to claim this break. Aides, counselors and principals may claim it if they have the receipts to back it up.

It used to be that you could deduct as much as you paid in taxes, but TCJA limits the SALT deduction to $10,000, or just $5,000 if you’re married but file a separate tax return. This cap applies to state income taxes, local income taxes, and property taxes combined. Itemizing your deductions means spelling them out in detail to the Internal Revenue Service by completing Schedule A and submitting it with your Form 1040 tax return. It can sometimes help reduce your taxable income, but a few tax rules limit some of them. One that’s affected is the state and local income tax deduction you can claim on your federal return. Among those items are state income taxes entered on Schedule A, Itemized Deductions. However, the procedure specifically states that it does not reflect law changes after Dec. 31, 2015.

Credit Karma is committed to ensuring digital accessibility for people with disabilities. We are continually improving the user experience for everyone, and applying the relevant accessibility guidelines. iPhone is a trademark of Apple Inc., registered in the U.S. and other countries. App Store is a service mark of Apple Inc.

Faqs: Standard Vs Itemized Deductions

Emerald Cash RewardsTMare credited on a monthly basis. Rewards are in the form of a cash credit loaded onto the card and are subject to applicable withdrawal/cash back limits. H&R Block tax software and online prices are ultimately determined at the time of print or e-file. Did you know you can donate $3 to the Presidential Election Campaign Fund on your 1040 form? H&R Block explains this type of public funding. Confused by dependent relationship options? Find out how to choose the right option.

Deductions for these state taxes are available if you prepare your return on Form 1040 and itemize your deductions on Schedule A, which is the only form you can report a state tax deduction on. Most of the states, and even some local governments, impose an income tax on their residents and other individuals who earn money within their state. And if you are employed, it’s likely you will see these taxes withheld from your salary in the same way federal taxes are. You can deduct all state income tax payments you make during the year (for tax years before 2018. Beginning in 2018, the deduction limit is $10,000) —which includes the withholding amounts reported on your W-2s and 1099s. Once you calculate the deduction, you must report it in the “taxes you paid” section of Schedule A. In another scenario, let’s say your itemized deductions totaled to $17,000 in 2019. As long as you continue to file a joint return, you likely qualify to claim the $24,200 standard deduction.