Content

Generally, people can qualify for the credit if their income is more than 100% of the federal poverty guideline but less than 400% . This page specifically covers Form 8962, which is used for the Premium Tax Credit . If your household income on your tax return is more than 400 percent of the federal poverty line for your family size, you are not allowed a premium tax credit and will have to repay all of the advance credit payments made on behalf of you and your tax family members. The federal government defines individuals and families as being in poverty if their household income falls below a certain level. The level varies based on household size and, to a lesser extent, location. Although many government programs base their eligibility requirements on federal poverty guidelines, taxes have a minor link to them.

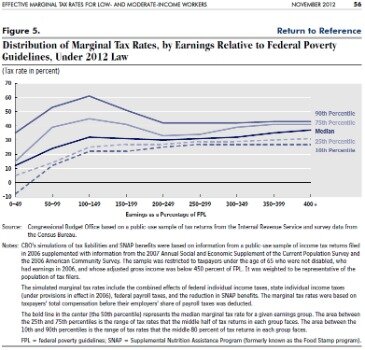

OMB has never issued either the poverty thresholds or the poverty guidelines. The U.S. federal poverty level is a measure of income the U.S. government uses to determine who is eligible for subsidies, programs, and benefits. Average tax rates for low-income households have changed markedly over the past quarter-century. Creation of the CTC and expansion of the EITC both lowered the effective individual income tax rate for low-income households from about 0.5 percent in the early 1980s to its negative value today . In contrast, the effective payroll tax rate for households in the lowest income quintile increased by more than half over the same period . The effective corporate income tax rate borne by low-income households has also fallen since 1979, while the effective excise tax rate rose slightly. The Urban-Brookings Tax Policy Center estimates that in 2020, households in the lowest income quintile have a negative average income tax rate as a result of refundable credits—namely the earned income tax credit and the child tax credit .

Wisconsin reduced its EITC from 14 percent of the federal credit to 11 percent for families with two children beginning in 2011. This change drove Wisconsin’s threshold for two-parent families of four below 125 percent of the poverty line. New Jersey reduced its EITC to 20 percent of the federal credit , beginning in 2010, raising taxes on families of three and four by $252 and $266 respectively.

The result is a concentration of income at the very top not seen since the 1920s. Maine restored its EITC from 4 percent to 5 percent of the federal credit, after it had been cut for tax years 2009 and 2010.

Frequently Asked Questions Related To The Poverty Guidelines And Poverty

The average federal tax burden tends to be much lower for low-income households than for high-income households. The federal poverty guidelines are used for determining low-income assistance eligibility, such as food stamps or housing aid. The IRS requires you to file a tax return so you can continue qualifying for advance tax payments on your health insurance from the Marketplace. In order to to this, you will need to add the information from your Form 1095-A into your eFile.com account. After you complete your return, we will generate Form 8962 for you based on the information you have entered from your Form 1095-A. The 8962 form will be efiled along with your completed tax return to the IRS.

Meanwhile, to be eligible for premium tax credits on health insurance marketplace plans, which would help reduce the monthly payments for a health plan, the criteria is in the range of 100% to 400% of FPL. One tax break specifically tied to the federal poverty guidelines is the Premium Tax Credit. This is a tax break intended to help some people pay for health insurance under the Affordable Care Act .

Another 24 states required families of four with income just above the poverty line to pay income tax in 2011. There is strong evidence that even income modestly above the poverty line is often insufficient to meet families’ basic needs, and so there is a strong case to be made for exempting near-poor families as well. Some states went further and levied income tax on working families in severe poverty. Five states — Alabama, Georgia, Illinois, Montana, and Ohio — taxed the income of two-parent families of four earning less than three-quarters of the poverty line, or $17,264. Four states — Alabama, Georgia, Illinois, and Montana — taxed the income of one-parent families of three earning less than three-quarters of the poverty line, or $13,442. The federal poverty level is used to establish who qualifies for certain federal subsidies and aid, such as Medicaid, Food Stamps , Family and Planning Services, the Children’s Health Insurance Program , and the National School Lunch Program. The FPL varies according to the size of the family and their geographical location within the country.

Poverty guidelines don’t capture other contributions to well-being, either. A family may have lots of assets, such as housing and capital gains and still live below the poverty level. Similarly, families that receive food stamps, housing assistance, and tax credits are also below the poverty level.

Most of the states without income taxes rely heavily on the sales tax instead, which renders their tax systems very burdensome for low-income families. Similarly, two states with income taxes but no general sales tax — Montana and Oregon — have less regressive tax systems overall than the average state because they do not levy general sales taxes, even though they impose above-average income tax burdens on the poor. At the other end of the spectrum, 16 states not only avoid taxing poor families but also offer tax credits that provide refunds to families of four at the poverty line.

Federal Poverty Level Guidelines And Chart

Also known as “federal poverty guidelines,” the FPL is used to measure a household’s poverty status. The U.S. Department of Health and Human Services has released the 2020 federal poverty level guidelines which are used to determine eligibility for programs such as Medicaid, food stamps, or education subsidies in 2021.

Office of Economic Opportunity adopted Orshansky’s poverty thresholds as a working or quasi-official definition of poverty. Bureau of the Budget designated the poverty thresholds with certain revisions as the federal government’s official statistical definition of poverty. Most of these programs are non-open-ended programs — that is, programs for which a fixed amount of money is appropriated each year. Other poverty indicators measure total wealth, annual consumption, or a subjective assessment of well-being.

- The Department of Health and Human Services updates its poverty guidelines, illustrating the set minimum amount of income that a family needs for food, clothing, transportation, shelter, and other necessities, once a year, adjusted for inflation.

- This is despite the fact that many studies indicate that in most parts of the U.S. the basic costs of living exceed the federal poverty line.

- Federal poverty levels are used to determine your eligibility for certain programs and benefits, including savings on Marketplace health insurance, and Medicaid and CHIP coverage.

- ASPE does not project price changes for the current year; instead, we issue guidelines based on price changes through the most recent completed year.

The federal poverty guidelines are sometimes referred to as the “federal poverty line” or FPL. The Department of Health & Human Services determines the federal poverty guideline amounts annually.

The Federal Poverty Level (fpl) Requirements For Welfare Programs

These changes would reduce the number of workers aged (other than full-time students) whom the federal tax code taxes into, or deeper into, poverty to by about 91 percent — from 5.51 million today to fewer than 500,000. On the other hand, a few states tax the incomes of the poor more heavily than in the early 1990s. In Arizona, Mississippi, and Ohio, the income tax threshold for families of four has fallen compared to the poverty line since 1991 .

Since the Premium Tax Credit is also refundable, you will receive the difference of the credit amount and your tax liability if your credit amount is more than your tax liability. If you don’t owe any taxes, you can get the full amount of the credit as a refund. However, if you receive advance payments of the credit, you will need to reconcile the payment with the actual premium tax credit amount (which is calculated by eFile.com on your tax return). The Marketplace will use the information you provide to them about your family and household income to estimate to credit amount you can claim on your tax return. You can use that estimate to decide if you want to have all, some, or none of your credit to be paid directly to your insurance company in advance so the credit can be applied to your monthly premiums. You will not pay a penalty on your 2020 return if you did not have health insurance in 2020.

States’ recent fiscal troubles are significantly slowing their progress in reducing the tax liabilities of poor families. In the 2011 tax year, only a few states significantly reduced the tax liabilities of low-income families relative to 2010. First, the income tax is a major component of most state tax systems, making up 34 percent of total state tax revenue nationally. The design of a state’s income tax thus has a major effect on the overall fairness of the state’s tax system. In 10 states, the threshold for a single-parent family of three is below the $17,922 poverty line for such a family . These findings show that that there is still significant room for improvement in many states’ tax treatment of low-income families. To some degree, the slowing of progress in reducing these families’ tax liabilities over the last several years has been inevitable, as states have faced the most difficult fiscal conditions in decades.

The bill would boost the phase-in rate to 20 percent (i.e., 20 cents for each additional dollar earned). It is possible for states to go in the opposite direction — raising revenues overall while improving their tax treatment of the poor.

Unfortunately, they don’t take into consideration the poverty levels between the contiguous states. The poverty guidelines are useful because they draw a line in the sand, differentiating between those who are poor and those who aren’t. It gives those who study the poor in America—and those trying to help them—a starting place to understand and relieve poverty. The Tax Policy Center estimates that in 2020, the CTC and the EITC together will average $860 for households in the lowest income quintile. About 30 percent of households in the lowest quintile will receive one or both refundable credits .

Health Insurance Marketplace® is a registered trademark of the Department of Health and Human Services. You can enroll in Marketplace health coverage February 15 through May 15 due to the coronavirus disease 2019 (COVID-19) emergency. If you’re not satisfied, return it within 60 days of shipment with your dated receipt for a full refund (excluding shipping & handling). If you’re not satisfied, return it to Intuit within 60 days of purchase with your dated receipt for a full refund. If you’re not satisfied with your purchase and have not filed or printed your return, return it to Intuit within 60 days of purchase with your dated receipt for a full refund (excluding shipping & handling).

For instance the Life-line program (the one where you can get a free or low cost “Obama phone” or broadband) uses 135% of the poverty level as a guideline. She is in the 10 percent bracket and hence will have a $114 federal income tax liability.

Get More With These Free Tax Calculators And Money

That is, the payments the lowest-income households receive from refundable credits exceed any income tax they owe. The largest tax burden for households in the bottom income quintile tends to come from the payroll tax, followed by excise taxes and a small amount of corporate tax.

Depending upon what assistance program you are applying for, you may need to look at income for a full 12 month year or, in some cases monthly income, . Either divide any dollar amount in the charts by the number of months you are looking for or see our monthly guidelines below. If you make between 100% – 400% of the Federal Poverty Level you may qualify forpremium tax credits on the Health Insurance Marketplace. While the table depicts the respective quintiles by each state, the actual income ranges for each quintile vary due to the overall income levels of the state population, e.g. the lowest quintile’s income is below $15,000 in Mississippi, but below $18,000 in Texas. is, when all state and local income, sales, excise and property taxes are added up, most state tax systems are regressive. Second, the tax system should be structured according to the principle of progressivity, so that those with relatively greater financial resources pay a higher rate of taxation.

For example, in 2020, a single parent with one child would be considered in poverty with a family income of less than $17,240 using the federal poverty guidelines for the 48 contiguous state. However, if you do not want to have any of your credit paid in advance, you can claim the entire credit on your tax return, which will either increase your refund or lower the amount of taxes you owe. Unfortunately, you will not qualify for the credit if you are also eligible for coverage through your state’s Medicaid program that is above the federal poverty levels.