Content

In cases of divorce or separation, the custodial parent typically gets to claim the child as a dependent. However, sometimes the noncustodial parent can claim a child as a dependent if the custodial parent signs a written declaration that he or she won’t claim the child as a dependent. The child must have lived with you for more than half the tax year. There are certain exceptions for temporary absences , for children who were born or died during the tax year, for kids of divorced or separated parents and for kidnapped kids. With the CDCTC, you can claim a credit for up to 35% of qualified care expenses.

- If you are married, and you file a joint return with your spouse, your parents cannot claim you as a dependent.

- However, once a single taxpayer’s income reaches $200,000, or a couple’s income reaches $400,000, the credit “starts to phase out,” Tobey says.

- In this way, your child is permitted either $1,100 in unearned income or, if your child earned more than $750, then you are permitted $350 in unearned income without having to file.

- This rule doesn’t apply to all tax credits and deductions, however.

This may influence which products we write about and where and how the product appears on a page. This may influence which products we review and write about , but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services.

Letting Your Parents Claim You As A Dependent Child On Their Tax Return

To claim the EIC, you must meet specific income and other requirements. For more information on the EIC, and to determine whether you qualify, visit the IRS website. The IRS offers child tax credits to help parents and guardians offset some of the costs of raising a family. If you have a dependent who isn’t your direct child, you may also be eligible to claim a credit. And because some child tax credits are refundable, you might even make some money when all is said and done.

It’s sadly very common that adult children and parents don’t talk – especially about money and taxes. So, what happens if your parents claimed you on their taxes and you filed for yourself?

The Child Tax Credit

First, you need to find out if you qualify to be claimed as a dependent. Were unmarried, treated as unmarried for federal income tax purposes, or separated from the child’s other parent by a divorce or separate maintenance decree. Generally, a married person who files a joint tax return (there are some important but complicated exceptions to this; see IRS Publication 501 for the details).

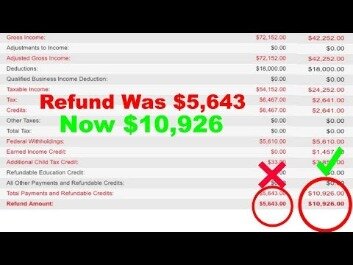

The credit is reduced by 5 percent of adjusted gross income over $200,000 for single parents ($400,000 for married couples). If the credit exceeds taxes owed, taxpayers can receive up to $1,400 of the balance as a refund, known as the additional child tax credit or refundable CTC. The Earned Income Credit is available to parents (and non-parents) who work and have earned income under $55,952. The tax credit typically leads to more money in your pocket at the end of the tax year and may also reduce the amount of taxes you owe the IRS.

State Child Tax Credits

But to claim a relative as a tax dependent on your tax return, the person must meet all of the following conditions. You don’t need to itemize in order to take advantage of the child tax credit or the child and dependent care tax credit. “You can claim the standard deduction and still get the Dependent Care Credits,” says Pon. Although dependent children (under 19 years old or a full-time student under 24) pay no taxes on the first $1,050 of unearned income, they are taxed at their rate for the next $1,050.

They also apply to your stepchild, foster child, grandchild, brother, sister, niece, nephew or a descendent of any of those people. Online tax software programs like TurboTax and H&R Block will help guide you. They must be related to youThis relationship includes a son, daughter, stepchild, eligible foster child, adopted child, sibling, step or half-sibling, or a descendant of any of them. support, which includes lodging, food, utilities, repairs, clothing, education, health care and other costs.

First, your child must qualify as a “dependent” under the IRS rules. You can read more about the qualifications of a dependent in IRS Publication 501. For a more in-depth look into the rules of claiming a child, review IRS Publication 929, Tax Rules for Children and Dependents. Parents may also qualify to change their filing status to “Head of Household” instead of Single. When you file as Head of Household, your tax rate is usually lower than that of someone filing as Single or Married Filing Separately. You will also receive a higher standard deduction than if you file using another status.

This credit effectively gave you a refund if the CTC reduced your tax bill to less than zero. (Remember that the CTC was previously not refundable.) The ACTC is largely phased out, but if you need to file a return for a tax year previous to 2018, you can find information for the ACTC on the Form 1040. However, the new tax law also caps the refundable portion of the CTC to 15% of your earned income that exceeds $2,500.

Deducting Your Child As A Dependent

This is part of the reason the CTC became refundable and its limits increased. You don’t need to itemize in order to take advantage of the adoption credit either, Pon says. That comes to $3,375, which means any money you’ve spent above that amount can be deducted. Say you make $50,000 and your student loan payments and IRA contributions add up to $5,000 for the year. After insurance, the cost of having your baby came to about $6,800. Last year, almost three out of four Americans, 72%, received a tax refund, with the average amount being close to $3,000, according to a recent survey from TurboTax.

Or your parents may be giving you money to help with your living expenses. Read more about our thoughts about when you should and shouldn’t accept money your parents. Tax Deductions Guide and 20 Popular Breaks in 2021 by Tina Orem A deduction cuts the income you’re taxed on, which can mean a lower bill. The person’s gross income for the year can’t be more than $4,300 in the 2020 or 2021 tax years. People who are disabled or have income from a sheltered workshop get an exception. Gross income includes money from rental properties, business income and taxable unemployment and Social Security benefits.

Starting with the 2018 tax year, there is an additional $500 Credit for Other Dependents . This allows you to claim non-child dependents, such as a parent, and dependents who are college students . The eligibility requirements are very similar but you cannot claim the ODC for a dependent who qualifies for the CTC. As a reminder, tax credits directly reduce the amount you owe the IRS.

“The most important thing to keep in mind when filing as a new parent is to make sure you have a proper tax ID number,” says Chris Cicalese, a CPA with New Jersey-based Alloy Silverstein Accountants and Advisors. Before these changes, the American Taxpayer Relief Act of 2012 had increased the CTC from $500 per child, its pre-2001 level, to $1,000 per child. The Bipartisan Budget Act of 2015 made the $3,000 refundability threshold permanent.

At that point, the credit for children under 17 will revert to $1,000 per child, and other dependents will no longer be eligible for a CTC. In this way, most household employee minors, which is likely most children with earned income under the age of 14, will likely not need to file. However, there are a few who are some combination of high earnings, older age, self-employed, or heavily invested who will need to file. For those children with both earned and unearned income, the limit is the larger of the kiddie tax limit or the child’s earned income limit plus $350. In this way, your child is permitted either $1,100 in unearned income or, if your child earned more than $750, then you are permitted $350 in unearned income without having to file.