Content

Additional qualifications may be required. There is no tuition fee for the H&R Block Income Tax Course; however, you may be required to purchase course materials. Additional training or testing may be required in CA, MD, OR, and other states. Valid at participating locations only. This course is not open to any persons who are currently employed by or seeking employment with any professional tax preparation company or organization other than H&R Block. The student will be required to return all course materials, which may be non-refundable.

The Tax Policy Center is a joint venture of the Urban Institute and Brookings Institution. TPC is made up of nationally recognized experts in tax, budget, and social policy who have served at the highest levels of government. It aims to provide independent analyses of current and longer-term tax issues and to communicate its analyses to the public and to policymakers in a timely and accessible manner.

So one spouse may make very large charitable contributions and receive a full deduction, even if he or she doesn’t have an adjusted gross income of at least double that amount. In 2016, in response to a Ninth Circuit decision, “Voss v. Commissioner,” the IRS confirmed that the limit applies on a per-taxpayer basis rather than on a per-residence basis. For 2018 taxes, this means that of an unmarried couple who buys a home together, each spouse is entitled to a full deduction.

Other Benefits Of Marriage

A citizen’s guide to the fascinating elements of the US tax system.

Getting married and staying married for the long-term brings the opportunity for more financial security, provided that each spouse practices good family financial rules. Don’t spend more than you have and limit—or eliminate—the use of credit cards. Also, do your research on how to manage money as a couple, which is a little more complex than you might think.

- Keep in mind that couples who get their health insurance via an exchange must enroll together, although each individual can choose a different plan.

- That’s why we provide features like your Approval Odds and savings estimates.

- She holds a bachelor’s degree in accounting from Saint Leo University.

- Please check with your employer or benefits provider as they may not offer direct deposit or partial direct deposit.

- What if they sold the house after the wedding?

If you got married this year, congratulations! Getting married is a big step in your life and will also impact your 2020 Tax Return. It can result in a change in filing status, tax bracket, and name or address changes. Let eFile.com help you with the tax part-answer a few simple questions during the e-File tax interview and we’ll select the correct form for you based on your answers—it’s that easy! Prepare and e-File your 2020 Tax Return now or before the April 15, 2021 deadline. However, if you want to learn more about how marriage affects your taxes, read on.

There are limits that apply to deductions and contributions, and income from both spouses feeds the equation. However, the income limits that come with the tax break are not doubled for married couples . For people with incomes at the other end of the earnings spectrum, a marriage penalty can come from the earned income tax credit. There are other provisions of the tax code that can often affect higher earners more when they marry. For instance, while an individual can have up to $200,000 in wage income before the Medicare surtax of 0.9% kicks in, the limit for married couples is $250,000.

Reopening Rotation: Cramer’s ‘mad Money’ Recap (wednesday 3

When you donate to charity, your itemized deduction for those charitable contributions are typically limited to 50% of your adjusted gross income. Generally, excess contributions can be carried forward and deducted in up to five subsequent tax years. For 2018, taxpayers can claim an itemized deduction for medical expenses, but only to the extent that their unreimbursed medical expenses exceed 7.5% of their adjusted gross income. Your deduction for capital losses is limited to $1,500 on each return (instead of $3,000 on a joint return). For federal tax purposes, if you are married on the last day of the tax year, you’re considered married for the entire year. So even if you get married on Dec. 31, 2018, you’re considered married for the 2018 tax year. We think it’s important for you to understand how we make money.

Typically you can deduct up to 50 percent of your adjusted gross income for charitable contributions. As a single person, if you make a major contribution during a year where you make less income, the total deductible amount is lower. While we never recommend losing money as a tax strategy, it’s nice to get a tax benefit if you do endure a business loss. Southern New Hampshire University is a registered trademark in the United State and/or other countries. H&R Block does not automatically register hour with SNHU. Students will need to contact SNHU to request matriculation of credit. Severe penalties may be imposed for contributions and distributions not made in accordance with IRS rules.

About H&r Block

Valid for an original 2019 personal income tax return for our Tax Pro Go service only. Must provide a copy of a current police, firefighter, EMT, or healthcare worker ID to qualify.

Under the AMT, when taxes are calculated, the higher of the two figures is what is owed by the taxpayer, much to the ire of those lucky enough to trigger it. That debate aside, there is much new information for married couples to consider. There has already been much discussion about how the tax code change makes only small reductions to income tax rates for most individual tax brackets while awarding significant tax reductions to corporations. Also, the cuts that benefit individuals will phase out in 2025 but will remain for corporations and other entities. Consider a couple with two children and $40,000 in total earnings, split evenly between spouses . Two factors will cause them to incur a marriage penalty of $2,357 in 2020.

Or, click the blue Download/Share button to either download or share the PDF via DocuX. It’s a secure PDF Editor and File Storage site just like DropBox. Your selected PDF file will load into the DocuClix PDF-Editor. There, you can add Text and/or Sign the PDF. Once the SSA has changed your name, they will send the information to the IRS.

Marriage can help wealthy spouses protect their assets should they die. Federal tax law allows assets to be transferred to a widow or widower without being subject to the federal estate tax. Now, if you don’t have time to change your name before the tax deadline, you can file using your maiden name. But make sure you take care of the name change by next year.

Filing your taxes jointly isn’t that different from filing as single or head of household. You and your spouse still have to report your income and list deductions and credits. The biggest difference is that you’ll choose married filing jointly as your filing status instead of the others. Married filing separately is a tax status for married couples who choose to record their incomes, exemptions, and deductions on separate tax returns. First of all, the new tax brackets for married couples filing a joint return are now double the single bracket rate at the same income, except for those in the 35% and 37% brackets. This alignment limits a primary cause of the previous marriage penalty, as more married couples filing jointly find that their combined incomes now place them in a lower bracket.

Choosing these methods will require your full name, new and old addresses, your date of birth, SSN , and any additional information they may request for identity purposes. If two spouses each earned $91,000, their combined income would be $182,000—landing them in the 28% bracket.

Beverly Bird—a paralegal with over two decades of experience—has been the tax expert for The Balance since 2015, crafting digestible personal finance, legal, and tax content for readers. Bird served as a paralegal on areas of tax law, bankruptcy, and family law. She has over 30 years of writing and editing experience, including eight years of financial reporting, and is also a published author of over 30 books. Professional services businesses are those in which the principal asset is the reputation or skill of its employees (e.g. doctors, lawyers, or accountants). All income from paid employment, including tips, bonuses, and the like.

Alimony No Longer Deductible; Now Taxable

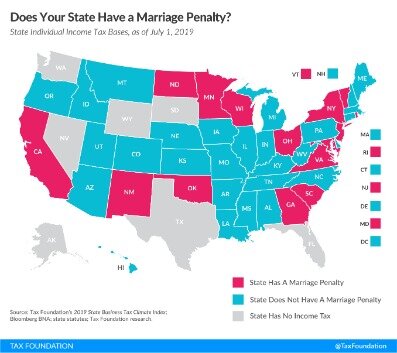

Your filing status is determined on December 31 of each year, so even if you were not married for most of the tax year, you do not have the option of filing as single if you are married on that date. Generally, married filing jointly provides the most beneficial tax outcome for most couples because some deductions and credits are reduced or not available to married couples filing separate returns. While most taxpayers no longer pay a marriage penalty, high-income couples still do.

This calculator lets you create specific situations to see how much federal income tax two people might pay if they were to marry. It compares the taxes a married couple would pay filing a joint return with what they would pay if they were not married and each filed as single or head of household. The calculator does not compare the taxes a married couple would pay filing jointly with what they would pay if married and filing separately.

Joe Bidens Policies And How They Could Impact Your Money

The exception to this rule is the handful of states that allow common law marriage, but it’s a myth that living together for a certain period gives even these partners all the rights of traditional marriage. Of course, the opposite is also true; if one partner has better credit than the other, their history and habit of meeting payments on time can help the other partner’s score.