Content

You have to sign onto your 2019 online account using the exact same User ID you used to create the online account. If you ordered TurboTax on a CD, you can also get the downloadable version after it releases in early November. To access,sign in to your TurboTax Advantage accountand selectDownloads. First time user and I’m very satisfied! Website was user friendly and return was processed fast compared to other sites. Western Governors University is a registered trademark in the United States and/or other countries. H&R Block does not automatically register hours with WGU.

Furthermore, our Maximum Refund Guarantee is based on the schedules and forms supported by TaxSlayer.com. Click here to learn how to notify TaxSlayer if you feel like you are entitled to a refund.

Consult an attorney for legal advice. Description of benefits and details at hrblock.com/guarantees. Gather your docs and let your tax pro do the rest. Just review and approve your return.

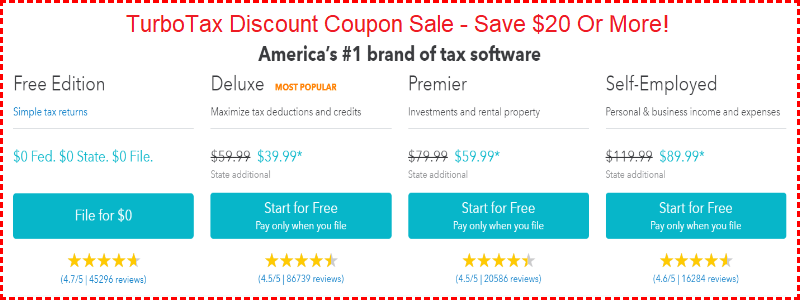

Turbotax Online

Visithrblock.com/ezto find the nearest participating office or to make an appointment. OBTP#B13696 ©2017 HRB Tax Group, Inc. Type of federal return filed is based on taxpayer’s personal situation and IRS rules/regulations. Form 1040EZ is generally used by single/married taxpayers with taxable income under $100,000, no dependents, no itemized deductions, and certain types of income . Additional fees apply with Earned Income Credit and you file any other returns such as city or local income tax returns, or if you select other products and services such as Refund Transfer.

Comparison pricing and features of other online tax products were obtained directly from the TurboTax®, H&R Block®, TaxAct®, Jackson Hewitt®, and Liberty Tax® websites on March 1, 2021. Filing with all forms, including self-employed. Cost of filing state with complex federal return. File taxes electronically (e-file) and receive email confirmation from the IRS once your online tax return has been accepted. Then, easily track your tax return on your phone with our TurboTax mobile app to see when your refund will hit your bank account. If you get a larger refund or smaller tax due from another tax preparation method, we’ll refund the amount paid for our software. TurboTax Free customers are entitled to a payment of $9.99.

and Ingo Money, Inc., subject to the Sunrise Banks and Ingo Money Service Terms and Conditions, the Ingo Money Privacy Policy, and the Sunrise Banks, N.A. Privacy Policy. Approval review usually takes 3 to 5 minutes but can take up to one hour. All checks are subject to approval for funding in Ingo Money’s sole discretion. Fees apply for approved Money in Minutes transactions funded to your card or account. Unapproved checks will not be funded to your card or account. Ingo Money reserves the right to recover losses resulting from illegal or fraudulent use of the Ingo Money Service.

It was checked for updates 2,953 times by the users of our client application UpdateStar during the last month. TurboTax is a Shareware software in the category Business developed by TurboTax. All rights reserved, Intuit and turbotaxdesktop are registered trademarks of Intuit Inc. Close all TurboTax windows on your web browser . Copy and paste the account recovery website link onto a new web browser window and run the tool. You get a code to install the CD which will also let you download the program so you don’t need to call in anymore if you don’t have a CD drive.

You may not download and/or save a copy of any of the screens except as otherwise provided in these Terms of Service, for any purpose. However, you may print a copy of the information on this Site for your personal use or records. If you make other use of this Site, except as otherwise provided above, you may violate copyright and other laws of the United States, other countries, as well as applicable state laws and may be subject to penalties. TaxSlayer does not grant any license or other authorization to any user of its trademarks, registered trademarks, service marks, or other copyrightable material or other intellectual property, by placing them on this Website. Classic All tax situations.

Does not include GST/HST and other non-income tax audits and reviews unless the issues are ancillary to the income tax review itself. Includes field audits through the restricted examination of books, but does not include the “detailed financial audit”. Over the past 5 years, more than 17M returns have been electronically filed with TurboTax based on a CRA NETFILE report. Intuit TurboTax Business 2019 is a reliable application for users to deal with tax matters and provides a complete solution for accounting and tax operations.

You can file taxes for a different year by selecting the year above. A listing of additional requirements to register as a tax preparer may be obtained by contacting CTEC at P.O.

Discount valid only for tax prep fees for an original 2017 personal income tax return prepared in a participating office. May not be combined with any other promotion including Free 1040EZ. Void if sold, purchased or transferred, and where prohibited. Must be a resident of the U.S., in a participating U.S. office. Referring client will receive a $20 gift card for each valid new client referred, limit two. Gift card will be mailed approximately two weeks after referred client has had his or her taxes prepared in an H&R Block or Block Advisors office and paid for that tax preparation. Referred client must have taxes prepared by 4/10/2018. H&R Block employees, including Tax Professionals, are excluded from participating.

Intuit Turbotax All Editions 2019 V2019 41.11.194

Terms and conditions, features, support, pricing, and service options subject to change without notice. your tax return to the IRS or state since the deadline for e-filing self-prepared past year tax returns has ended. Due to federally declared disaster in 2017 and/or 2018, the IRS will allow affected taxpayers an extended filing date to file and pay for their 2017 taxes.

Another way to prevent getting this page in the future is to use Privacy Pass. You may need to download version 2.0 now from the Chrome Web Store.

Not valid on subsequent payments. Expires January 31, 2021. CTEC# 1040-QE-2355 ©2020 HRB Tax Group, Inc. Transferring funds from another bank account to your Emerald Card may not be available to all cardholders and other terms and conditions apply. There are limits on the total amount you can transfer and how often you can request transfers. MetaBank® does not charge a fee for this service; please see your bank for details on its fees. The Check-to-Card service is provided by Sunrise Banks, N.A.

Box 2890, Sacramento, CA ; or at Minimum monthly payments apply. Line balance must be paid down to zero by February 15 each year. Year-round access may require an Emerald Savings® account. Fees apply to Emerald Card bill pay service. See Online and Mobile Banking Agreement for details. H&R Block Emerald Prepaid Mastercard® is issued by MetaBank®, N.A., Member FDIC, pursuant to license by Mastercard International Incorporated.

File 100% Free With Unlimited Live Tax Advice And An Expert Review

If you pay a penalty or interest due to a TurboTax calculation error, we will reimburse the penalty and interest. Does not include calculation errors due to errors in CRA tables. This product is limited to one installation with the purchased license code. Click on the below link to download the latest version offline setup of Intuit Intuit TurboTax Business 2019 for Windows x64 architecture.

This powerful application automates the accounting and tax-related tasks of a small business with a variety of available tools and all the necessary calculations that are required for handling the tax and accounts. It provides a simple and easy to use environment with a one-stop solution for tax and accounting. Download Intuit TurboTax Business 2019 free latest version offline setup for Windows 64-bit. Intuit TurboTax Business 2019 free download crack is a reliable application for handling different accounting and tax handling tasks. If you’re not satisfied, return it within 60 days of shipment with your dated receipt for a full refund (excluding shipping & handling).

Power of Attorney required. Does not provide for reimbursement of any taxes, penalties or interest imposed by taxing authorities. Terms and conditions apply. H&R Block tax software and online prices are ultimately determined at the time of print or e-file. All prices are subject to change without notice. This option requires you to provide a valid phone number, email address and bank account information in your return. To use this option you must be filing a Federal return and receiving a refund from your federal return to cover the expenses listed above.

Free technical support by phone throughout the year. See our support site for hours of service.

Offer valid for tax preparation fees for new clients only. A new client is an individual who did not use H&R Block office services to prepare his or her 2016 tax return. Valid receipt for 2016 tax preparation fees from a tax preparer other than H&R Block must be presented prior to completion of initial tax office interview.

H&R Block does not automatically register hour with SNHU. Students will need to contact SNHU to request matriculation of credit. Additional feed may apply from SNHU. Timing is based on an e-filed return with direct deposit to your Card Account. Use of for Balance is governed by the H&R Block Mobile and Online Banking Online Bill Payment Agreement and Disclosure.

Download safely while discovering alternative software you can try. Most of our users has downloaded the TurboTax 2019 – All Editions – Deluxe, Premier, Home and Business, Business cracked and reported to us that is working with no problem. The TurboTax 2019 – All Editions – Deluxe, Premier, Home and Business, Business run instantly and work like a charm. Every personal TurboTax return is backed by our Audit Support Guarantee for free one-on-one audit guidance from a trained tax professional. We’ll find every tax deduction and credit you qualify for to get you the biggest tax refund, guaranteed. For customers purchasing Audit Defence services across Canada, services will be provided by TurboTax tax experts.

- TaxSlayer.com’s Knowledge Center also provides you with valuable tax knowledge and troubleshooting tips.

- Gather your docs and let your tax pro do the rest.

- Our team know the problems around the internet related to all the cracked softwares available online and we are sure that you finded damaged content, crack not working, unavailable serials or keys expired.

- We will automatically transfer information from your federal tax return to your state tax return.

- TaxSlayer reserves the right to change any information on this Website including but not limited to revising and/or deleting features or other information without prior notice.

TaxSlayer will not intentionally monitor or disclose any private electronic-mail message unless required by law. TaxSlayer reserves the right to change any information on this Website including but not limited to revising and/or deleting features or other information without prior notice. Clicking on certain links within this Website might take you to other web sites for which TaxSlayer assumes no responsibility of any kind for the content, availability or otherwise. (See “Links from and to this Website” below.) The content presented at this Site may vary depending upon your browser limitations. Self-Employed Best for contractors, 1099ers, side hustlers, and the self-employed.

Our 60,000 tax pros have an average of 10 years’ experience. We’re here for you when you need us. Not sure where to start? We’ll find the tax prep option for you. Store all of your tax info and docs for up to six years.

Turbotax 2019 Home & Business For Mac, Download Version

Free ITIN application services available only at participating H&R Block offices, and applies only when completing an original federal tax return . CAA service not available at all locations.