This financial management system focuses on leveraging finances to be as accountable to the revenue generation sources as possible and to advance the organization rather than generate a profit. Failure to follow the federal guidelines could lead to a reduction in grant money, loss of further grant funds or costs being attributed to your own organization. A restricted grant is when an individual, business, government or a foundation donates money to a nonprofit for a specific purpose. Depending on the size of the grant, the grantor may require monthly or quarterly reports to ensure the money is managed and spent according to the grant agreement. It helps them ensure they have the funds necessary to continue operating. Fund accounting allows nonprofits to clearly understand how much of their funding is spent on various fundraising, program, and operational expenses.

- Post-award consists of processes that occur between award inception and award close-out.

- This allows the organization to make more accurate budgets and ensure they have the funds necessary to continue operating in the future.

- All financial reports are submitted by the Grant Accounting Office.

- Typically grants do not pay for ‘non-profit salaries,’ but you may find grants that fund program expenses.

- These 501 organizations are the primary type of organization discussed in matters of fund accounting.

- Like nonprofit organizations, government entities also use a type of fund accounting, usually referred to as encumbrance accounting, which budgets and reserves funds for specific expenditures.

- Manage your time by planning and scheduling your daily activities.

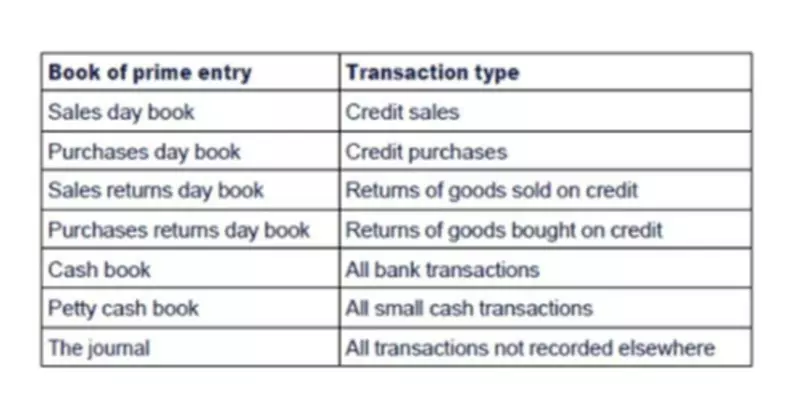

While government fund types are different, their purpose is similar. Understand the specific requirements of the grant and what accounting methods and practices are allowed. There are a few things grant accounting to keep in mind when understanding the requirements of a grant and what accounting methods are allowed. First, grants can come in different types, and each type may have different requirements.

Guidelines for Successful Grants Management

It is important to always document grants according to the matching principle. This means that you should keep records of all communications and correspondence with the grantor. When receiving a conditional grant, do not recognize the funds until you have met all of the conditions. This will ensure that you are in compliance with the terms of the grant.

For instance, an endowment fund must be maintained, but the interest can be spent on specific projects. These governments must stay true to the standards set by the Governmental Accounting Standards Board . This board has the responsibility of setting financial standards for state and local governments. Its purpose is essentially the same as the Financial Accounting Standards Board , which holds the same responsibilities, but for non-governmental organizations. Fund accounting is a system of accounting used to track the amount of money allocated to various operations at an organization. It’s a system designed to ensure funds are used productively and for the benefit of the organization as a whole.

What is grant accounting?

For example, organizations that rely heavily on grants likely have specific deadlines and requirements they need to meet for each grant. Therefore, they use fund accounting to keep track of those deadlines in addition to tracking donor-restricted funds. Grant accounting for nonprofits is the method of recording and monitoring government grants in your accounting system. The capital or income approach can be used for grant accounting. The nature of the grant determines how the grant accounting must be done to accurately track its costs and benefits.